Description

Introduction

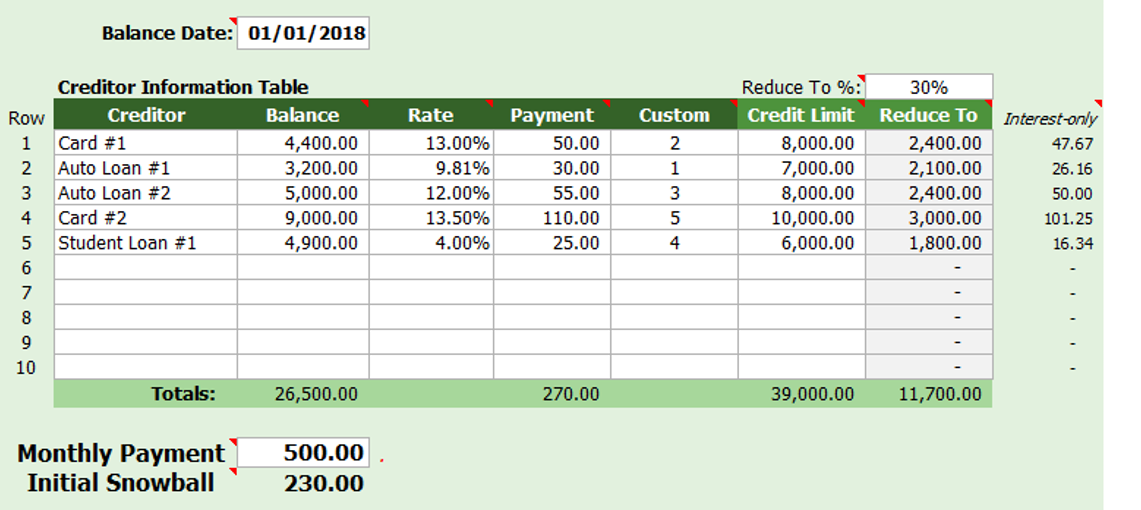

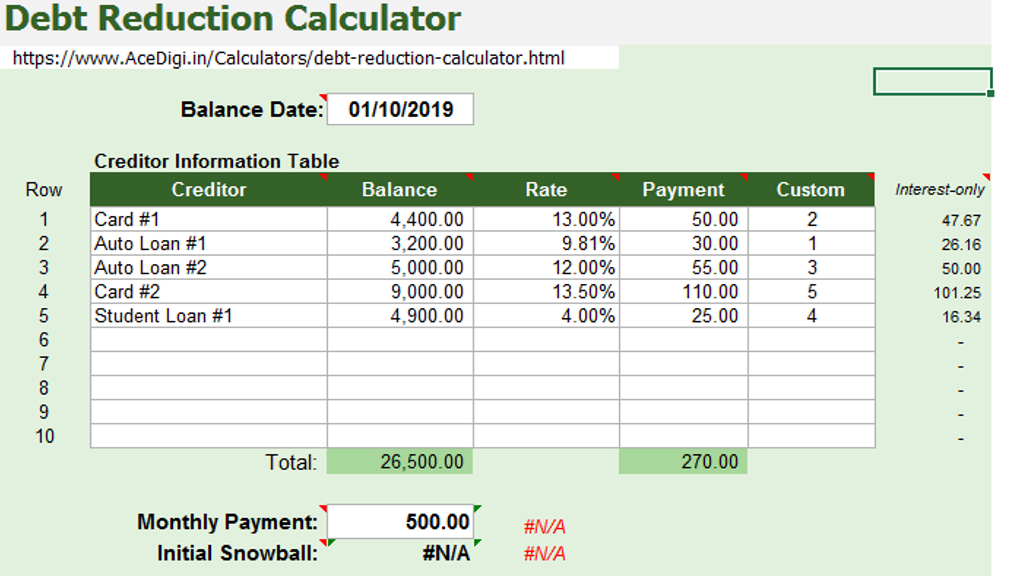

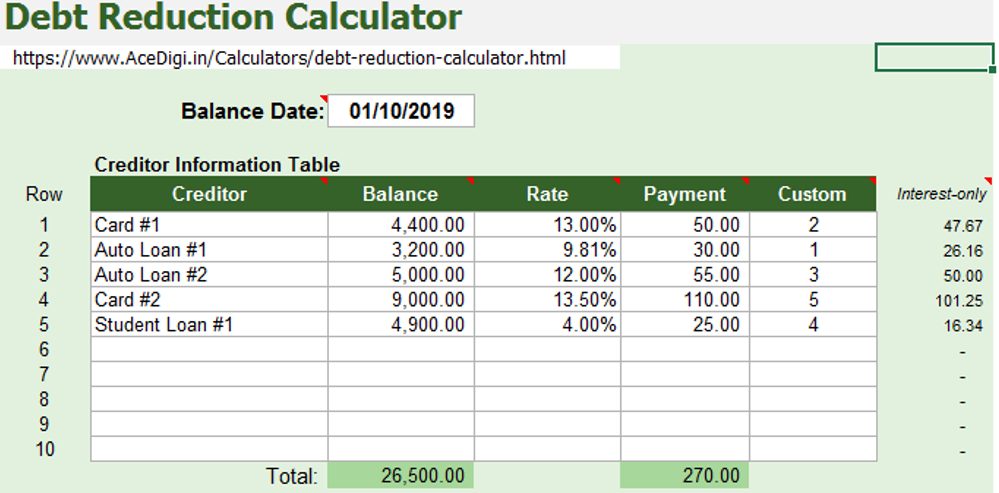

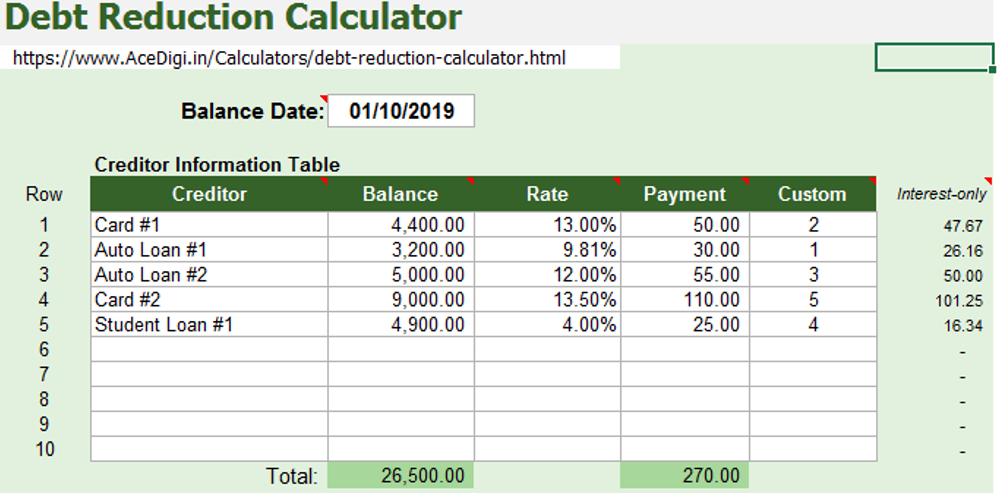

Embarking on the journey to financial freedom involves addressing critical questions: How quickly can one escape the clutches of debt, and how much can be saved in interest payments? AceDigi presents the Debt Reduction Calculator, a powerful tool designed to answer these questions and guide individuals towards a debt-free future. While the path to debt liberation is challenging, with a well-structured plan and unwavering determination, it becomes not only feasible but also rewarding. The Debt Reduction Calculator, utilizing the debt snowball methodology, is a user-friendly spreadsheet compatible with Microsoft Excel® and Google Sheets. This tool employs the debt roll-up approach to formulate a payment schedule, illustrating the most efficient way to eliminate debts.

Versatility in Debt Reduction Strategies

One of the standout features of the AceDigi Debt Reduction Calculator lies in its flexibility, allowing users to choose or create diverse debt reduction strategies. The two prominent approaches include the debt snowball, prioritizing the lowest balance first, and the debt avalanche, focusing on the highest-interest debt. Upon entering creditor information into the worksheet, users can effortlessly select their preferred strategy from a dropdown box. This adaptability empowers individuals to tailor their debt repayment plan to suit their financial goals, potentially leading to substantial savings, ranging from hundreds to thousands of dollars.

Budgeting as the Foundation

Regardless of the chosen strategy, the initial step in any debt snowball plan is crafting a budget and adhering to it diligently. The effectiveness of the debt reduction plan hinges on the commitment to the allocated budget. Maximizing the amount allocated to the debt snowball accelerates the journey towards achieving financial goals. While fast-tracking debt payoff is a crucial objective, it is essential to consider other financial goals and risk factors. Striking a balance between debt reduction and other financial priorities ensures a holistic and sustainable approach to financial wellness.

