Description

Introduction

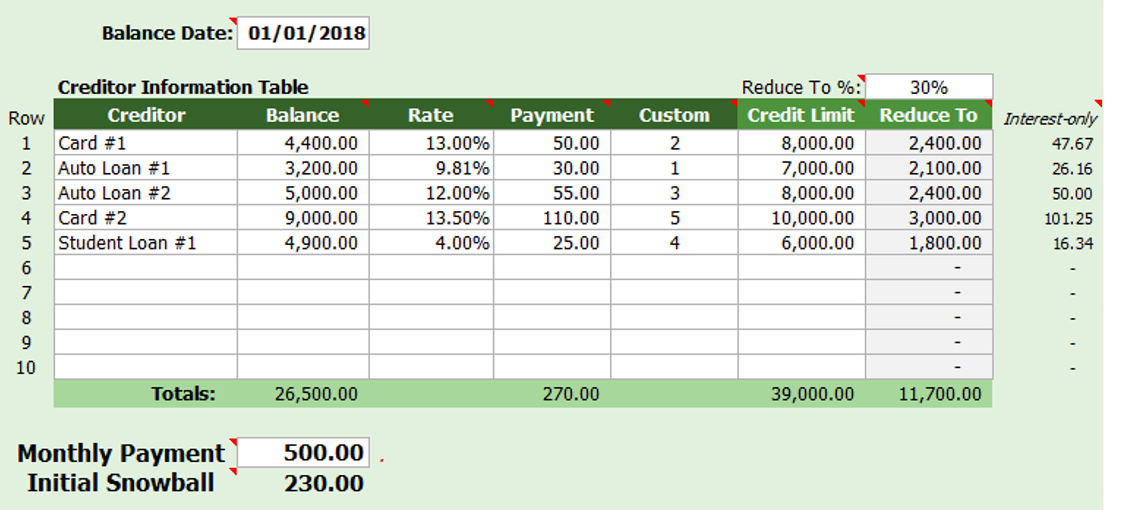

AceDigi presents the Credit Repair Edition of our renowned debt reduction calculator, meticulously designed to not only aid in reducing your debt but specifically target improvements in your credit score. By harnessing the snowball effect, this calculator strategically reduces credit card balances to predetermined levels, addressing a key factor affecting credit scores—the balance-to-limit ratio. Rather than waiting until a card is entirely paid off to initiate the snowball effect on the next debt, our spreadsheet streamlines the process, helping users achieve two distinct goals:

Goal 1 – Credit Repair:

In the initial stage, the Debt Reduction Calculator focuses on using your additional monthly payment, often referred to as the “snowball,” to bring down credit card balances to specified levels. This targeted approach aims to mitigate the negative impact of high balances relative to credit limits on your credit score.

Goal 2 – Debt Free:

Once the first goal is accomplished, the snowball is redirected towards paying off credit cards using the traditional snowball approach, facilitating a comprehensive debt-free journey.

Understanding the Credit Repair Process

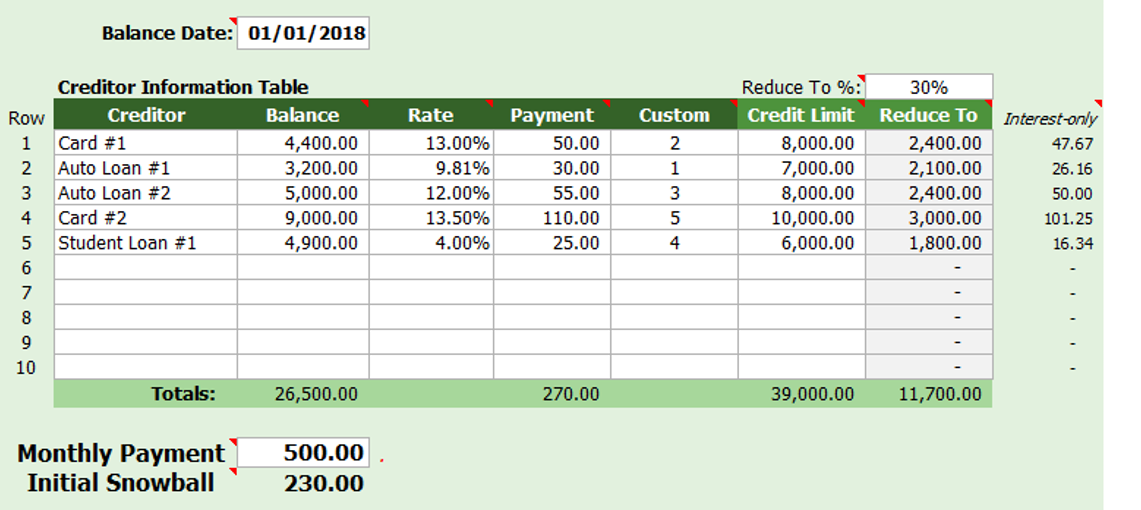

Your credit score is influenced by various factors, and one critical element is the balance-to-limit ratio on your credit cards. High balances in comparison to credit limits can negatively impact your credit score. The AceDigi Credit Repair Edition of the Debt Reduction Calculator addresses this concern through a two-stage process:

- Setting Specific Balances:

Users have the ability to specify the desired balances for their credit cards. The calculator then utilizes the snowball effect to systematically reduce the balances to these predefined levels. This targeted reduction aids in improving the balance-to-limit ratio, positively impacting the credit score.

- Traditional Snowball Approach:

Following the achievement of the credit repair goal, the calculator seamlessly transitions to the conventional snowball method. The snowball, representing the surplus monthly payment, is applied to pay off credit cards progressively. This stage focuses on achieving complete debt freedom.

Note: While advertisements on AceDigi.com do not serve as endorsements, we strongly recommend referring to the provided references [1] and [2] for additional insights.

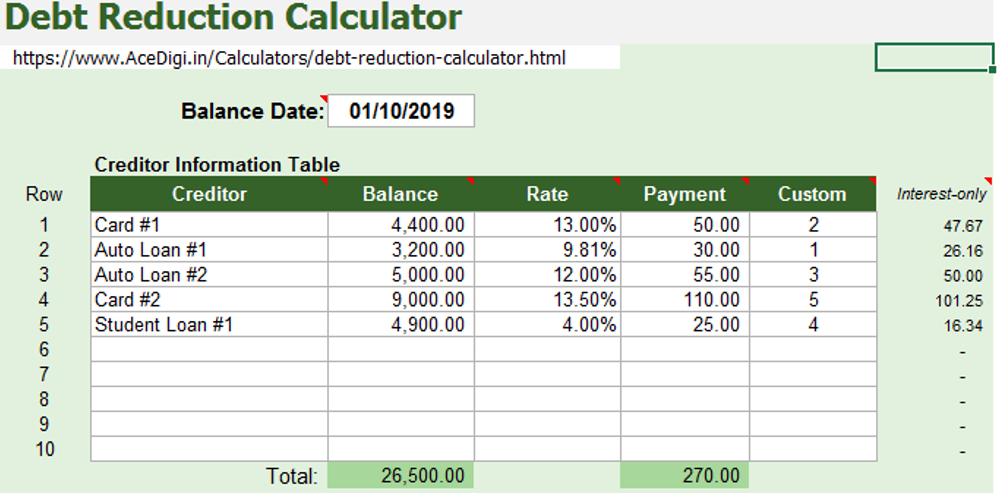

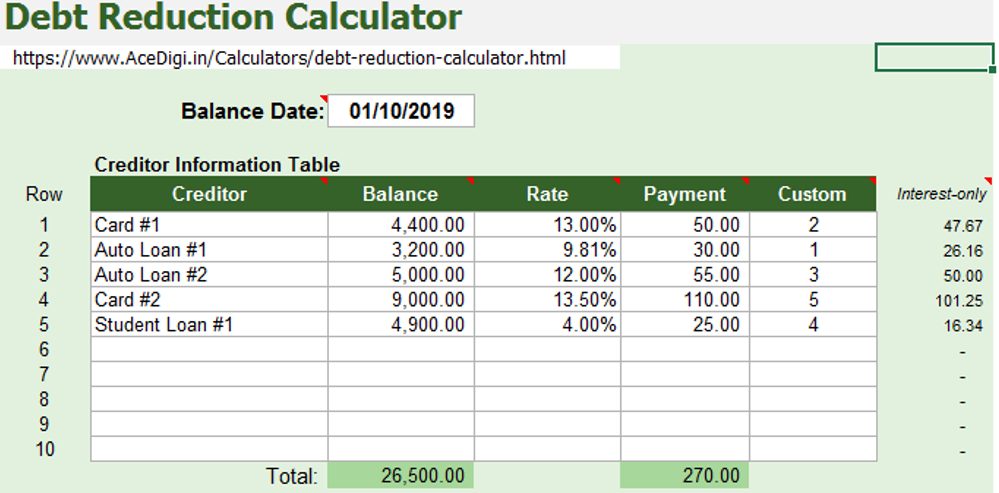

Description

The AceDigi Credit Repair Calculator, an enhanced version of the original debt reduction calculator, shares a similar structure and functionality. Users can follow the instructions provided for the debt reduction calculator, as they apply seamlessly to the Credit Repair Edition. The user-friendly interface and intuitive design ensure a smooth experience, guiding individuals through the process of strategically reducing debt and improving their credit profile.

