Description

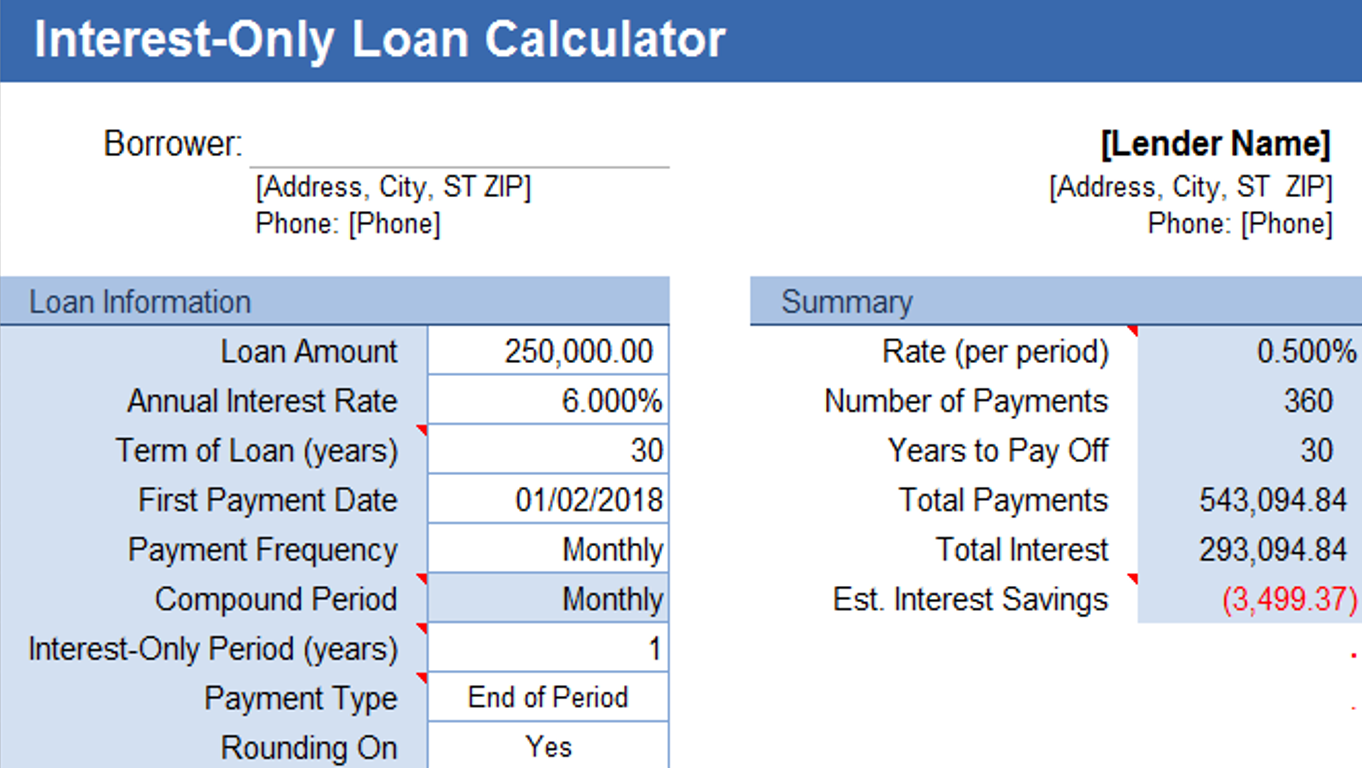

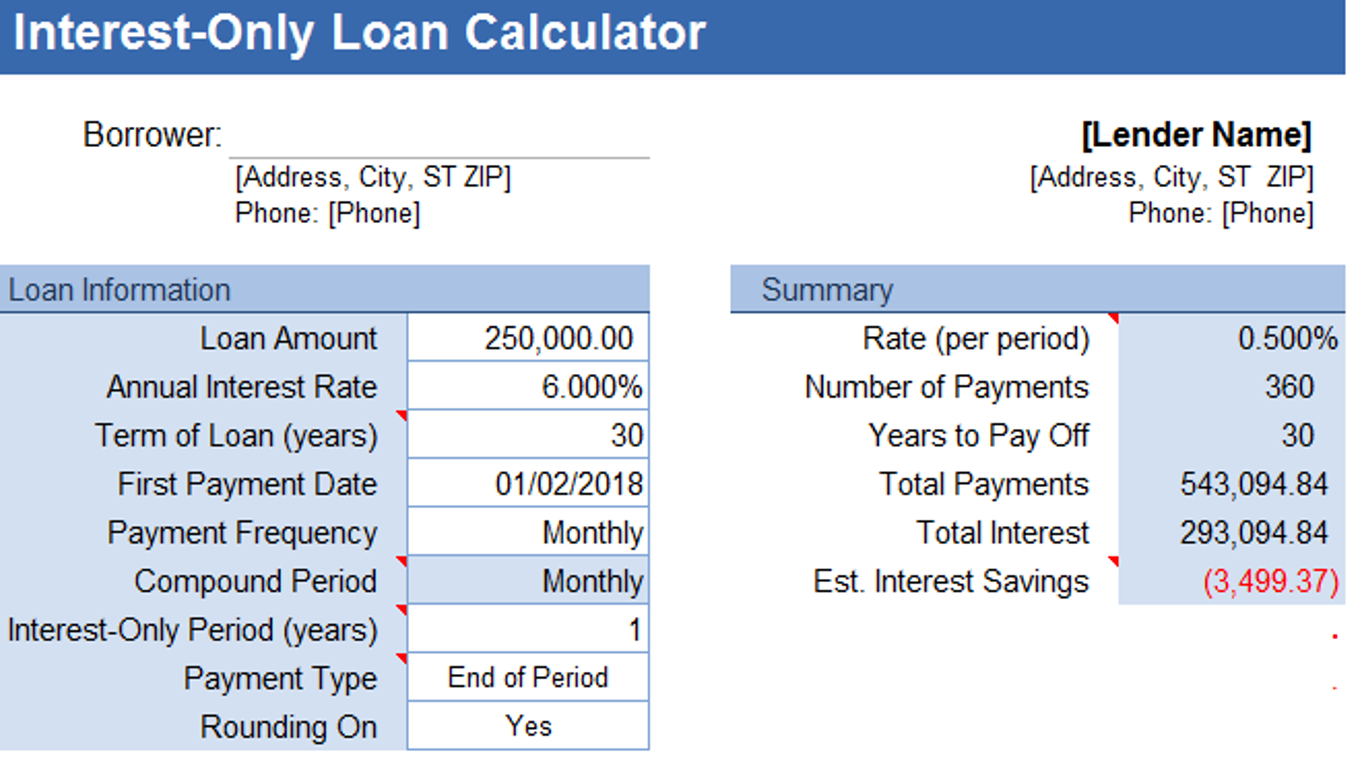

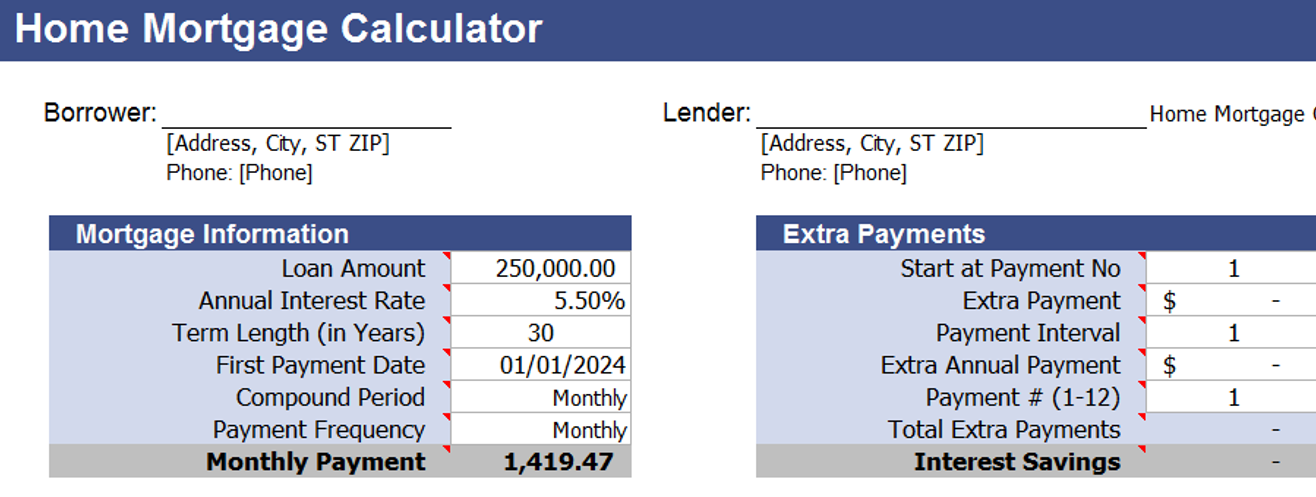

AceDigi presents a robust and user-friendly Interest-Only Loan Calculator, an advanced spreadsheet derived from our renowned Loan Amortization Schedule tool. This powerful calculator is designed to simplify the complex calculations associated with interest-only loans for fixed-rate mortgages, providing users with insights into their payment structures, including options for extra payments. The AceDigi Interest-Only Loan Calculator brings ease and precision to your financial planning, allowing you to specify the duration of the interest-only period and estimate the impact of additional payments.

Understanding Interest-Only Mortgage Loans:

Interest-only payment options are commonly offered for both fixed-rate and variable-rate loans and mortgages. This unique feature allows borrowers to make payments that cover only the interest component for a specified number of years, excluding any principal repayment. The primary advantage is a reduced initial payment, providing financial flexibility during the initial years of the loan.

