Description

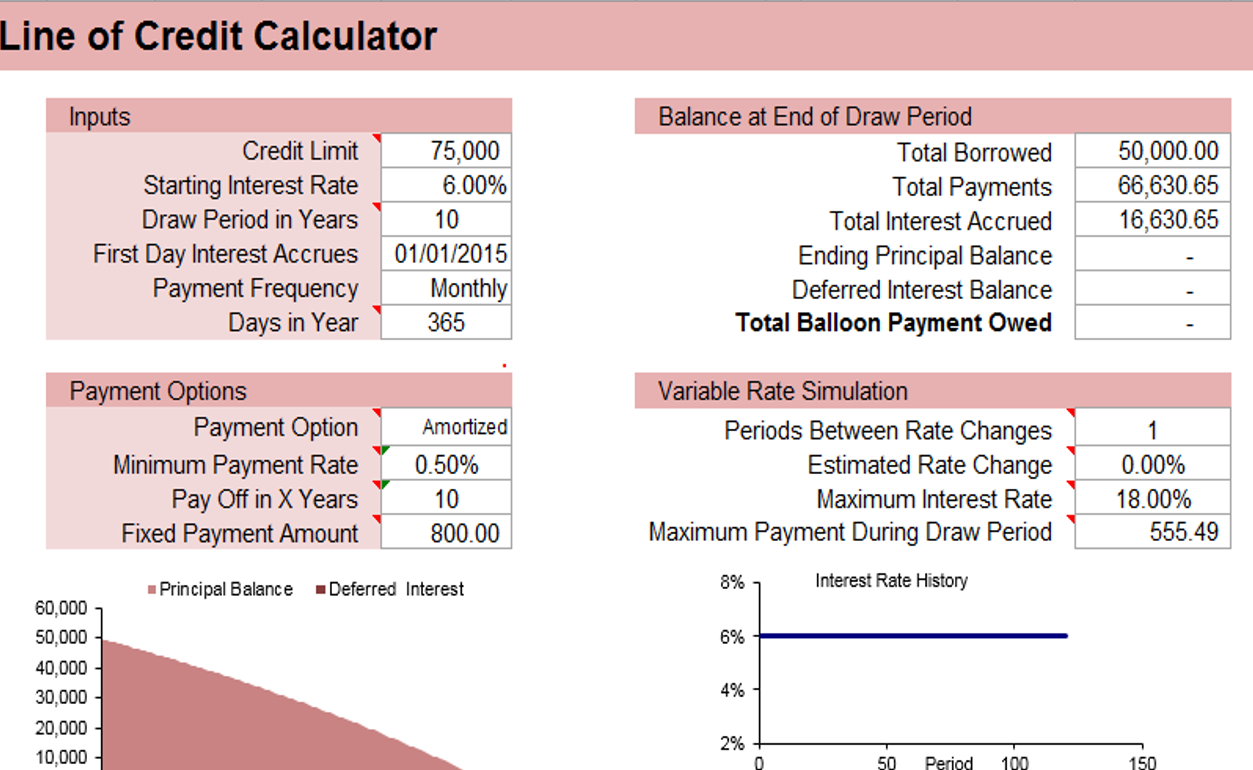

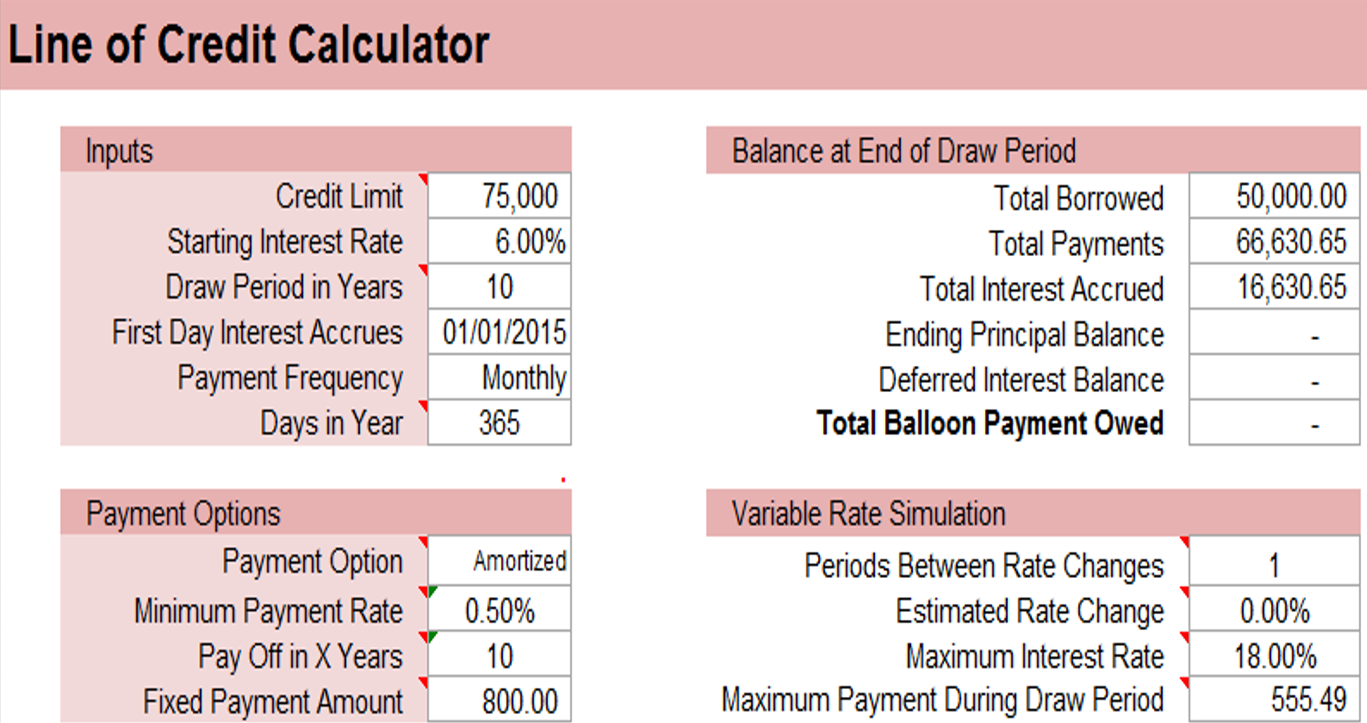

AceDigi introduces a powerful and flexible Home Equity Line of Credit (HELOC) Calculator, designed to assist individuals in estimating payments required to effectively manage and pay off their debt. While I generally advise against acquiring a home equity line of credit, understanding that circumstances may vary, this Line of Credit Calculator offers a comprehensive and versatile tool for those who already have a HELOC. Far exceeding the capabilities of most online HELOC calculators, this spreadsheet is adept at simulating a general revolving line of credit. For lenders seeking a method to monitor a line of credit, the AceDigi Line of Credit Tracker provides a viable solution.

