Description

Introduction:

Effectively managing your business finances is a cornerstone of success. AceDigi understands the significance of having a well-structured business budget, whether you are a startup or an established enterprise. Our Business Budget Spreadsheet provides a dynamic tool for businesses of all sizes, helping you make informed decisions about growth, investments, and financial stability. In this comprehensive guide, we’ll explore the importance of a business budget, introduce our Business Budget Spreadsheet, and provide practical insights for optimizing your budgeting process.

The Significance of a Business Budget:

A business budget serves as a financial roadmap, guiding you through crucial decisions that impact your company’s growth and stability. Here are key reasons why having a business budget is essential:

- Strategic Growth Decisions:

A well-structured budget enables you to assess your financial health and make informed decisions about expanding your business. It helps you identify opportunities for growth, whether through new ventures, increased marketing efforts, or expanding your product and service offerings.

- Salary and Compensation Planning:

Determining whether you can give yourself and your employees a raise is a critical aspect of financial planning. A business budget allows you to allocate funds for salaries, bonuses, and employee benefits while maintaining financial sustainability.

- Inventory and Asset Purchases:

For businesses involved in selling products, effective inventory management is crucial. A budget helps you allocate funds for purchasing additional inventory and acquiring assets, ensuring a smooth operational process.

- Bankruptcy Avoidance:

Regularly reviewing your business budget allows you to spot financial challenges early on. By identifying potential issues, you can take corrective actions to avoid bankruptcy and maintain financial stability.

