Description

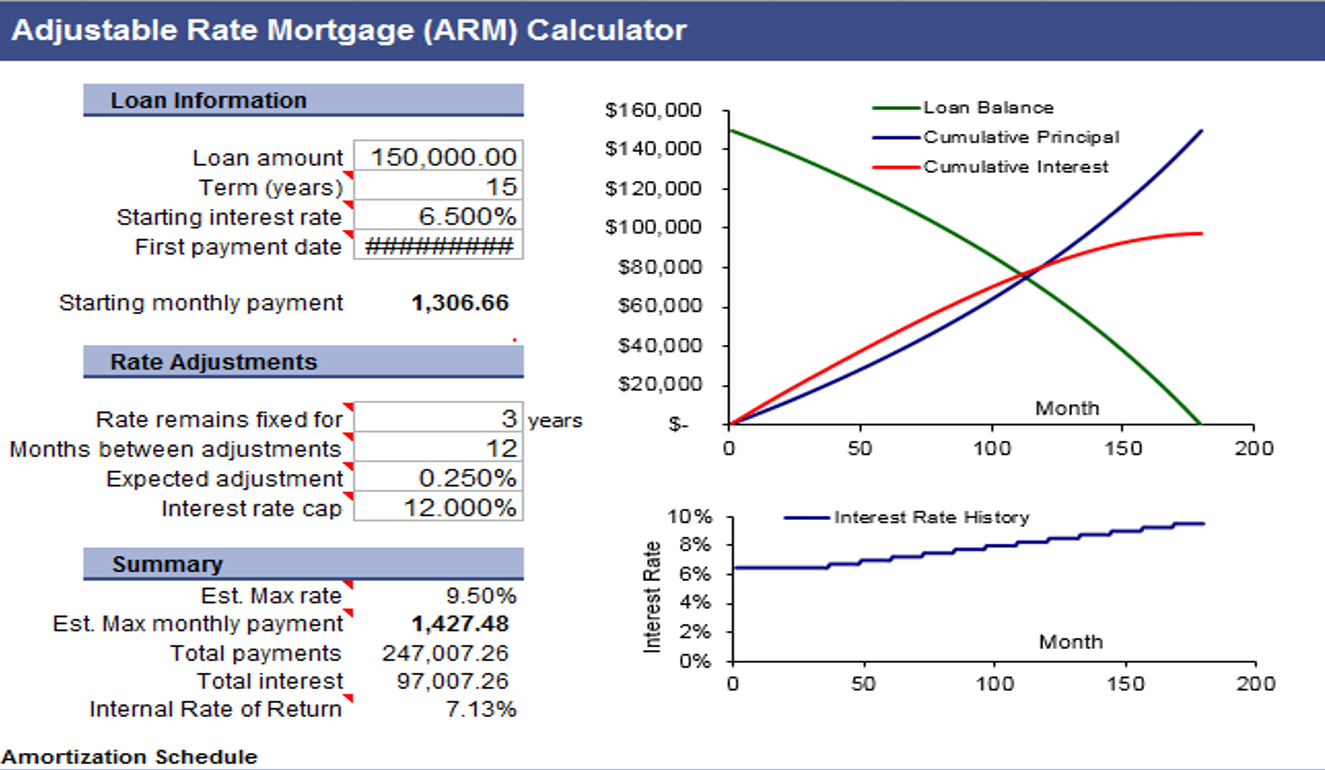

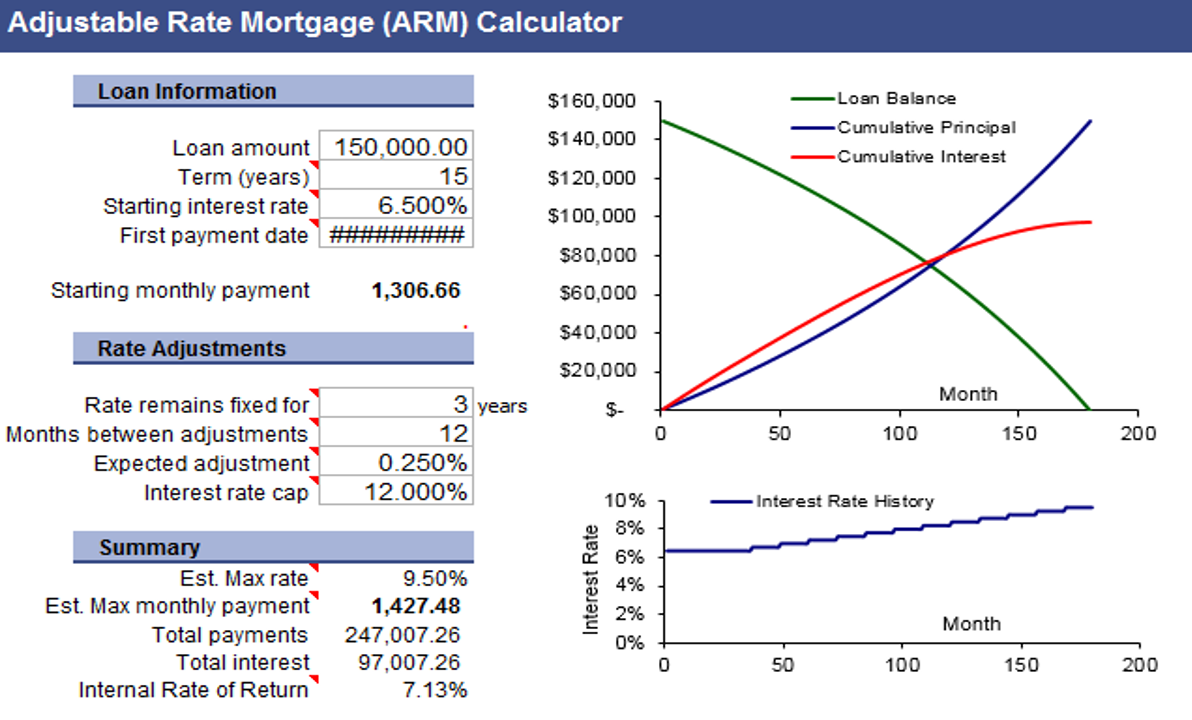

AceDigi presents a powerful and versatile ARM calculator for Excel, providing users with the ability to estimate monthly payments and create an amortization schedule for adjustable rate mortgages. This free spreadsheet stands out as one of the few ARM calculators that allows users to include additional payments, adding a layer of customization to the calculation process. The flexibility extends to manual input of interest rates, allowing users to overwrite cell formulas if needed, making it a user-friendly tool for a range of scenarios.

Description of AceDigi ARM Calculator:

Designed to cater to the nuances of adjustable rate mortgages (ARMs), this spreadsheet goes beyond the typical ARM calculator. It not only estimates monthly payments but also incorporates optional extra payments. The calculator generates an amortization table and graphs, providing users with a comprehensive overview of their ARM loan. Users can effortlessly estimate the maximum interest rate and monthly payment for commonly used fully amortized ARMs.

Updates for Enhanced Functionality:

AceDigi is committed to continually enhancing user experience, and as part of this commitment, updates have been introduced to the ARM calculator:

- Tabulated Worksheet (Update 5/25/2017):

A new “Tabulated” worksheet has been added to facilitate the listing of interest rate changes by date. This table format ensures clarity, and changes can be organized chronologically. While interest is not calculated on a daily basis, this feature allows users to note interest rate changes accurately.

- Manual Interest Rate Entry (Update 9/20/2018):

In the main worksheet, users now have the flexibility to manually enter interest rates in the Rate column, overriding the existing formula. Cells can be highlighted to indicate changes made by the user, ensuring transparency in the adjustment process.

Understanding Adjustable Rate Mortgages (ARMs):

An Adjustable Rate Mortgage (ARM) comes in various types, and AceDigi’s calculator specifically addresses estimated payments for a Fully Amortizing ARM, the most common variant. For instance, a “5/1 ARM” signifies a fixed interest rate for the initial 5 years (60 months), after which the rate can adjust annually. This characteristic introduces the potential for changes in monthly payments, making ARMs dynamic and responsive to market fluctuations.

