Description

In the quest for financial stability and control, AceDigi presents a powerful tool – the Monthly Budget Spreadsheet. This free resource is designed to empower individuals in taking charge of their personal finances, offering a comprehensive platform to compare budgeted amounts with actual spending on a monthly basis. Whether you’re striving for short-term financial goals or planning for an entire year, AceDigi’s suite of budgeting solutions has you covered.

Unlock Financial Control with AceDigi:

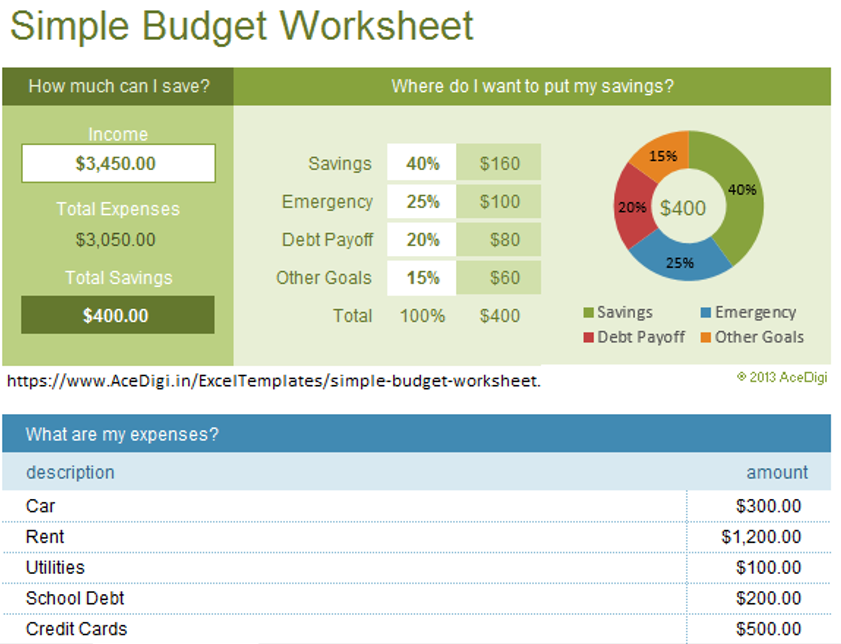

Managing personal finances requires diligence and a strategic approach. AceDigi’s Monthly Budget Spreadsheet is crafted to simplify this process, providing users with a clear overview of their budget and spending patterns. The flexibility of this tool allows users to compare monthly budgets to actual expenditures easily, fostering financial awareness and responsibility.

