Description

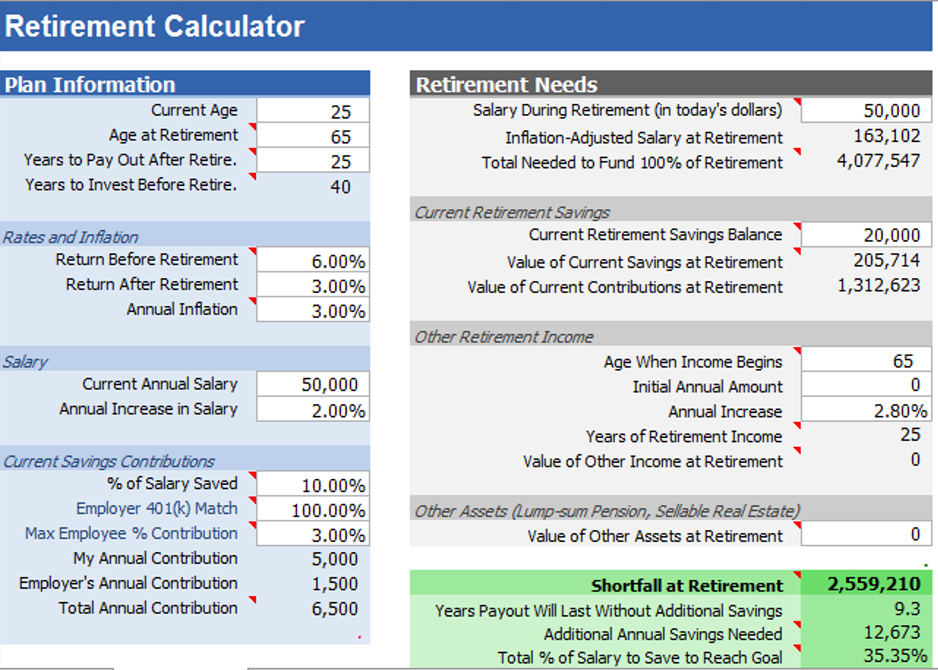

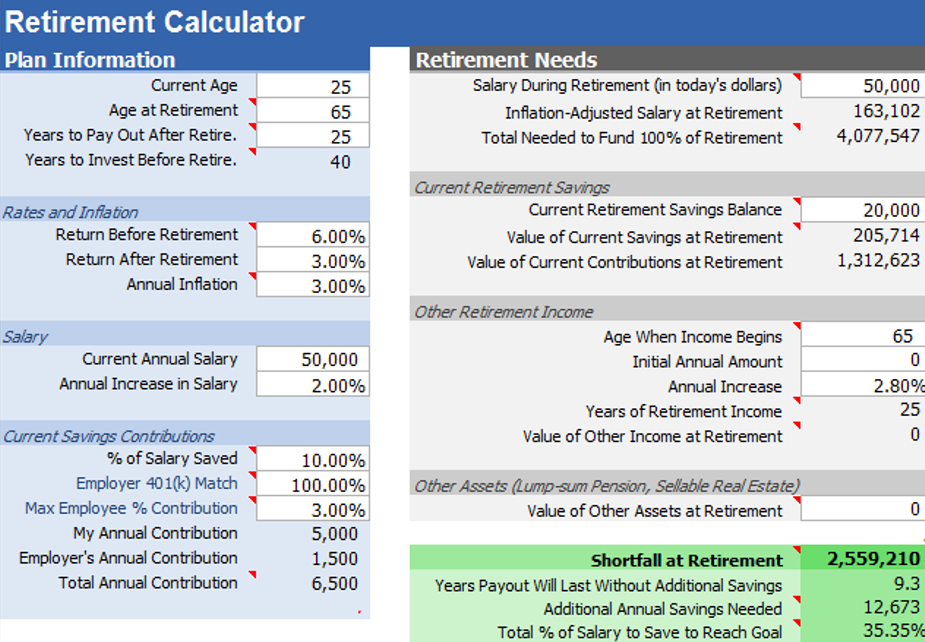

AceDigi’s Retirement Calculator Spreadsheet is a valuable tool designed to answer the complex question of how much of your salary you need to save to achieve your retirement goals. While recognizing that it doesn’t offer the depth of professional financial planning software, this spreadsheet provides a quick estimation that can be particularly useful for those seeking a straightforward approach to retirement planning.

