Description

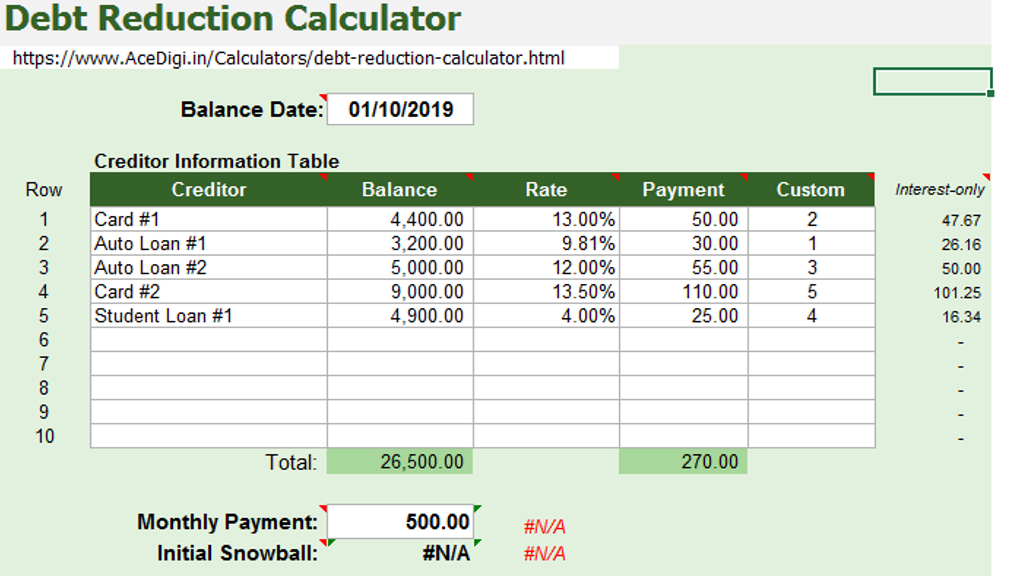

AceDigi’s Debt Reduction Calculator is your ally in the journey to financial freedom. If you’ve ever wondered how quickly you can escape the clutches of debt or how much you can save in interest payments, this powerful tool is here to provide answers. Navigating the challenging path of debt elimination requires a solid plan and unwavering determination, and AceDigi’s Debt Reduction Calculator, available for Microsoft Excel® and Google Sheets, is designed to assist you in this endeavor. Utilizing the renowned debt roll-up approach, commonly known as the debt snowball, this spreadsheet generates a personalized payment schedule to efficiently guide you through paying off your debts.

Key Features:

Versatile Debt Reduction Strategies: One of the standout features of this spreadsheet is its flexibility in choosing or creating different debt reduction strategies. Whether you prefer the popular debt snowball (paying the lowest balance first) or the debt avalanche (paying the highest-interest first), the choice is yours. The ability to select from various strategies can potentially save you hundreds or even thousands of dollars.

Budget-Centric Approach: Regardless of the strategy chosen, the initial step in any debt snowball plan is crafting a budget and adhering to it. The more you can allocate from your budget to boost your debt snowball, the quicker you’ll reach your financial goals. It’s essential to consider other financial goals and risk factors in addition to debt payoff speed.

Description of Pro Version:

The Pro version of the AceDigi Debt Reduction Calculator enhances your debt management capabilities in two significant ways:

- Extended Creditor Listing: The Pro version allows you to list more than 10 creditors, catering to individuals with diverse debt portfolios. Choose from versions enabling you to list up to 20 or even 40 creditors.

- Commercial Use License: Unlike the free version, which is restricted to personal use, the Pro version grants a Commercial Use License. This license enables professionals to utilize the spreadsheet in business settings, providing valuable assistance to clients. The template includes dedicated sections for client and preparer details, facilitating professional use. While the commercial license allows the creation of reports or PDFs, sharing the actual spreadsheet file is not permitted.

Using the AceDigi Debt Snowball Calculator:

Follow these straightforward steps to maximize the benefits of the debt snowball worksheet:

