Description

AceDigi introduces a robust Home Equity Loan Calculator, embedded within an Excel workbook and equipped with three distinct calculators to address key inquiries: (1) How much money can I borrow? (2) What will my monthly payment be? (3) How much home equity might I have in 5 years? This comprehensive tool is designed to provide clarity and insights into your home equity loan, facilitating informed financial decisions.

Understanding Home Equity Loans

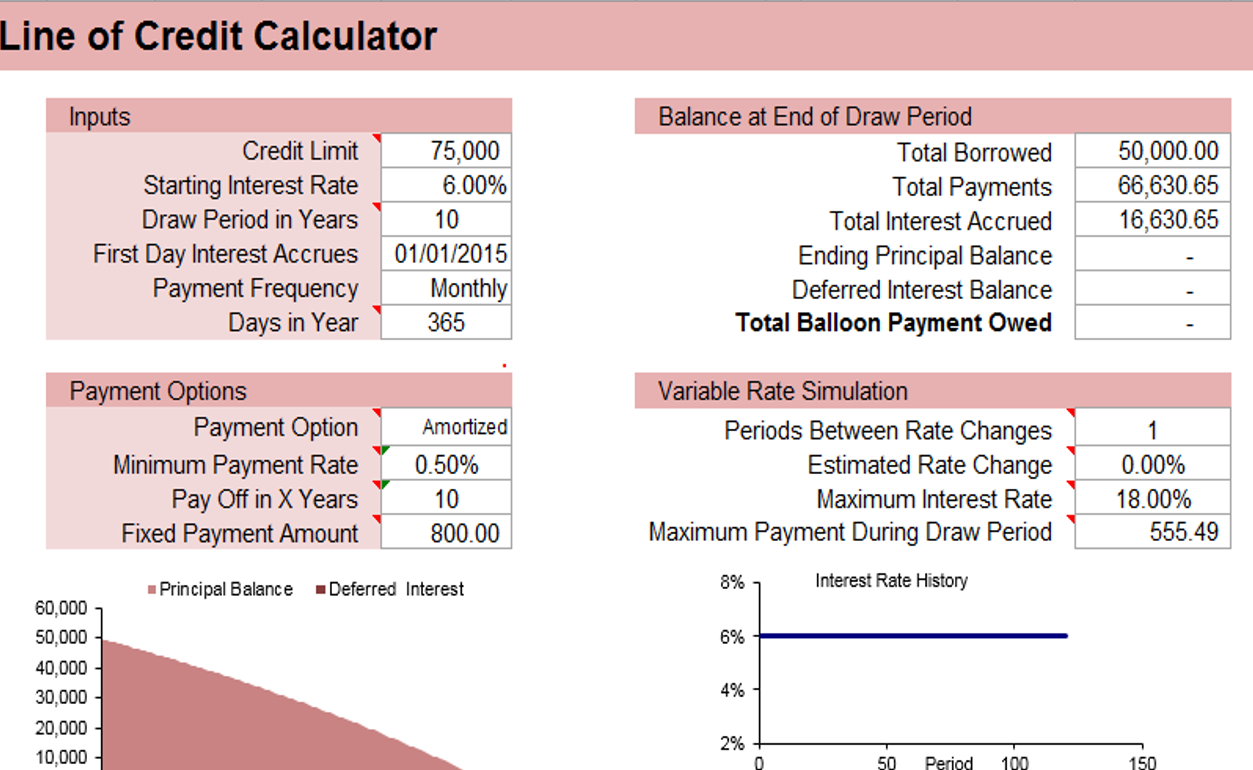

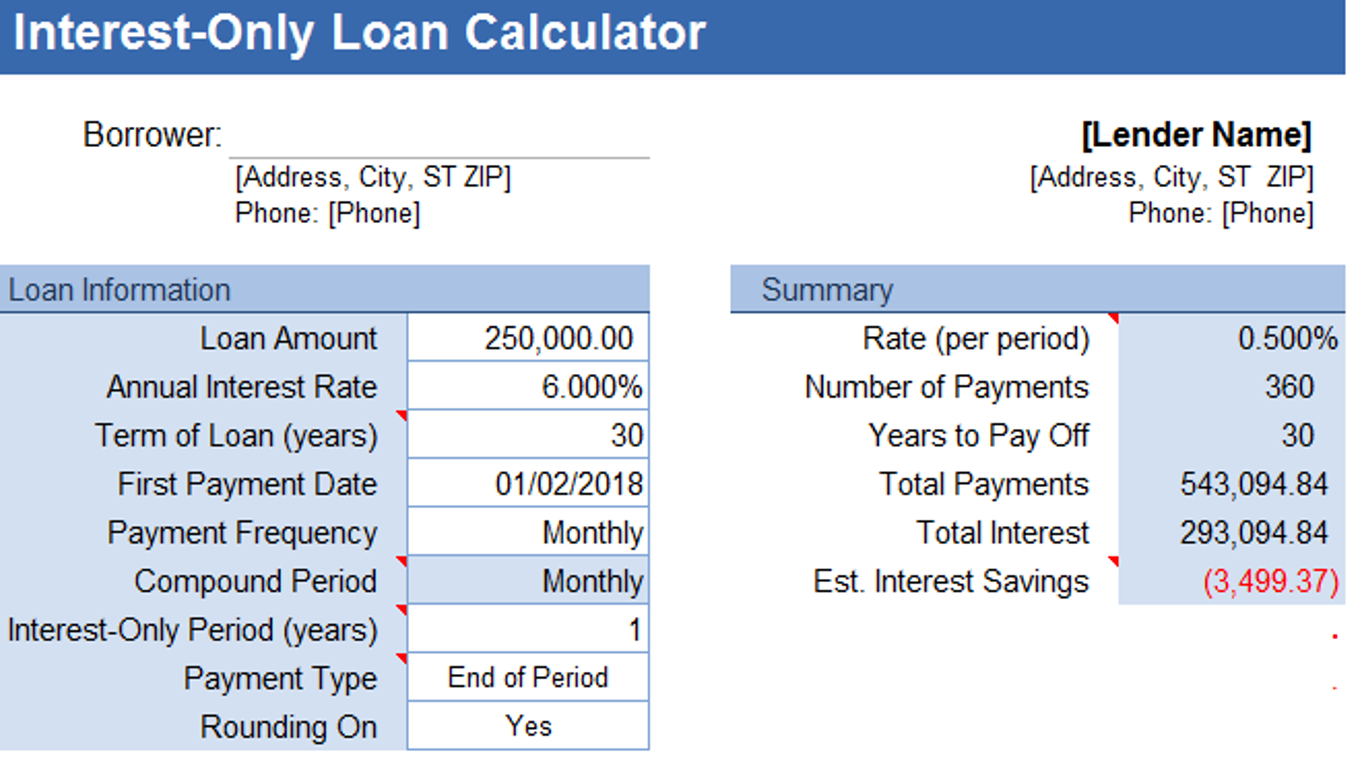

A home equity loan, often referred to as a “second mortgage,” is a financial instrument where homeowners leverage the equity in their homes to secure a loan. While the terms “home equity loan” and “second mortgage” are used interchangeably, the latter encompasses a broader category. The AceDigi Home Equity Loan Calculator evaluates fixed-rate loans, accommodating optional extra payments configured to simulate accelerated bi-weekly payments. For those seeking an adjustable rate mortgage calculator, AceDigi recommends exploring the ARM mortgage calculator. Additionally, if a Home Equity Line of Credit (HELOC) calculator is required, the AceDigi HELOC calculator is available.

Overview of the Excel Workbook

This feature-rich Excel workbook incorporates three specialized calculators to comprehensively address the intricacies of home equity loans:

