Description

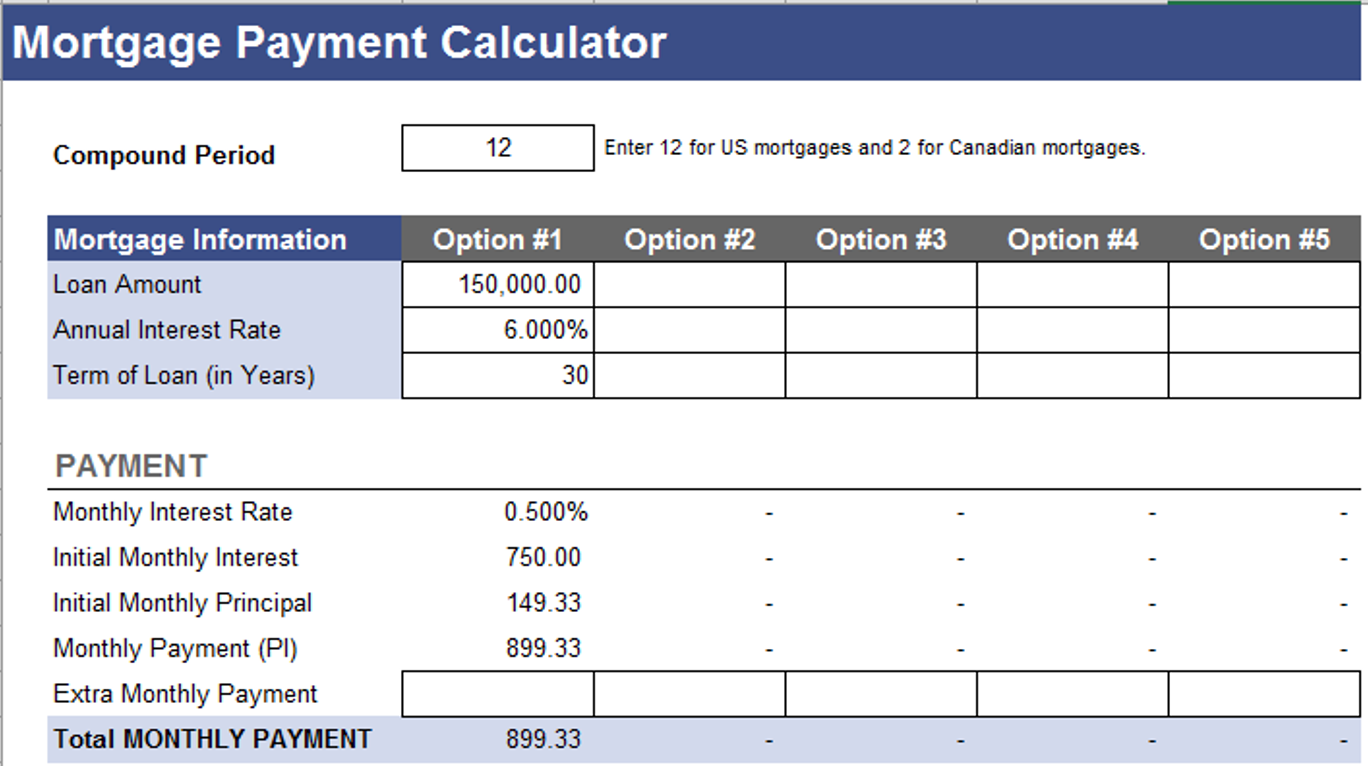

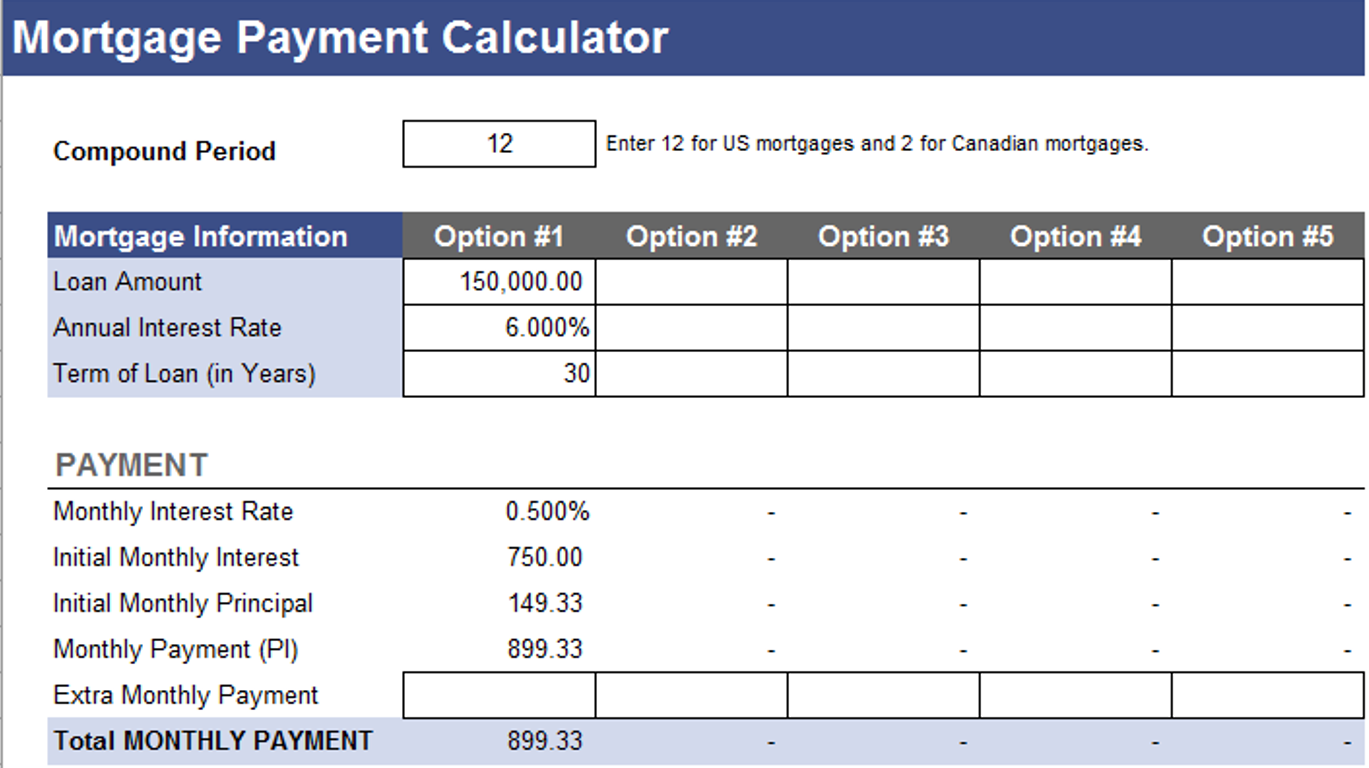

In the realm of comprehensive financial planning, AceDigi introduces the Mortgage Payment Calculator—an advanced spreadsheet that transcends simplicity, offering users a powerful tool to compare various mortgages side by side. Striving for clarity and financial empowerment, this calculator goes beyond the mundane, enabling users to calculate monthly payments, assess the impact of extra payments, estimate home equity over time, and much more. As we delve into the intricacies of this tool, AceDigi stands ready to revolutionize your approach to mortgage management.

Description of the AceDigi Mortgage Payment Calculator:

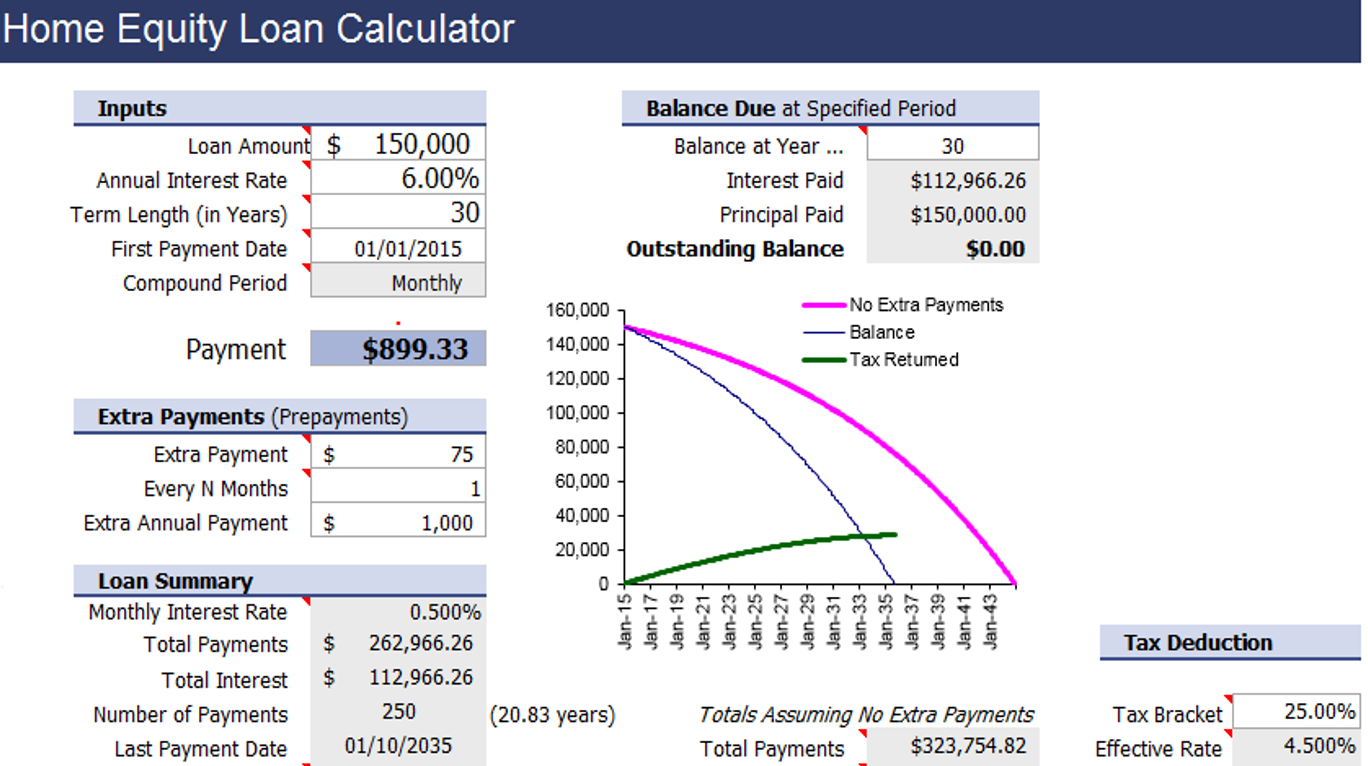

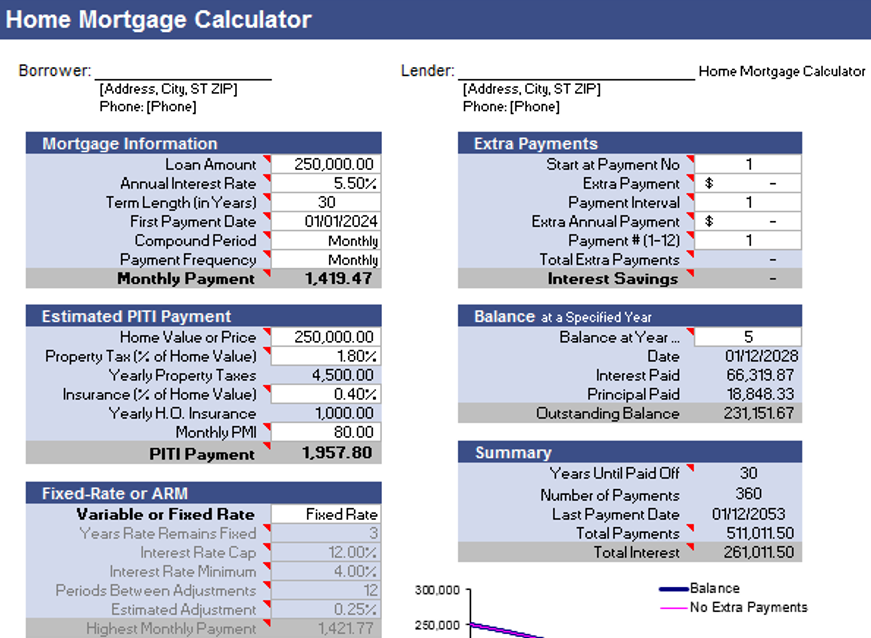

This cutting-edge spreadsheet encapsulates three fundamental functionalities: calculating monthly payments, evaluating the impact of extra payments, and estimating home equity over a specified period. The objective is to empower users to make informed decisions about their mortgages, considering factors such as additional payments, loan terms, interest rates, and more. As an embodiment of simplicity and functionality, AceDigi aims to transform your mortgage planning experience.

How to Use the AceDigi Mortgage Payment Calculator:

- Compare Mortgage Payments:

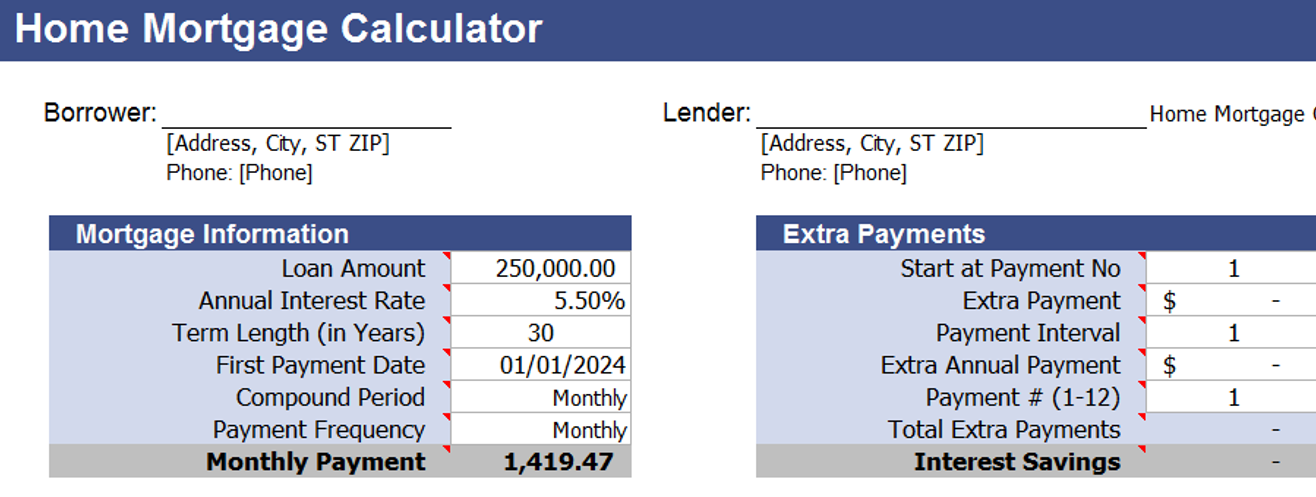

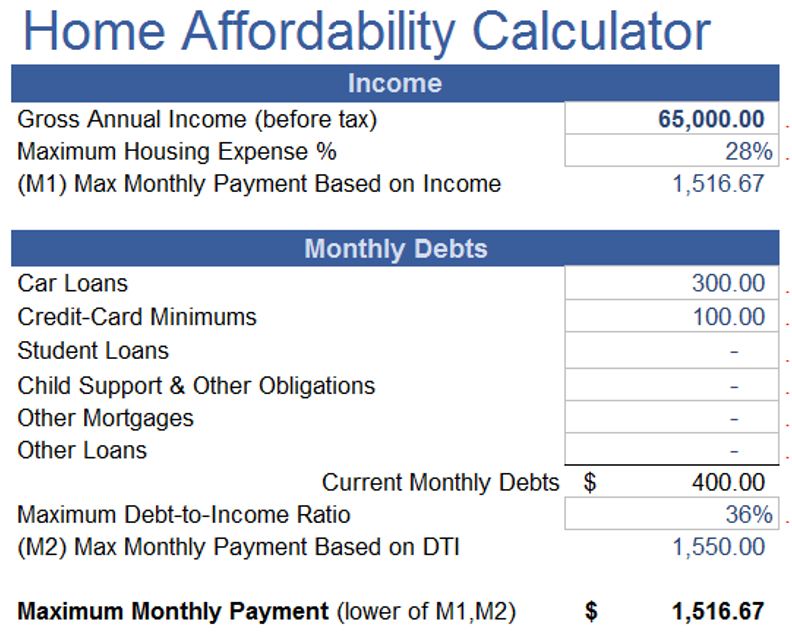

This user-friendly mortgage calculator facilitates side-by-side comparisons of monthly mortgage payments for different loan scenarios. It excludes closing costs, mortgage insurance, and property taxes, focusing solely on the core mortgage payments. Users can explore various terms, rates, and loan amounts, allowing for a comprehensive understanding of affordability and long-term interest implications.

Tip: Utilize the Home Expense Calculator for a holistic view, considering additional homeownership expenses.

- Pay off Your Mortgage Early:

Extra payments, or “prepayments,” can significantly impact the mortgage payoff timeline and interest savings. AceDigi’s Mortgage Payment Calculator empowers users to assess the effect of making extra monthly payments. By providing flexibility for annual payments and occasional lump sums, users gain insights into the potential savings and accelerated mortgage payoff.

Financial Insight: Making extra payments can be likened to investing the money in an interest-bearing account with a rate equal to the mortgage rate. While it offers potential interest savings, users should consider the liquidity of their funds.

- Estimate Accelerated Biweekly Mortgage Payments:

The concept of an Accelerated Biweekly Payment” plan involves making payments every two weeks, resulting in 26 payments per year (equivalent to one additional monthly payment). AceDigi’s calculator simplifies the estimation of accelerated biweekly payments, offering users the ability to gauge the impact of this strategy on their mortgage payoff.

Implementation: Enter an amount in the Extra Monthly Payment field equal to the Monthly Payment divided by 12, simulating the accelerated biweekly structure.

- Calculate Home Equity:

AceDigi’s Mortgage Payment Calculator extends its utility to estimate home equity over a specified number of years. This feature proves invaluable for users contemplating the sale of their home. Calculating owner’s equity involves subtracting the remaining loan amount from the property’s estimated value.

Note: The property value, fluctuating with market dynamics, requires users to estimate its future value for accurate equity calculations.

Terms Used in the AceDigi Mortgage Payment Calculator:

- Compound Period:

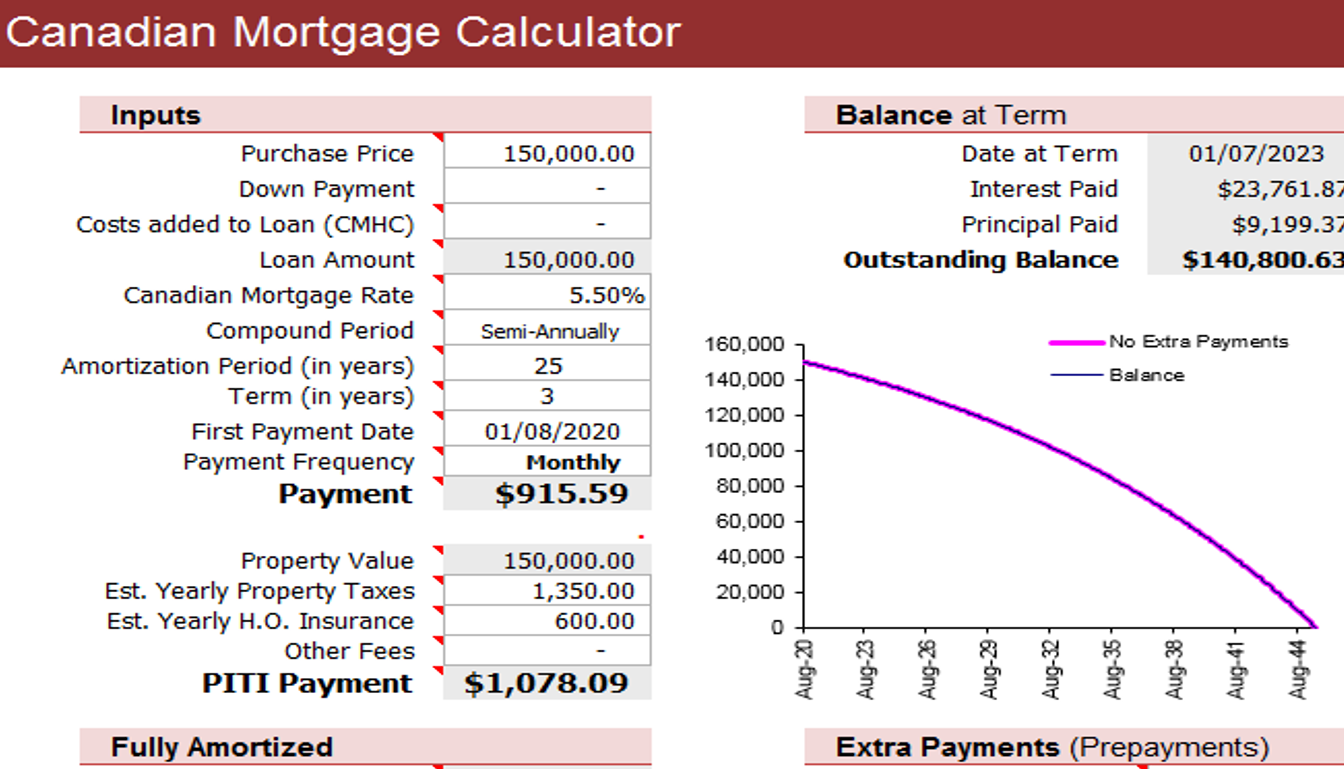

Definition: The frequency at which the annual interest rate is compounded.

US Mortgages: Quoted based on a monthly compound period (Enter 12).

Canadian Mortgages: Quoted based on a semi-annual compound period (Enter 2).

- Loan Amount:

Definition: The borrowed amount. Users can enter the current balance, adjusting the Term of Loan accordingly.

