Description

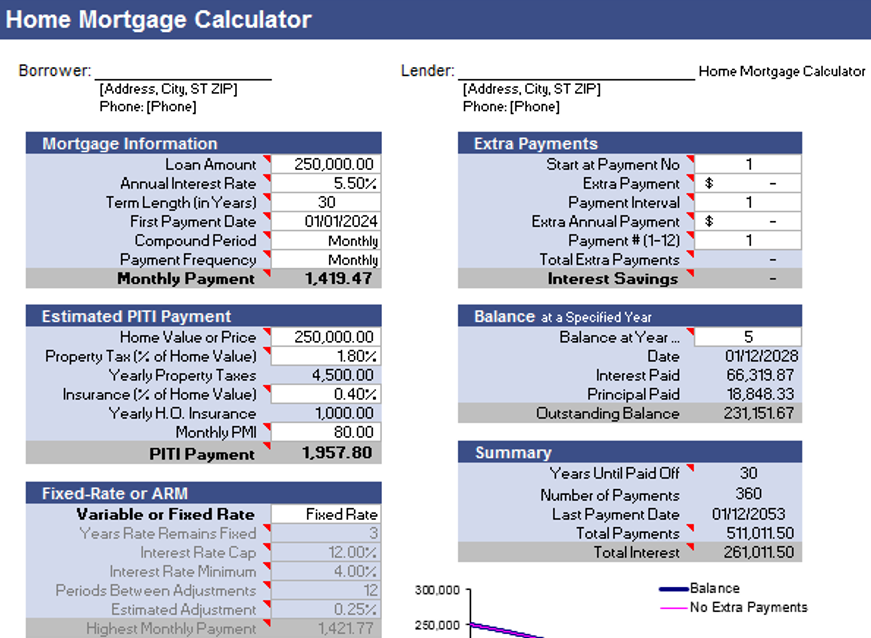

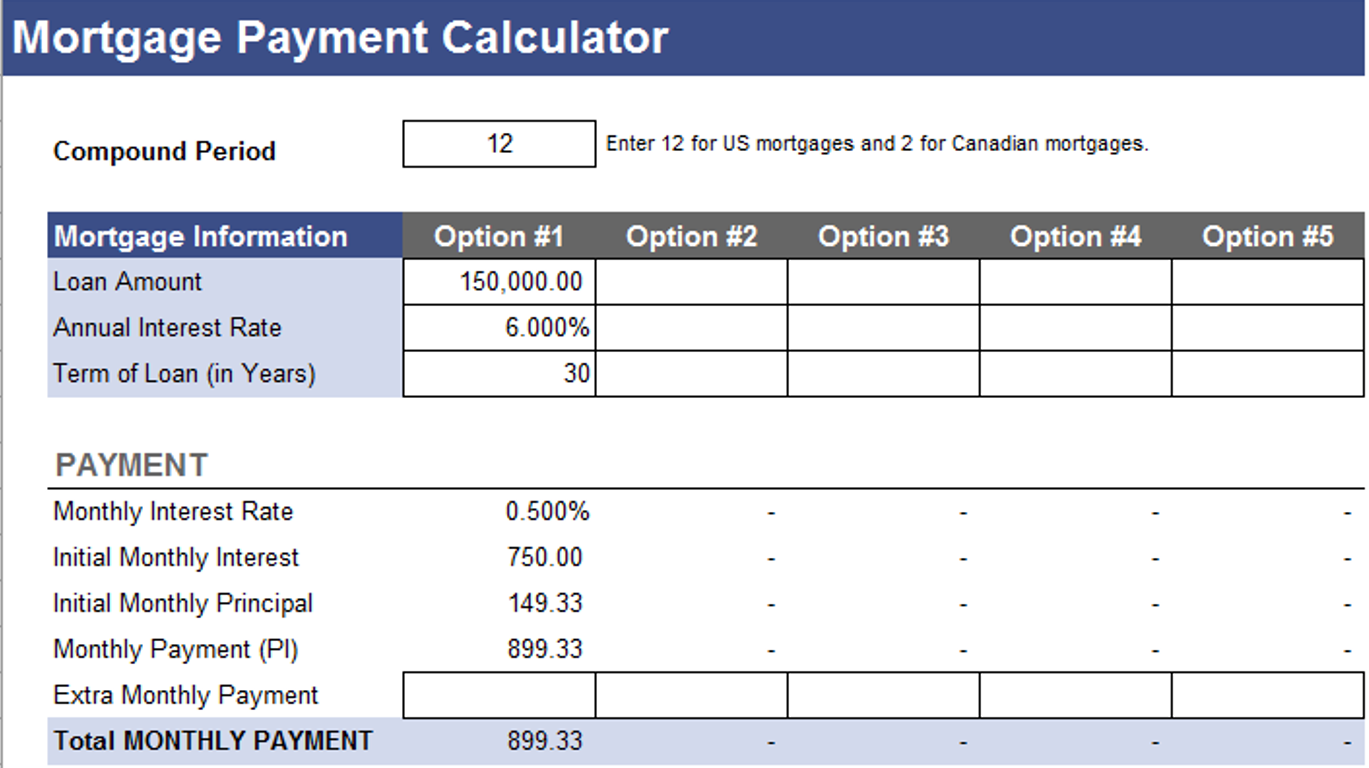

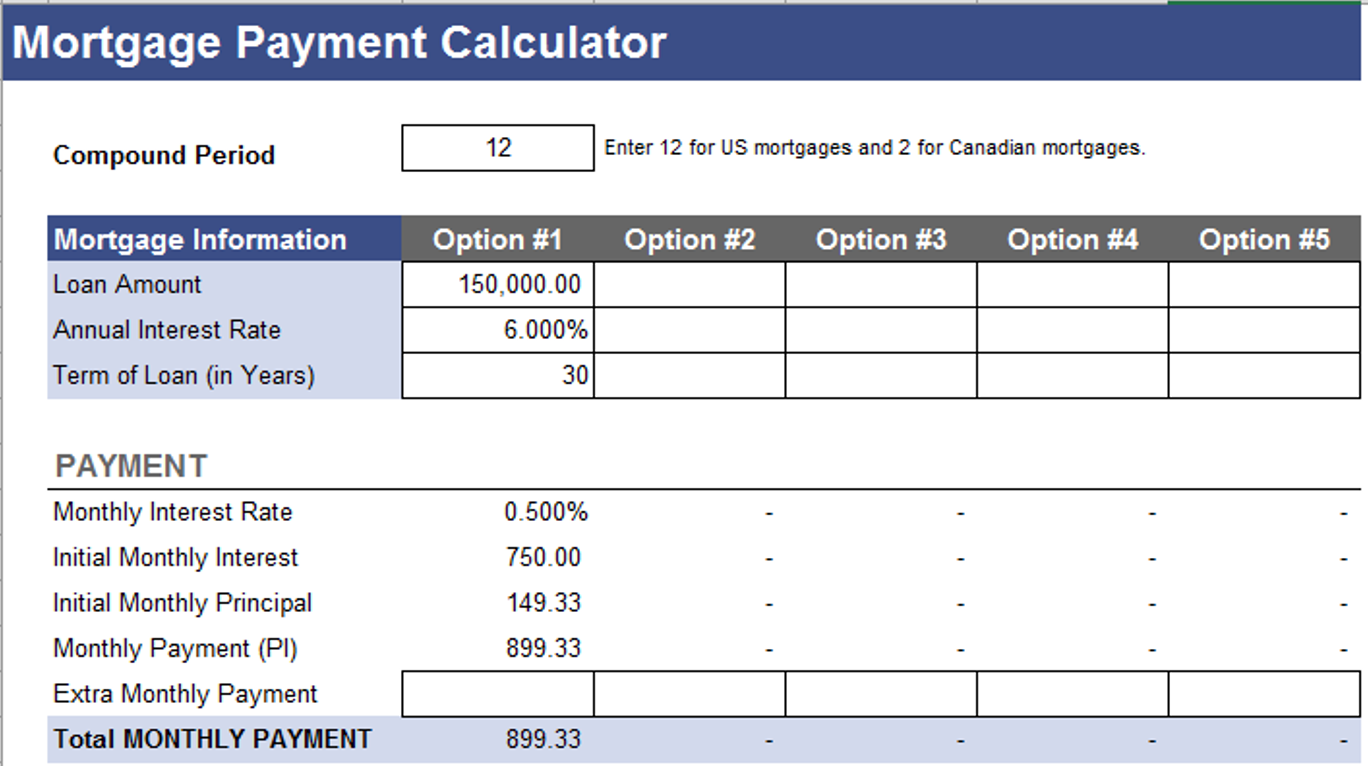

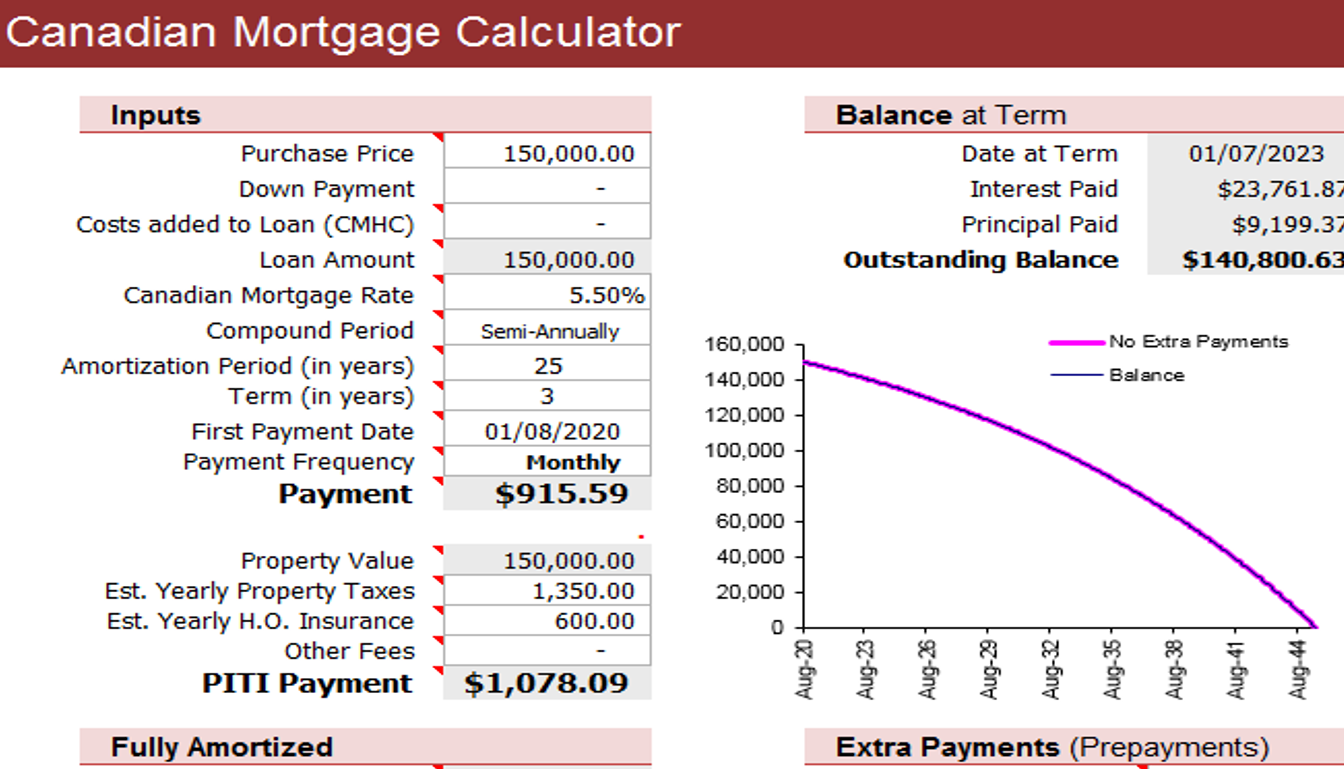

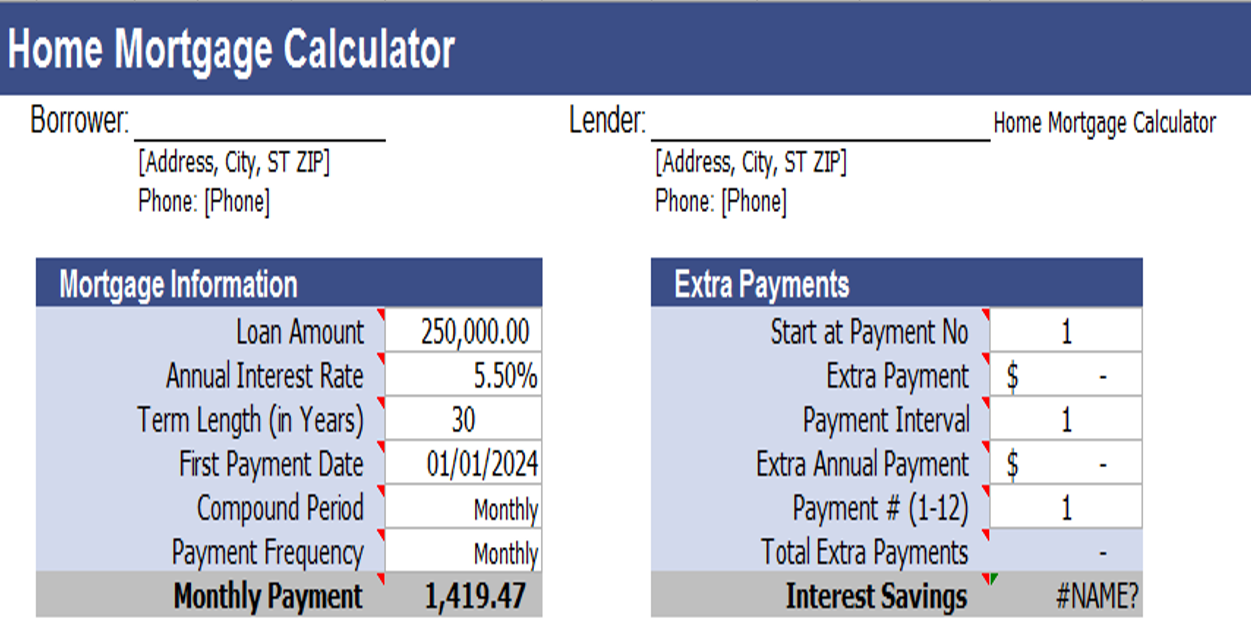

AceDigi’s Comprehensive Home Mortgage Calculator for Excel stands as a robust all-in-one tool, seamlessly integrating the functionalities of various mortgage and loan calculators. This versatile worksheet empowers users to dissect both variable-rate and fixed-rate mortgages, providing insights into potential savings through extra payments.

Offering a holistic perspective, this calculator aids in estimating the complete mortgage payment, encompassing insurance and interest costs. For a more comprehensive evaluation of monthly homeownership expenses, our Home Expense Calculator is also available. Explore our array of mortgage spreadsheets, and don’t hesitate to reach out if there’s a specific tool you require.

The AceDigi Home Mortgage Calculator excels as an all-encompassing solution. It accommodates analysis for fixed or variable rate home mortgages, allowing users to configure periodic extra payments or manually input additional payments within the Payment Schedule. The spreadsheet proves invaluable for comparing diverse parameters such as term lengths, interest rates, loan amounts, and potential savings from extra payments. Moreover, it computes the outstanding balance after a specified number of years and calculates the tax return if the paid interest is tax-deductible.

Guidance on utilizing this free home mortgage calculator, along with definitions for key terms, is conveniently integrated as cell comments within the spreadsheet. If questions arise, users can hover over cells marked by a small red triangle for clarification.

This mortgage calculator serves as a tool to address various queries:

– How much can be saved through extra payments?

– How does the tax deduction from interest payments evolve over time?