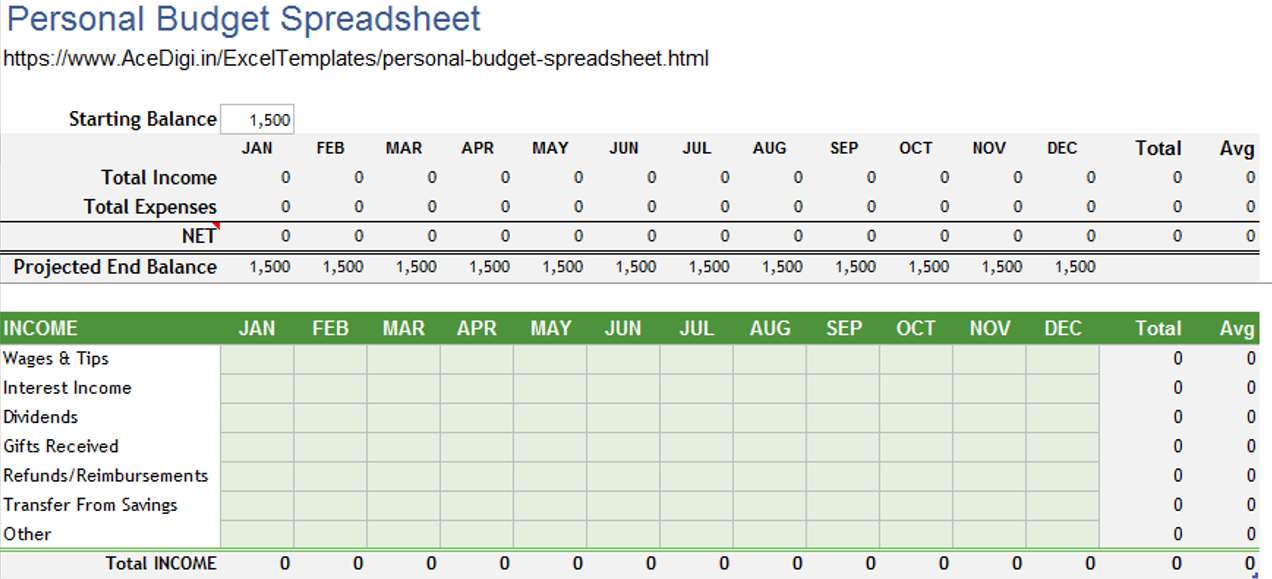

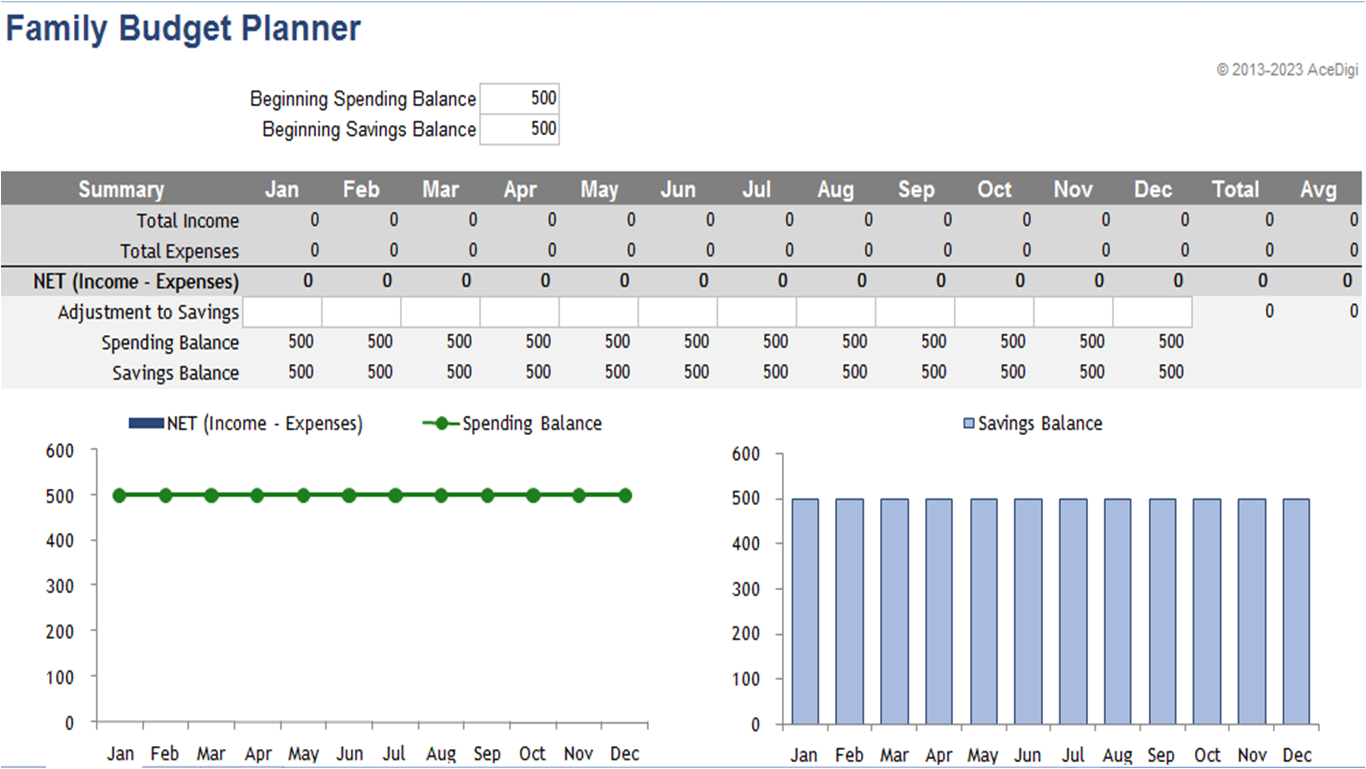

For those seeking a more extended planning horizon, AceDigi recommends exploring the Yearly Personal Budget. Families, in particular, can benefit from the Family Budget Planner, which offers a more detailed set of budget categories tailored to household dynamics.

Understanding AceDigi’s Monthly Budget Spreadsheet:

This user-friendly spreadsheet is designed for simplicity and effectiveness. Users can easily compare their monthly budget to actual expenditures, with the added convenience of being able to print the information on a single page in portrait orientation. The layout ensures clarity and accessibility, enabling users to identify potential areas of overspending at a glance.

How to Use the Monthly Budget Spreadsheet:

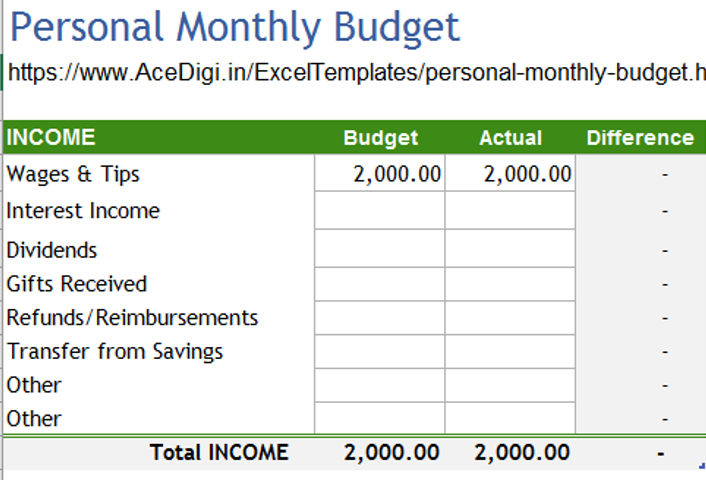

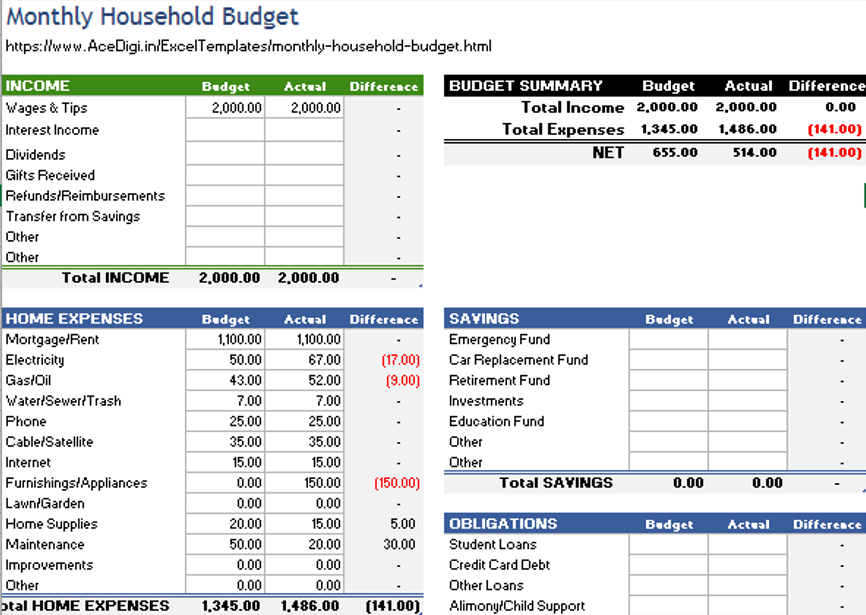

To utilize this template effectively, users need to fill in the highlighted numbers in the Budget and Actual columns, particularly those in the Home Expenses category. These numbers serve as examples and should be replaced with the user’s specific financial data.

The purpose of this budget worksheet is to facilitate a monthly comparison between the budgeted amounts and the actual income and expenses. Users record their desired budget for each category in the “Budget” column, representing their financial goals. At the end of the month, the “Actual” column is updated with the real expenditures incurred during that period.

For those desiring a more detailed breakdown of budget categories, AceDigi recommends exploring the Household Budget worksheet. Additionally, individuals new to budgeting or those looking for foundational tips can refer to AceDigi’s articles titled “Make a Budget” and “5 Basic Budgeting Tips.”

Navigating the Personal Monthly Budget Template:

The calculations in the “Difference” column are structured to highlight potential issues. In this accounting format, negative numbers are enclosed in parentheses (like (115.00)), and conditional formatting is applied to make negative numbers appear in red. This visual cue serves as a warning, making it easy to identify instances of overspending compared to the budgeted amounts.

The Monthly Budget Summary table, situated in the upper right of the worksheet, consolidates all income and expenses. It calculates the Net as Income minus Expenses, offering a quick assessment of the overall financial health. A negative Net indicates that the monthly budget has been exceeded, prompting users to reassess their spending habits.

Why Choose AceDigi for Personal Budgeting?*

AceDigi’s Monthly Budget Spreadsheet is more than just a financial tool; it’s a companion on your journey to financial control. The choice to use AceDigi is rooted in its commitment to providing accessible and user-friendly solutions. The flexibility of the template, coupled with its visual warnings for overspending, ensures that users can navigate their financial landscape with confidence.

Conclusion:

In the realm of personal finance, AceDigi’s Monthly Budget Spreadsheet emerges as a beacon of financial empowerment. Whether you’re a seasoned budgeter or someone taking the first steps towards financial control, this tool provides a structured and user-friendly approach. Unlock the potential of your personal finances with AceDigi, where financial control meets simplicity, creating a pathway to a secure and stable financial future.

5. Omar Hassan –

Using these templates for a few months now, and they’ve exceeded my expectations. Intuitive and time-saving. Highly valuable for anyone looking to simplify their tasks.”

5. Omar Hassan –

Love the customization options! These templates have allowed me to tailor my work to my specific needs. Well-designed, and the support provided is excellent. A satisfied user!

Sophia Williams –

I’ve tried various templates before, but these stand out. They’re not just functional; they add a touch of elegance to my work. Definitely worth the investment.

Amit Modi –

Cannot express how much these templates have simplified my workload. Comprehensive and made complex tasks much more manageable. Impressed with the quality and functionality.