Description

Introduction:

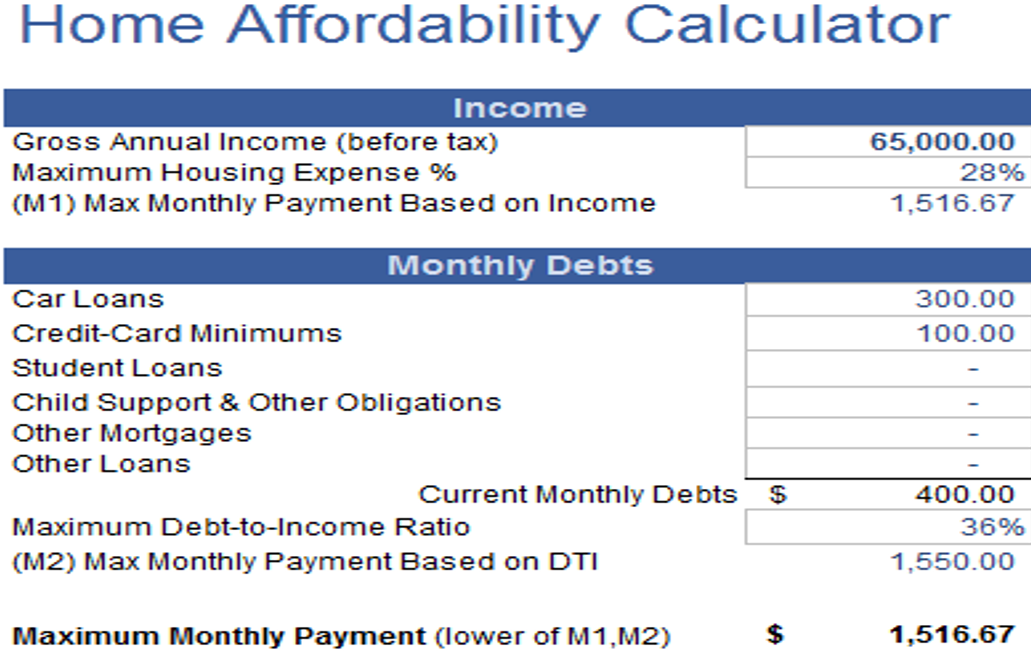

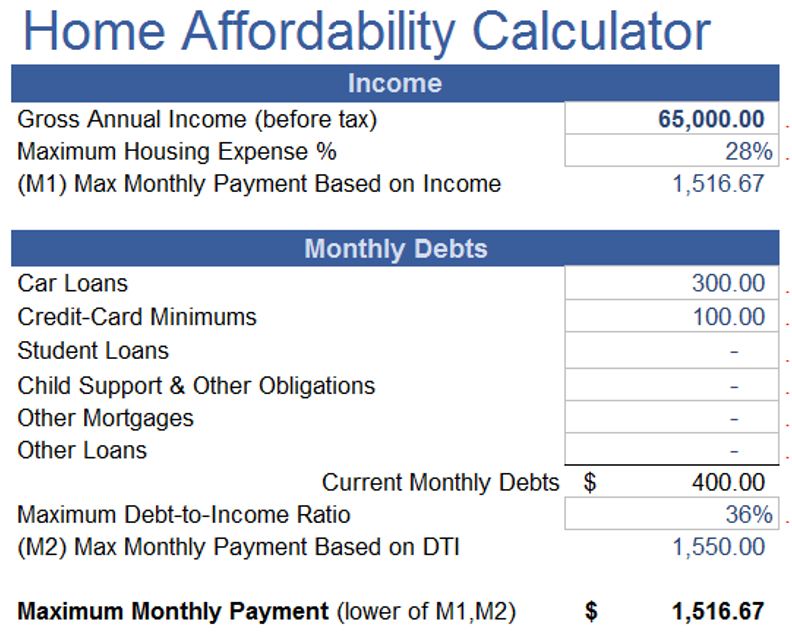

Embarking on the journey of homeownership is an exciting yet complex endeavor. To guide you through this process, AceDigi presents its Home Affordability Calculator, a powerful tool designed to assist you in determining how much home you can afford. This calculator takes into account crucial factors such as income, debt, available funds, and various housing expenses, providing a comprehensive estimate of the mortgage you might afford. In this discussion, we will delve into the features, functionality, and key considerations when using AceDigi’s Home Affordability Calculator.

Key Factors Considered by the Calculator:

- Housing Expense to Income Ratio:

This ratio is a fundamental metric in determining affordability. The calculator assesses the proportion of your income that will go towards housing expenses, providing a realistic snapshot of your financial capacity.

- Total Debt to Income Ratio (DTI):

Evaluating your overall debt in relation to your income is crucial. The calculator considers your total debt, including existing obligations, to ensure a comprehensive assessment of your financial standing.

- Available Funds:

The funds available for closing costs and down payment play a pivotal role in the home-buying process. AceDigi’s calculator factors in these available funds, offering a practical approach to determining your affordability.