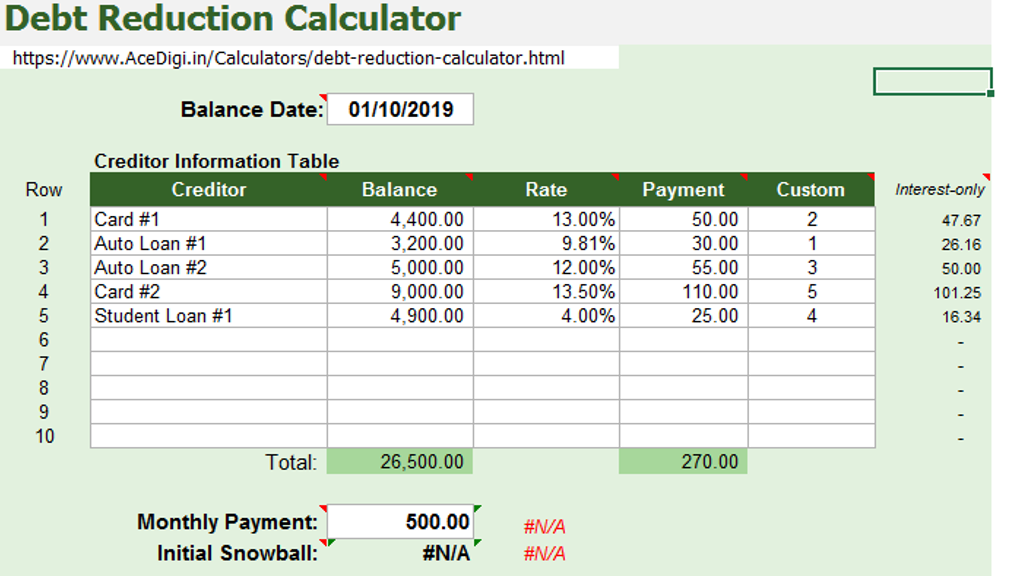

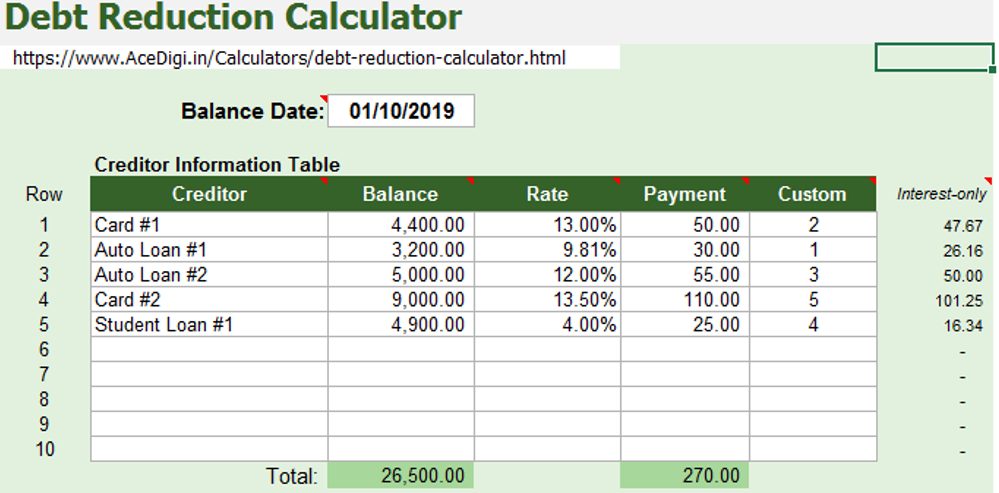

- Creditor Information Input: Enter abbreviated names for your creditors, along with current balances and interest rates for all debts, including credit cards, home equity lines of credit, or second mortgages.

- Minimum Payment Details: Input the minimum monthly payment for each debt. While this spreadsheet assumes a fixed minimum payment, periodic updates may be necessary, especially for debts with changing minimum payments.

- Total Monthly Payment Determination: Enter the total monthly payment you can allocate towards your debts based on your home budget. The difference between total minimum payments and your allocated monthly payment forms your initial snowball or extra payment, applied strategically to one debt target at a time.

- Results Analysis: Examine the results table to view debts in the chosen order, along with total interest paid and months required to pay off each debt. Experiment with different payoff strategies or use the Custom column for a personalized approach.

Debt Reduction Strategies:

Explore various debt reduction strategies within the AceDigi Debt Snowball Calculator:

- Debt Snowball (Lowest Balance First): This strategy focuses on paying off the lowest balance first, leveraging the psychological benefit of witnessing quick debt eliminations, as advocated by financial expert Dave Ramsey.

- Debt Avalanche (Highest Interest First): This strategy targets debts with the highest interest first, minimizing total interest paid. Depending on the balance of higher interest loans, it may take longer to completely pay off the first debt.

- No Snowball:Opt for this option to determine the time required to pay off debts solely based on individual specified minimum payments, without the snowball effect.

- User-Specified Order:Choose the order in which debts are targeted. Options include “Order Entered in Table,” “Custom-Highest First,” or “Custom-Lowest First,” allowing flexibility in debt payoff sequencing.

- Debt Snowflaking: This term refers to making extra debt payments beyond the normal monthly payment (snowball). The “Additional” column in the Payment Schedule worksheet facilitates adding “snowflakes” for any given month.

In conclusion, AceDigi’s Debt Reduction Calculator empowers individuals and professionals alike in managing and conquering debt. Whether you’re following a debt snowball or avalanche strategy, the customizable features and detailed analysis provided by this tool make it an indispensable companion on your journey to financial freedom.

Samuel Parker –

As someone who isn’t an expert, these templates have been a blessing. Simple to navigate with clear instructions. Now, I can manage my data without any hassle. Great job!

4. Aisha Rahman –

Cannot express how much these templates have simplified my workload. Comprehensive and made complex tasks much more manageable. Impressed with the quality and functionality.

5. Omar Hassan –

I stumbled upon these templates and couldn’t be happier. They’re like a secret weapon for productivity. The range is impressive, and the simplicity of use is refreshing

Isabella Carter –

Absolutely loving these templates! They’ve brought a level of organization to my work that I didn’t know I needed. Clean designs and intuitive functionality make them a winner.