Commercial-Use Version for Financial Advisors

For financial advisors or debt specialists seeking advanced functionalities, a commercial-use version is available for purchase. This version caters to professionals who require additional features and customization options in line with their specialized needs. For more details on obtaining the commercial version of the debt reduction calculator, interested parties are encouraged to contact AceDigi directly.

Updates and Enhancements

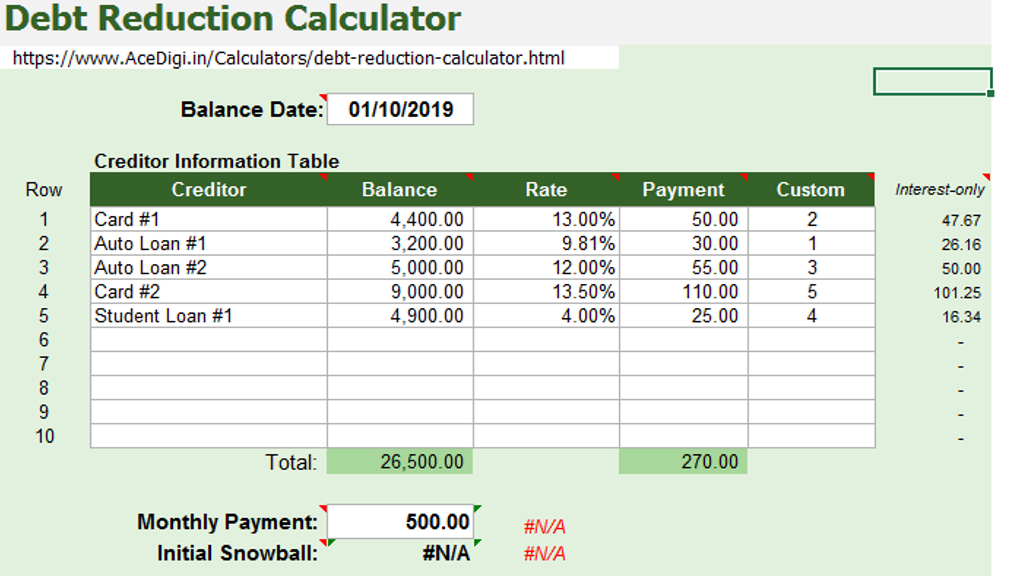

Acknowledging the importance of continuous improvement, AceDigi has diligently worked to enhance the functionality of the Credit Repair Calculator. A bug that caused #VALUE errors in scenarios where extra payments exceeded the remaining balance on snowball targets has been successfully addressed in the June 13, 2018 update. Furthermore, in the October 19, 2023 update, the manual entry of “Reduce To” values has been replaced with the option to input the Credit Limit for each debt, along with a single Percent to reduce balances to a specific percentage of the credit limit. Users still have the flexibility to overwrite the formula in the “Reduce To” column for precise amount entries.

Conclusion

AceDigi’s commitment to financial empowerment is exemplified through the Credit Repair Edition of the Debt Reduction Calculator. By specifically targeting credit repair goals in conjunction with debt reduction, this calculator offers a strategic approach to improving credit scores. Whether users aim to achieve specific credit card balances or embark on a debt-free journey, AceDigi provides a comprehensive tool that adapts to individual financial goals. The user-friendly interface ensures accessibility for all, while continuous updates underscore AceDigi’s dedication to delivering a cutting-edge financial management solution.

Charlotte Anderson –

These templates have made collaboration with my team smoother. The shared templates ensure consistency in our reports, and the feedback from my colleagues has been overwhelmingly positive.

Sophia Williams –

Using these templates for a few months now, and they’ve exceeded my expectations. Intuitive and time-saving. Highly valuable for anyone looking to simplify their tasks.”

Emily Thompson –

The templates provided are a lifesaver! Easy to use and have improved my organization significantly. Versatile and suitable for various tasks. Kudos to the creators!

Benjamin Harrison –

The templates provided are a lifesaver! Easy to use and have improved my organization significantly. Versatile and suitable for various tasks. Kudos to the creators!