Description

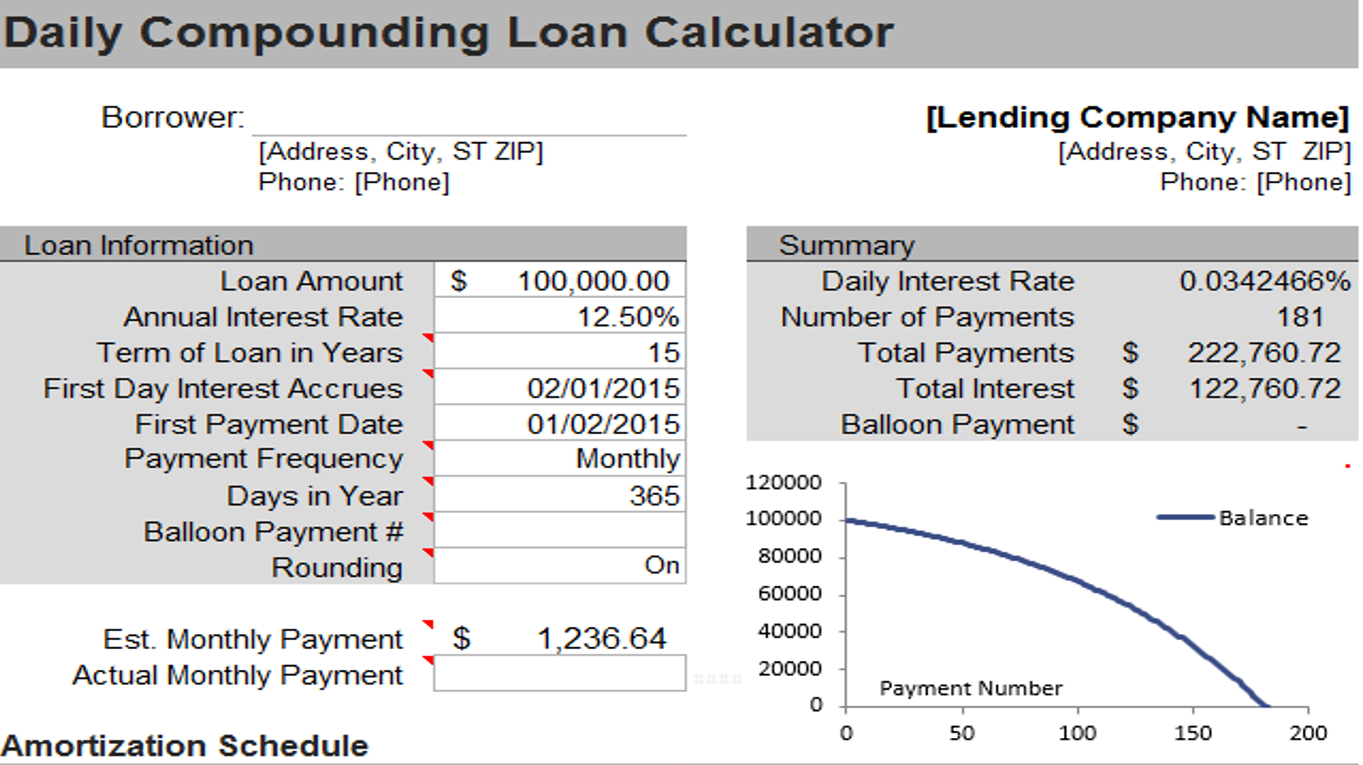

AceDigi offers a comprehensive spreadsheet designed for analyzing and tracking daily compounding loans, ensuring precise calculations for accrued interest and facilitating effective payment tracking. This calculator is an extension of our simple interest loan calculator, taking into account daily compounding and incorporating features that allow users to monitor payments by inputting actual dates and corresponding amounts paid.

Cautionary Note: Verify Your Loan Type

Before utilizing this spreadsheet, it is crucial to be certain that your loan follows a daily compounding structure. AceDigi provides a variety of loan calculators, each tailored to specific loan types. Incorrect utilization of the calculator may yield inaccurate results. Exercise caution and ensure the suitability of this tool for your specific loan type.

Spreadsheet Overview

This spreadsheet comprises two distinct worksheets, each serving a unique purpose to cater to the intricacies of daily compounding loans.

- Amortization Schedule Worksheet:

The first worksheet facilitates the creation of an estimated amortization schedule for a daily compounding loan. Users can input various assumptions such as payment frequency, interest rates, and other relevant parameters to tailor the schedule according to their specific loan terms.

- Payment Tracking Worksheet:

The second worksheet, depicted in the accompanying image, allows users to log actual payment dates and corresponding amounts. The interest is computed based on the entered dates, utilizing a daily compounding formula. To illustrate the daily compounding process, users can input a row for each day, revealing the incremental addition of interest to the principal balance on a daily basis.

Utilizing the Spreadsheet for Credit Card Analysis

For individuals with credit cards that impose interest based on daily compounding or use an average daily balance, this spreadsheet serves as a valuable tool for analysis and tracking. Users can seamlessly add new purchases by entering negative values into the Payment column. Additionally, entering a date with a zero payment enables the calculation of the balance on a specific date, such as the credit card statement date.

Enhanced Understanding of Daily Compounding

The AceDigi Daily Compounding Loan Analysis Spreadsheet provides users with a nuanced understanding of how daily compounding functions. By entering data for each day, users witness the continual addition of interest to the principal, mirroring the intricacies of credit card interest accrual.

Conclusion

AceDigi’s commitment to providing tailored financial tools is evident in the functionality of this Daily Compounding Loan Analysis Spreadsheet. With an emphasis on accuracy and user-friendly design, this resource empowers individuals to analyze, track, and gain insights into their loans, particularly those subject to daily compounding. Remember to exercise diligence in verifying the nature of your loan before using this tool, ensuring optimal results and informed financial decision-making.

Emily Thompson –

These templates are a lifesaver for someone like me who’s always on the go. Quick, easy, and efficient – they’ve become an essential part of my toolkit. Thumbs up!

4. Aisha Rahman –

Cannot express how much these templates have simplified my workload. Comprehensive and made complex tasks much more manageable. Impressed with the quality and functionality.

Alex Scott –

Using these templates has been a time-saver. The ease of use combined with the polished designs has elevated my work. It’s like having a design team at my fingertips!

Samuel Parker –

I stumbled upon these templates and couldn’t be happier. They’re like a secret weapon for productivity. The range is impressive, and the simplicity of use is refreshing