Description

Introduction:

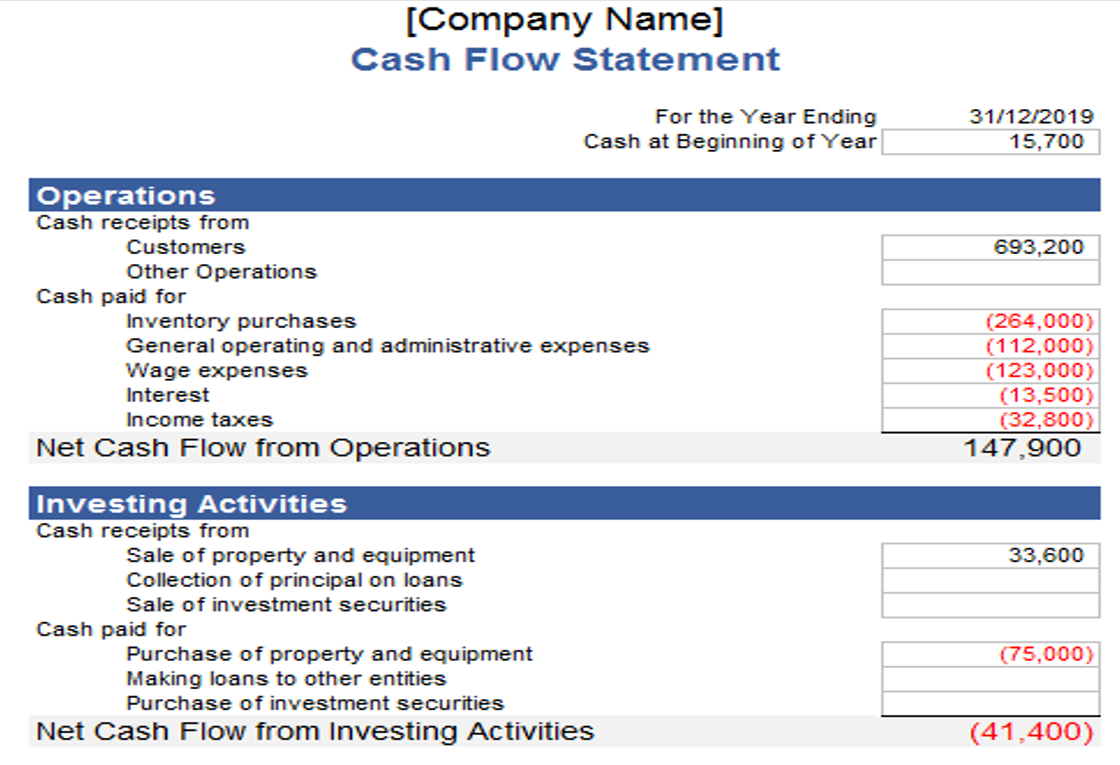

In the intricate realm of business finance, understanding and managing cash flow is paramount to sustained success. AceDigi presents a comprehensive guide to the Cash Flow Statement, a powerful financial tool that unveils the inflow and outflow of cash within a business. This guide aims to demystify the components, importance, and practical applications of the Cash Flow Statement, offering small-business owners valuable insights into shaping their financial strategies.

Decoding the Cash Flow Statement:

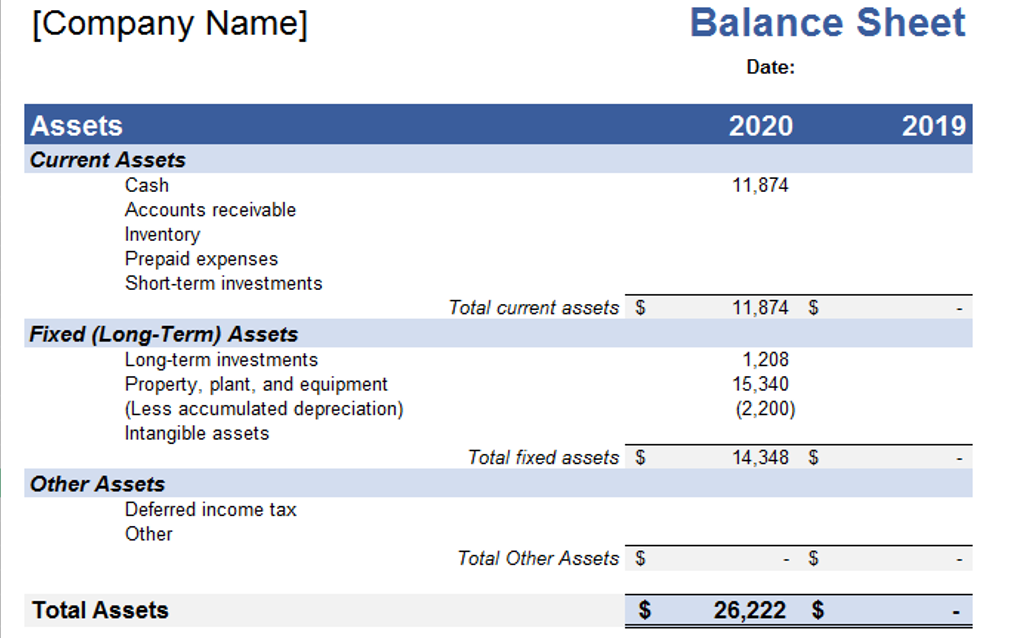

The Cash Flow Statement, often referred to as the Statement of Cash Flows, serves as a financial compass, delineating a company’s cash movements. It vividly illustrates where a business’s money originated (cash receipts) and where it was disbursed (cash paid). It encompasses both physical currency and funds within a checking account. The Cash Flow Statement collaborates with the Balance Sheet and Income Statement, forming a trifecta of financial documents crucial for holistic financial analysis.

Categorization of Cash Flow:

The Cash Flow Statement typically dissects cash flow into three primary categories:

- Operating Activities:

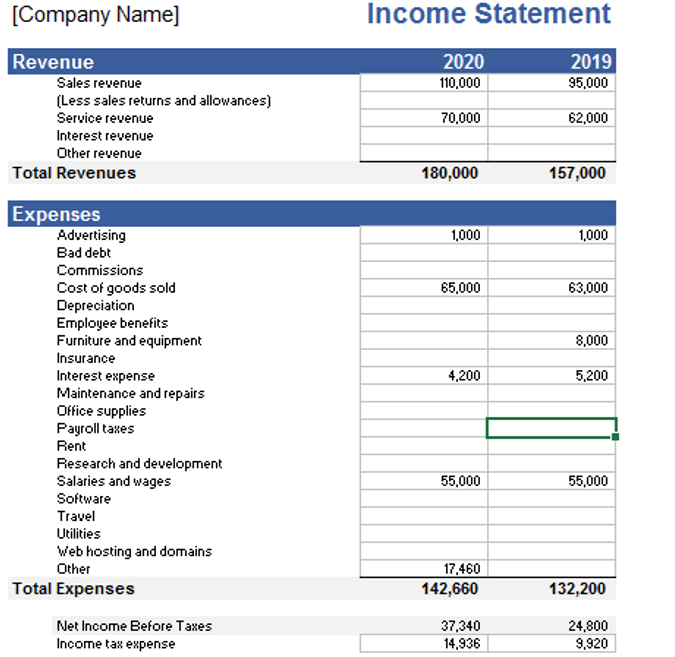

This category encapsulates the day-to-day operational aspects of the business, including selling products, purchasing inventory, paying wages, and settling operating expenses. The Net Cash Flow from Operations holds particular significance, aligning with the Current Assets and Current Liabilities sections of the Balance Sheet and the Revenue and Expenses section of the Income Statement.

- Investing Activities:

Investing activities involve transactions related to assets, such as acquiring or selling property and equipment, lending money, collecting principal amounts, and engaging in transactions with investment securities. This section correlates with the Long-Term Assets section of the Balance Sheet.

- Financing Activities:

Financing activities encompass borrowing and repaying loans, issuing or repurchasing stock, collecting funds from owners or investors, and cash dividend payments. This section corresponds to the Long-Term Liabilities and Owners’/Stockholders’ Equity from the Balance Sheet.