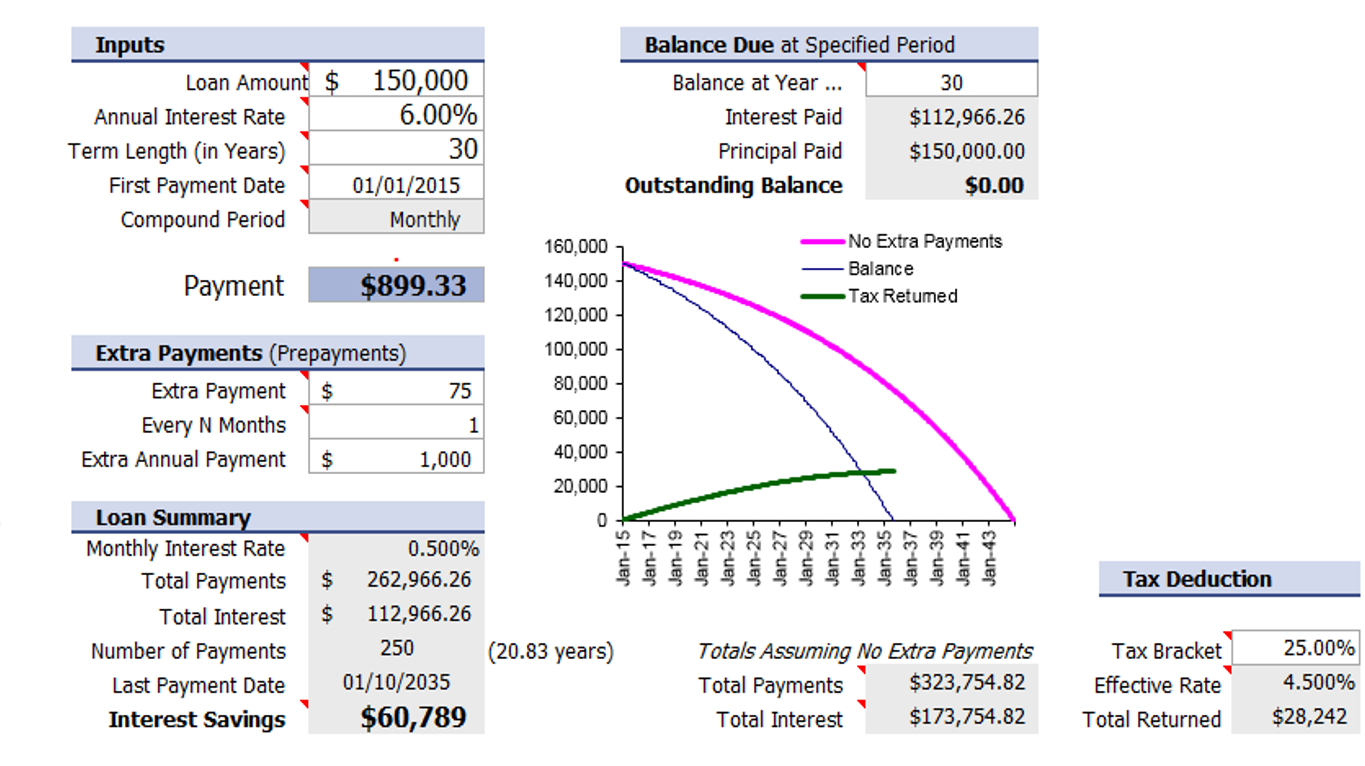

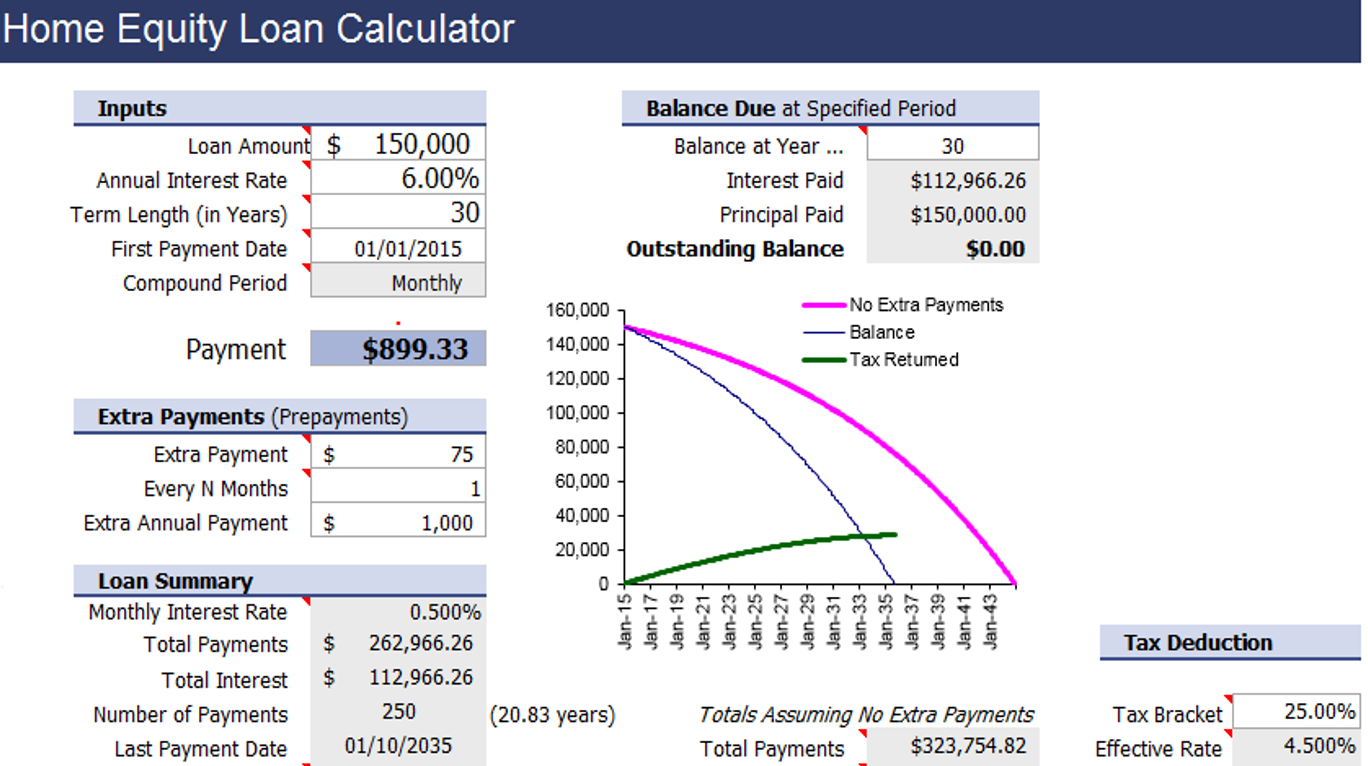

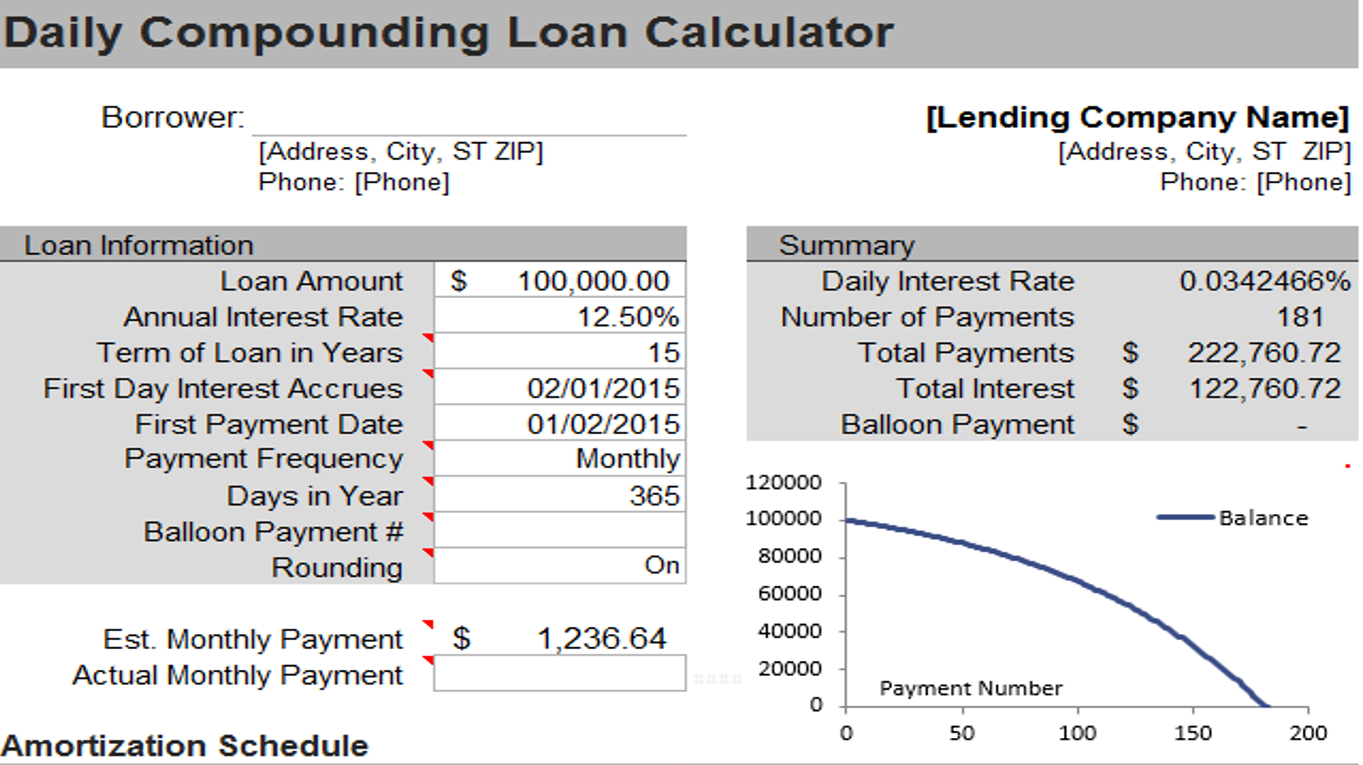

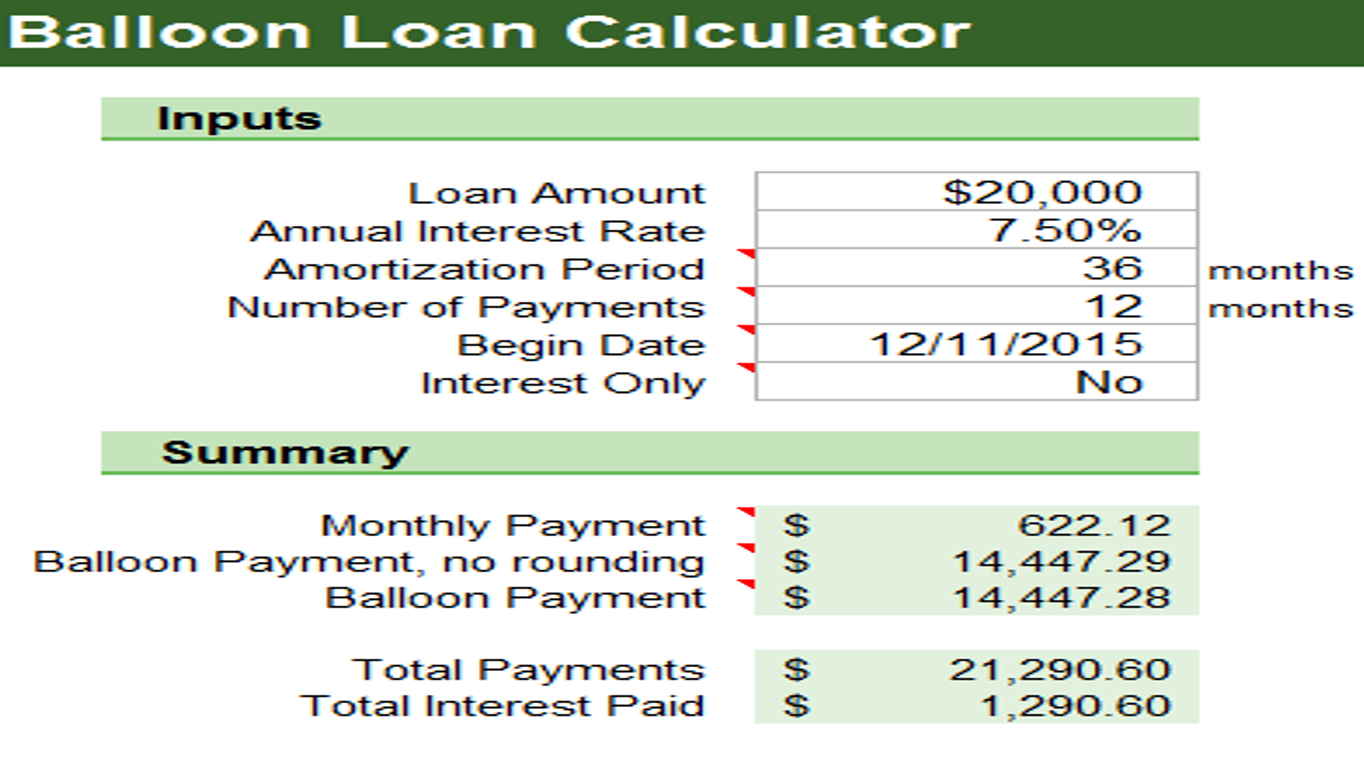

- Amortization Schedule Calculator:

Enables the calculation of monthly payments on a fixed-rate home equity loan.

Creates an amortization schedule for effective visualization of payment progress.

Allows users to set up periodic extra payments or manually enter prepayments in the payment schedule.

- HomeEquity Calculator:

Located on the third tab of the workbook, it calculates the amount of equity in a home after a specified number of years.

While limited to fixed-rate mortgages, it proves valuable for analyzing the current state of your loan and making predictions, especially if contemplating selling your home in the future.