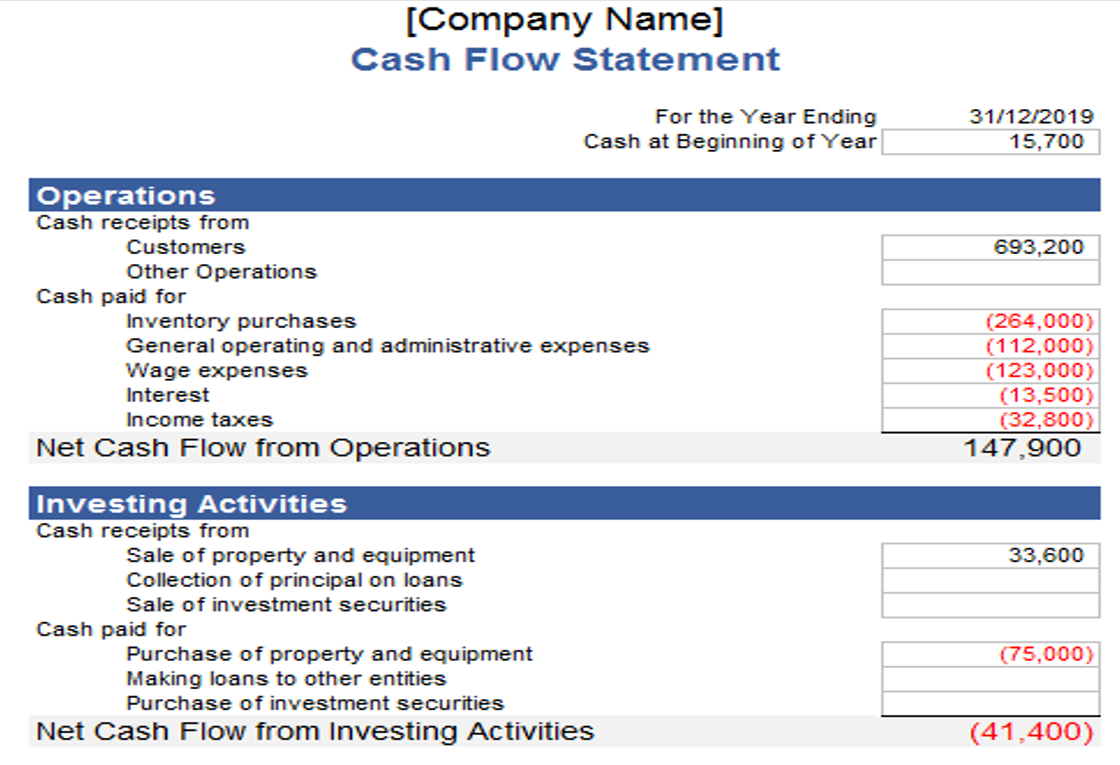

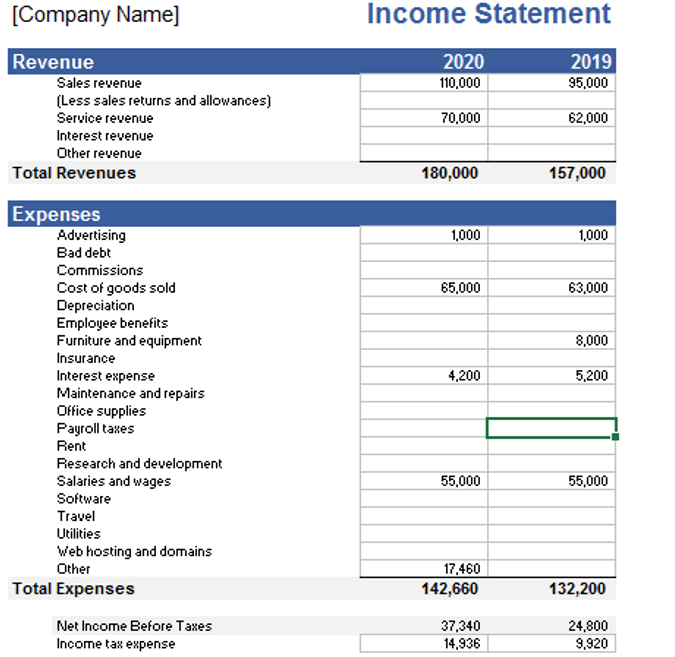

