Description

AceDigi proudly presents its Home Equity Loan Calculator, an Excel workbook containing three powerful calculators designed to empower homeowners in making informed financial decisions. This versatile tool addresses essential queries, including the amount available for borrowing, monthly payment estimations, and future home equity projections. Whether you’re planning to sell your home or exploring accelerated payment strategies, the AceDigi Home Equity Loan Calculator provides valuable insights for your homeownership journey.

Understanding Home Equity Loans:

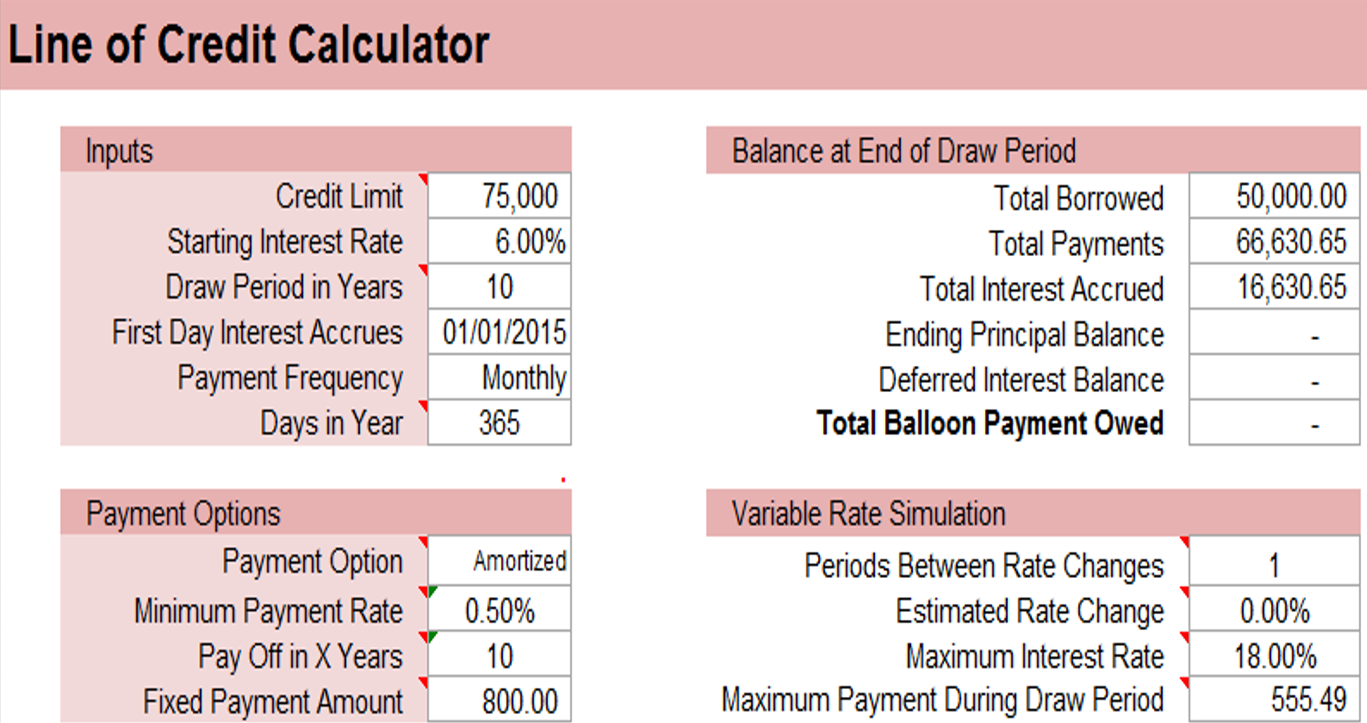

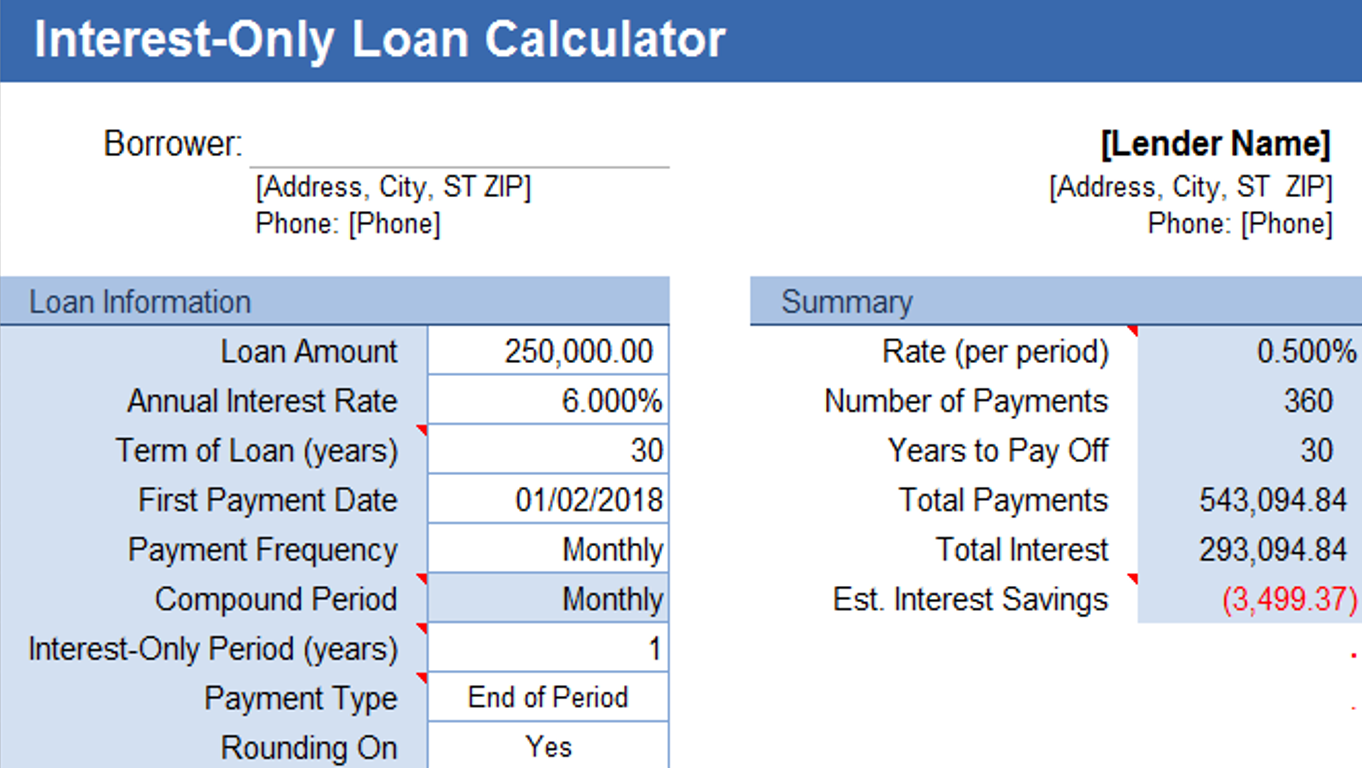

A home equity loan is commonly referred to as a “second mortgage,” and the terms are often used interchangeably. In essence, it allows homeowners to borrow against the equity they have built in their homes. Unlike other specialized calculators, AceDigi’s Home Equity Loan Calculator emphasizes flexibility, enabling users to include first and second mortgages in their calculations. This tool is not limited to fixed-rate loans; it can also accommodate interest-only mortgages and provides an avenue for simulating accelerated bi-weekly payments.

Key Features of AceDigi Home Equity Loan Calculator:

- Three Calculators in One Workbook:

AceDigi’s Excel workbook integrates three distinct home equity calculators, each serving a specific purpose. Users can seamlessly switch between these calculators to address different aspects of their home equity scenario.