Importance of Cash Flow Analysis:

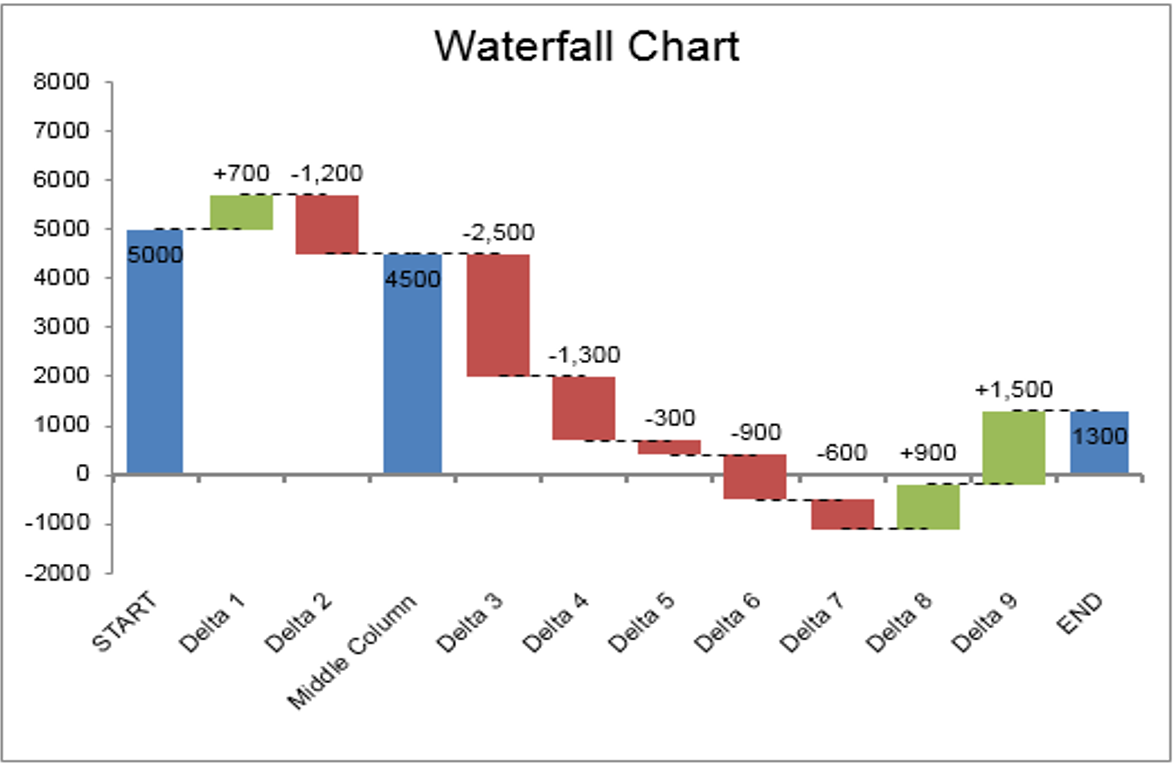

Cash flow analysis extends beyond historical tracking; it is a forward-looking tool essential for strategic financial planning. Key aspects of its significance include:

- Timing in Financial Operations:

Cash flow analysis enables businesses to ensure they have adequate funds when needed to cover expenses, purchase inventory, acquire assets, and meet employee payroll. It revolves around the crucial element of financial timing.