Description of the HELOC Calculator

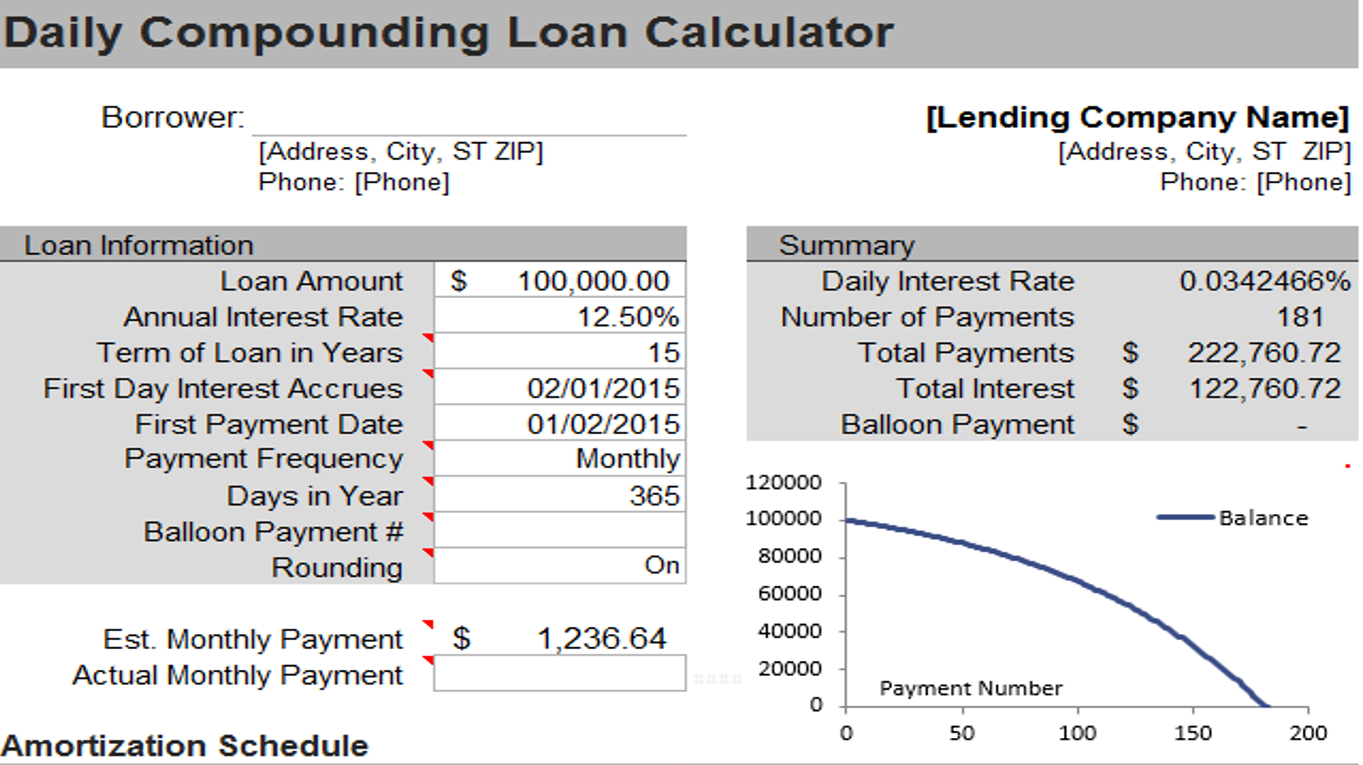

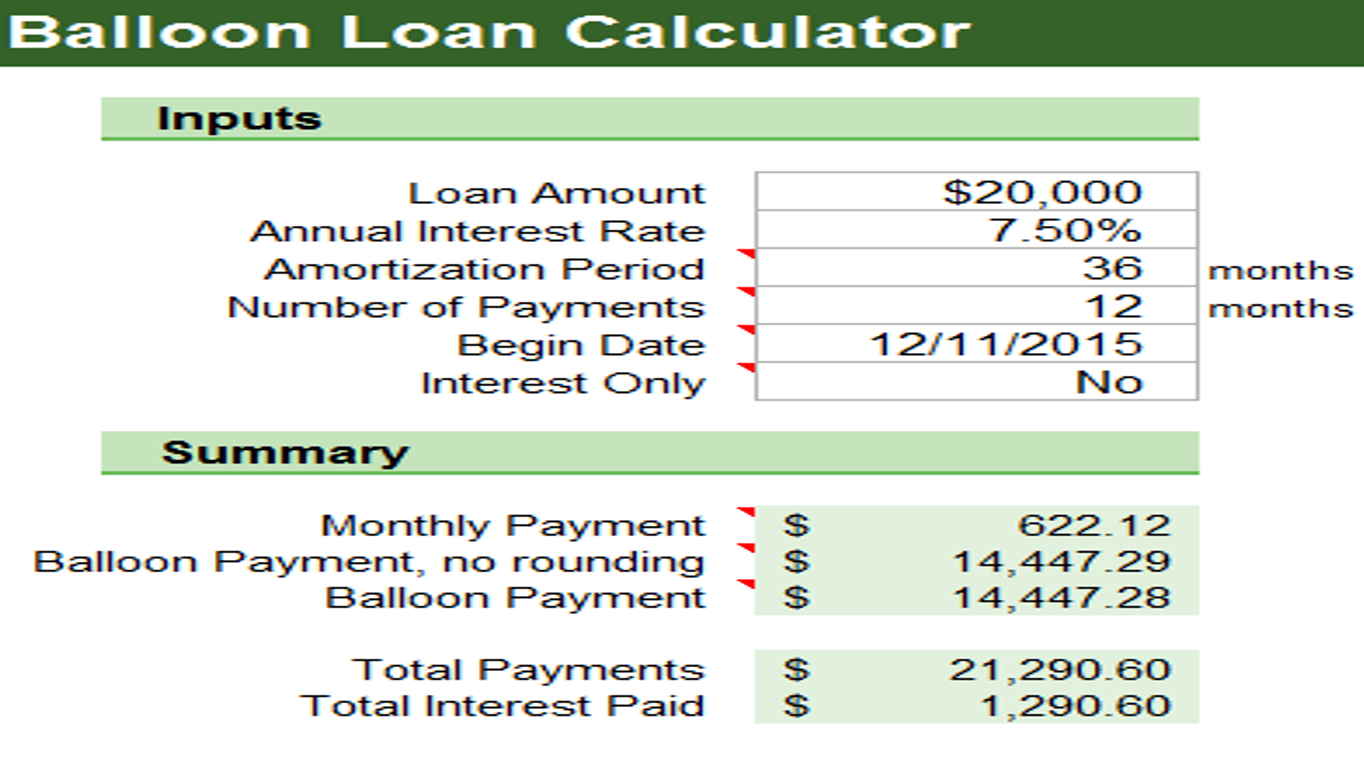

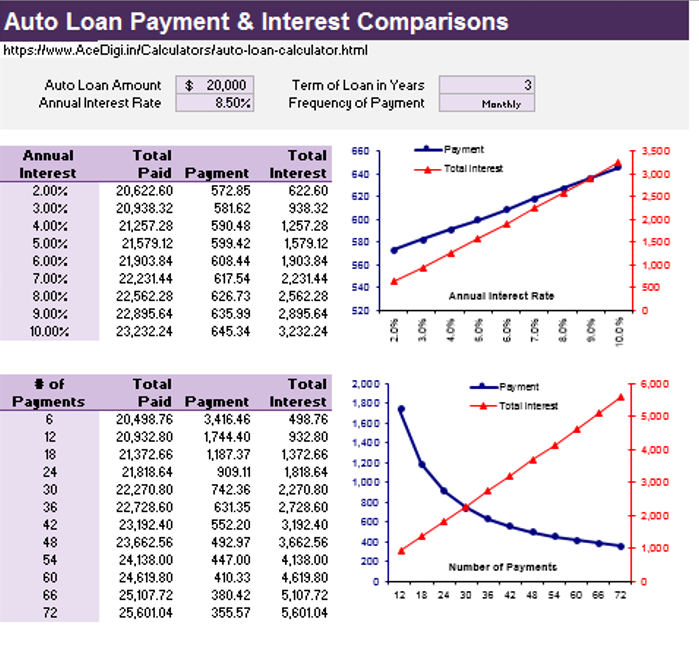

This spreadsheet serves as a valuable resource for creating an estimated payment schedule tailored to a revolving line of credit. Whether the line of credit features a variable or fixed interest rate, daily interest accrual, or a fixed draw period, this calculator accommodates various scenarios. The key features of this dynamic tool include:

Additional Payments: Users can input additional payments, specifying whether they are principal-only payments to expedite debt reduction.

Multiple Payment Options: Choose from Amortized, Minimum, Interest-Only, or Fixed Payment options, allowing flexibility in managing your financial strategy.

Variable Rate Simulation: The calculator enables users to set the rate change to 0 for a fixed rate or opt for the random rate change option. This functionality is not intended to predict future rates but to simulate potential scenarios if rates were to increase or decrease. The Random Rate Change option adds an element of exploration, allowing users to observe how values fluctuate by repeatedly pressing F9.

Using the Line of Credit Calculator

While this calculator offers a robust set of features, it is essential to recognize certain assumptions and simplifications inherent in its design. Therefore, users should not expect the calculated amounts to precisely match their bank’s figures. Given the complexity of the spreadsheet, the possibility of errors exists. Users are encouraged to report any suspected errors, though perfection in matching calculations is not guaranteed.

Read the Cell Comments: To gain a comprehensive understanding of the HELOC calculator, users are advised to read the comments marked by small red triangles in many cells. These comments provide valuable insights and clarifications.