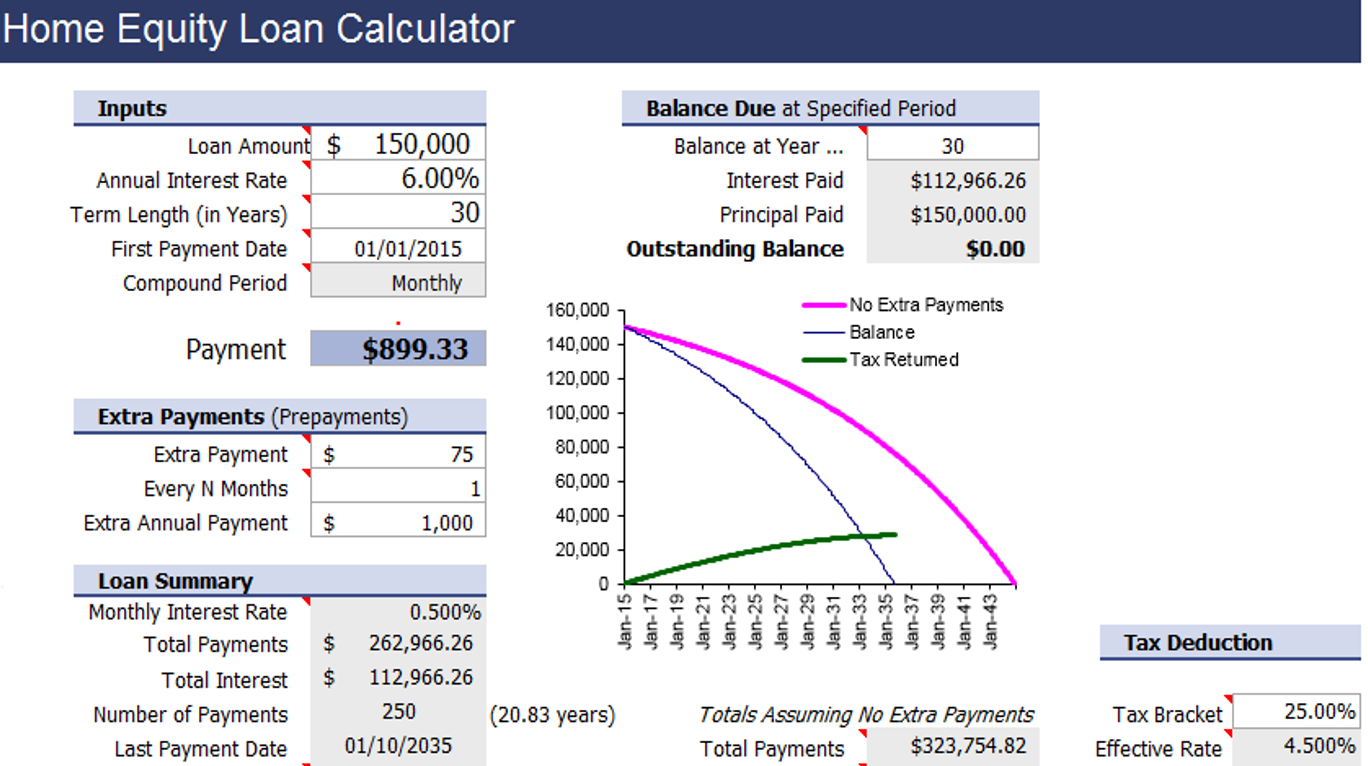

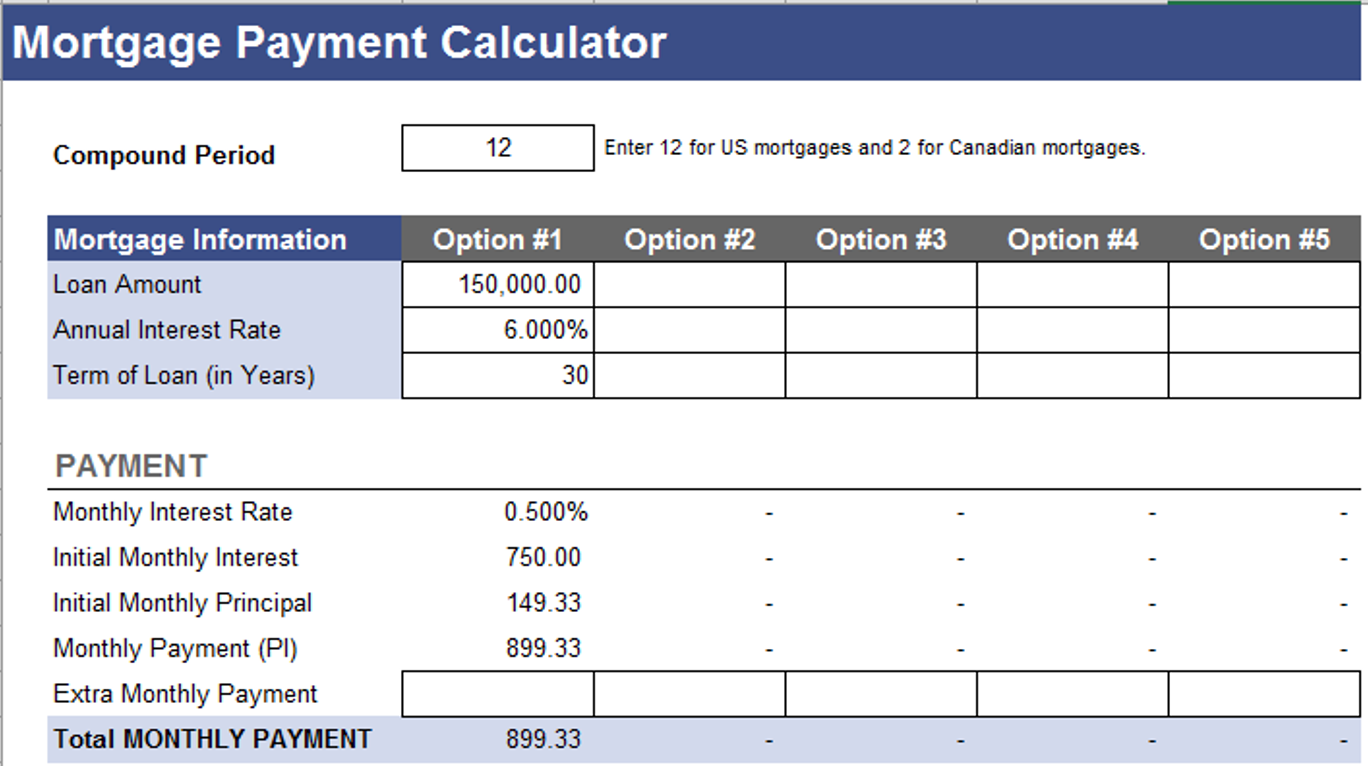

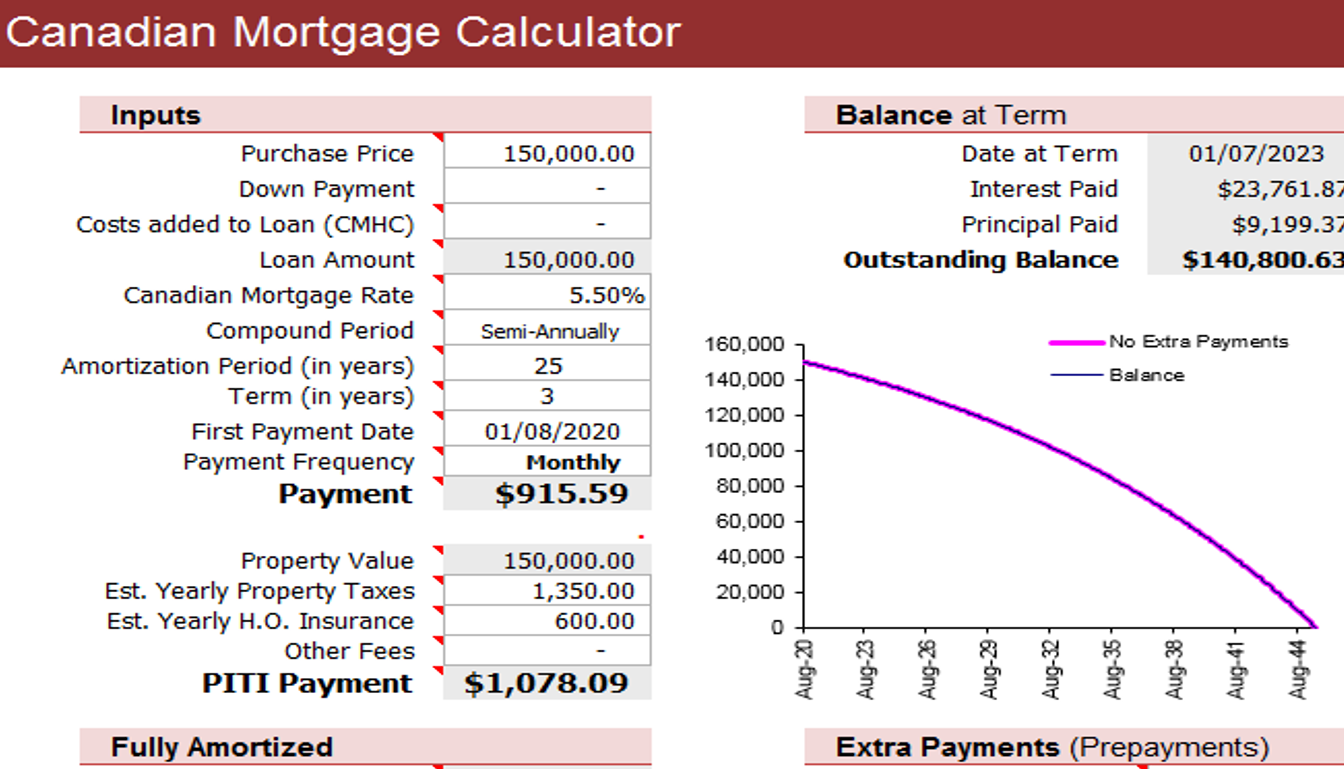

- Comprehensive Monthly Payment Calculation:

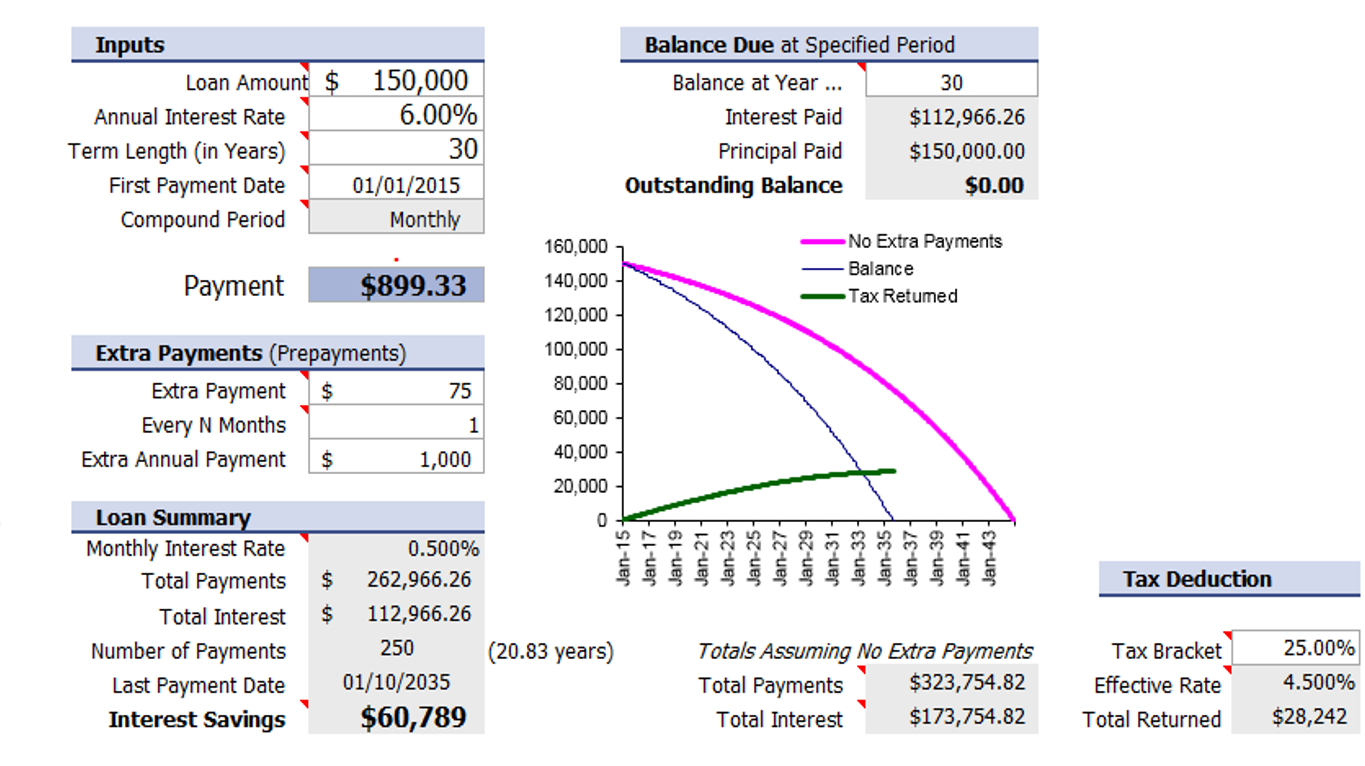

The calculator creates an amortization schedule, allowing users to calculate their monthly payments for fixed-rate home equity loans accurately. It accommodates optional extra payments, providing flexibility to simulate various payment scenarios.