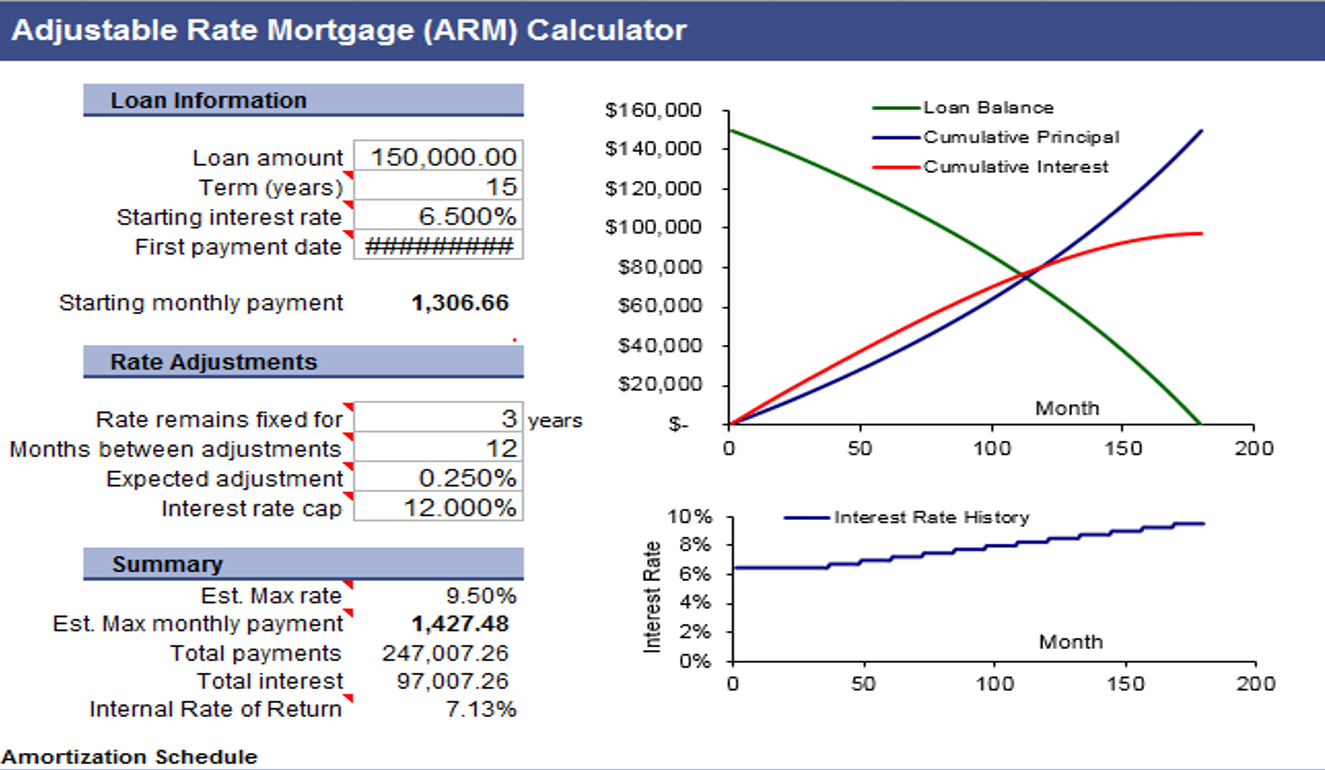

- Annual Interest Rate:

Definition: The lender’s quoted annual interest rate. Assumes a fixed annual rate.

- Term of Loan (in Years):

Definition: The total years to pay off the mortgage. For Canadian mortgages, this may be labeled “Amortization Period.”

- Monthly Interest Rate:

Calculation: Derived from the annual interest rate and the compound period.

- Initial Monthly Interest:

Insight: Displays the initial monthly interest and principal payments for comparison on the first payment.

- Monthly Mortgage Payment (PI):

Composition: Consists of principal (P) and interest (I).

- Extra Monthly Payment:

Definition: Additional amount paid towards the principal each month (prepayment).

- Number of Payments:

Calculation: Adjusted based on extra payments, reflecting the mortgage payoff timeline.

- Total Payments:

Definition: The total principal and interest payments over the mortgage’s life.

- Total Interest:

Definition: The cumulative interest paid throughout the mortgage.

- BALANCE at Year N:

Purpose: Estimates the mortgage balance and home equity after a specified number of years.

- Loan Balance Due:

Definition: The outstanding principal balance.

- Property Value:

Dynamic Factor: The property’s market value, requiring estimation for future equity calculations.

- OWNER’S EQUITY:

Insight: Reflects estimated equity based on property value and remaining loan amount.

AceDigi: Transforming Mortgage Management:

AceDigi’s Mortgage Payment Calculator transcends conventional tools, offering users an intuitive, flexible, and insightful platform for mortgage planning. Whether you seek to compare mortgages, accelerate payoff, estimate equity, or plan for the future, AceDigi stands as your trusted financial companion. Download the

Alex Scott –

I’ve tried various templates before, but these stand out. They’re not just functional; they add a touch of elegance to my work. Definitely worth the investment.

Isabella Carter –

I appreciate the versatility of these templates. Whether it’s project planning or expense tracking, there’s a template for everything. They’ve become my go-to solution for various tasks.

Benjamin Harrison –

Love the customization options! These templates have allowed me to tailor my work to my specific needs. Well-designed, and the support provided is excellent. A satisfied user!

2. Fatima Khan –

Kudos to the creators of these templates! They’ve struck the perfect balance between sophistication and simplicity. My reports now have a professional edge, thanks to these gems.