Description

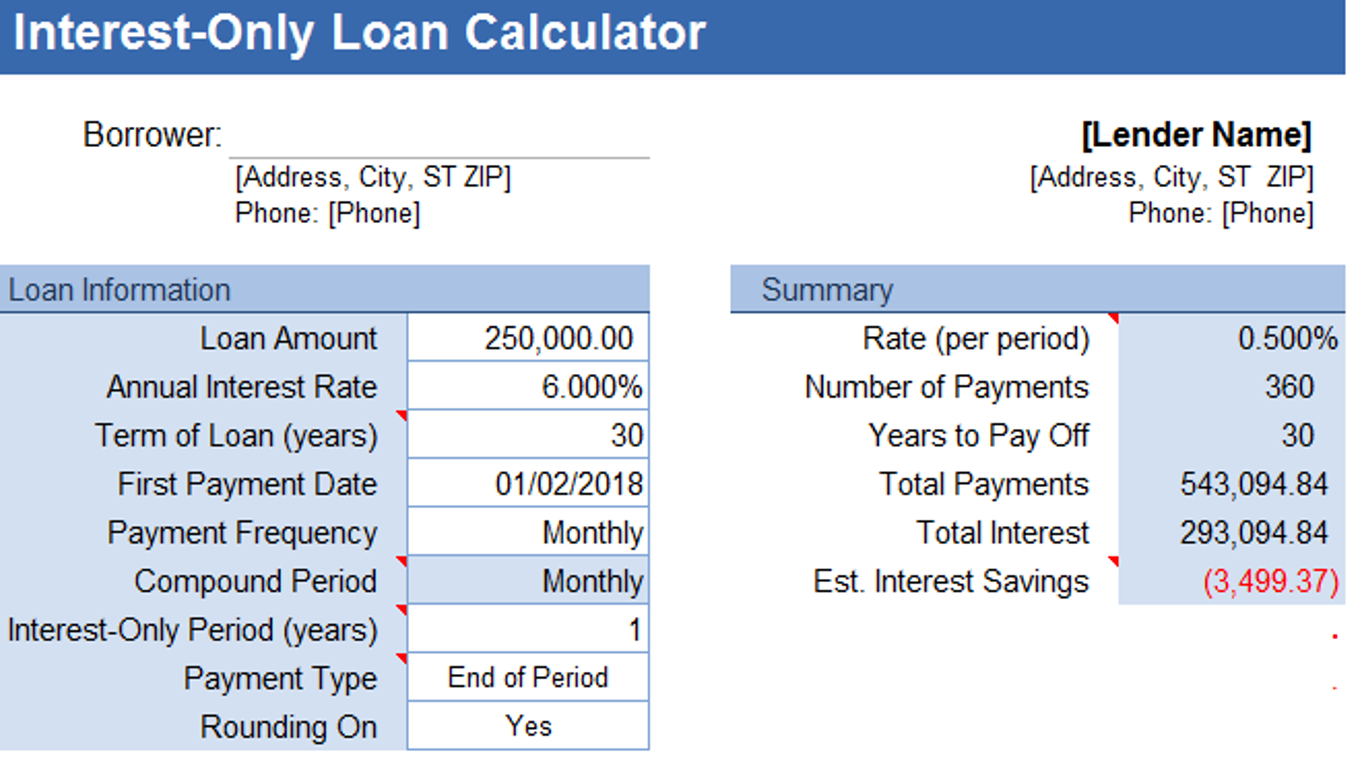

AceDigi presents a dynamic Interest-Only Loan Calculator, a robust spreadsheet built on the foundation of our renowned Loan Amortization Schedule. Tailored to empower users in calculating interest-only payments for fixed-rate loans or mortgages, this tool allows customization of the interest-only (IO) period while accommodating the calculation of the impact of extra payments before and after the IO duration.

Understanding Interest-Only Mortgage Loans

Interest-only payment options are prevalent in both fixed-rate and variable-rate loans and mortgages. This unique feature enables borrowers to make payments that exclusively cover the interest, with no contribution towards the principal, for a specified period. This results in lower initial payments during the early years or months of the loan term.

During the interest-only period, borrowers typically have the flexibility to make extra payments towards the principal without incurring penalty fees. At the conclusion of the IO period, the monthly payment is recalculated based on the remaining loan term and the outstanding balance.

Fortunately, with the AceDigi Interest-Only Loan Calculator, users can effortlessly perform these intricate calculations without the need for manual computations.

