Description

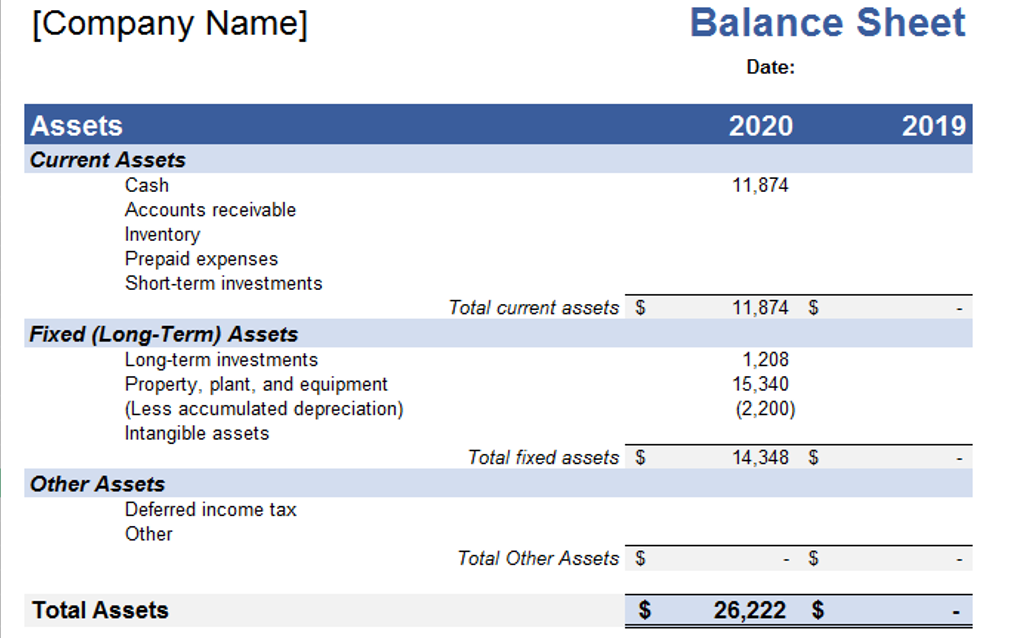

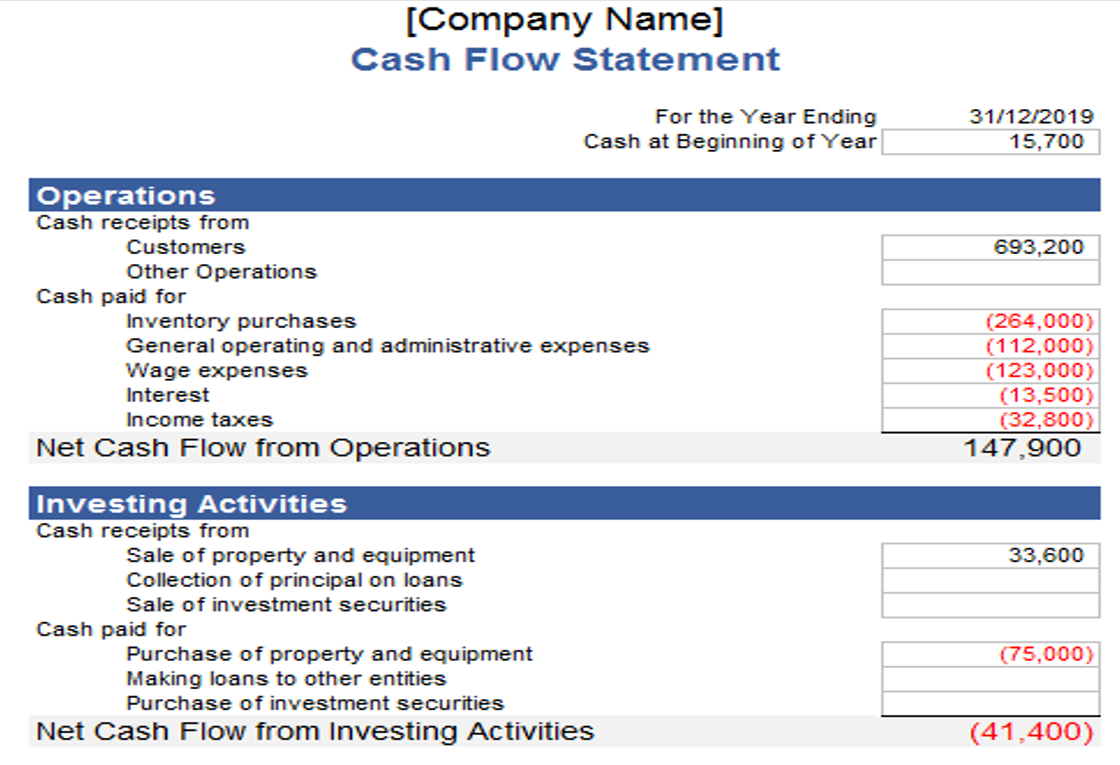

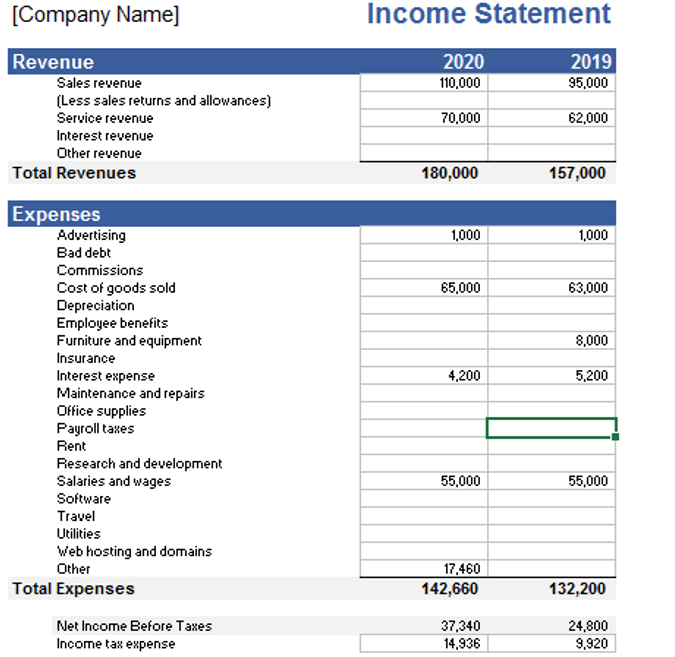

The financial health of a company is effectively encapsulated in the balance sheet, a crucial financial statement that provides a comprehensive overview of a company’s assets (what it owns) and liabilities (what it owes). This financial document plays a pivotal role in assessing the overall strength of a company, offering valuable insights into the distribution of company resources and facilitating meaningful comparisons with similar entities.

In my perspective as a small business owner, while the income statement holds greater utility in the day-to-day operations of the business, the balance sheet remains an indispensable accounting tool, supplying key information essential for strategic decision-making. To provide a comprehensive financial snapshot, a complete set of financial statements should ideally include both the balance sheet and the income statement.

The balance sheet serves as a dynamic indicator of a company’s net worth at a specific point in time. This is achieved by deducting total liabilities from total assets, resulting in the calculation of owner’s equity. In corporate contexts, this is often referred to as shareholder’s equity, while in simpler terms, it signifies the net worth of the business.

Description:

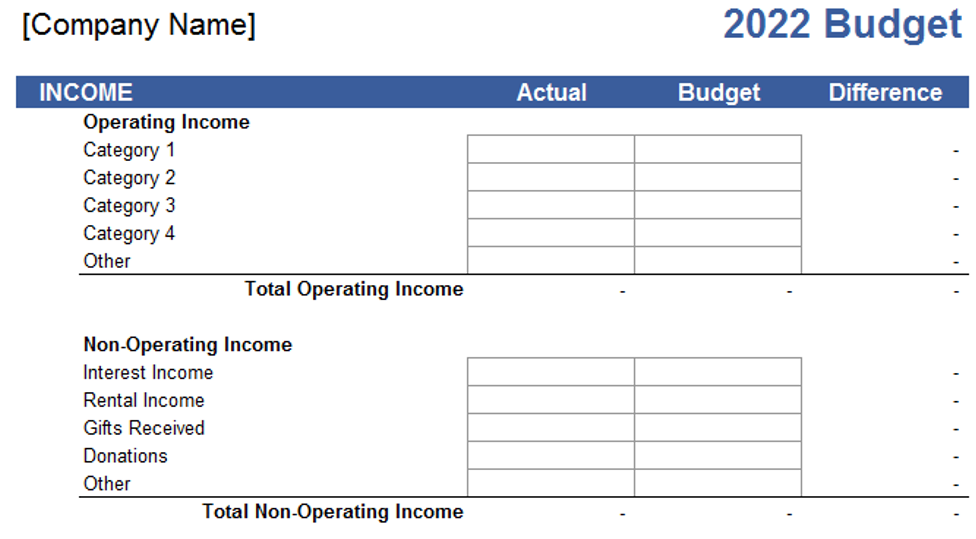

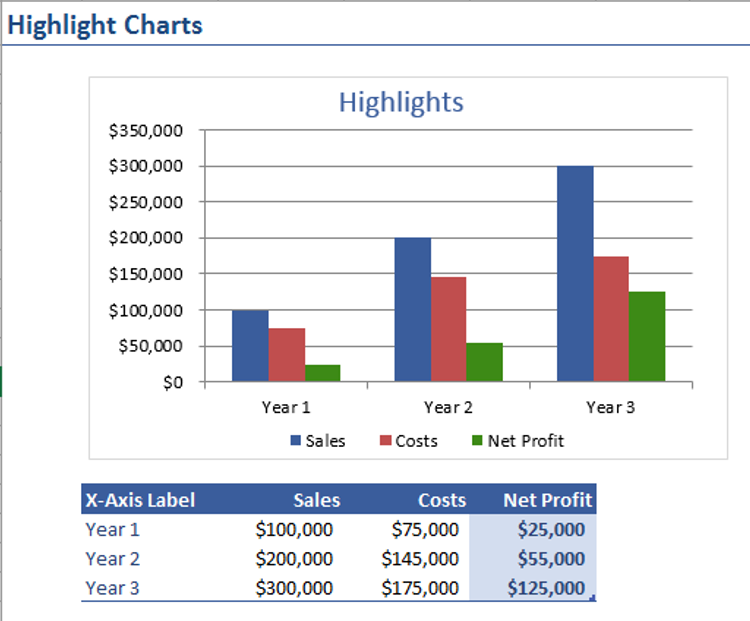

AceDigi presents a free Balance Sheet template tailored for small business owners. This template not only facilitates a comprehensive financial overview but also incorporates common financial ratios, making it an invaluable resource for assessing the financial health of a business over a two-year period. Below, we delve into the different categories of assets and liabilities covered by this template.

Balance Sheet Essentials:

- The Accounting Equation:Central to the balance sheet is the fundamental accounting equation – Assets = Liabilities + Owner’s Equity. This equation underscores the essential balance between a company’s resources and its obligations, providing a foundational framework for the balance sheet.

- Current Assets: In balance sheet terminology, “current” typically refers to short-term assets with a maturity of one year or less. This category encompasses cash (including coins and balances in checking and savings accounts), accounts receivable (amounts owed to the business by customers within a 10-60 day period), inventory (goods intended for sale), and prepaid expenses (e.g., insurance and rent).

- Long-Term Assets:This category encompasses assets with a more extended lifecycle. It includes long-term investments, the cost of property and equipment (e.g., land, buildings, vehicles, etc.), offset by accumulated depreciation, intangible assets (such as patents, contracts, trademarks, copyrights, and goodwill), and other assets (e.g., deferred income tax resulting from property value depreciation).

- Current Liabilities: Current liabilities represent obligations to be settled within one year. These include accounts payable, short-term loans, income taxes payable, wages, unearned revenue (e.g., service contracts), and the current portion of long-term debt (e.g., mortgage payments payable within 12 months).

- Long-Term Liabilities: This category encompasses obligations with a duration beyond one year. It includes long-term debt (e.g., notes, mortgages), capital lease obligations (leases structured as loans), and deferred income tax (e.g., tax due on the increase in the value of an investment security, deferred until the security is sold).

Conclusion:

AceDigi’s Balance Sheet template for small business owners emerges as a valuable resource for financial management. By encapsulating essential financial ratios and enabling a two-year comparison, this template empowers business owners to gauge their financial standing and make informed decisions. Understanding the distinct asset and liability categories outlined in the template is integral to harnessing its full potential. In the complex landscape of business finance, AceDigi’s Balance Sheet template stands as a user-friendly tool, enhancing financial transparency and aiding in strategic financial planning.

Emily Thompson –

Using these templates has been a time-saver. The ease of use combined with the polished designs has elevated my work. It’s like having a design team at my fingertips!

Benjamin Harrison –

Love the customization options! These templates have allowed me to tailor my work to my specific needs. Well-designed, and the support provided is excellent. A satisfied user!

3. Yusuf Ali –

Using these templates for a few months now, and they’ve exceeded my expectations. Intuitive and time-saving. Highly valuable for anyone looking to simplify their tasks.”

Liam Walker –

These templates are a lifesaver for someone like me who’s always on the go. Quick, easy, and efficient – they’ve become an essential part of my toolkit. Thumbs up!