Description

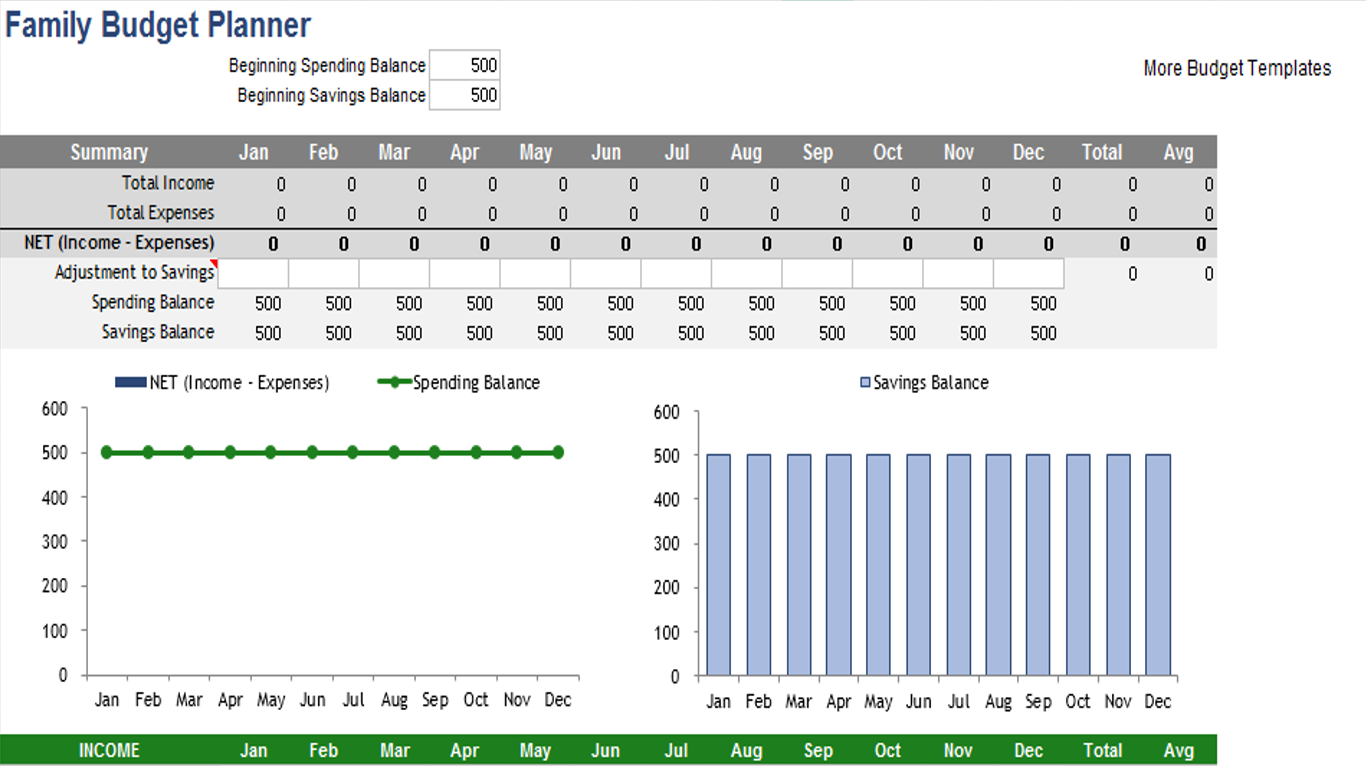

Are you actively managing your budget and diligently working towards your savings goals, or do you find yourself grappling with the challenge of allocating your savings effectively? As financial aspirations diversify, from college funds to dream vacations, having a strategic approach to savings becomes paramount. The AceDigi Savings Goal Tracker steps in as a versatile solution, providing a seamless blend of a Savings Account Register and a Goal Tracker. Whether you’re a Quicken enthusiast or a user of Budget Planner spreadsheets, this tool is designed to elevate your financial tracking experience. Let’s delve into the features that make the AceDigi Savings Goal Tracker an indispensable companion in your financial journey.

Understanding the AceDigi Savings Goal Tracker: A Comprehensive Overview

The AceDigi Savings Goal Tracker transcends traditional methods of lumping savings together, offering a systematic approach to managing short- and medium-term financial goals. Here’s a detailed exploration of its key features:

- Goal Allocation Based on Percentages:

One of the standout features of this spreadsheet is its ability to calculate goal allocations based on percentages. This functionality allows you to distribute your monthly savings across various goals, ensuring a balanced and strategic approach to achieving each objective. Whether it’s saving for college, a dream vacation, or holiday expenses, the Savings Goal Tracker equips you with the precision to allocate funds according to your priorities.

- Deposits and Withdrawals Tracking:

Similar to a basic account register, the Savings Goal Tracker allows you to record deposits and withdrawals effortlessly. This streamlined approach ensures that every financial transaction related to your savings goals is meticulously documented. The simplicity of tracking your financial inflows and outflows becomes a powerful tool for maintaining clarity and control over your savings endeavors.