Description of the Interest-Only Loan Calculator

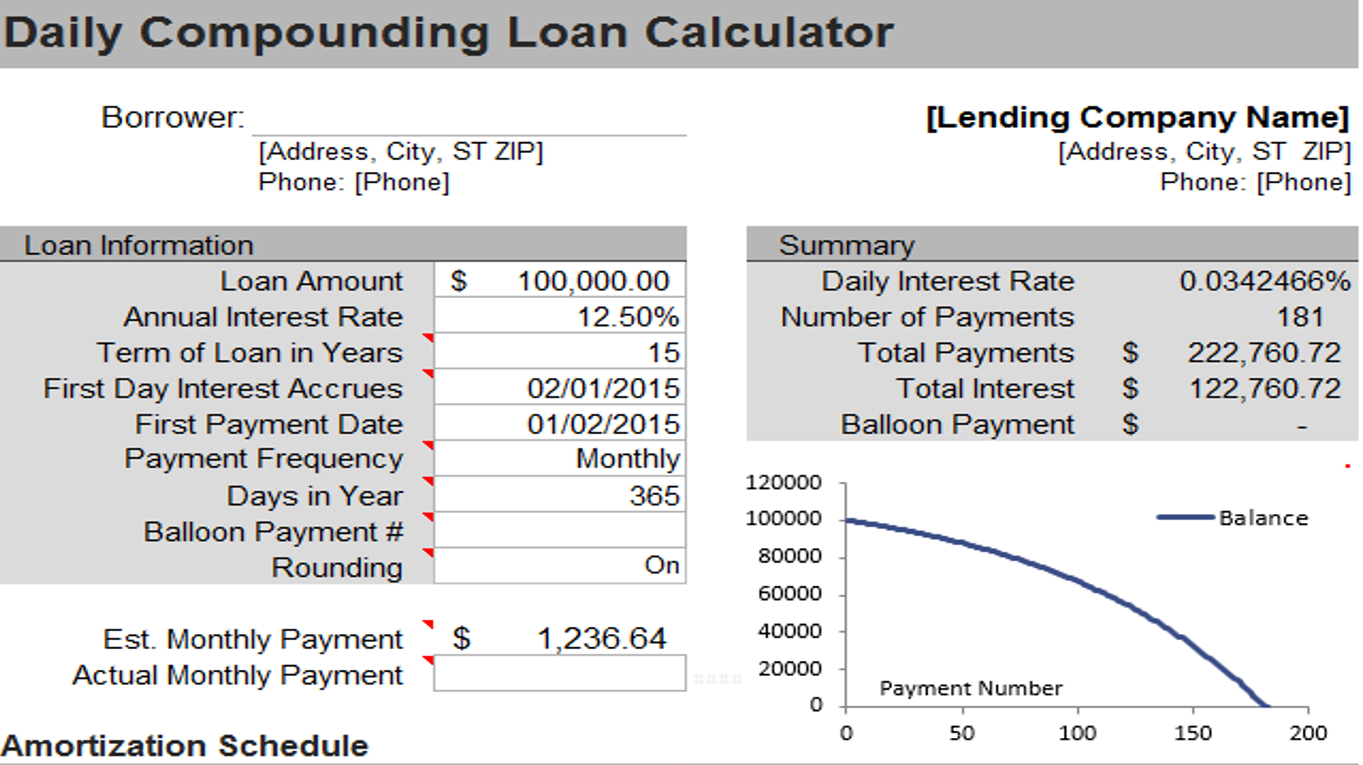

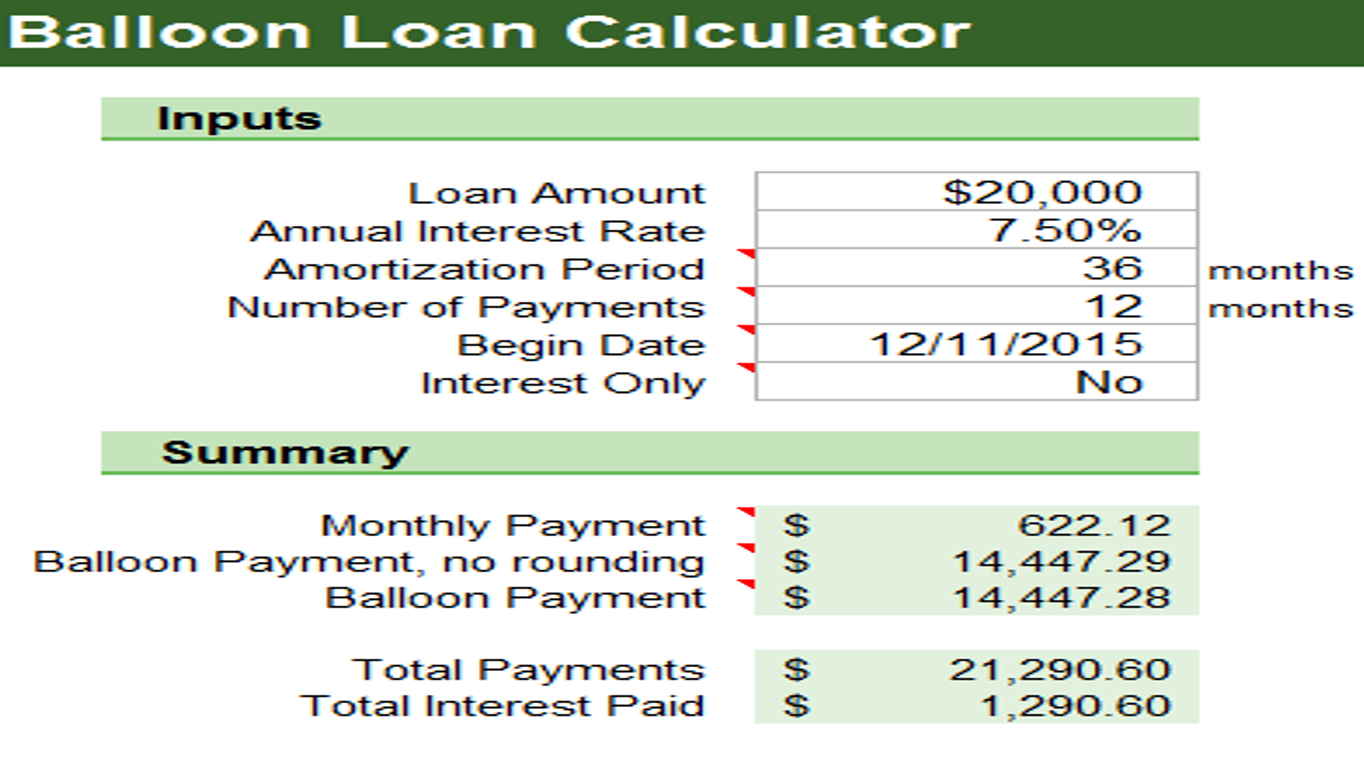

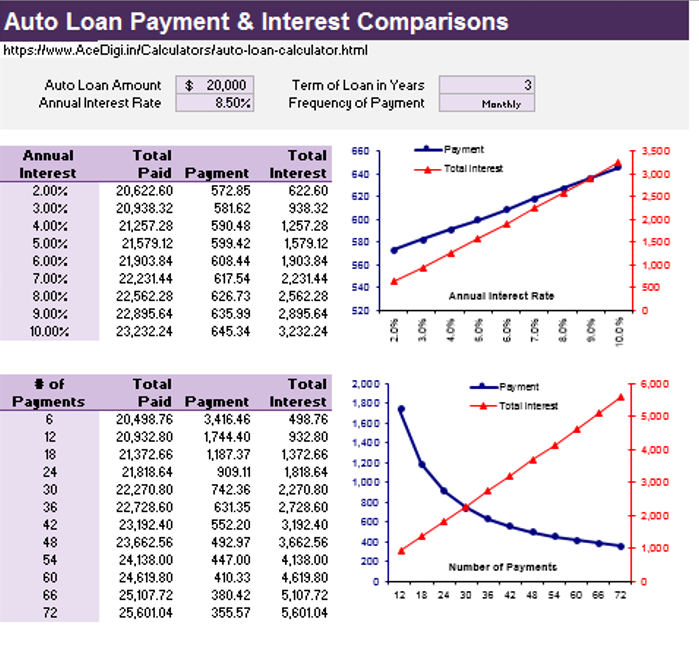

This comprehensive spreadsheet generates an amortization schedule specifically designed for fixed-rate loans. It incorporates features for optional extra payments and an interest-only period, making it adaptable for both interest-only loans and interest-only mortgages.

Update 8/17/2018: Enhancements for User Convenience

In response to user feedback and evolving needs, the main XLSX version tailored for Excel 2007+ has undergone an update. The new version enables the duplication of the loan worksheet, allowing users to compare different loans within the same workbook. Cosmetic changes have been implemented for an improved user interface, accompanied by updated comments and help information.

As a valuable addition, a commercial-use version of this Interest-Only Loan calculator is included as a bonus spreadsheet with the purchase of the Loan Amortization Schedule.

Navigating the Interest-Only Calculator

AceDigi’s Interest-Only Calculator boasts an intuitive design, ensuring ease of use for all users. Simply input your loan details in the cells with a white background, and the spreadsheet automates all subsequent calculations. For those opting to include extra payments, the amortization table provides a designated space.

To further assist users, comments within the file, marked with a small red triangle on select cells, offer guidance and clarification on any potential queries.

Determining Suitability: Is an Interest-Only Loan Right for You?