During the interest-only period, borrowers often have the flexibility to make extra payments towards the principal without incurring penalty fees. However, it is crucial to understand that at the end of this interest-only (IO) period, a recalibration of the monthly payment occurs based on the remaining loan term and the outstanding balance.

Fortunately, with the AceDigi Interest-Only Loan Calculator, you don’t need to navigate these intricate calculations manually. The spreadsheet automates the process, empowering users to make informed decisions about their loan structures.

Description of the AceDigi Interest-Only Loan Calculator:

This versatile spreadsheet generates a comprehensive amortization schedule tailored for fixed-rate loans, accommodating optional extra payments and an interest-only period. Whether you opt for an interest-only loan or mortgage, AceDigi’s calculator serves as an invaluable tool for understanding and managing your financial obligations.

Updates and Commercial Use:

As part of our commitment to continual improvement, we updated the XLSX version of the calculator for Excel 2007+ on August 17, 2018. This update allows users to duplicate the loan worksheet for convenient comparison of different loans within the same workbook. We’ve also made cosmetic enhancements and updated comments and help information for a seamless user experience.

For users seeking a commercial application, a special commercial use version of the AceDigi Interest-Only Loan Calculator is provided as a bonus spreadsheet upon purchasing the Loan Amortization Schedule. This bonus enhances the versatility of the tool for those engaged in commercial loan analysis.

Utilizing the Interest-Only Calculator:

AceDigi ensures that the Interest-Only Loan Calculator is user-friendly and intuitive. Users can effortlessly input their loan details in the cells with a white background, and the spreadsheet takes care of the intricate calculations automatically. For those interested in incorporating extra payments, the amortization table provides a straightforward avenue for input.

It is advisable to peruse the comments within the file, identified by a red triangle, for additional guidance on specific cells. These comments are designed to address common queries and enhance user understanding.

Is an Interest-Only Loan Right for You?