- Equity Projection with HomeEquity Worksheet:

The HomeEquity worksheet, the third tab in the workbook, enables users to project the amount of equity they will have in their home after a specified number of years. This projection is invaluable for homeowners planning to sell their homes, offering insights into potential equity growth.

- Inclusive of First and Second Mortgages:

Unlike conventional home equity loan calculators, AceDigi’s tool allows users to include both their first and second mortgages in the calculations. This comprehensive approach offers a more accurate representation of the overall financial scenario.

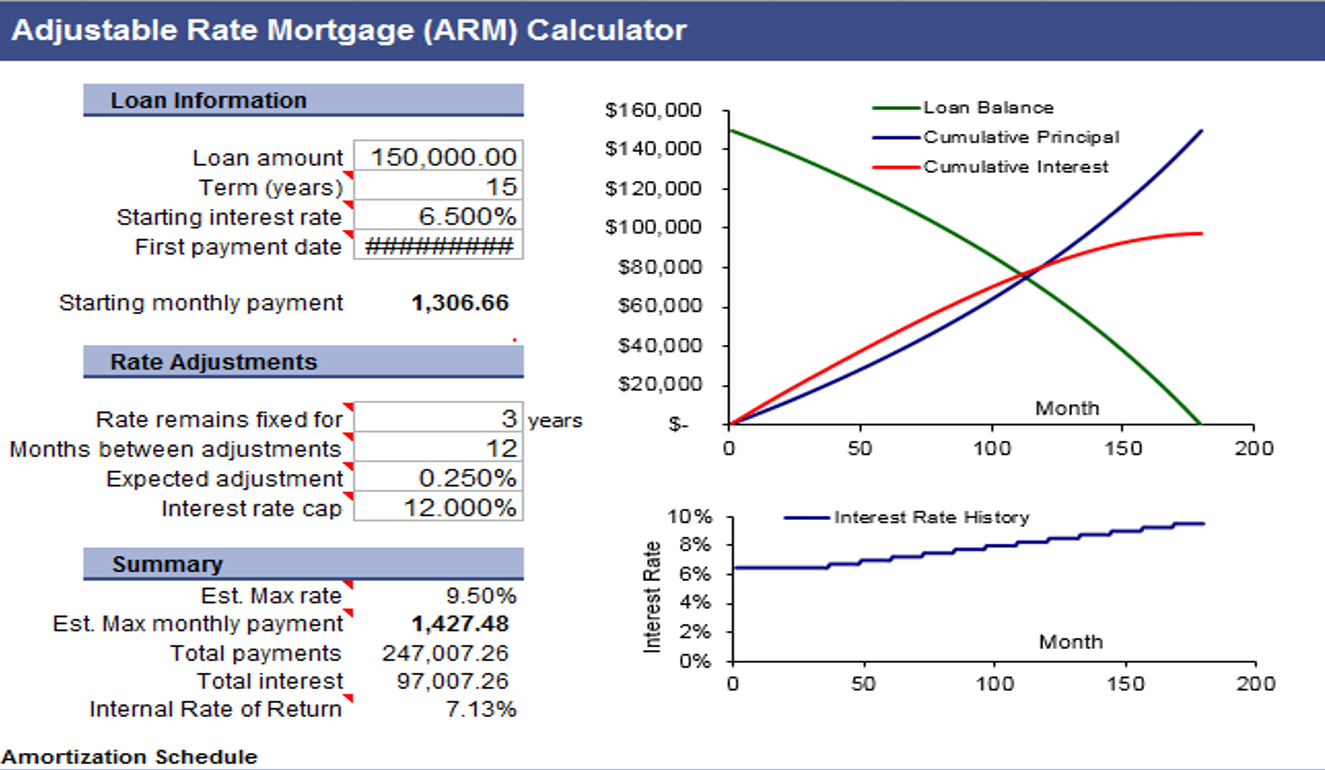

- Analysis of Financial Scenarios:

Users can explore various financial scenarios by experimenting with inputs such as loan term, interest rate, and monthly payments. The calculator is not restricted to users who have made prepayments in the past, ensuring adaptability to diverse financial histories.