While the decision of whether an interest-only loan is suitable lies with the individual borrower, we strongly recommend a thorough review of the referenced materials below. Fixed-rate loans with an interest-only option are relatively straightforward to comprehend and predict. However, interest-only mortgages featuring adjustable rates pose additional complexities and potential risks, making it imperative for borrowers to delve into comprehensive research and understand the nuances involved.

In conclusion, AceDigi’s Interest-Only Loan Calculator stands as a reliable and user-friendly tool, empowering borrowers to navigate the intricacies of interest-only loans and mortgages with precision and ease. Utilize this powerful spreadsheet to make informed decisions and gain a comprehensive understanding of your loan dynamics.

Isabella Carter –

Cannot express how much these templates have simplified my workload. Comprehensive and made complex tasks much more manageable. Impressed with the quality and functionality.

Benjamin Harrison –

These templates have turned mundane tasks into a breeze. The attention to detail is evident, and they’ve made data analysis surprisingly enjoyable. A fantastic find!

Henry Taylor –

Love the customization options! These templates have allowed me to tailor my work to my specific needs. Well-designed, and the support provided is excellent. A satisfied user!

Amit Modi –

Kudos to the creators of these templates! They’ve struck the perfect balance between sophistication and simplicity. My reports now have a professional edge, thanks to these gems.