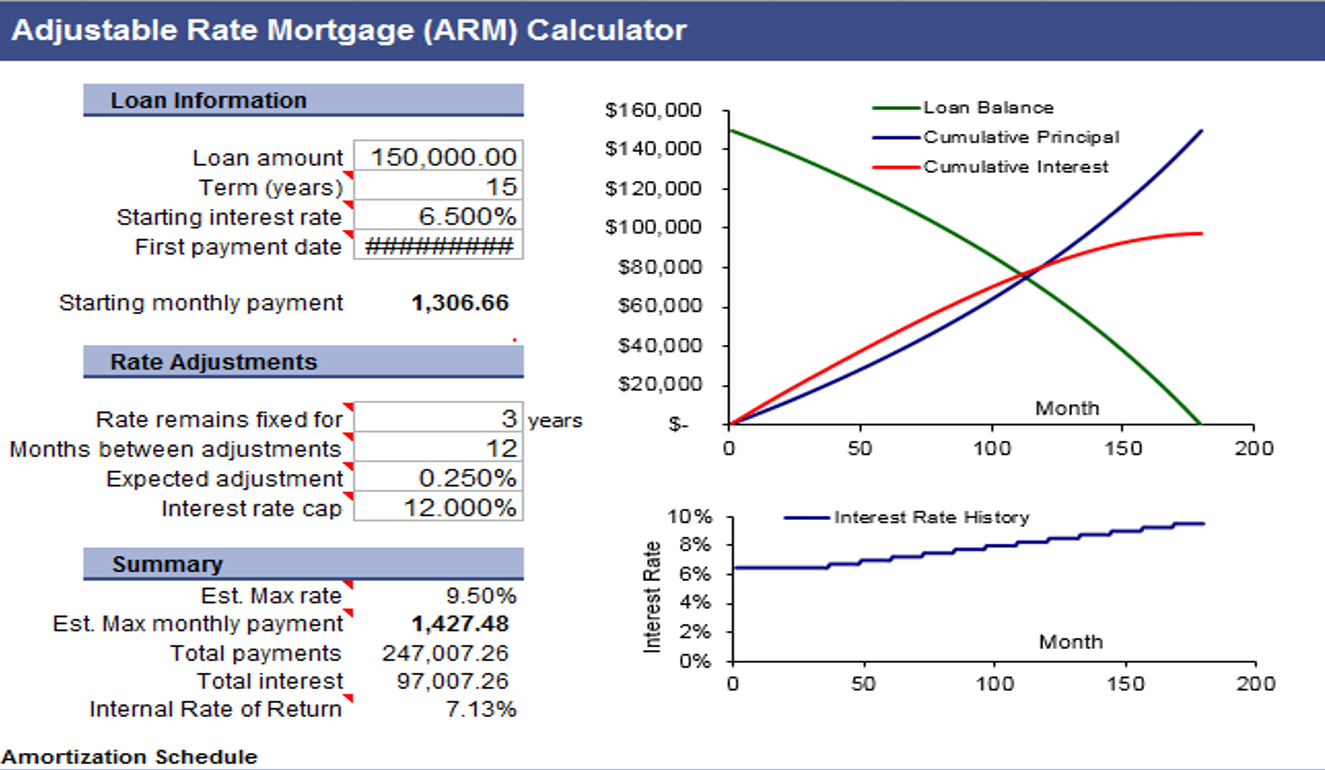

Determining the suitability of an interest-only loan is a personal decision that depends on various factors. While a fixed-rate loan with an interest-only option is relatively straightforward to comprehend, interest-only mortgages with adjustable rates introduce a higher level of risk. For personalized insights, it is recommended to delve into the referenced material below, gaining a deeper understanding of the implications and risks associated with interest-only loans.

Conclusion: Empowering Your Loan Decisions with AceDigi

AceDigi’s Interest-Only Loan Calculator serves as a comprehensive and efficient tool for individuals navigating the complexities of interest-only loans. Whether you seek a reduced initial payment or wish to explore the impact of additional payments, this calculator offers a holistic view of your financial obligations. Stay informed, make empowered decisions, and embrace financial clarity with the AceDigi Interest-Only Loan Calculator. Your journey to financial understanding and control begins here.

Ava Richardson –

The templates provided are a lifesaver! Easy to use and have improved my organization significantly. Versatile and suitable for various tasks. Kudos to the creators!

2. Fatima Khan –

The templates provided are a lifesaver! Easy to use and have improved my organization significantly. Versatile and suitable for various tasks. Kudos to the creators!

1. Ahmed Malik –

I’ve tried various templates before, but these stand out. They’re not just functional; they add a touch of elegance to my work. Definitely worth the investment.

1. Ahmed Malik –

These templates are a lifesaver for someone like me who’s always on the go. Quick, easy, and efficient – they’ve become an essential part of my toolkit. Thumbs up!