Strategic Considerations for ARMs:

- Optimal Period of Ownership:

ARMs become desirable when purchased during periods of low-interest rates, especially for individuals planning to sell the property within a few years. Examples include the 5/1 or 7/1 ARM, where the initial fixed-rate period aligns with the anticipated ownership duration.

- Risk and Initial Interest Rates:

ARMs, known for their inherent risk, often feature lower initial interest rates, making them attractive to buyers. However, individuals intending to own a property for an extended period may find the potential for rate adjustments risky.

- Market Conditions and ARM Suitability:

ARMs may be preferable during times of high-interest rates if there is an expectation of gradual rate decreases. This scenario could lead to decreasing monthly payments over time, providing a strategic advantage.

Conclusion:

AceDigi’s ARM Calculator emerges as a valuable asset for individuals navigating the intricacies of adjustable rate mortgages. By offering a user-friendly interface, customizable features, and continuous updates, AceDigi empowers users to make informed decisions about their mortgage scenarios. Explore the flexibility of the ARM calculator, understand the dynamics of ARMs, and embark on your mortgage journey with confidence. Download the free AceDigi ARM Calculator for Excel and elevate your financial planning experience.

4. Aisha Rahman –

The templates provided are a lifesaver! Easy to use and have improved my organization significantly. Versatile and suitable for various tasks. Kudos to the creators!

4. Aisha Rahman –

Kudos to the creators of these templates! They’ve struck the perfect balance between sophistication and simplicity. My reports now have a professional edge, thanks to these gems.

5. Omar Hassan –

These templates have made collaboration with my team smoother. The shared templates ensure consistency in our reports, and the feedback from my colleagues has been overwhelmingly positive.

Charlotte Anderson –

Cannot express how much these templates have simplified my workload. Comprehensive and made complex tasks much more manageable. Impressed with the quality and functionality.