Evolution and Updates:

Originally created in response to multiple requests for a combined 401(k) savings and retirement withdrawal calculator, AceDigi continually refines and enhances the spreadsheet. Updates address user feedback and improve functionality. Notable updates include bug fixes, additional features like limiting Other Retirement Income to a specific number of years, and improvements in labeling and instructions for better user clarity.

Key Updates:

Bug Fixes:AceDigi has diligently addressed bugs in the formula, ensuring accurate calculations. Notably, a bug related to the assumption of the employer match being maxed out was rectified, providing a more realistic representation of employer contributions.

Flexibility in Retirement Period Rates: Users can input different rates of return for the accumulation and retirement periods, recognizing the shift towards lower-risk investments during retirement. This unique feature allows for a more nuanced and realistic projection of future financial scenarios.

Enhanced User Guidance: Updates include improved labels and instructions, making it easier for users to navigate and understand the various sections of the spreadsheet. This includes clarifications on the Employer Match section, ensuring users interpret the information correctly.

Error Corrections: AceDigi has meticulously addressed errors in formulas, particularly in the “Value of Other Income at Retirement” section. This correction enhances the accuracy of predicting the additional salary required to reach zero at the end of the payout period.

Adaptation for Specific Scenarios: While the calculator was not initially designed for cases where Current Age is greater than or equal to Age at Retirement, AceDigi has made adjustments in version 1.1.0 to handle such scenarios more effectively.

Using the Retirement Calculator Spreadsheet:

Understanding the spreadsheet’s limitations is crucial. Future rates of return, inflation, salary changes, unforeseen disasters, and lifespan cannot be predicted with certainty. AceDigi emphasizes that the spreadsheet serves as a mathematical exercise, and users bear responsibility for their chosen inputs and interpretations of results.

Key Explanations:

Rates of Return and Inflation: Estimating these values is essential, acknowledging the uncertainty of future rates. Notably, the spreadsheet allows users to enter different rates for the accumulation and retirement periods, recognizing the shift to lower-risk investments during retirement.

Defining Retirement Goals: Users define their retirement goal by entering a lifestyle-based salary in today’s dollars. This represents the desired standard of living during retirement, adjusted for inflation. If expecting additional income during retirement, withdrawals from the nest egg are adjusted accordingly.

Years to Pay Out: Determining the number of years for which the retirement nest egg should last is a critical aspect of goal setting. Factors like life expectancy, family support, and government assistance influence this decision.

Current Savings Contributions: Annual savings contributions are calculated as a percentage of salary, allowing for an increase as salary rises. The spreadsheet assumes contributions to a 401(k), with additional savings beyond 401(k) limits directed to other accounts if an Employer Match is specified.

Employer Match Clarifications: The spreadsheet clarifies the interpretation of the Employer Match section, emphasizing that it represents a match percentage up to a specified employee contribution percentage. This means the employer stops matching when the employee contribution exceeds a certain percentage of salary.

Social Security and Taxes: Social security calculations are not included in the spreadsheet. Users can use the Other Retirement Income section to estimate additional income sources like social security. Notably, the calculator does not account for taxes, and users are urged to consider tax implications independently.