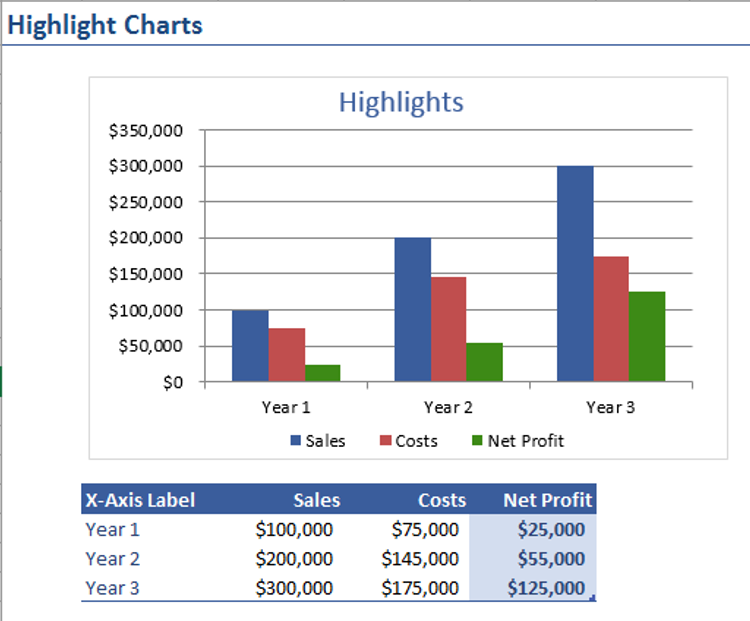

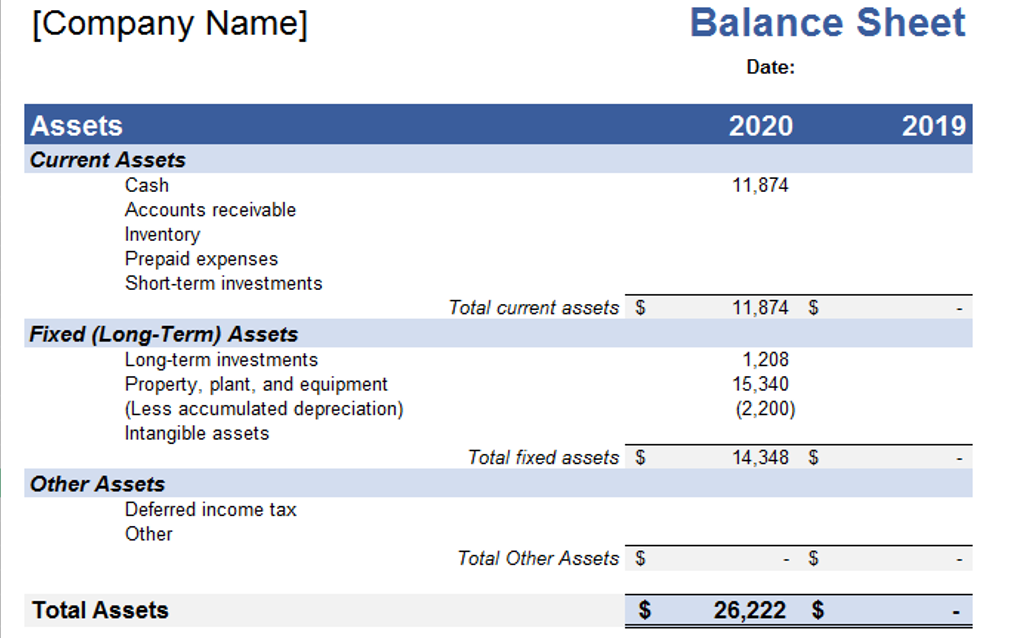

AceDigi’s Business Budget Spreadsheet:

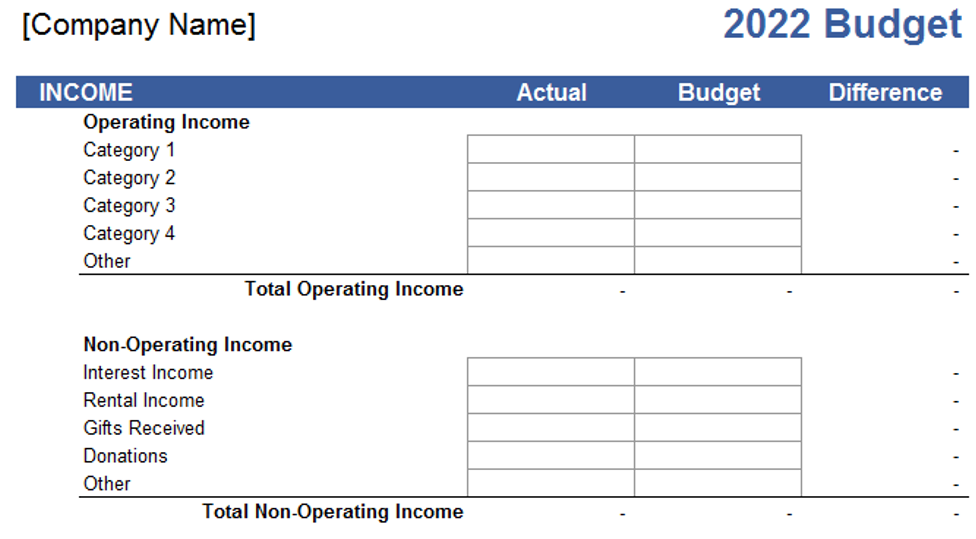

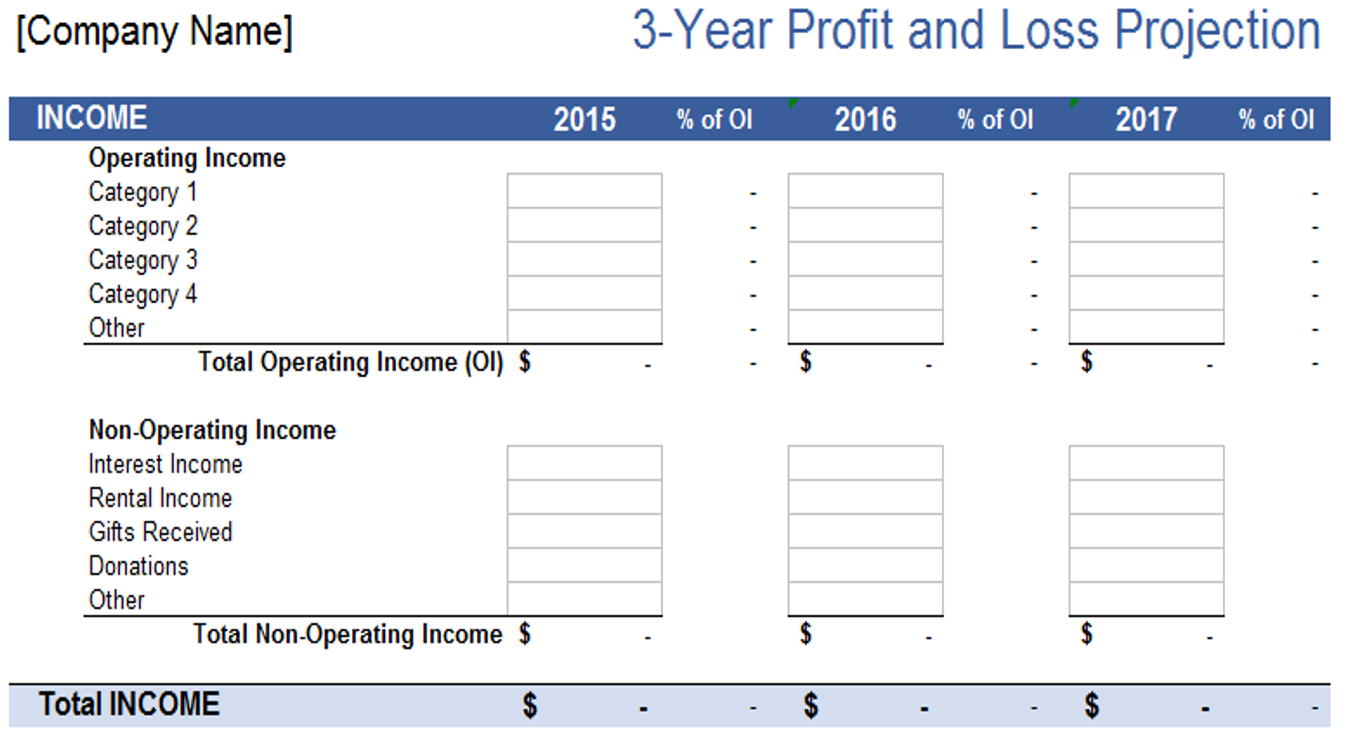

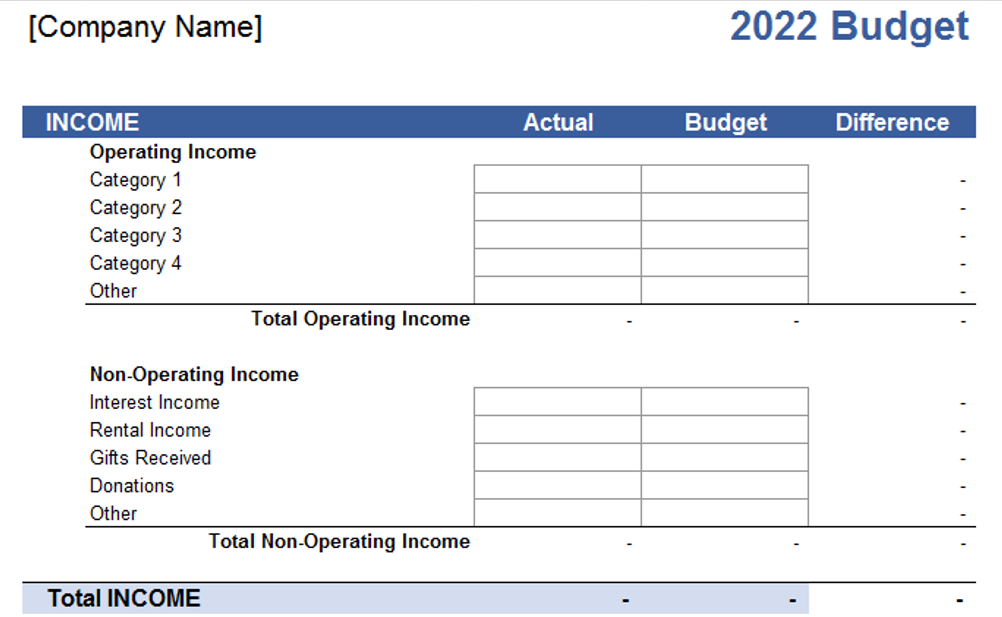

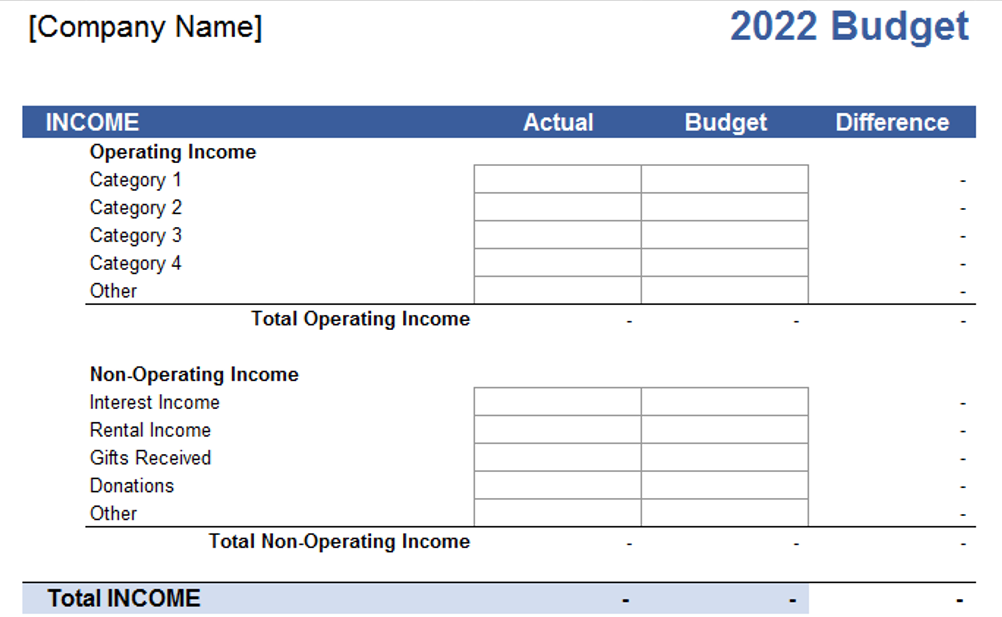

Our Business Budget Spreadsheet is designed to align seamlessly with the Income Statement Template, creating a parallel structure for your financial statements. Whether you provide services or sell products, this spreadsheet offers two sample business budgets tailored to your specific needs.

Service Providers:

The Services worksheet is tailored for companies offering services. It categorizes income and business expenses in a manner consistent with an income statement. The spreadsheet provides a comprehensive yet flexible framework, allowing you to modify categories to suit your business needs easily.

Product Sellers:

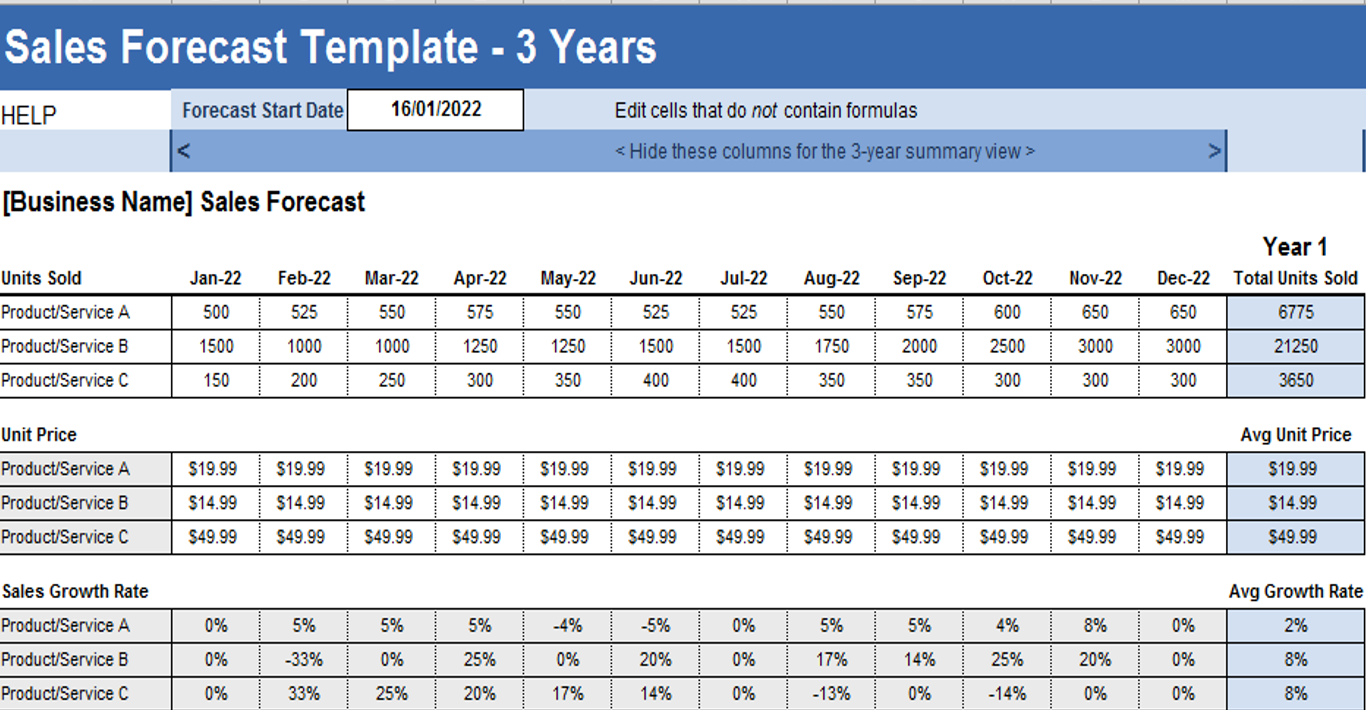

The Goods spreadsheet is ideal for businesses involved in selling products. It records net sales quarterly, providing a foundation for analyzing costs associated with producing and purchasing goods. This detailed analysis helps in determining pricing strategies, identifying profitable products, and optimizing your product line.

Using the Business Budget Spreadsheet Effectively:

Customizing and utilizing AceDigi’s Business Budget Spreadsheet is straightforward, but a few key considerations enhance its effectiveness:

- Double-Check the Formulas:

If you modify categories, ensure you double-check the formulas, particularly SUM() formulas calculating totals and subtotals. Accurate calculations are crucial for a reliable budget.

- Conditional Formatting for Red Values:

The spreadsheet utilizes conditional formatting to highlight discrepancies in income and expenses. Red values indicate areas that require closer examination, serving as visual cues for potential financial challenges.

- Analyzing Cost of Goods Sold:

For businesses selling products, analyzing the Cost of Goods Sold (COGS) is paramount. This variable cost analysis includes expenses related to production and purchase of goods, offering insights into product profitability and pricing strategies.

- Income Taxes:

The spreadsheet includes a section for estimating income taxes. By subtracting total expenses from total income, you can make a simple estimate of income taxes, assuming all expenses are tax-deductible.

- Budgeting Large Non-Recurring Expenses:

While budgeting helps determine your ability to afford upgrades and new investments, this spreadsheet primarily focuses on your day-to-day operational income and expenses. Net Income is a key indicator to assess your capacity for expansion and large purchases.

Conclusion:

AceDigi’s Business Budget Spreadsheet is a versatile and user-friendly tool designed to empower businesses in their financial decision-making. By incorporating essential financial aspects into your budgeting process, you gain insights that are vital for sustained growth and financial stability. Whether you are a startup exploring business plans or an established enterprise seeking to optimize your budget, AceDigi’s Business Budget Spreadsheet is your key to navigating the path to financial success. Remember, a well-crafted budget is not just a financial document; it’s a strategic roadmap guiding your business towards prosperity.

Certainly! Here are five Muslim names: –

Impressed with the variety of templates available. From budgeting to project management, they cover it all. Well-designed and have significantly improved my productivity. Highly recommended!

1. Ahmed Malik –

Using these templates has been a time-saver. The ease of use combined with the polished designs has elevated my work. It’s like having a design team at my fingertips!

Alex Scott –

These templates have turned mundane tasks into a breeze. The attention to detail is evident, and they’ve made data analysis surprisingly enjoyable. A fantastic find!

Sophia Williams –

I stumbled upon these templates and couldn’t be happier. They’re like a secret weapon for productivity. The range is impressive, and the simplicity of use is refreshing