Description

Introduction:

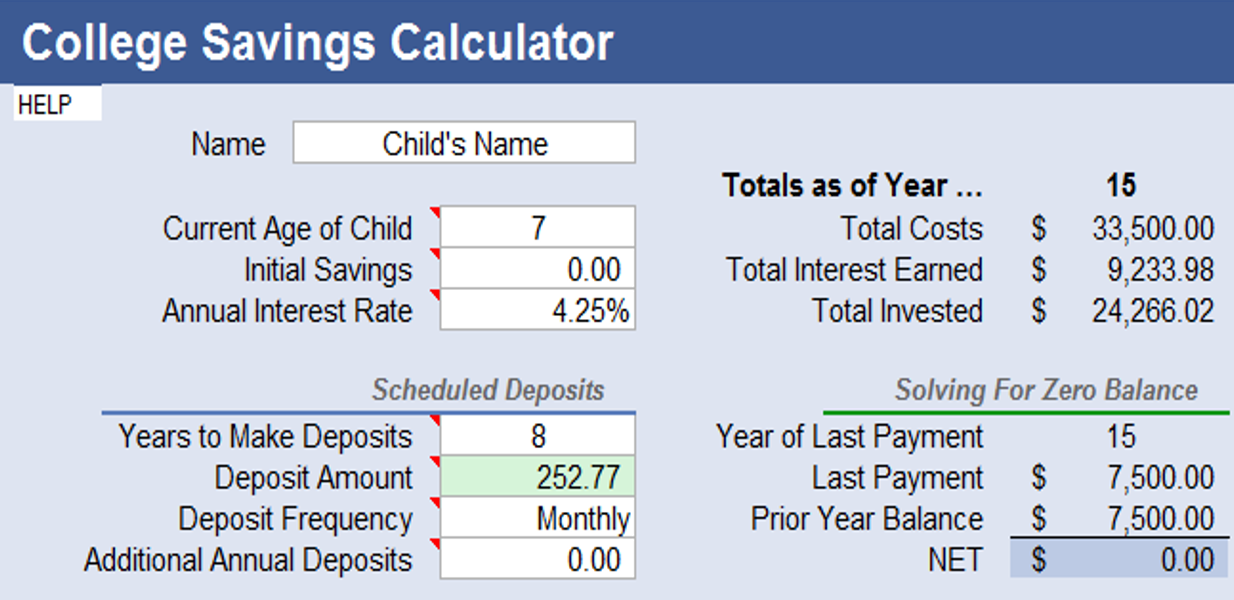

Embarking on the journey of funding your child’s college education requires careful planning and financial foresight. AceDigi presents its College Savings Calculator, a powerful tool designed to assist parents in determining the optimal savings plan to secure a bright academic future for their children. As the costs of education continue to rise, early planning becomes a strategic move. This calculator not only estimates the required savings but also allows for customization, including K-12, High School, college, and major events. This discussion explores the features, functionality, and practical applications of the AceDigi College Savings Calculator.

Understanding the Importance of College Savings:

The ever-increasing costs associated with higher education necessitate a proactive approach to financial planning. Parents are encouraged to set up a college savings plan at the earliest opportunity to ensure that sufficient funds are available when their child is ready for college. The College Savings Calculator by AceDigi serves as a valuable tool in deciphering the amount to be saved annually, considering various educational milestones and potential major expenses.

Key Features of AceDigi College Savings Calculator:

- Comprehensive Savings Plan:

The calculator facilitates the creation of a comprehensive educational savings plan encompassing K-12, High School, College, and other significant events.

Users can tailor the plan to their specific needs, ensuring a realistic and goal-oriented approach.

- Extra Deposits and Customization:

The calculator allows for the inclusion of extra deposits within the yearly savings schedule, accommodating unexpected expenses or additional contributions.

Users can make a copy of the worksheet for each child, customizing the savings plan to individual requirements.

- Flexible Deposit Frequency:

Users can choose different deposit frequencies, offering flexibility in planning monthly, quarterly, or annual contributions.

This feature ensures that the savings plan aligns with individual financial preferences and capabilities.

- Year vs. Age vs. School Year Analysis:

The calculator aligns the investment year with the beginning of the school year, offering convenience in tracking educational milestones.

Age and School Year columns provide a quick reference to identify the child’s grade level at different stages of the savings plan.

- Incorporating Various Educational Costs:

Beyond college expenses, the calculator allows users to include costs associated with K-12, High School, and other relevant events.

Users can anticipate and plan for potential expenses that may impact the overall savings goal.

- Solving for Monthly Deposit Amount:

The calculator automatically solves for the monthly deposit amount based on user inputs such as Initial Savings, Annual Deposits, Costs, and Extra Annual Deposits.

Users can set their savings goal and adjust parameters to meet their financial objectives.

Practical Application and Tips:

- Customizing Inputs:

The default inputs serve as illustrations, and users are encouraged to customize values based on their unique circumstances.

Tailor the savings plan to align with specific educational goals, anticipated expenses, and financial capabilities.

- Timing of Withdrawals:

While the calculator assumes all costs are withdrawn at the beginning of the school year, users can adjust the timing to reflect their actual circumstances.

The conservative approach ensures a prudent estimation of savings needs.

- Mission or Study Abroad Planning:

Users planning for missions or study abroad programs can include associated costs in relevant years, enhancing the calculator’s adaptability.

The calculator accommodates additional events, fostering a holistic approach to educational savings.

- Monthly Deposit Amount Adjustment:

The calculator allows users to manually adjust the monthly deposit amount based on their preferences and financial capacities.

The NET Value serves as a crucial indicator, helping users gauge whether their savings strategy aligns with their financial goals.

Conclusion:

AceDigi’s College Savings Calculator emerges as an invaluable resource for parents navigating the complexities of educational funding. By combining flexibility, customization, and precision, this calculator empowers users to plan for their child’s academic journey systematically. As education costs evolve, early planning becomes a cornerstone of financial success. Utilize AceDigi’s College Savings Calculator to pave the way for your child’s educational dreams, ensuring a secure and prosperous future.

5. Omar Hassan –

These templates have made collaboration with my team smoother. The shared templates ensure consistency in our reports, and the feedback from my colleagues has been overwhelmingly positive.

4. Aisha Rahman –

These templates are a lifesaver for someone like me who’s always on the go. Quick, easy, and efficient – they’ve become an essential part of my toolkit. Thumbs up!

Benjamin Harrison –

Impressed with the variety of templates available. From budgeting to project management, they cover it all. Well-designed and have significantly improved my productivity. Highly recommended!

Sophia Williams –

Cannot express how much these templates have simplified my workload. Comprehensive and made complex tasks much more manageable. Impressed with the quality and functionality.