More Retirement Calculators:

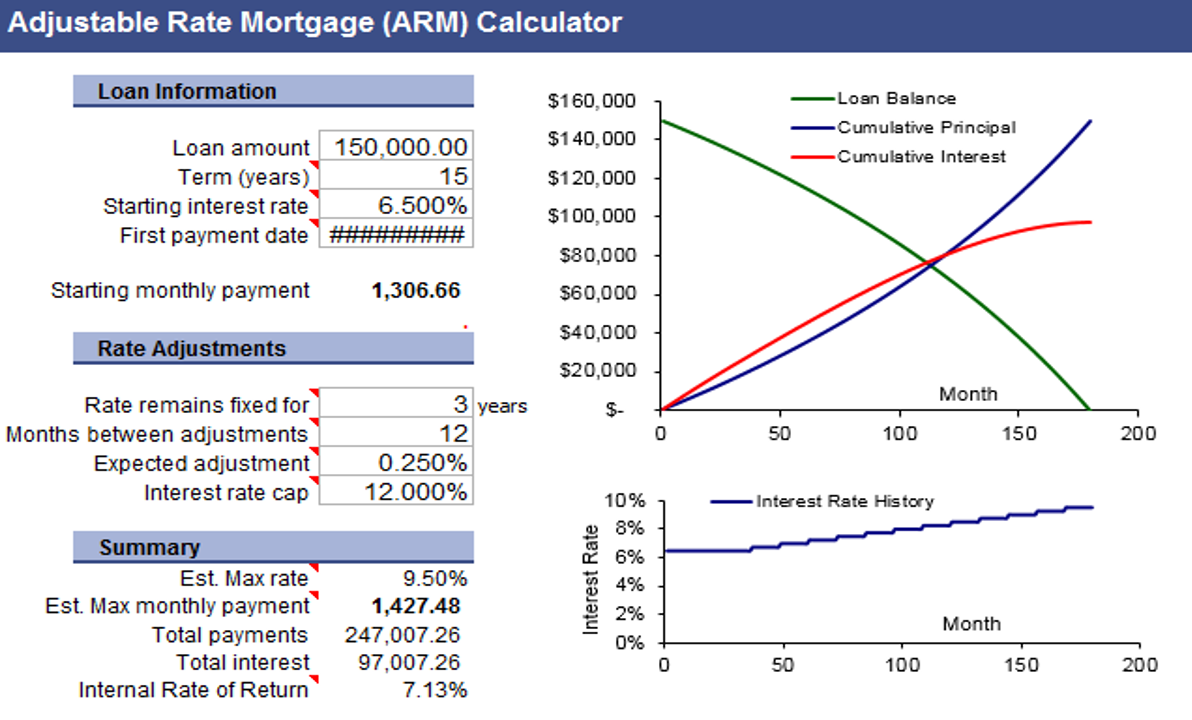

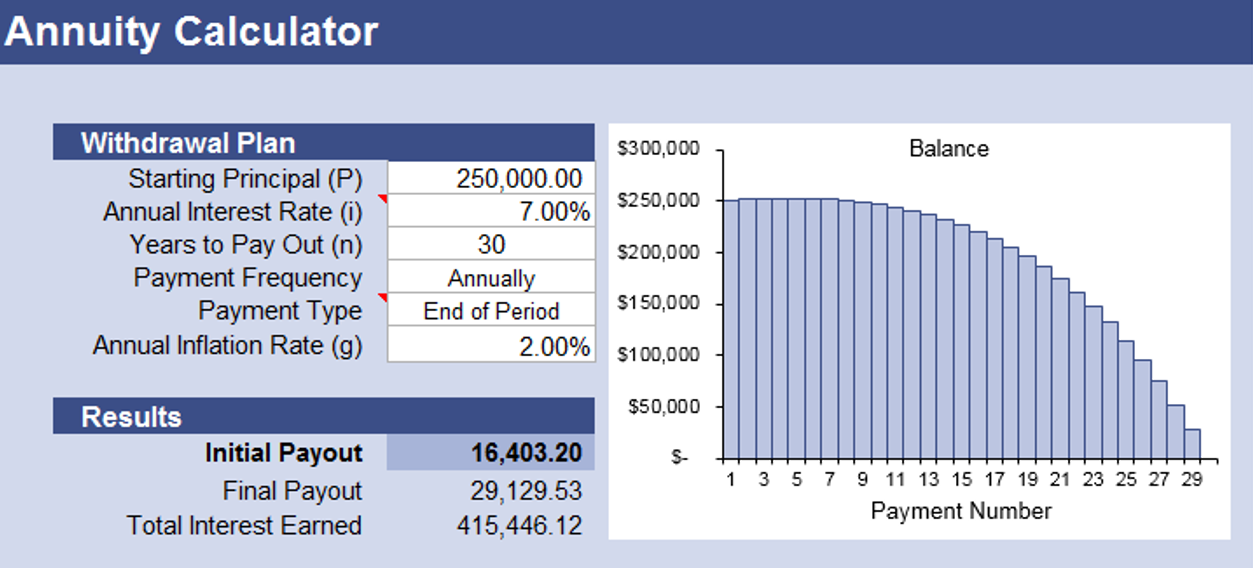

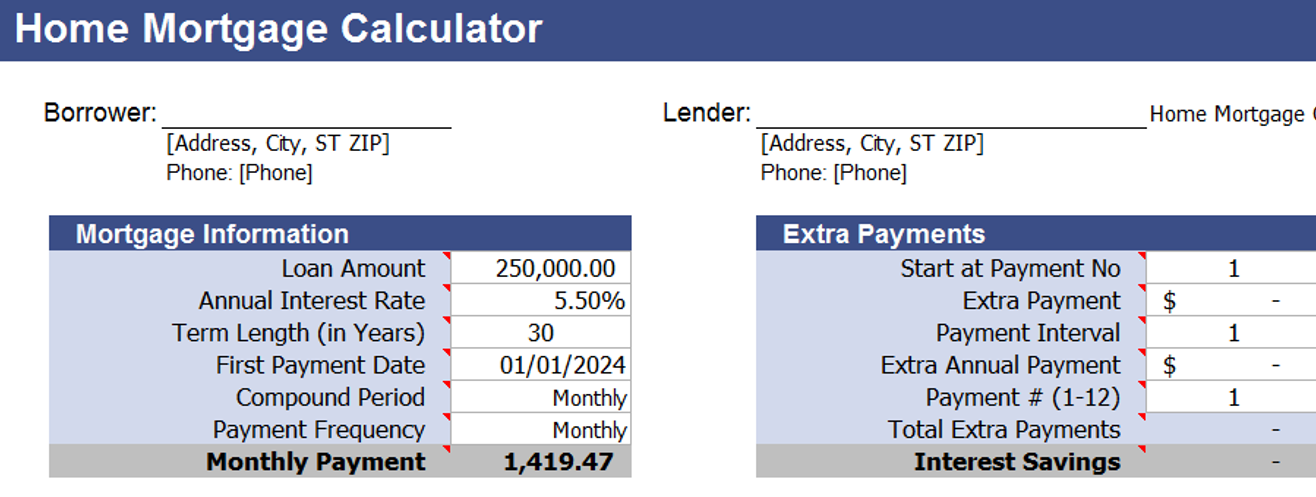

AceDigi offers a suite of retirement calculators catering to various needs, including an Annuity Calculator for withdrawal amount estimation based on a specified nest egg and duration, a Withdrawal Calculator for determining the duration of a nest egg based on desired withdrawals, and a 401(k) Savings Calculator for estimating final savings under different rate scenarios.

In conclusion, AceDigi’s Retirement Calculator Spreadsheet, continuously refined through updates and user feedback, stands as a versatile and user-friendly tool for those seeking a quick yet insightful estimation of retirement savings goals. While acknowledging the uncertainties inherent in financial planning, this spreadsheet empowers users to make informed decisions about their retirement journey.

4. Aisha Rahman –

The templates provided are a lifesaver! Easy to use and have improved my organization significantly. Versatile and suitable for various tasks. Kudos to the creators!

Sophia Williams –

I appreciate the versatility of these templates. Whether it’s project planning or expense tracking, there’s a template for everything. They’ve become my go-to solution for various tasks.

Isabella Carter –

As someone who isn’t an expert, these templates have been a blessing. Simple to navigate with clear instructions. Now, I can manage my data without any hassle. Great job!

Benjamin Harrison –

These templates have turned mundane tasks into a breeze. The attention to detail is evident, and they’ve made data analysis surprisingly enjoyable. A fantastic find!