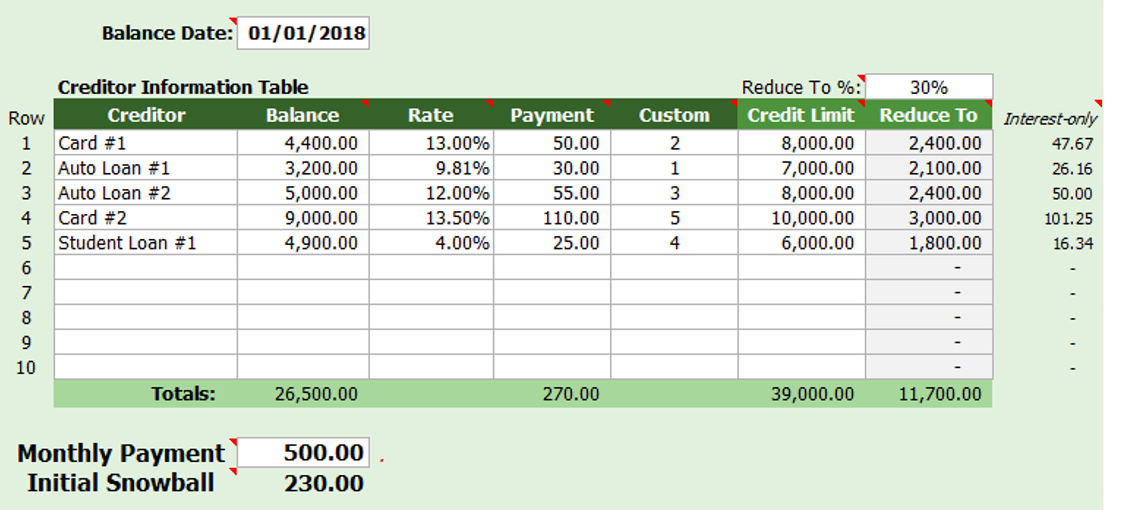

Understanding the Monthly Paymen

After determining the monthly contribution towards debt payoff, users can input this figure into the calculator as the total Monthly Payment. This consistent monthly payment remains unchanged throughout the repayment period. What evolves is the allocation of this payment—the snowball—directed towards the targeted debt. The Debt Reduction Calculator provides users with the flexibility to tailor their monthly payment based on their financial capacity, creating a realistic and achievable repayment plan.

Debt Reduction Strategies

- Debt Snowball:

This popular strategy involves paying off debts starting with the lowest balance. As each debt is eliminated, the freed-up funds are redirected towards the next debt on the list. This method emphasizes building momentum and psychological victories, fostering motivation throughout the debt payoff journey.

- Debt Avalanche:

In contrast, the debt avalanche strategy prioritizes debts with the highest interest rates. By targeting the most financially burdensome debts first, this approach minimizes overall interest payments, potentially saving considerable amounts in the long run.

Using the AceDigi Debt Snowball Calculator

AceDigi’s user-friendly Debt Reduction Calculator simplifies the process of eliminating credit card debt, auto loans, student loans, and other financial obligations. Users can effortlessly create a debt reduction schedule based on the popular debt snowball strategy or experiment with a customized approach tailored to their unique financial circumstances.

Conclusion

AceDigi’s commitment to financial empowerment is exemplified through the Debt Reduction Calculator, a versatile and dynamic tool designed to guide individuals on their journey to financial freedom. By offering a range of debt reduction strategies and emphasizing the importance of budgeting, this calculator provides a comprehensive solution to debt management. As users navigate their unique financial landscapes, the AceDigi Debt Reduction Calculator stands as a reliable companion, fostering informed decision-making and propelling them towards a debt-free and financially secure future.

Emily Thompson –

These templates have significantly improved the way I track my projects. User-friendly and visually appealing. Added a professional touch to my presentations. Highly recommend!

Charlotte Anderson –

Must-have for anyone working with data. Functional and aesthetically pleasing. An integral part of my workflow, making data management a breeze.

Oliver Mitchell –

These templates are a lifesaver for someone like me who’s always on the go. Quick, easy, and efficient – they’ve become an essential part of my toolkit. Thumbs up!

3. Yusuf Ali –

Cannot express how much these templates have simplified my workload. Comprehensive and made complex tasks much more manageable. Impressed with the quality and functionality.