Description

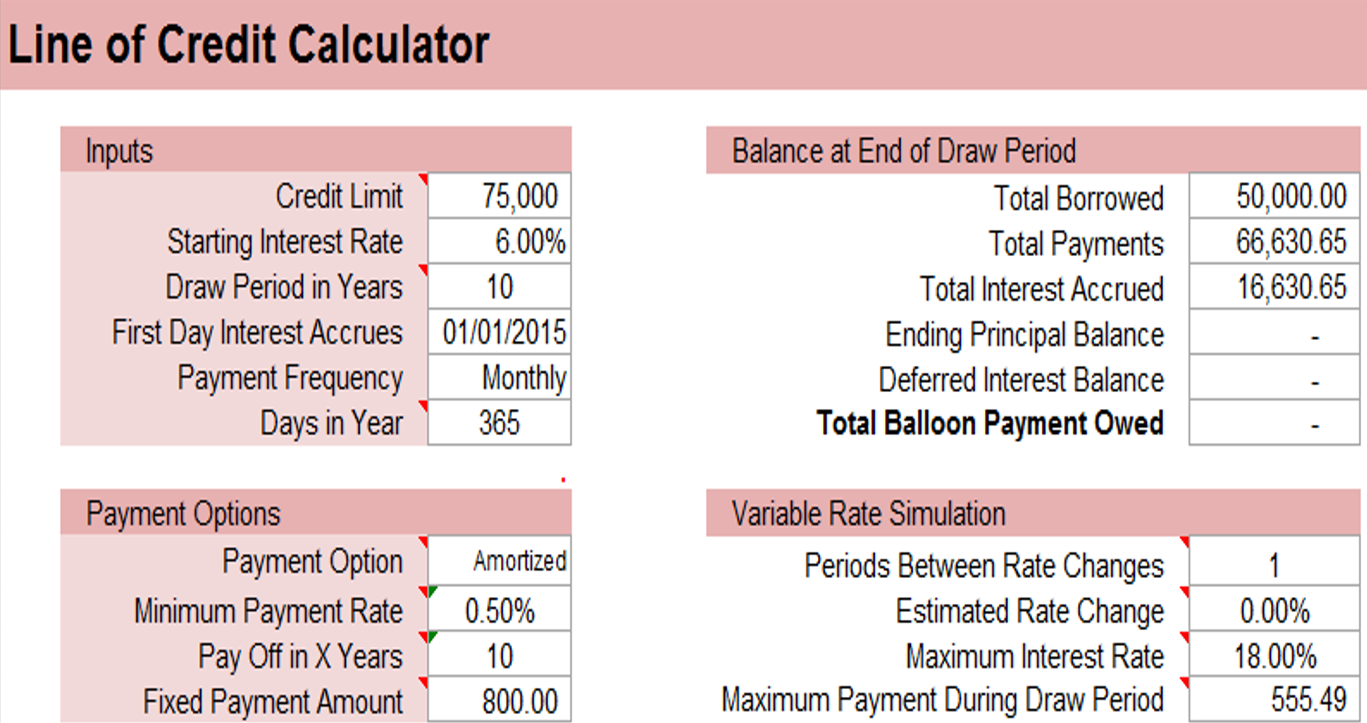

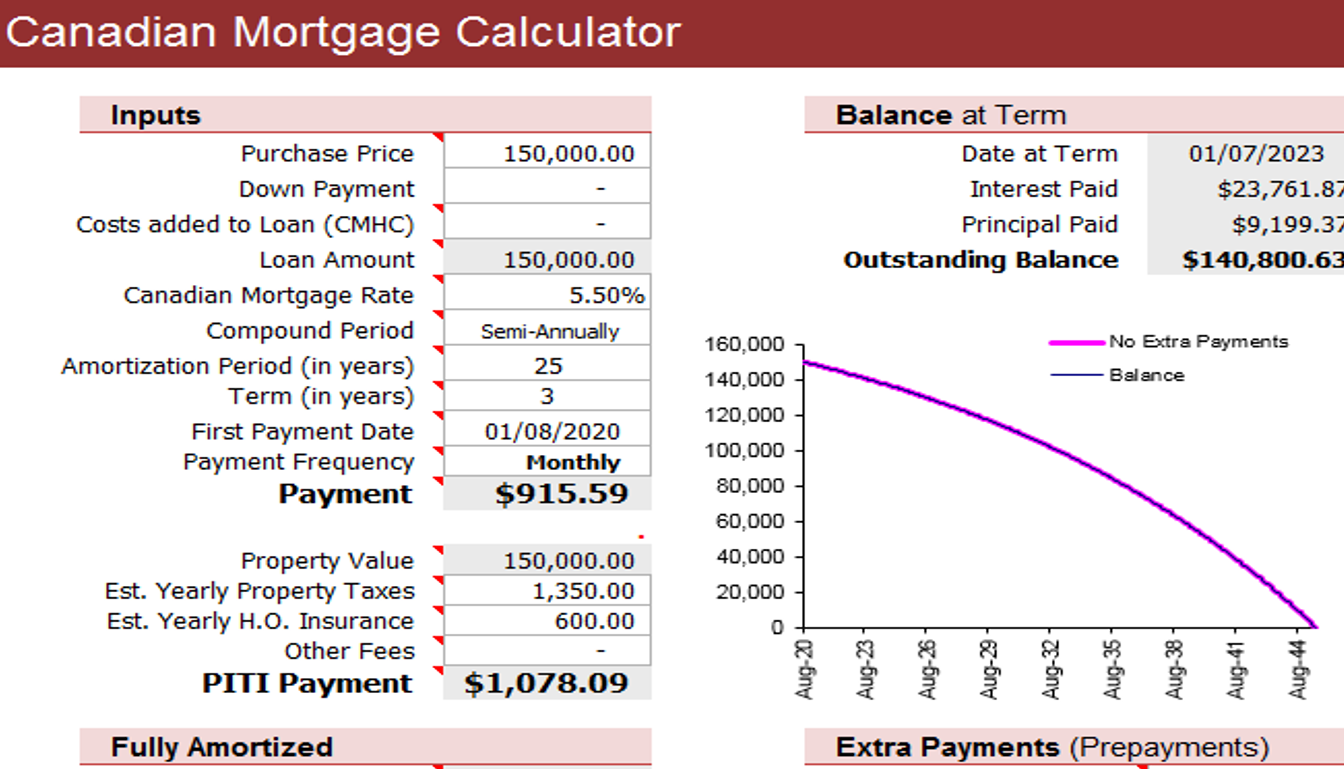

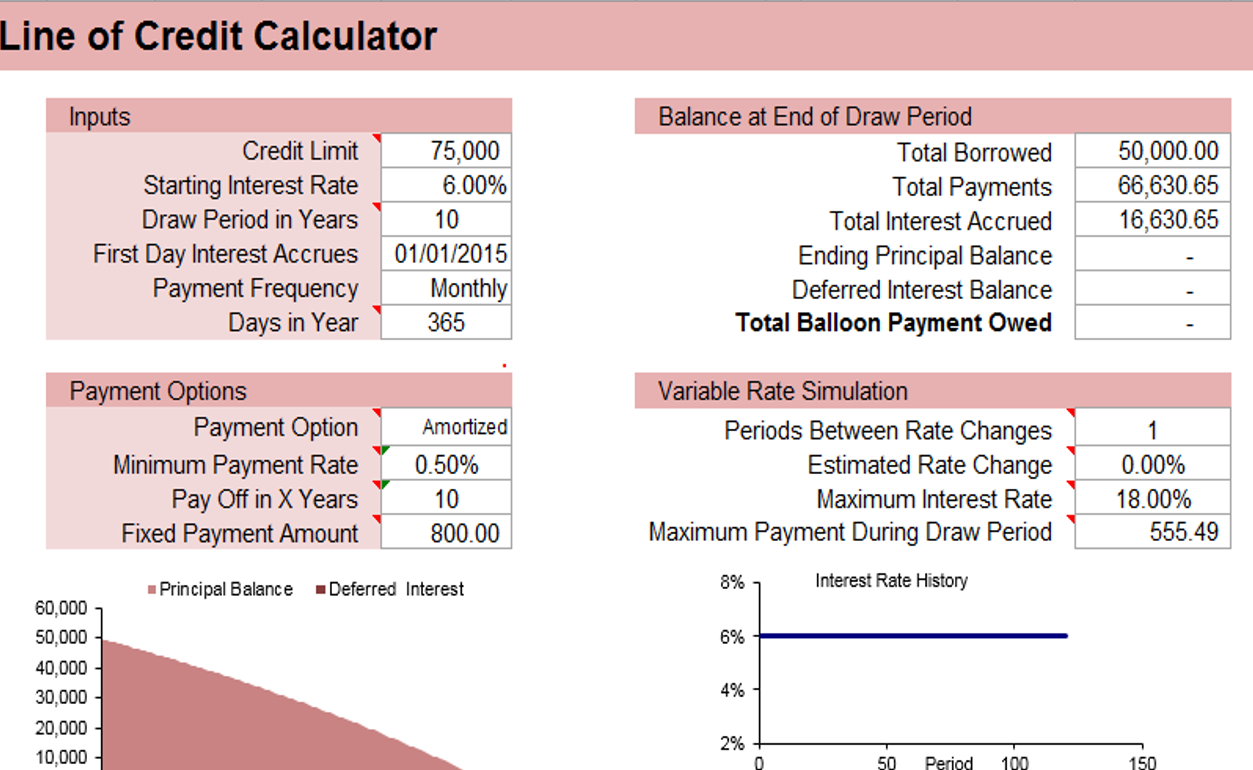

AceDigi brings you a cutting-edge Home Equity Line of Credit (HELOC) Calculator designed to empower users in estimating payments required to manage their debts effectively. While it’s generally advised to approach home equity lines of credit with caution, acknowledging the potential risks, this calculator serves as a valuable resource for those who already possess a HELOC. The AceDigi Line of Credit Calculator stands out for its enhanced power and flexibility, surpassing typical HELOC calculators available online. While its primary function is as a HELOC calculator, its versatile design allows it to simulate a general revolving line of credit, making it an invaluable tool for both individuals and lenders seeking effective debt management solutions.

Description of the AceDigi Line of Credit Calculator:

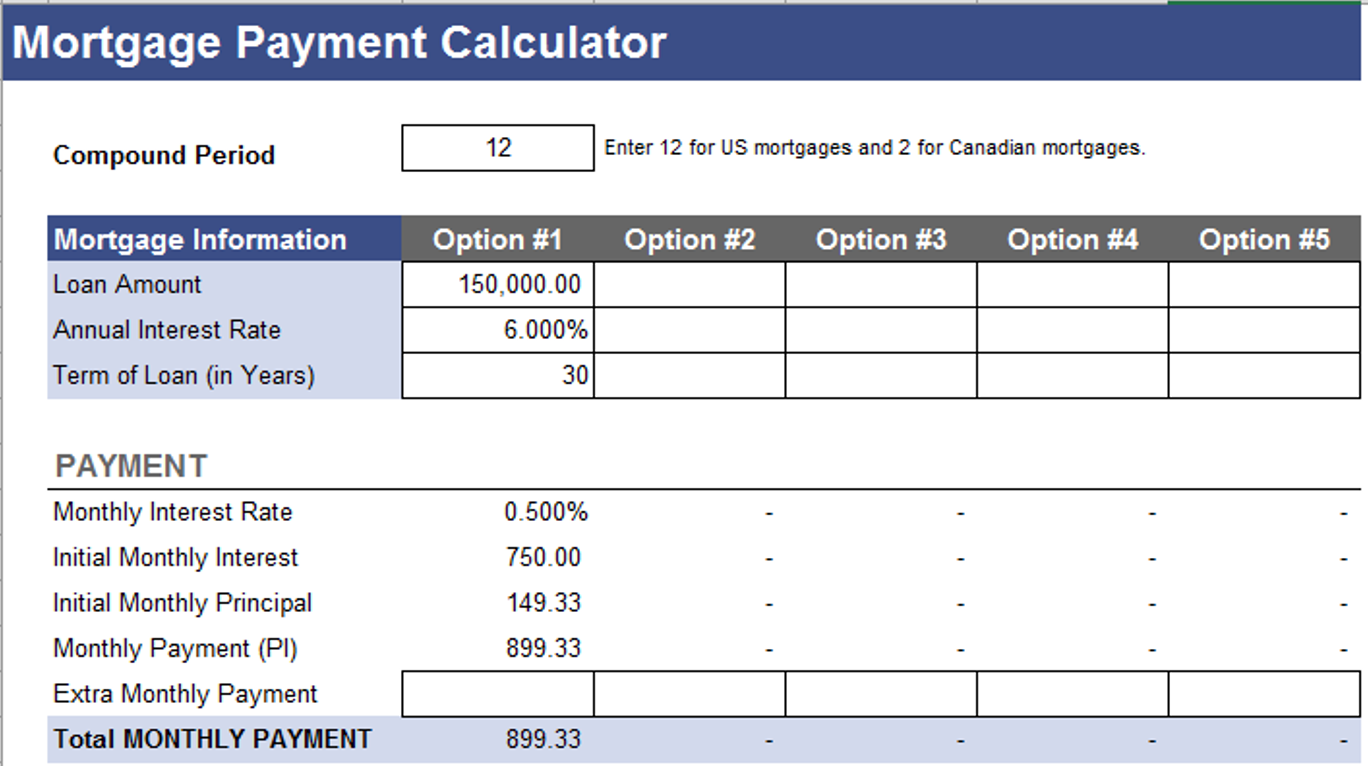

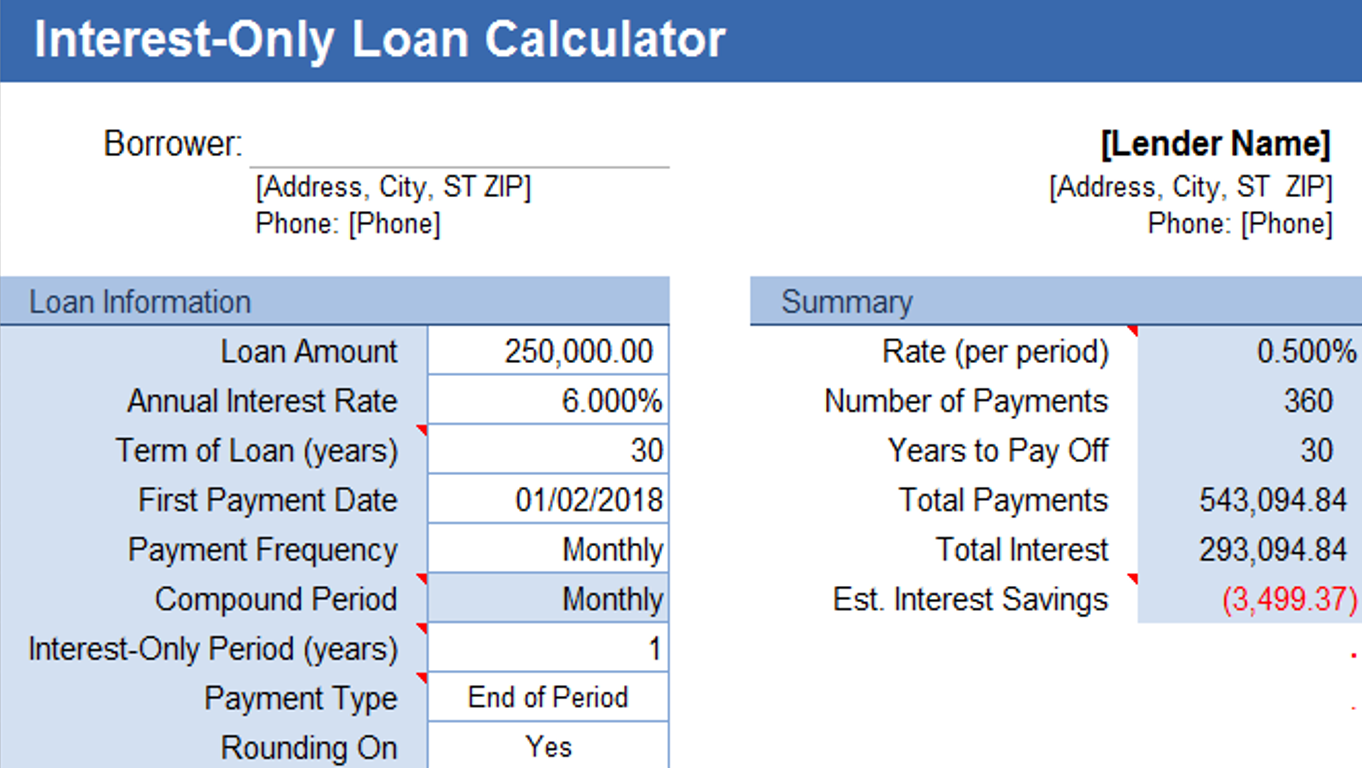

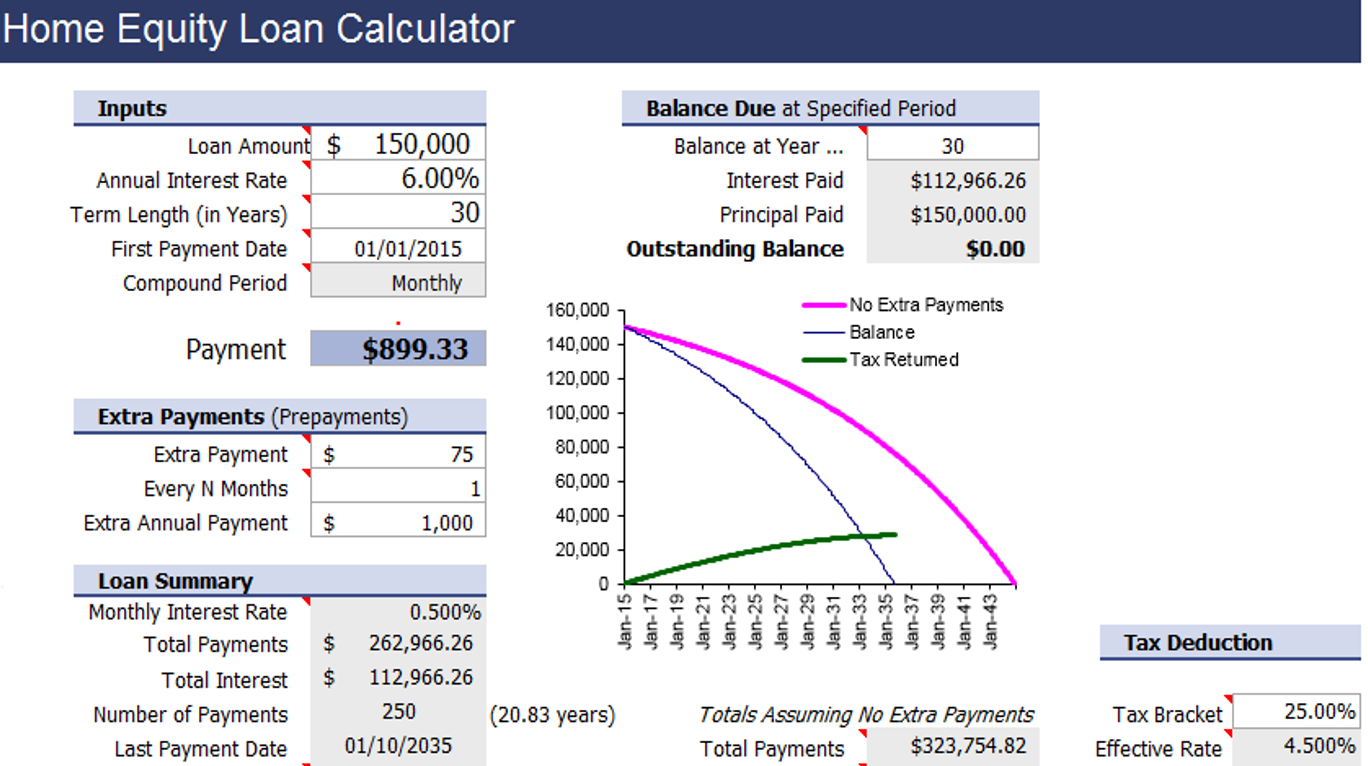

This sophisticated spreadsheet is crafted to generate an estimated payment schedule tailored for a revolving line of credit. It accommodates both variable and fixed interest rates, daily interest accrual, and a defined draw period, providing users with a comprehensive view of their financial obligations. Key features include the ability to incorporate additional payments, specifying whether they are principal-only payments, and the flexibility to choose from various payment options such as Amortized, Minimum, Interest-Only, or Fixed Payment.

Utilizing the AceDigi Line of Credit Calculator:

Given the inherent complexity of home equity line of credit calculations, users are advised not to anticipate an exact match with their bank’s calculations. The intricacies of the spreadsheet may introduce some variations, and users are encouraged to report any suspected errors for further refinement. To enhance user understanding, the calculator includes cell comments marked with red triangles, providing valuable insights into its functioning.

Exploring Additional Features:

Variable Rate Simulation: The calculator includes a feature allowing users to simulate potential rate fluctuations. While it doesn’t aim to predict future rates, it provides a dynamic platform to understand the potential impact of rate changes. The Random Rate Change option adds an element of exploration, enabling users to observe how values change with repeated simulations.

Tracking Payments: Users have the option to manually input Payment Date, Interest Rate, and Payment details within the table for those who wish to track their actual payments. By overwriting formulas, users can customize their tracking experience. Highlighting modified cells can help users identify those no longer containing formulas.

Disclaimer:

It’s crucial to acknowledge the assumptions and simplifications embedded in the HELOC calculator. As with any financial tool, users should exercise diligence and report any discrepancies they observe. The AceDigi Line of Credit Calculator is designed to be a powerful aid, but its effectiveness is enhanced when used with awareness of its inherent complexities.

Why Choose AceDigi?

AceDigi distinguishes itself with its commitment to providing advanced and user-friendly financial tools. The Home Equity Line of Credit Calculator is a testament to our dedication to empowering users with tools that go beyond the standard offerings. Whether you are an individual seeking effective debt management or a lender tracking a line of credit, AceDigi offers a solution tailored to your needs.

Conclusion: Master Your Financial Strategy with AceDigi

The AceDigi Home Equity Line of Credit Calculator emerges as a comprehensive and flexible tool for users navigating the intricacies of revolving lines of credit. Empower yourself with accurate estimations, additional payment options, and dynamic simulations of rate changes. As you embark on your financial journey, trust AceDigi to be your partner in achieving clarity and control over your financial obligations. Download the AceDigi Line of Credit Calculator today and embark on a path to financial mastery.

Ava Richardson –

Impressed with the variety of templates available. From budgeting to project management, they cover it all. Well-designed and have significantly improved my productivity. Highly recommended!

Charlotte Anderson –

Using these templates has been a time-saver. The ease of use combined with the polished designs has elevated my work. It’s like having a design team at my fingertips!

Oliver Mitchell –

I appreciate the versatility of these templates. Whether it’s project planning or expense tracking, there’s a template for everything. They’ve become my go-to solution for various tasks.

1. Ahmed Malik –

I’ve tried various templates before, but these stand out. They’re not just functional; they add a touch of elegance to my work. Definitely worth the investment.