Tracking Payments: The calculator allows manual entry of Payment Date, Interest Rate, and Payment within the table for those who wish to monitor actual payments. Users can overwrite formulas if they choose this approach, and it is recommended to highlight such cells to identify the absence of formulas.

Variable Rate Simulation: The feature for simulating variable rates is not intended as a crystal ball for predicting future rates. Instead, it serves to help users visualize potential outcomes based on rate fluctuations. The Random Rate Change option, in particular, adds an interactive element, allowing users to observe dynamic changes by pressing F9.

Conclusion

AceDigi’s Home Equity Line of Credit Calculator emerges as a comprehensive and user-friendly tool, offering unparalleled flexibility for individuals managing a HELOC. Whether users seek to estimate payments, explore the impact of additional payments, or simulate variable rate scenarios, this spreadsheet proves invaluable. It stands as a testament to AceDigi’s commitment to providing powerful financial tools that empower users to make informed decisions and gain control over their financial landscape. Utilize this calculator to navigate your home equity journey with precision and confidence.

Benjamin Harrison –

Top-notch templates! Cover a wide range of needs with impressive attention to detail. Improved the professionalism of my reports and presentations. Highly satisfied!

Certainly! Here are five Muslim names: –

I’ve tried various templates before, but these stand out. They’re not just functional; they add a touch of elegance to my work. Definitely worth the investment.

Sophia Williams –

The templates provided are a lifesaver! Easy to use and have improved my organization significantly. Versatile and suitable for various tasks. Kudos to the creators!

Navdeep Yadav –

Using these templates has been a time-saver. The ease of use combined with the polished designs has elevated my work. It’s like having a design team at my fingertips!