Description

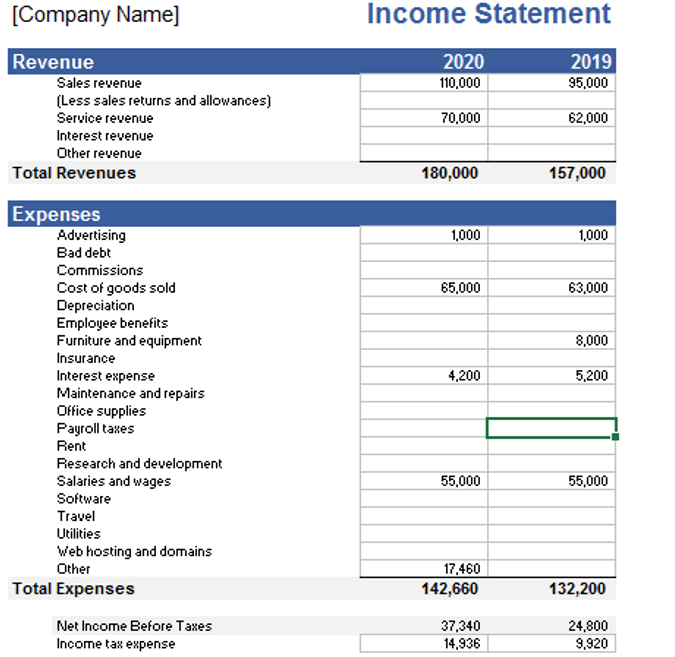

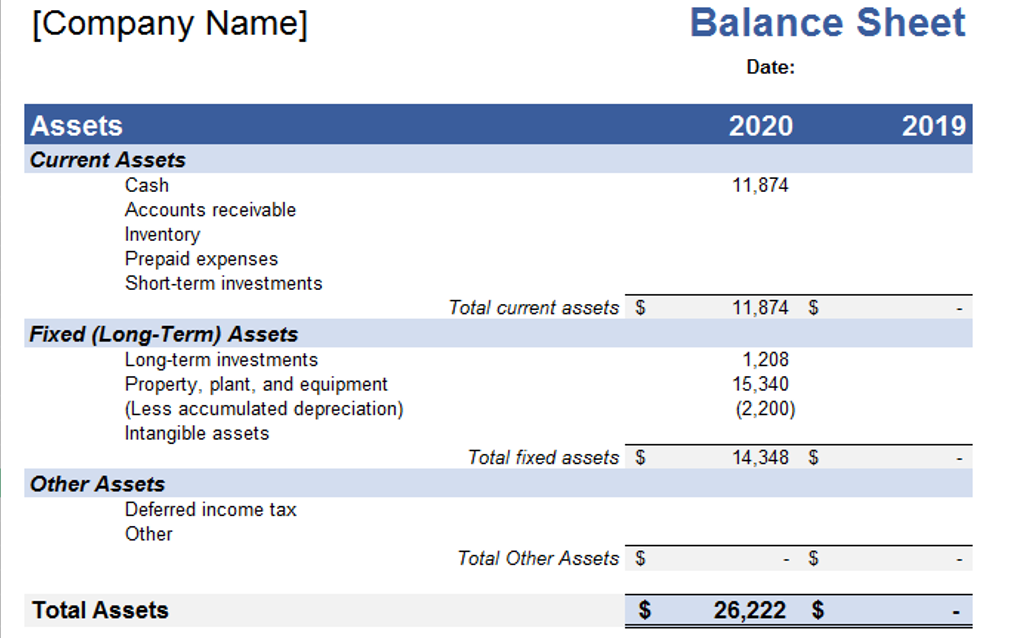

An integral financial document, the income statement, also known as the profit and loss statement, serves as a cornerstone in evaluating a company’s financial performance. Central to this statement is the Net Income, a key value derived from summarizing a company’s revenues and business expenses. The income statement provides a comprehensive overview of a company’s financial trajectory, complementing the insights gained from a balance sheet statement.

In essence, an income statement encapsulates the financial health of a company over a specific timeframe. It is often utilized in conjunction with a balance sheet to offer a holistic understanding of the company’s financial standing. The Net Income, the focal point of the income statement, represents the residual profit after deducting all expenses from the total revenue.

Income Statement Formats:

The formatting of an income statement can vary, and the template provides two distinct examples tailored for small service-oriented businesses or retail companies. The first example illustrates a simplified “single-step” income statement, consolidating all revenues and expenses except for income tax expense. The second example, a “multi-step” income statement, delves deeper by breaking out Gross Profit and Operating Income as separate lines. This format calculates Gross Profit by subtracting Cost of Goods Sold from Net Sales, subsequently determining Operating Income after adjusting for interest expense and income tax, resulting in Income from Continuing Operations.

Description:

Our income statement template, meticulously crafted for small-business owners, features two example income statements on separate worksheet tabs. The first exemplifies a straightforward single-step income statement, while the second, a multi-step income statement, introduces calculations for Gross Profit and Operating Income.

Key Components:

- Revenues:

Sales Revenue: Income generated from product or service sales.

Service Revenue: Revenue derived from providing services.

Interest Revenue: Earnings from interest on investments.

Other Revenue: Additional income streams like renting office space, licensing technologies, or selling advertising.

Customization Tip: Modify the Revenue section to highlight your company’s primary revenue sources.

- Cost of Goods Sold (COGS):

Primarily applicable to retail businesses.

Cost of Goods Sold is separated, and Gross Profit is calculated as Net Sales minus COGS.

COGS calculation involves factors like beginning inventory, goods purchased, raw materials, direct labor, and ending inventory.

- Operating Expenses:

Encompasses all operational costs, including advertising, salaries, rent, utilities, insurance, legal fees, accounting fees, supplies, research and development costs, and maintenance.

Excludes interest expense and income taxes, as they are treated separately.

- Operating Income (EBIT):

In the multi-step income statement, Operating Income is determined by subtracting the total Operating Expenses from Gross Profit.

Excludes interest expense and income tax, leading to the term EBIT (Earnings Before Interest and Taxes).

- Income from Continuing Operations:

Represents the bottom line, calculated as Operating Income minus interest expense and income tax.

Reflects the company’s ongoing profitability.

- Below-the-Line Items:

Includes non-recurring items below the Net Income line, such as gains or losses from extraordinary events.

Accounting changes, income from discontinued operations, and extraordinary items fall into this category.

Understanding the intricacies of an income statement is crucial for business owners seeking a comprehensive evaluation of their financial performance. By providing a clear delineation of revenues, expenses, and profits, the income statement aids in informed decision-making and strategic planning. Utilizing AceDigi’s income statement template, coupled with the guidelines and examples provided, empowers small-business owners to navigate the complexities of financial reporting, fostering a deeper understanding of their company’s financial trajectory.

5. Omar Hassan –

Impressed with the variety of templates available. From budgeting to project management, they cover it all. Well-designed and have significantly improved my productivity. Highly recommended!

2. Fatima Khan –

The templates provided are a lifesaver! Easy to use and have improved my organization significantly. Versatile and suitable for various tasks. Kudos to the creators!

3. Yusuf Ali –

Absolutely loving these templates! They’ve brought a level of organization to my work that I didn’t know I needed. Clean designs and intuitive functionality make them a winner.

Isabella Carter –

Using these templates feels like having a personal assistant. They’ve made my workload more manageable, and the results are consistently impressive. Highly recommended!