- Housing Expenses:

Beyond the mortgage, housing expenses such as property tax, insurance, PMI, HOA fees, and others are critical considerations. The calculator provides a holistic view of these expenses, ensuring a thorough evaluation of your financial commitment.

Factors NOT Considered in the Calculator:

It’s important to note that while AceDigi’s Home Affordability Calculator provides a comprehensive assessment, it does not account for certain factors, including other savings goals, income stability, and fluctuations in the housing market. Users are encouraged to view the calculator as an educational tool rather than financial advice.

Understanding the Calculator’s Approach:

- Find the Minimum of the Maximums:

The calculator employs a conservative approach by finding the minimum of multiple maximums. Lenders use various rules of thumb to assess risk, and the calculator considers the minimum of these maximums to determine affordability.

- Minimum Monthly Payment Calculation:

The calculator determines the maximum mortgage payment through various methods, emphasizing a conservative approach. Users can identify limiting factors by reviewing the logical flow of the calculations.

- Calculating the Maximum PI Payment Based on Expenses:

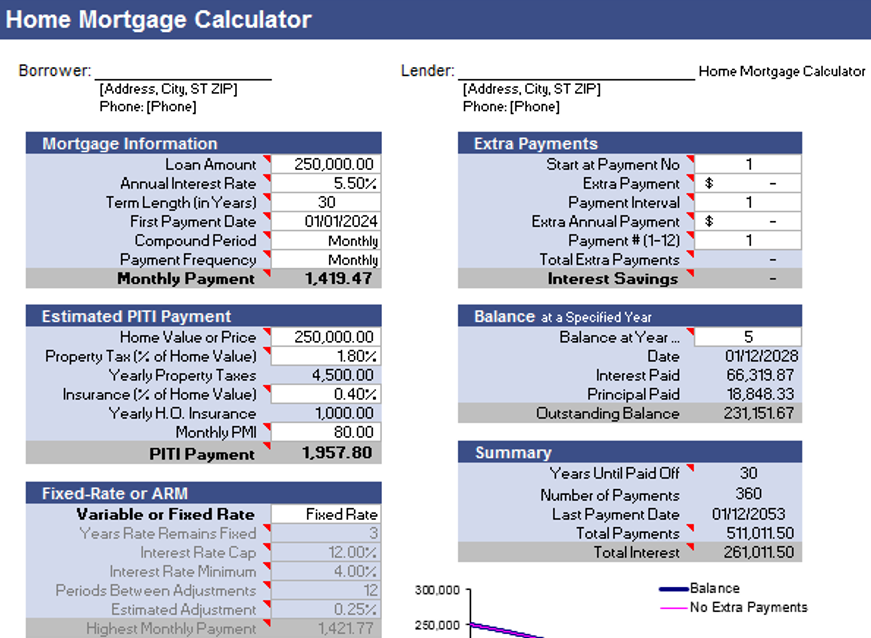

Principal + Interest (PI) payment is a crucial aspect of the mortgage. The calculator subtracts property tax, homeowners insurance, PMI, HOA fees, and other expenses from the Maximum Monthly Housing Payment, providing the Maximum PI Payment Based on Expenses.

- Expense Amounts Based on Home Value:

Users input monthly costs for property tax, homeowners insurance, PMI, HOA fees, and other expenses. These values are deducted from the Maximum Monthly Housing Payment, refining the affordability assessment.

- Calculating the Maximum PI Payment Based on Available Funds:

Available funds for down payment and closing costs are essential limiting factors. The calculator estimates closing costs as a percentage of the home value and factors in down payment considerations.

Practical Application and Tips:

- Customizing Inputs:

Users are urged to customize inputs based on their specific circumstances, including savings goals, income stability, and regional housing market variations.

- Budget Evaluation:

While the calculator estimates the mortgage you might afford, users should evaluate their overall budget using tools like AceDigi’s family budget planner. This ensures a comprehensive assessment of monthly housing payments.

- Closing Costs and Down Payment Analysis:

Closing costs and down payment considerations are crucial limiting factors. Users can adjust these values to understand their impact on home affordability.

Conclusion:

AceDigi’s Home Affordability Calculator emerges as an indispensable tool for individuals navigating the complexities of purchasing a home. By incorporating crucial financial factors, this calculator empowers users to make informed decisions regarding their homeownership journey. As you embark on the path to your dream home, utilize AceDigi’s Home Affordability Calculator for a comprehensive and accurate assessment of your affordability. Remember, this calculator serves as an educational guide, prompting users to consider various factors beyond the mortgage to ensure a financially sound investment in homeownership.

Henry Taylor –

Must-have for anyone working with data. Functional and aesthetically pleasing. An integral part of my workflow, making data management a breeze.

Charlotte Anderson –

As someone who isn’t an expert, these templates have been a blessing. Simple to navigate with clear instructions. Now, I can manage my data without any hassle. Great job!

4. Aisha Rahman –

Top-notch templates! Cover a wide range of needs with impressive attention to detail. Improved the professionalism of my reports and presentations. Highly satisfied!

Isabella Carter –

I’ve tried various templates before, but these stand out. They’re not just functional; they add a touch of elegance to my work. Definitely worth the investment.