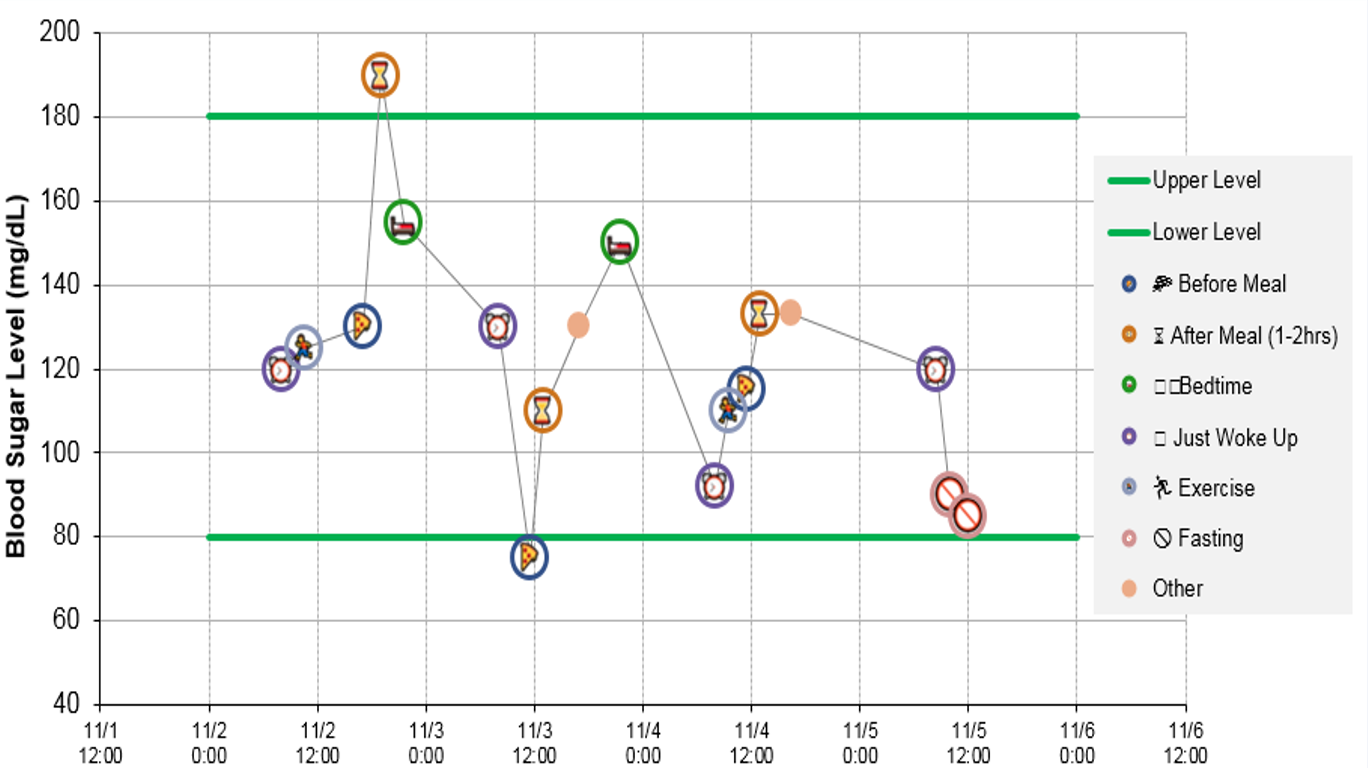

- Visualizing Goal Progress with Charts:

The power of visualization comes to the forefront with the Savings Goal Tracker’s charting capabilities. Monitoring the progress of your savings goals becomes an intuitive and visually engaging experience. The chart provides insights into the growth of individual goals, fostering motivation and informed decision-making. Whether you prefer pie charts or bar graphs, the visual representation of your financial journey adds a dynamic dimension to your savings tracking.

The Landscape of Your Savings Accounts: Unveiling the Reality

Consider the number of savings accounts you currently manage – a primary Savings Account, a Money Market Account for enhanced interest rates, and various long-term investments like a 401(k), IRA, or CD. The challenge arises when attempting to consolidate short- and medium-term savings goals into one or two accounts. While retirement funds find their place in specialized accounts, other aspirations such as vacations, furniture purchases, or down payments on a home often end up coexisting in a common pool.

While emerging tools like Mint.com strive to simplify savings goal tracking, the AceDigi Savings Goal Tracker distinguishes itself by providing a tailored and user-friendly solution. Regardless of whether you’re saving for a specific life event or multiple irregular expenses, this tracker streamlines the management of diverse savings goals.

Deposits, Withdrawals, and Splits: Mastering Financial Transactions

Understanding the intricacies of financial transactions is crucial for effective savings management. The Savings Goal Tracker introduces the concept of “Split” transactions, akin to Quicken’s functionality. In the context of this tracker, a deposit can be likened to a split transaction, allowing users to allocate funds to various savings goals seamlessly.

Interest earned is not overlooked, as the tracker permits the “splitting” or “allocation” of interest to different goals. Even withdrawals can be recorded as sourced from multiple goals, catering to scenarios where a single transfer serves multiple irregular expenses.

In essence, the AceDigi Savings Goal Tracker empowers users to navigate the complexities of financial transactions with finesse, ensuring that every dollar contributes meaningfully to their diverse savings objectives.

Conclusion: AceDigi Savings Goal Tracker – Your Financial Navigator

In the dynamic landscape of ersonal finance, the AceDigi Savings Goal Tracker emerges as a reliable navigator, guiding users towards financial clarity, efficiency, and goal attainment. With its user-friendly interface, percentage-based goal allocation, and intuitive tracking of deposits and withdrawals, this tool transcends conventional savings management. As you embark on your financial journey, let the AceDigi Savings Goal Tracker be your ally, transforming the way you approach and achieve your savings goals. Download this comprehensive tracker today and embark on a path of financial empowerment and goal realization.

Reviews

There are no reviews yet.