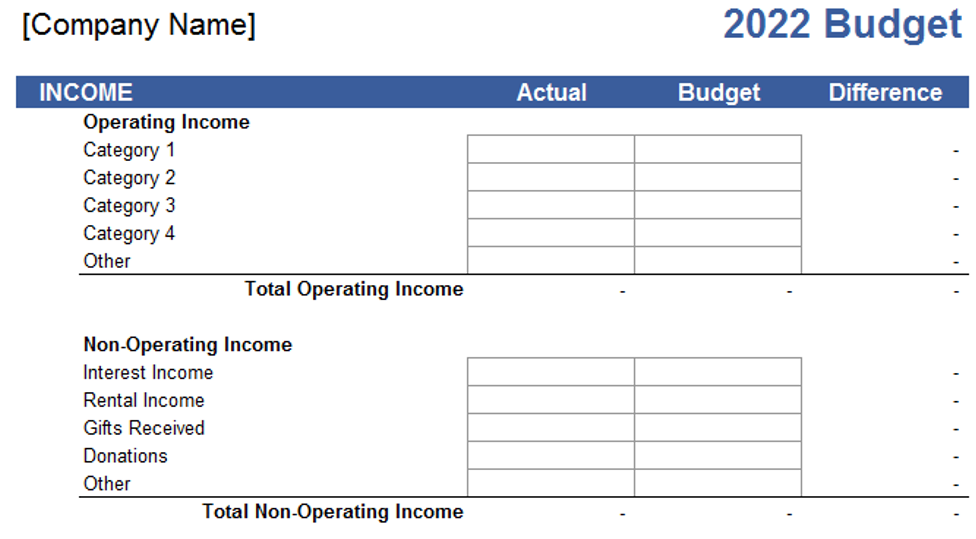

- Cash Flow Budgeting:

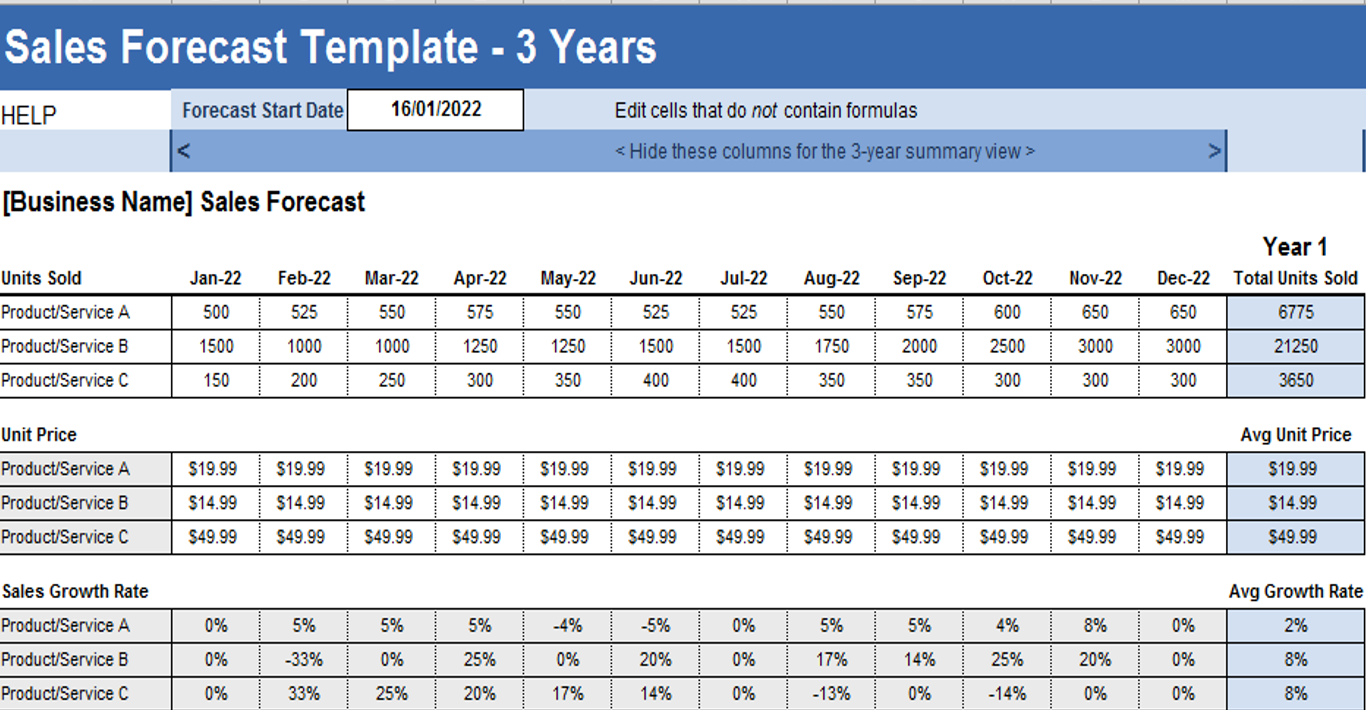

By analyzing past cash flows, businesses can project and plan for future cash flows, creating a comprehensive cash flow budget. This proactive approach aids in anticipating financial needs and aligning resources accordingly.

