Description

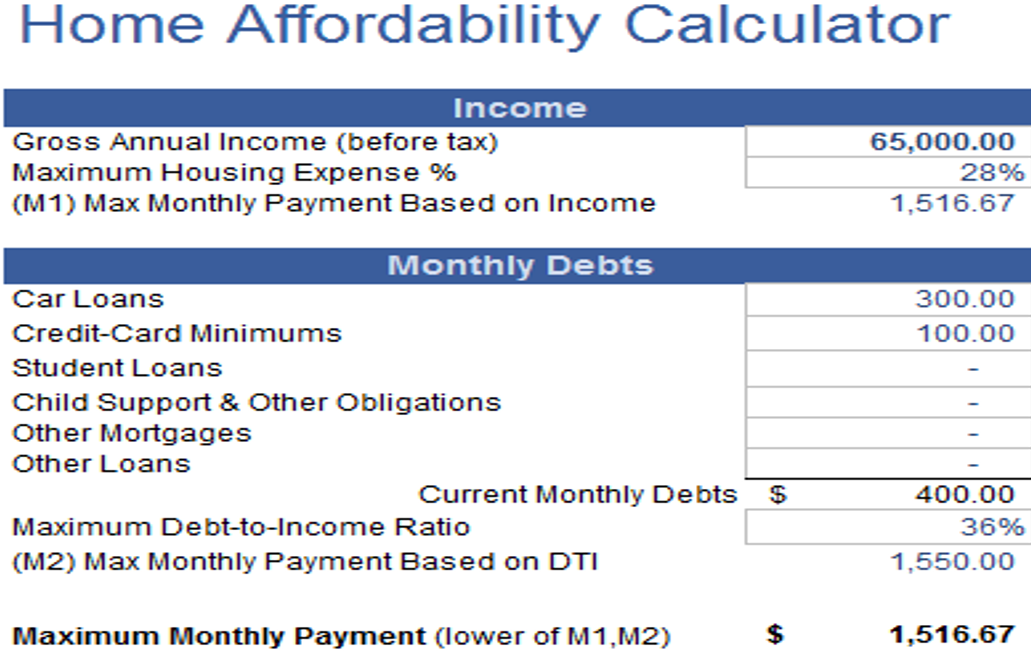

AceDigi presents a comprehensive Home Affordability Calculator, a powerful tool designed to assist individuals in determining the estimated mortgage they can afford when considering various factors. When contemplating the purchase of a home, it’s crucial to assess affordability judiciously. AceDigi’s calculator takes into account four common factors to provide a holistic estimate of the mortgage that might be within one’s financial reach.

Factors Considered by AceDigi’s Home Affordability Calculator:

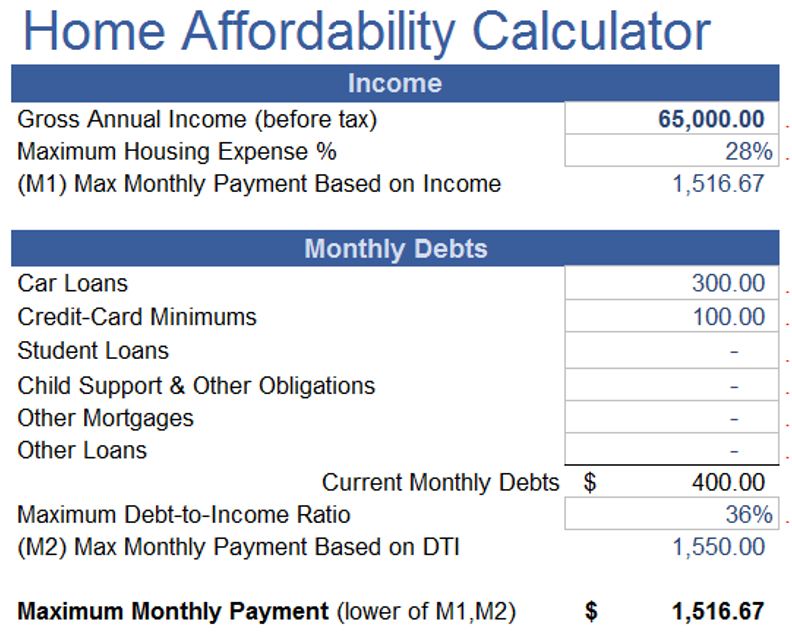

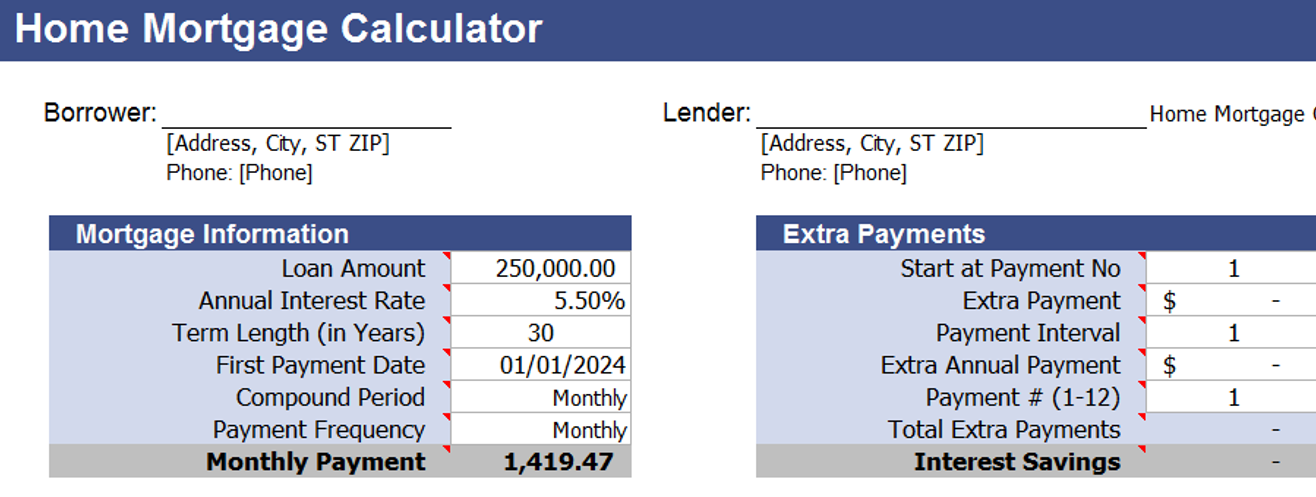

- Income: The calculator employs the 28/36 rule, focusing on the “28” part, where users input their annual income. This rule suggests that a household should spend a maximum of 28% of its gross monthly income on housing expenses.