- LoanCalculator Worksheet:

Located on the first tab, it closely resembles AceDigi’s home mortgage calculator.

Tailored for standard fixed-rate home equity loans, providing an amortization schedule and facilitating experimentation with extra payments to expedite loan payoff and reduce interest costs.

Utilizing the HomeEquity Calculator

The HomeEquity worksheet, featured as the third tab, empowers users to gauge their home equity over time. While designed for fixed-rate mortgages, it serves as a valuable analytical tool for assessing the current state of your loan and making informed predictions, particularly in scenarios where selling your home is a consideration. Key questions addressed include the time required to pay off each loan, the equity buildup in a specified period, and the potential impact of a home value decrease.

Users simply input the current balance, annual interest rate, and monthly payment (excluding taxes and insurance). Uniquely, this calculator accommodates both the 1st mortgage and 2nd mortgage (or a home equity loan). It caters to interest-only mortgages, assuming a constant rate. Additionally, for payments exceeding the regular amortized monthly payment, the surplus is allocated towards the principal.

Optimizing the LoanCalculator Worksheet

The LoanCalculator worksheet, located on the first tab, closely mirrors AceDigi’s home mortgage calculator. Specifically tailored for standard fixed-rate home equity loans, it assists in creating an amortization schedule. Users can experiment with extra payments to explore their impact on loan payoff and interest savings.

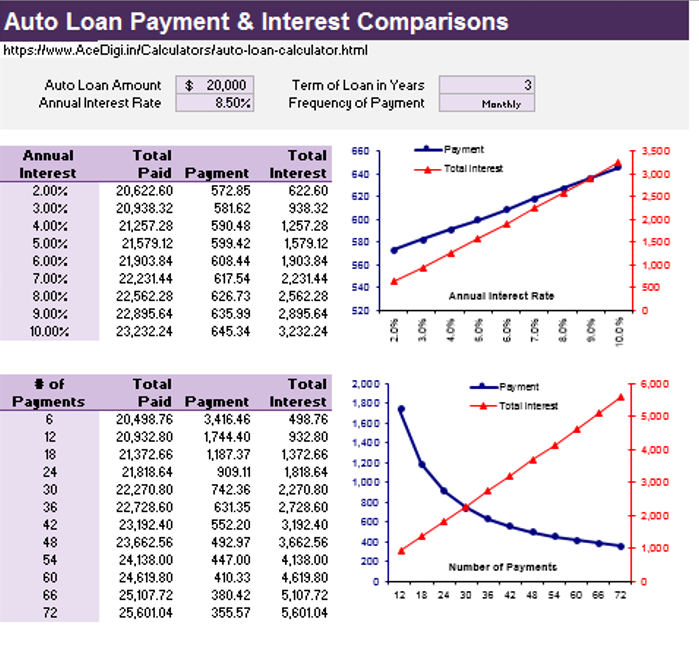

Evaluating Bi-Weekly Payment Options

The Home Equity Loan Calculator proves versatile in estimating interest savings from accelerated bi-weekly payment plans. Typically, making bi-weekly payments involves paying half of the monthly payment every two weeks, resulting in 26 payments per year. The spreadsheet allows users to simulate this by making an extra payment of Payment/12 each month, where Payment represents the normal monthly payment. This simulation closely mirrors reality, provided lenders do not impose fees for prepayments. While the amortization table may not align precisely with lender-provided data, it offers a reliable approximation.

Conclusion

AceDigi’s Home Equity Loan Calculator Excel workbook emerges as a comprehensive and user-friendly tool for individuals navigating the complexities of home equity loans. By seamlessly integrating three specialized calculators, AceDigi empowers users to make informed decisions regarding borrowing, monthly payments, and long-term equity projections. Utilize this resource to gain clarity on your home equity journey, ensuring financial decisions align with your goals and aspirations.

Ava Richardson –

I stumbled upon these templates and couldn’t be happier. They’re like a secret weapon for productivity. The range is impressive, and the simplicity of use is refreshing

Amit Modi –

Cannot express how much these templates have simplified my workload. Comprehensive and made complex tasks much more manageable. Impressed with the quality and functionality.

Samuel Parker –

Impressed with the variety of templates available. From budgeting to project management, they cover it all. Well-designed and have significantly improved my productivity. Highly recommended!

Liam Walker –

Top-notch templates! Cover a wide range of needs with impressive attention to detail. Improved the professionalism of my reports and presentations. Highly satisfied!