Using the Home Equity Loan Calculator:

The AceDigi Home Equity Loan Calculator is user-friendly and intuitive. The following worksheets within the workbook serve distinct purposes:

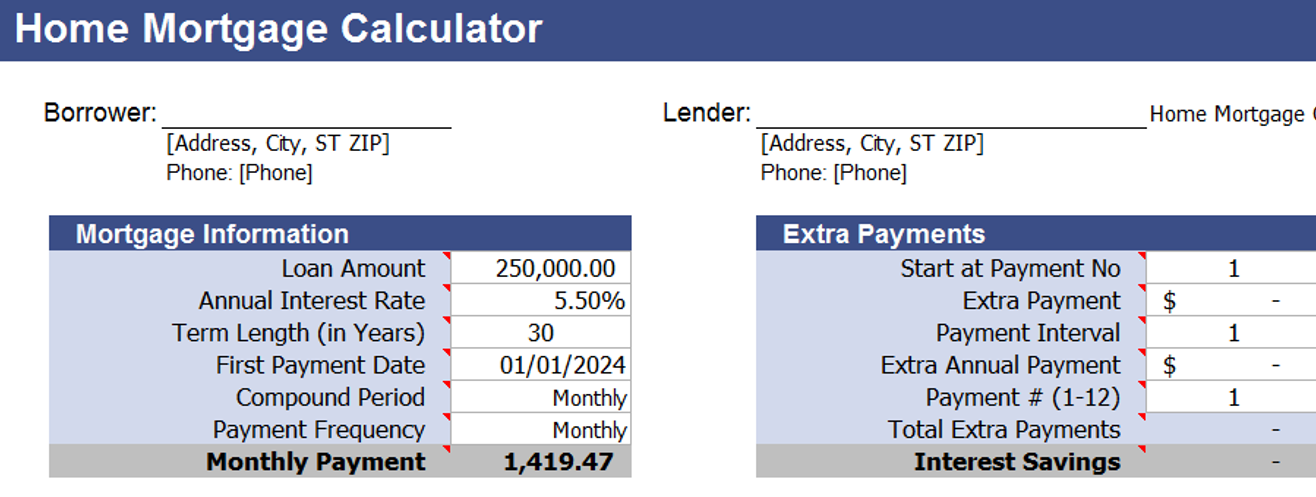

- Loan Calculator Worksheet:

Resembling AceDigi’s home mortgage calculator, this worksheet allows users to create an amortization schedule and experiment with extra payments. It treats the home equity loan as a second standard fixed-rate mortgage.

- Home Equity Worksheet:

Designed for projecting future home equity, this worksheet aids in answering critical questions about the payoff timeline and potential equity accumulation in the coming years.

- Bi-Weekly Payment Options:

The calculator facilitates the estimation of interest savings through accelerated bi-weekly payment plans. Users can simulate the impact by making extra payments, aligning with their payment preferences.

Enhanced Flexibility for Users:

AceDigi’s Home Equity Loan Calculator stands out for its inclusive approach, accommodating various mortgage types and providing room for personalized financial scenarios. The tool’s ability to incorporate both fixed-rate and interest-only mortgages, along with the option for extra payments, adds a layer of flexibility that caters to diverse homeowner needs.

Conclusion:

Empower your homeownership journey with the AceDigi Home Equity Loan Calculator. Whether you are planning to sell your home, considering additional payments, or exploring different financial scenarios, this feature-packed Excel workbook is your go-to tool. Download it today to gain valuable insights, make informed decisions, and navigate the path to financial stability. AceDigi remains committed to providing versatile financial tools, and the Home Equity Loan Calculator exemplifies this commitment. Explore the possibilities, calculate with confidence, and take control of your home equity journey with AceDigi.

Charlotte Anderson –

Using these templates has been a time-saver. The ease of use combined with the polished designs has elevated my work. It’s like having a design team at my fingertips!

Samuel Parker –

The templates provided are a lifesaver! Easy to use and have improved my organization significantly. Versatile and suitable for various tasks. Kudos to the creators!

Charlotte Anderson –

These templates are a lifesaver for someone like me who’s always on the go. Quick, easy, and efficient – they’ve become an essential part of my toolkit. Thumbs up!

2. Fatima Khan –

Must-have for anyone working with data. Functional and aesthetically pleasing. An integral part of my workflow, making data management a breeze.