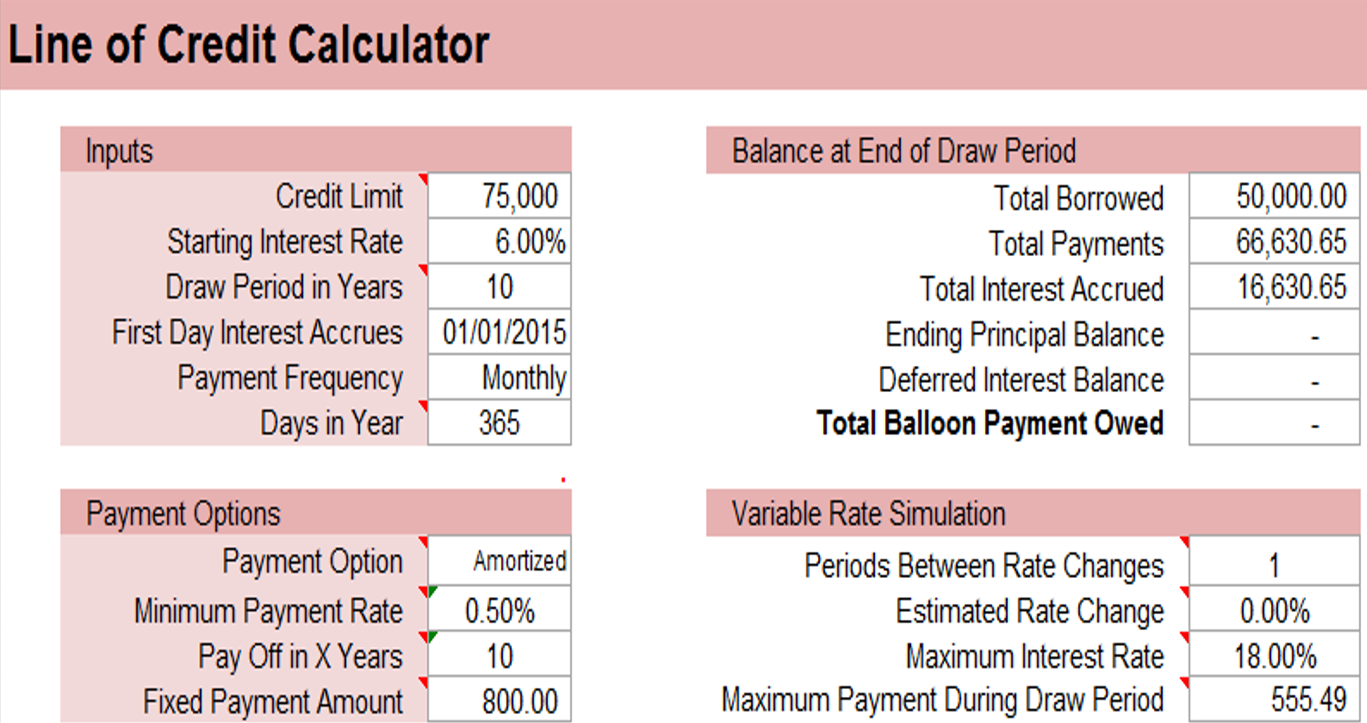

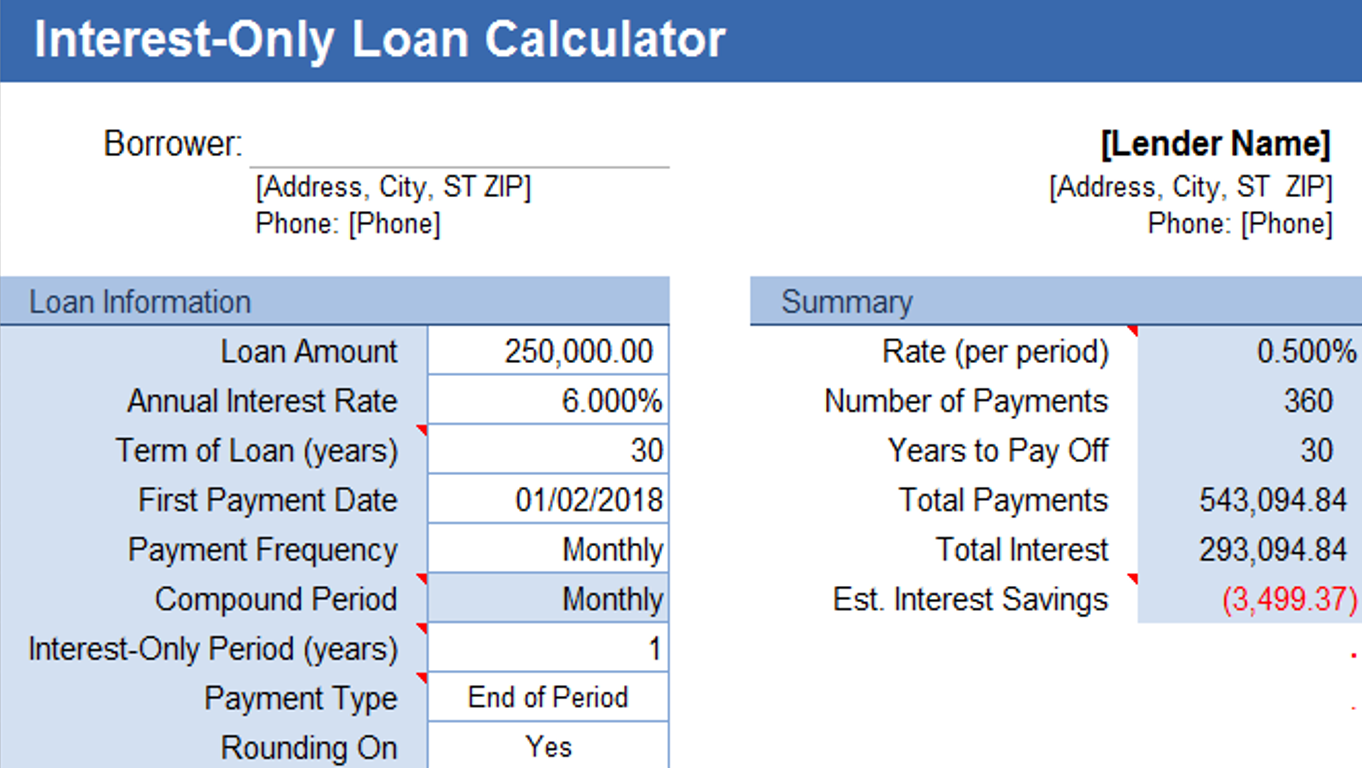

- Expenses: The calculator factors in the full PITI payment (Principal + Interest + Taxes + Insurance) to determine the maximum principal and interest payment. Users need to estimate monthly costs for property tax, homeowners’ insurance, private mortgage insurance (PMI), homeowners’ association (HOA) fees, and other relevant expenses.

- Available Funds: The calculator recognizes that funds for the down payment and closing costs are crucial considerations. Closing costs are estimated as a percentage of the home value, and users can input both variable and fixed closing costs. The down payment, a significant limiting factor, is usually recommended to be at least 20% of the home value.

How AceDigi’s Home Affordability Calculator Works:

- Finding the Maximum Housing Expense Based Solely on Income:

Users input their annual income to determine the maximum housing expense based on the 28/36 rule.

- Determining the Maximum PI (Principal+Interest) Payment Based on Expenses:

The PITI payment is broken down, and users estimate monthly costs for property tax, homeowners’ insurance, PMI, HOA fees, and other expenses. The Maximum PI Payment Based on Expenses is calculated by subtracting these expenses from the Maximum Monthly Housing Payment.

- Finding the Maximum PI Payment Based on Available Funds:

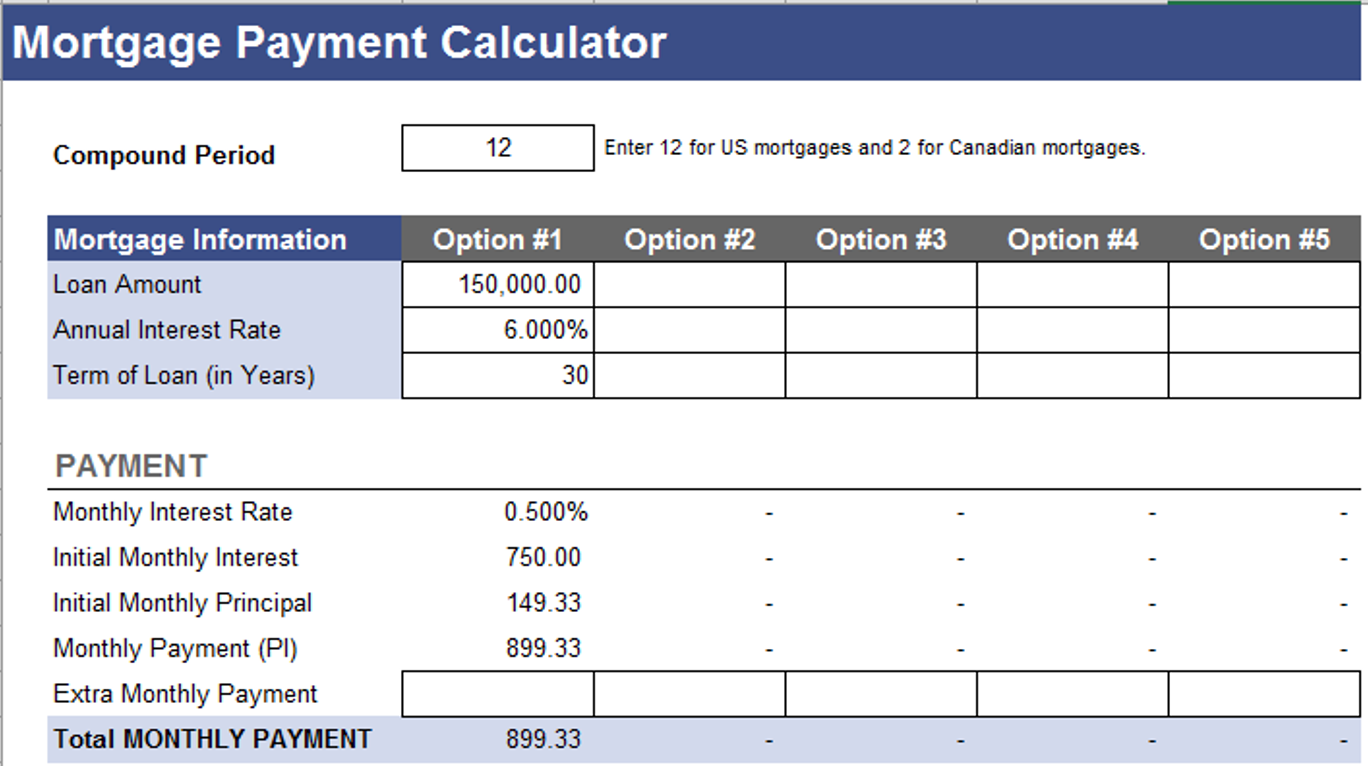

Users input available funds for the down payment and closing costs. The calculator estimates closing costs as a percentage of the home value and considers fixed closing costs. The maximum PI payment based on available funds is determined.

- Calculating the Rest of the Story:

The Maximum PI Payment is used to adjust the term and rate in the financing section, resulting in the calculation of the loan amount, down payment, closing costs, and ultimately, the Maximum Home Price. The results are presented graphically for user convenience.

- Identifying Limiting Factors:

AceDigi’s calculator uses arrows to point out limiting factors, helping users understand whether it’s income, down payment, or other expenses that are constraining their estimated home price.

Important Considerations and Recommendations

The calculator emphasizes that it should only be used for educational purposes and not as financial advice.

Users are encouraged to evaluate their budget using tools like AceDigi’s family budget planner to assess if they can afford the monthly housing payment indicated by the affordability calculator.

Tips for Using the Calculator:

Users can leverage the red arrows within the calculator to identify limiting factors and understand the elements influencing their estimated home price.

Available funds for the down payment and closing costs play a crucial role in determining affordability.

Conclusion:

AceDigi’s Home Affordability Calculator offers a transparent and logical approach to estimating the mortgage one might afford. While the calculator simplifies the process, it’s essential for users to delve deeper into all factors involved in home buying. The tool serves as a valuable aid in making informed decisions about purchasing a home, allowing users to visualize and understand the various elements affecting their affordability.

Note on Possible Bugs:

Given the complexity of the calculator, AceDigi acknowledges the possibility of bugs or typos. Users are encouraged to scrutinize any discrepancies and identify potential errors. The calculator’s transparency enables users to understand its inner workings, and contact is welcomed only for genuine bug reports, not for lender-specific nuances. The calculator offers a robust and insightful tool for users seeking clarity in their home affordability assessment.

Amit Modi –

Love the customization options! These templates have allowed me to tailor my work to my specific needs. Well-designed, and the support provided is excellent. A satisfied user!

Navdeep Yadav –

Using these templates feels like having a personal assistant. They’ve made my workload more manageable, and the results are consistently impressive. Highly recommended!

Henry Taylor –

Using these templates has been a time-saver. The ease of use combined with the polished designs has elevated my work. It’s like having a design team at my fingertips!

Charlotte Anderson –

These templates have significantly improved the way I track my projects. User-friendly and visually appealing. Added a professional touch to my presentations. Highly recommend!