Description

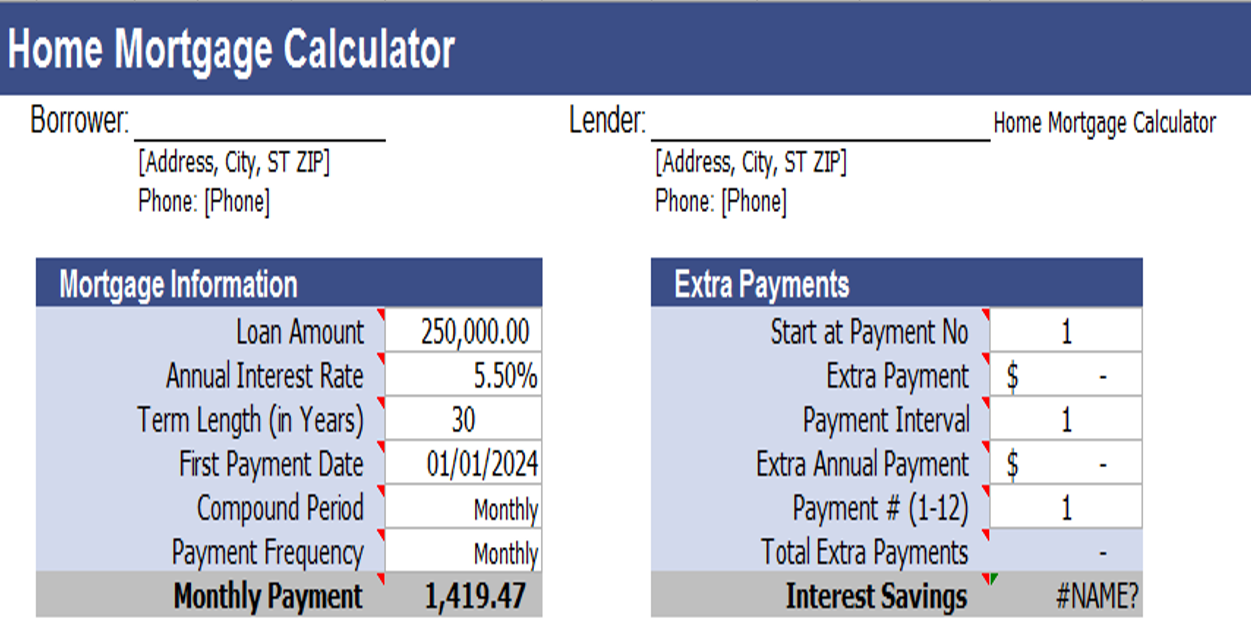

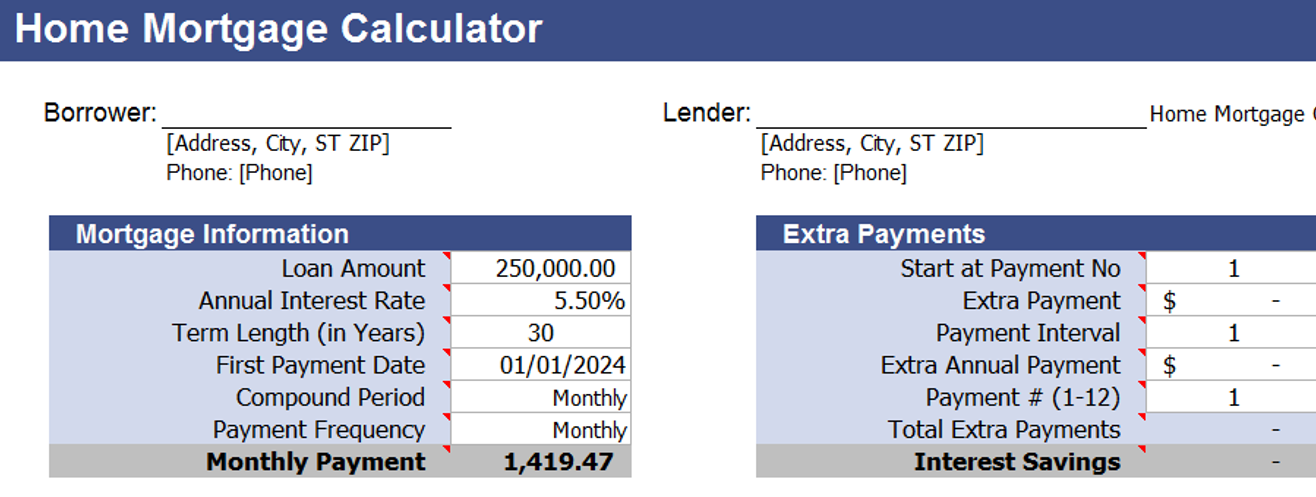

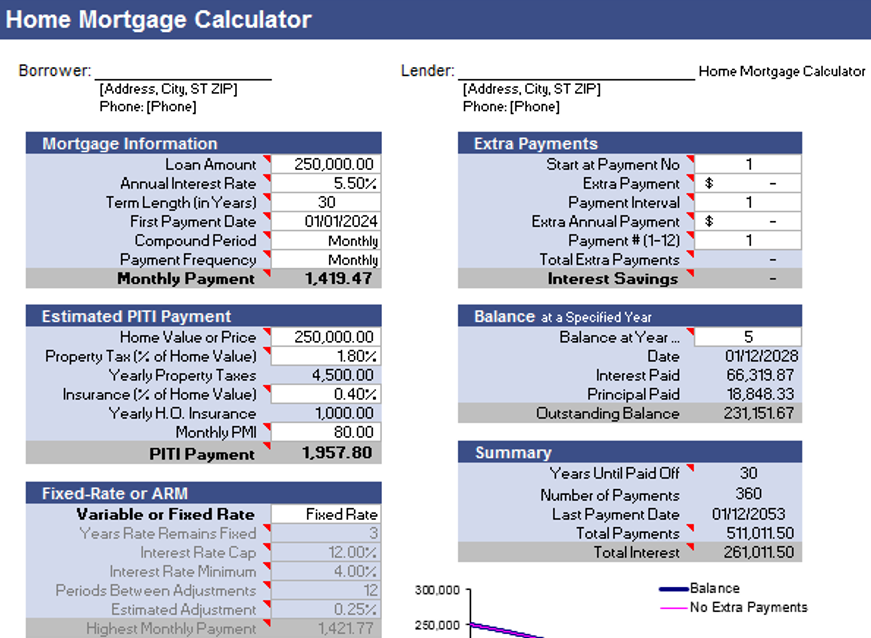

In the realm of homeownership, making informed financial decisions is paramount, and a reliable mortgage calculator is an essential tool in this endeavor. AceDigi presents a powerful and versatile solution with the AceDigi Home Mortgage Calculator for Excel—an all-in-one worksheet that amalgamates features from various mortgage and loan calculators. This tool goes beyond the basics, allowing users to analyze both variable-rate and fixed-rate mortgages while providing insights into potential savings through extra payments.

Overview of AceDigi Home Mortgage Calculator:

This free Home Mortgage Calculator is a feature-rich worksheet designed to empower users in assessing their mortgage scenarios comprehensively. Whether you are considering a variable-rate or fixed-rate mortgage, this tool facilitates a detailed analysis, incorporating factors such as insurance, interest, and potential savings from making additional payments.

Key Features of AceDigi Home Mortgage Calculator:

- Comprehensive Payment Analysis: Estimate your full mortgage payment, including insurance and interest, to gain a holistic understanding of your financial commitments.

- Flexible Extra Payment Options: Set up periodic extra payments or manually add additional payments within the Payment Schedule, allowing you to explore different payment scenarios.

- Comparison Capabilities: Compare various term lengths, rates, and loan amounts to make informed decisions about your mortgage.

- Outstanding Balance Calculation: Determine the outstanding balance at the end of a specified number of years, providing clarity on the progress of your mortgage.

- Tax Deduction Assessment: Calculate the tax returned if the interest paid is tax deductible, aiding in financial planning and optimization.

Using AceDigi Home Mortgage Calculator:

To facilitate ease of use, the spreadsheet includes information on how to operate the calculator and definitions of key terms as cell comments. Users can access these explanations by hovering the mouse over any cell marked with a red triangle in the corner, ensuring clarity and guidance throughout the process.

Addressing Key Financial Questions:

AceDigi Home Mortgage Calculator empowers users to address various financial questions, including:

Extra Payment Savings: Determine how much you can save by making extra payments towards your mortgage.

Tax Deduction Analysis: Track how the tax deduction from paying interest changes over time.

Variable-Rate Mortgage Exploration: Assess potential changes in monthly payments with a variable-rate mortgage.

Early Loan Repayment: Understand how soon you could pay off your home by making additional payments.