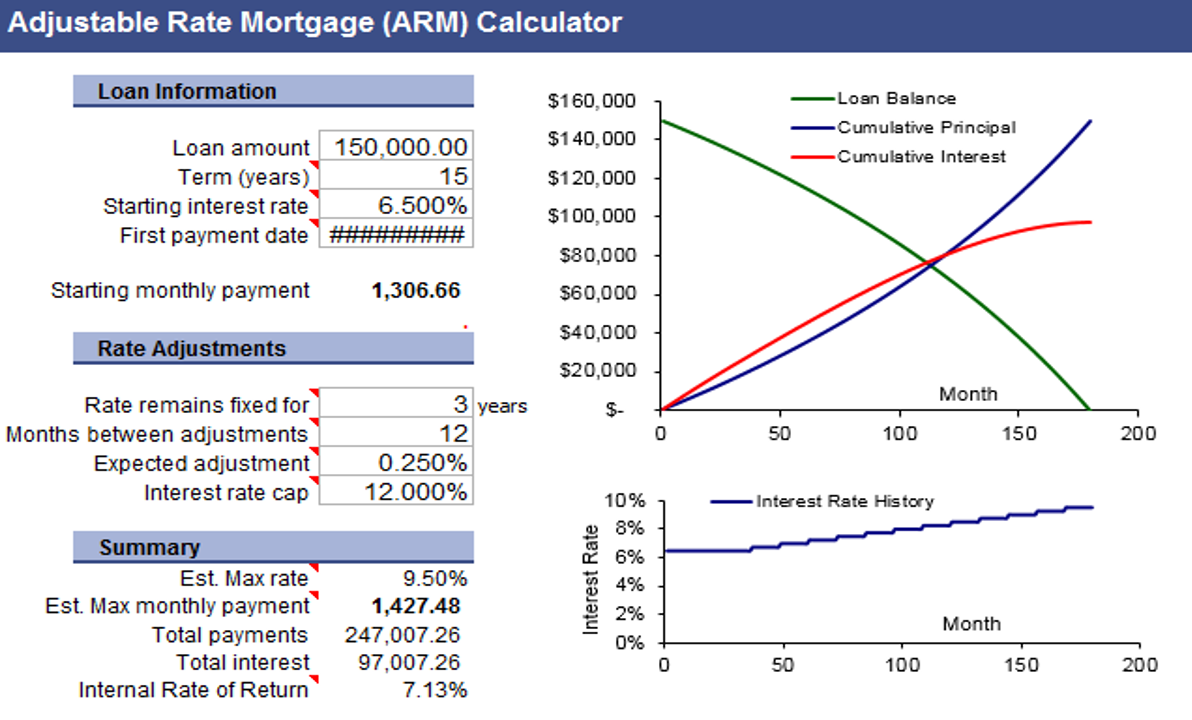

– How might monthly payments fluctuate with a variable-rate mortgage?

– What is the potential early payoff period with extra payments?

– What will the loan balance be after 3 or 5 years?

New Features of the AceDigi Home Mortgage Calculator:

- Estimates Property Taxes and Insurance for PITI payment calculations.

- Automatic computation of “Accelerated Bi-Weekly” payments.

- Compatibility with both US and Canadian mortgages through the compounding option.

- Highly flexible options for additional payments.

- Choice between fixed-rate and variable-rate mortgages.

- Freedom to select when scheduled extra payments commence.

Analyzing an Existing Mortgage:

Users can approach the analysis of an existing home mortgage through two methods:

1:Entering Original Loan Details:

Input the original loan amount and date, making adjustments to the payment history in the Payment Schedule as necessary. To enhance user flexibility, a new feature in the Extra Payments section allows specifying the payment number at which scheduled extra payments commence. This accommodates users who have already made payments for a certain duration.

2:Entering Current Mortgage Balance:

Alternatively, users can input the current mortgage balance and adjust the term length until the Principal and Interest (PI) payment aligns with the existing payment structure. For monthly payments, users can enter fractional years, such as “=10+5/12” for 10 years and 5 months.

AceDigi’s commitment to providing a comprehensive and user-friendly mortgage calculator is evident in the continuous improvement of features and functionalities. Whether you are a homeowner looking to optimize payments or a prospective buyer assessing different mortgage scenarios, the AceDigi Home Mortgage Calculator is a powerful ally in making informed financial decisions.

Oliver Mitchell –

Impressed with the variety of templates available. From budgeting to project management, they cover it all. Well-designed and have significantly improved my productivity. Highly recommended!

Certainly! Here are five Muslim names: –

These templates have turned mundane tasks into a breeze. The attention to detail is evident, and they’ve made data analysis surprisingly enjoyable. A fantastic find!

Sophia Williams –

Impressed with the variety of templates available. From budgeting to project management, they cover it all. Well-designed and have significantly improved my productivity. Highly recommended!

Sophia Williams –

Must-have for anyone working with data. Functional and aesthetically pleasing. An integral part of my workflow, making data management a breeze.