Description

Introduction:

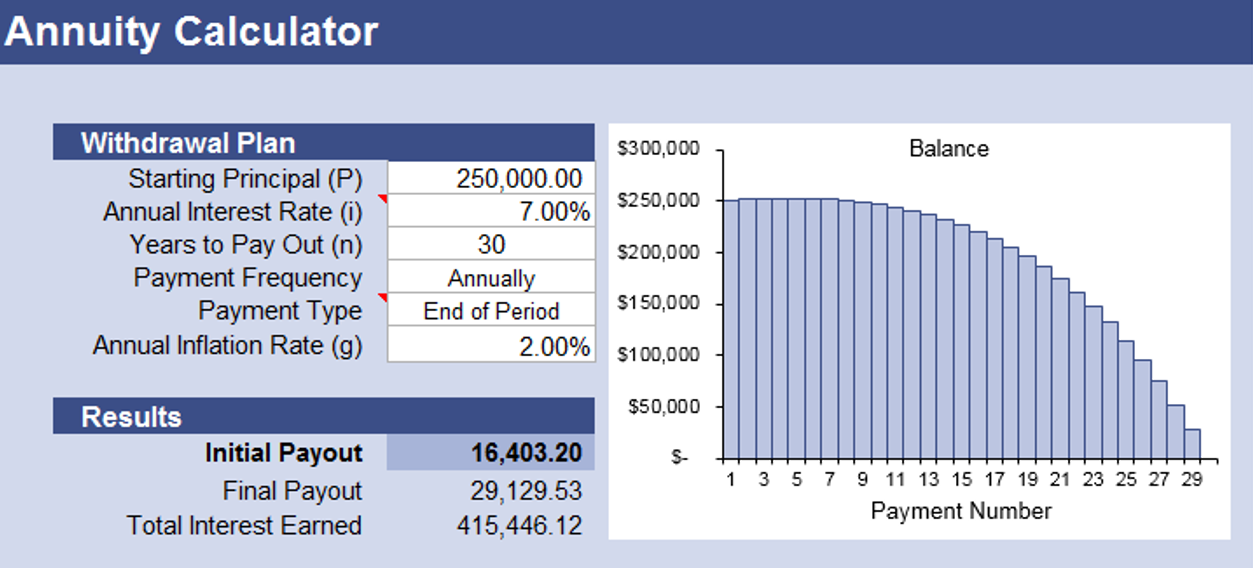

AceDigi presents its Annuity Calculator, a powerful tool based on the time-value-of-money or “finance theory” definition of annuity. Unlike traditional annuity calculators, this tool diverges from analyzing Insurance Annuities, focusing on providing insights into fixed-rate savings accounts. By definition, an annuity is a sequence of fixed payments over a specific duration, making this calculator an invaluable resource for anyone seeking answers to questions related to withdrawals or annuity payments. The following discussion delves into the calculator’s features, its applications, and how it can enhance financial planning.

Understanding the Annuity Calculator:

The Annuity Calculator by AceDigi was meticulously designed to cater to general inquiries about withdrawals or annuity payments from fixed-rate savings accounts. This calculator is adept at addressing a range of questions that individuals may have regarding their financial planning:

- Withdrawal or Annuity Payment Calculation:

What is the annual withdrawal or annuity payment over n years if I start with $P?

How many years can I withdraw $A if I begin with $P?