Projected Loan Balance: Predict the loan balance at the end of specific periods, such as 3 or 5 years.

New Features of AceDigi Home Mortgage Calculator:

In its latest version, the AceDigi Home Mortgage Calculator introduces several new features, enhancing its functionality and user experience:

Property Taxes and Insurance Estimation: The calculator now estimates Property Taxes and Insurance for the calculation of the PITI (Principal, Interest, Taxes, and Insurance) payment.

Accelerated Bi-Weekly Payments: Automatic calculation of so-called “Accelerated Bi-Weekly” payments for increased flexibility.

Compatibility: The calculator is adaptable to both US and Canadian mortgages through the compounding option.

Extra Payment Flexibility: Highly flexible options for scheduling and adjusting extra payments to suit individual preferences.

Mortgage Type Selection: Users can choose between a fixed-rate or variable-rate mortgage based on their preferences and financial goals.

Analyzing Existing Mortgages:

AceDigi Home Mortgage Calculator offers two approaches to analyze existing mortgages. Users can either enter the original loan amount and date, making adjustments to the payment history within the Payment Schedule, or enter the current mortgage balance, adjusting the term length until the Principal and Interest (PI) payment matches the current payment.

Note on Compatibility:

It’s essential to note that AceDigi Home Mortgage Calculator does not cater to “simple interest mortgages” or interest-only mortgages. For these scenarios, AceDigi recommends exploring alternative calculators like the Simple Interest Mortgage Calculator or the Interest-Only Mortgage Calculator.

In conclusion, the AceDigi Home Mortgage Calculator emerges as a versatile and user-friendly tool for individuals navigating the complexities of homeownership. Empowering users to make informed financial decisions, this comprehensive calculator is an invaluable resource for anyone seeking clarity and precision in their mortgage planning. Download AceDigi Home Mortgage Calculator today and take control of your mortgage journey with confidence.

5. Omar Hassan –

These templates have significantly improved the way I track my projects. User-friendly and visually appealing. Added a professional touch to my presentations. Highly recommend!

Amit Modi –

Must-have for anyone working with data. Functional and aesthetically pleasing. An integral part of my workflow, making data management a breeze.

Emily Thompson –

Using these templates has been a time-saver. The ease of use combined with the polished designs has elevated my work. It’s like having a design team at my fingertips!

Certainly! Here are five Muslim names: –

These templates have turned mundane tasks into a breeze. The attention to detail is evident, and they’ve made data analysis surprisingly enjoyable. A fantastic find!