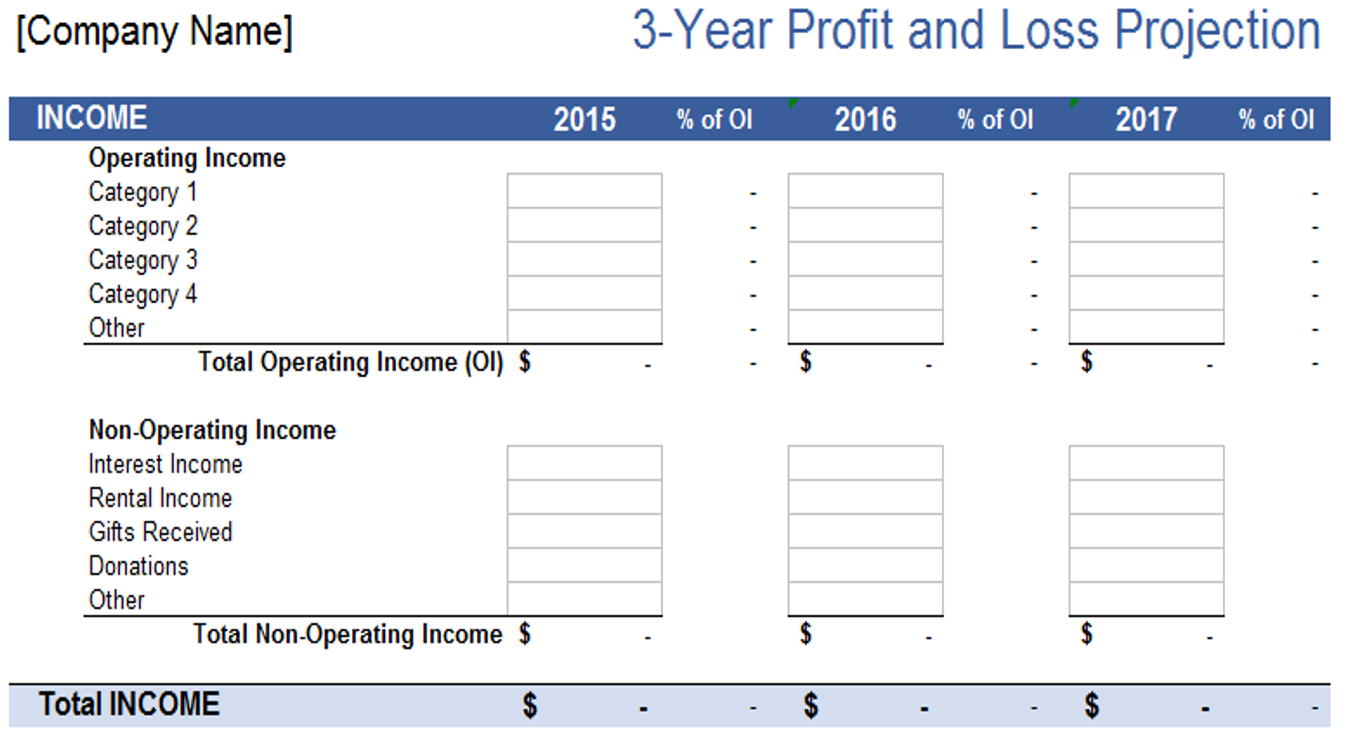

- Differentiation from Budgets and Profit Projections:

While business budgets and profit and loss projections rely on the Income Statement, cash flow analysis focuses specifically on the movement of cash. For small, straightforward businesses operating predominantly with cash transactions, the distinction might seem subtle, but it holds significance in financial planning.

AceDigi’s Cash Flow Statement Template:

Designed with simplicity and functionality in mind, AceDigi offers a user-friendly Cash Flow Statement template tailored for small-business owners. This template provides an example of formatting and categorization, which can be customized to suit individual business needs.