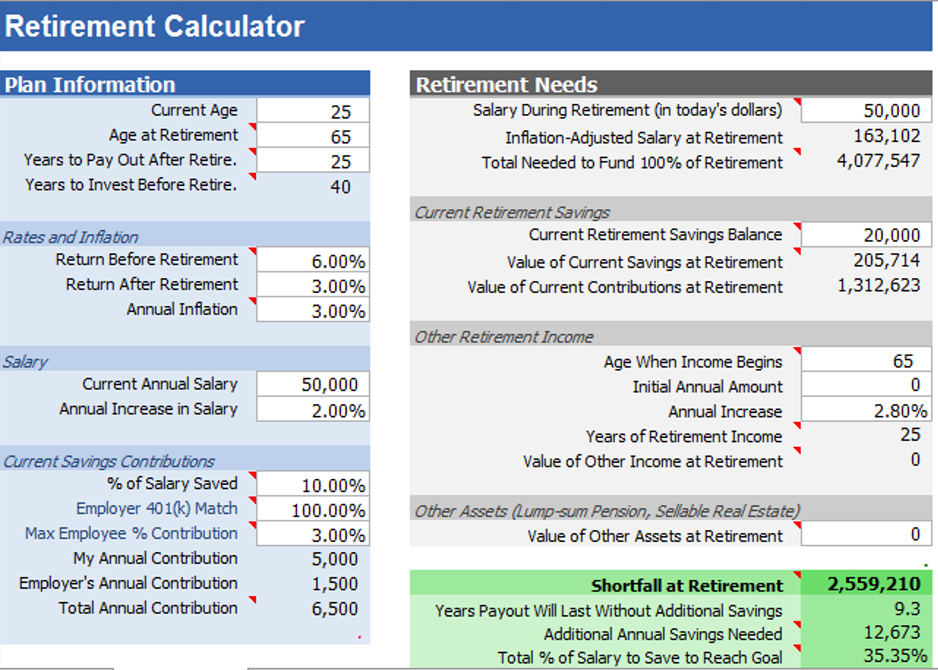

- Retirement Savings Planning:

What is the required savings for retirement to withdraw $A annually for n years?

These questions can be effortlessly answered using the built-in Excel formulas embedded in the calculator, providing users with accurate and insightful results. Whether planning for retirement, determining annual withdrawals, or assessing the sufficiency of initial payouts, AceDigi’s Annuity Calculator offers a versatile solution.

Components of the Annuity Calculator:

The Annuity Calculator comprises two comprehensive worksheets, each serving distinct purposes to meet various financial planning needs.

Yearly Cash Flow Table and Balance Graph:

The first worksheet offers a detailed yearly cash flow table accompanied by a graphical representation of the balance.

This section is specifically designed to solve for the annuity payment amount, aiding users in visualizing their financial trajectory over time.

Variable Solver Worksheet:

The second worksheet, as depicted in the accompanying screenshot, allows users to solve for essential variables such as annuity payment, initial principal, or the number of years for payout.

An added feature enables users to specify an annual inflation rate, incorporating real-world considerations where withdrawals or annuity payments may need to increase over time.

Inflation Adjustment for Annuity Payments:

One of the distinguishing features of AceDigi’s Annuity Calculator is its capability to adjust for inflation. In the context of retirement planning, where withdrawals occur annually, the reality of inflation necessitates a dynamic approach to payment calculations. Unlike fixed-annuity calculators that assume constant withdrawals, AceDigi’s calculator accommodates inflation adjustments over time, ensuring a more accurate representation of future financial scenarios.

It’s essential to differentiate between inflation adjustment and terms like variable annuity or adjustable annuity, which are typically associated with interest rates and are commonly used in the context of Insurance Annuities.

Conclusion:

AceDigi’s Annuity Calculator emerges as a comprehensive and user-friendly tool for individuals seeking precise answers to intricate financial questions. Whether contemplating retirement, planning for annual withdrawals, or assessing the sustainability of initial payouts, this calculator provides a holistic approach to financial planning. By incorporating inflation adjustments and leveraging built-in Excel formulas, users can make informed decisions and gain valuable insights into their financial future. Empower your financial planning journey with AceDigi’s Annuity Calculator, where precision meets ease for optimal financial outcomes.

Henry Taylor –

The templates provided are a lifesaver! Easy to use and have improved my organization significantly. Versatile and suitable for various tasks. Kudos to the creators!

Samuel Parker –

I appreciate the versatility of these templates. Whether it’s project planning or expense tracking, there’s a template for everything. They’ve become my go-to solution for various tasks.

Isabella Carter –

Using these templates for a few months now, and they’ve exceeded my expectations. Intuitive and time-saving. Highly valuable for anyone looking to simplify their tasks.”

Henry Taylor –

These templates have made collaboration with my team smoother. The shared templates ensure consistency in our reports, and the feedback from my colleagues has been overwhelmingly positive.