Description

AceDigi offers a comprehensive and user-friendly Auto Loan Calculator, providing a valuable tool for individuals navigating the complexities of car financing. This free calculator is designed to empower users by estimating the overall cost of purchasing a vehicle, taking into account various factors such as the sales price, sales tax, and additional charges and fees that often accompany the decision to buy a car.

Key Features of AceDigi’s Auto Loan Calculator:

- Estimating Total Loan Amount:

The Auto Loan Calculator worksheet serves as a dynamic tool for calculating the amount needed for financing. It factors in essential elements, including the sales price of the car, destination charge, fees, sales tax, down payment, cash rebate, and the trade-in value of an older vehicle. By inputting these values, users can obtain a comprehensive estimate of the total loan amount required for the purchase.

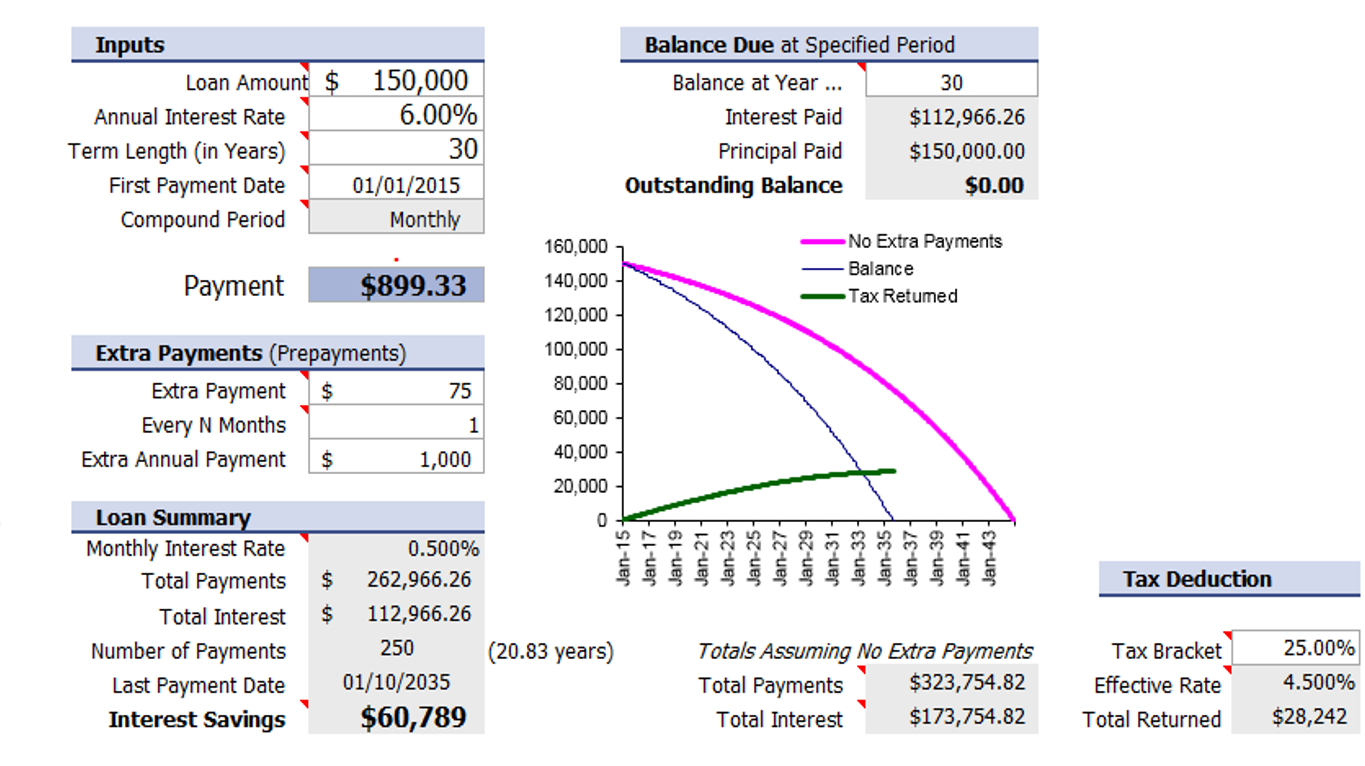

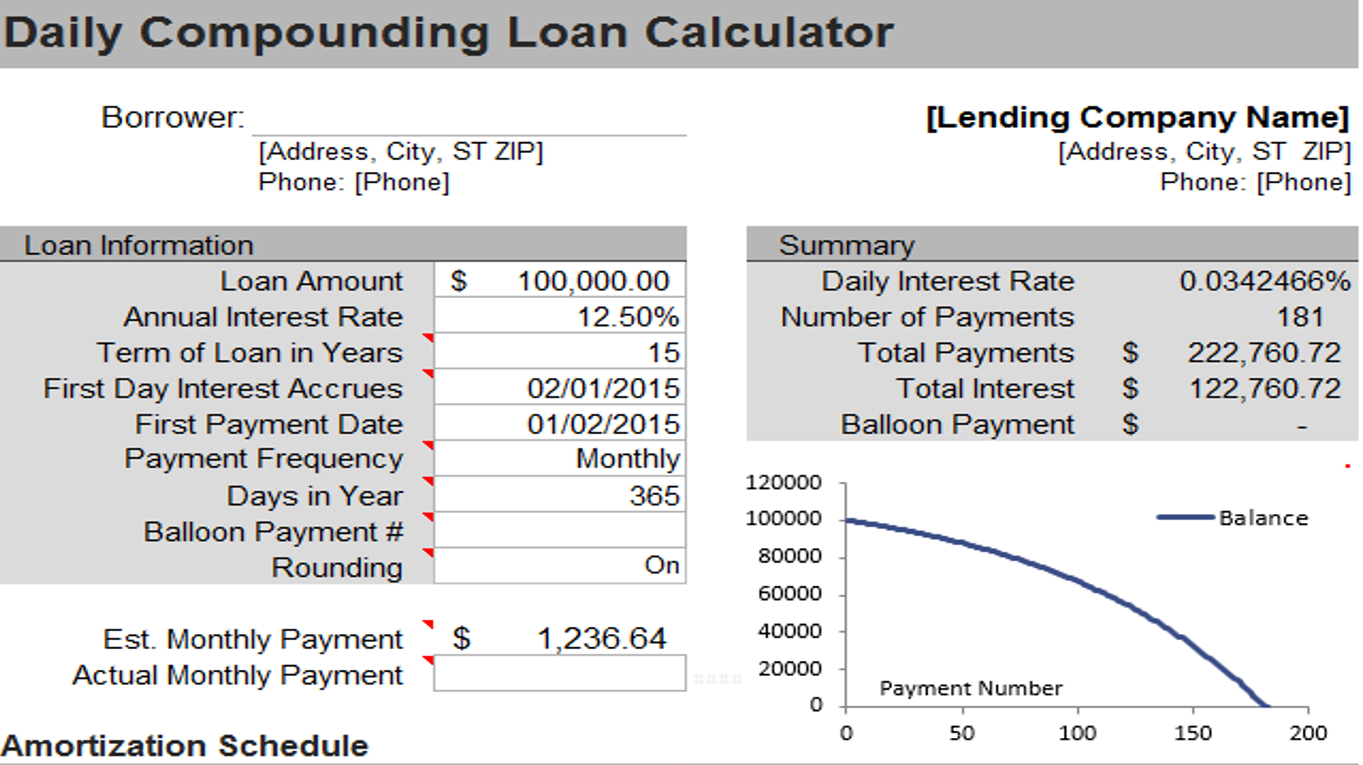

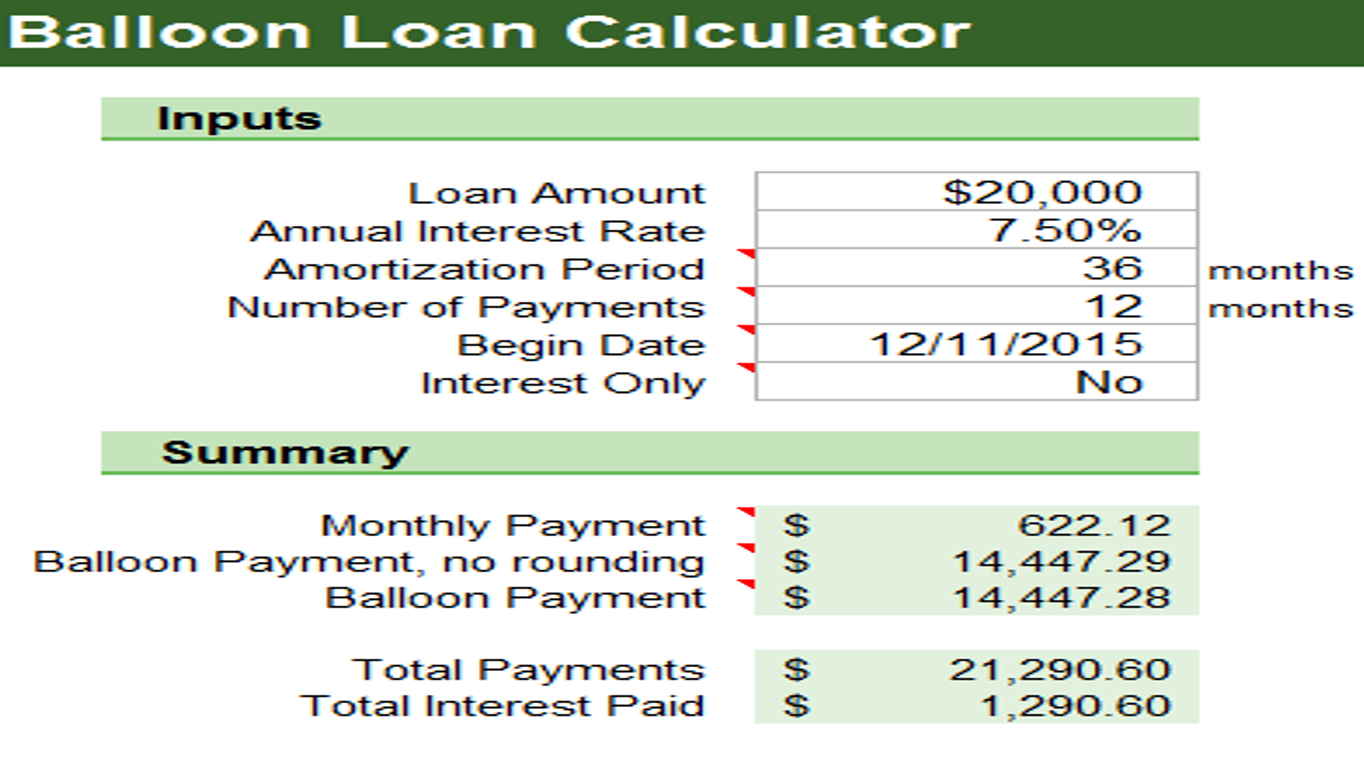

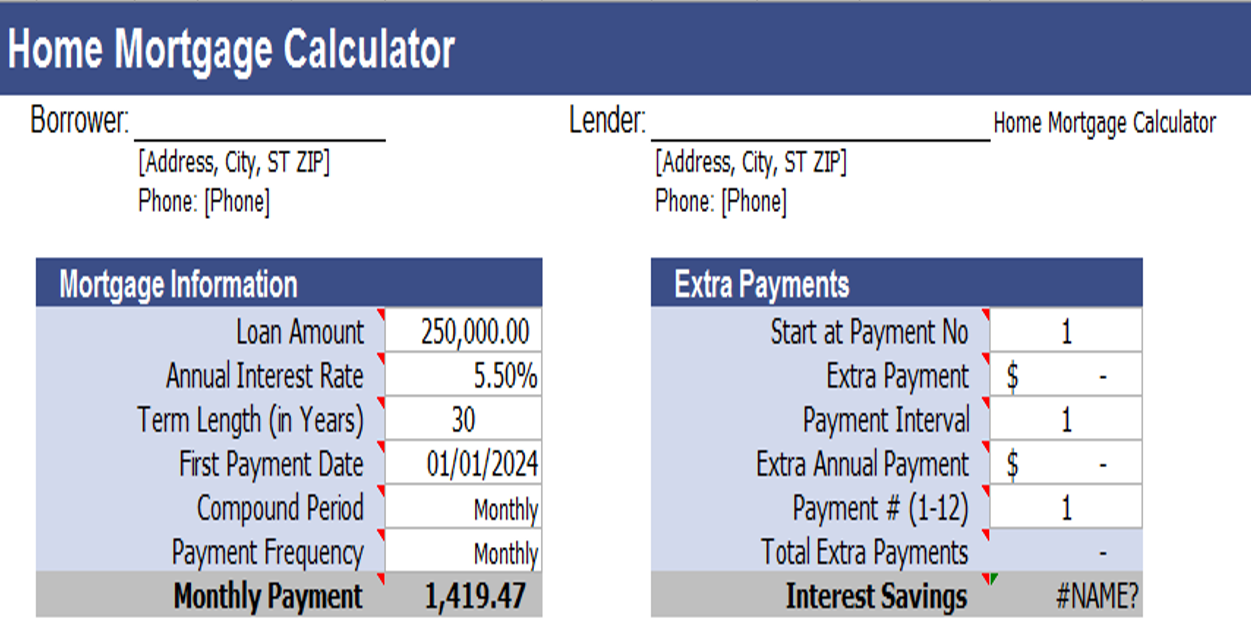

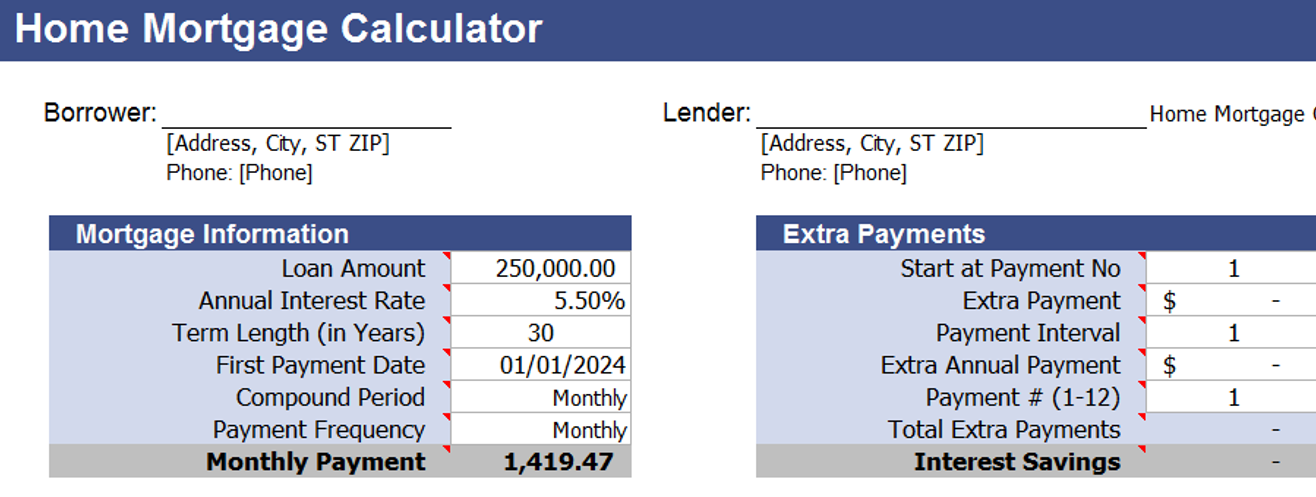

- Amortization Schedule Analysis:

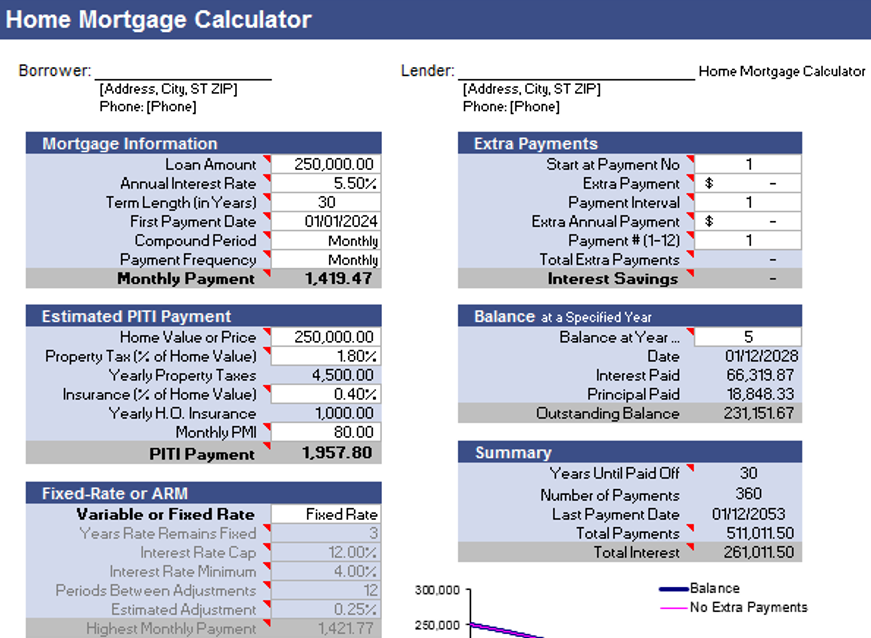

The Payment Calculator worksheet, showcased in the featured image, enables users to create an amortization table based on key parameters such as auto loan amount, annual interest rate, term of the loan (in years), and payment frequency. This feature facilitates a detailed analysis of different loan scenarios by allowing users to manipulate variables like the loan amount, interest rate, and loan term. Additionally, users can explore the impact of making extra payments on paying off the car loan early and reducing the total interest paid.

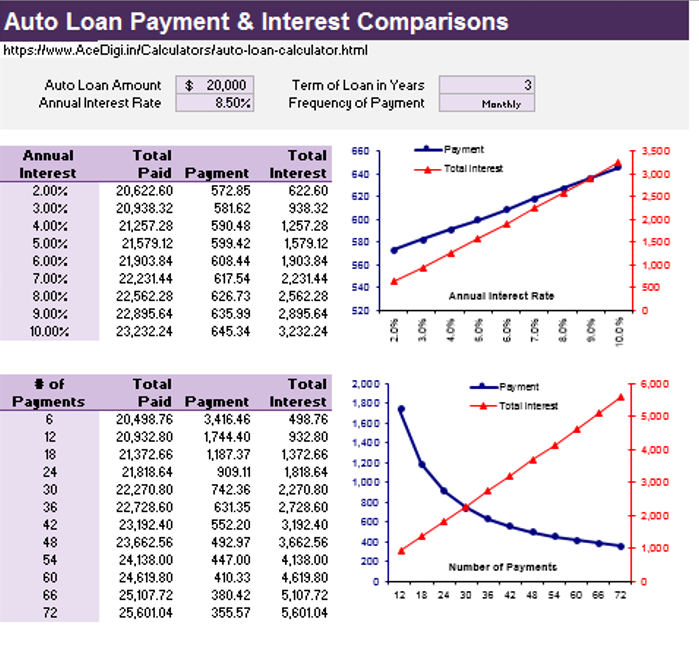

- Loan Comparisons with Graphical Representation:

– The third worksheet, titled Loan Comparisons, utilizes inputs from the loan payment calculator to generate graphs illustrating how variations in interest rates, the number of payments, or the amount of the down payment influence the monthly payment and total interest paid over the loan duration.

Using AceDigi’s Auto Loan Calculator:

– The spreadsheet is designed to be user-friendly, with instructions embedded within the cells as comments. Users can simply input values into the white-background cells, and the calculator dynamically updates the corresponding numbers. The Payment Calculator includes yellow cells for entering values in the Extra Payments column, allowing users to explore the impact of additional payments on the loan.

The spreadsheet is unlocked to provide users with the flexibility to customize it according to their individual needs. While AceDigi doesn’t offer technical support for creating custom spreadsheets, the user is encouraged to understand the equations and formulas before making modifications.

Cash Back vs. Low-Interest Financing:

AceDigi’s Auto Loan Calculator addresses the common dilemma of choosing between cash rebates and low-interest financing offered by auto manufacturers. Users can input a cash rebate amount and an annual interest rate, enabling them to save or print two versions of the spreadsheet for easy and effective comparisons.

AceDigi’s commitment to providing a practical and empowering financial tool is evident in the thoughtful design and functionality of the Auto Loan Calculator. Simplify your car financing decisions, analyze different scenarios, and make informed choices with AceDigi’s Auto Loan Calculator.

Amit Modi –

These templates have turned mundane tasks into a breeze. The attention to detail is evident, and they’ve made data analysis surprisingly enjoyable. A fantastic find!

3. Yusuf Ali –

Kudos to the creators of these templates! They’ve struck the perfect balance between sophistication and simplicity. My reports now have a professional edge, thanks to these gems.

3. Yusuf Ali –

Top-notch templates! Cover a wide range of needs with impressive attention to detail. Improved the professionalism of my reports and presentations. Highly satisfied!

Ava Richardson –

Kudos to the creators of these templates! They’ve struck the perfect balance between sophistication and simplicity. My reports now have a professional edge, thanks to these gems.