Customization and Usage:

Small-business owners can easily adapt the template to their specific requirements. The “cash receipts from” and “cash paid for” labels can be modified or removed as needed, offering flexibility in structuring the statement.

Worksheets for In-Depth Analysis:

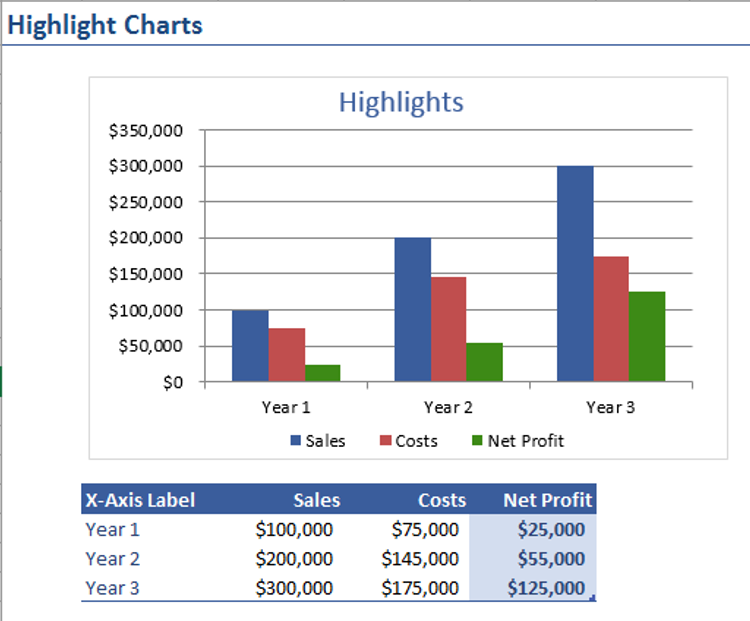

The template includes two worksheets for comprehensive year-to-year and month-to-month cash flow analysis. These worksheets aid businesses in conducting thorough cash flow projections, allowing for better financial planning.

Practical Applications and Recommendations:

- Double-Check Formulas:

When modifying the template, it is crucial to double-check the formulas, especially SUM() formulas calculating totals and subtotals. Ensuring accurate calculations is imperative for a reliable cash flow statement.

- Conditional Formatting for Red Values:

Conditional formatting is incorporated to highlight discrepancies. Red values indicate areas requiring closer scrutiny, providing visual cues for potential financial challenges.

- Analyzing Cost of Goods Sold (COGS):

For businesses selling products, the template encourages a thorough analysis of the Cost of Goods Sold (COGS). Understanding variable costs associated with production and purchase of goods is vital for pricing strategies and profitability assessments.

- Income Taxes Estimation:

The template includes a section for estimating income taxes, assuming all expenses are tax-deductible. Small adjustments to the Net Income Before Taxes can be made by subtracting taxable expenses, facilitating an estimate of the income tax budget.

- Budgeting Large Non-Recurring Expenses:

While the primary focus is on day-to-day operational income and expenses, the template assists in determining the feasibility of larger investments or upgrades. Net Income serves as a key indicator for evaluating the capacity for expansion and significant purchases.

Conclusion:

AceDigi’s Cash Flow Statement template emerges as a versatile tool, empowering small-business owners with a structured approach to financial analysis. By understanding the components and leveraging practical applications, businesses can navigate the complexities of cash flow management effectively. Remember, the Cash Flow Statement is not just a financial document; it is a strategic compass guiding businesses towards financial resilience and success. Whether you are a startup or an established enterprise, AceDigi’s Cash Flow Statement template is your ally in deciphering the financial pulse of your business.

Henry Taylor –

Using these templates feels like having a personal assistant. They’ve made my workload more manageable, and the results are consistently impressive. Highly recommended!

Sophia Williams –

The templates provided are a lifesaver! Easy to use and have improved my organization significantly. Versatile and suitable for various tasks. Kudos to the creators!

Navdeep Yadav –

Love the customization options! These templates have allowed me to tailor my work to my specific needs. Well-designed, and the support provided is excellent. A satisfied user!

4. Aisha Rahman –

These templates have made collaboration with my team smoother. The shared templates ensure consistency in our reports, and the feedback from my colleagues has been overwhelmingly positive.