Description

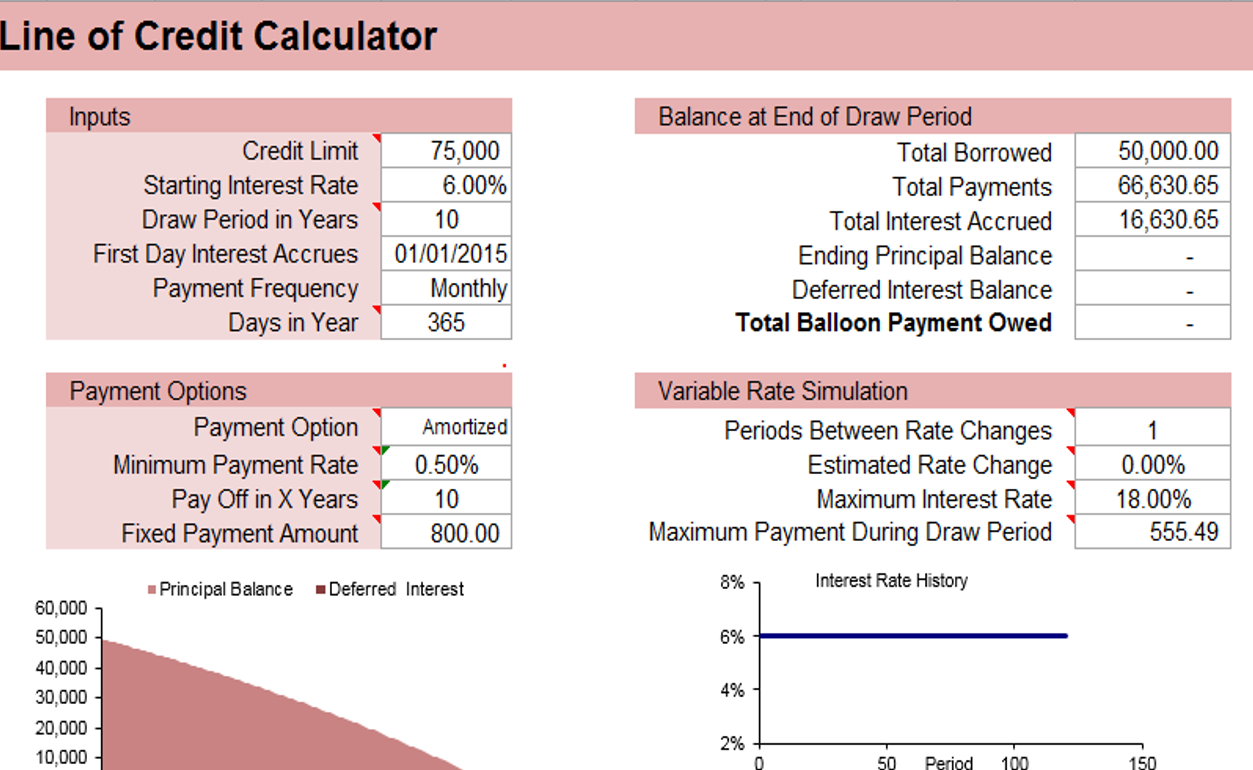

AceDigi introduces the Line of Credit Tracker, a powerful tool designed specifically for small business owners and lenders seeking to meticulously track payments, draws, and changes in interest rates for a line of credit. This innovative spreadsheet is tailored to provide a more accurate and detailed overview compared to its predecessor, offering enhanced features and flexibility for effective line of credit management.

Description of the Line of Credit Tracker

This spreadsheet is crafted to cater to the needs of small business owners and lenders by facilitating the tracking of payments and draws for a line of credit that accrues daily interest based on the current principal balance. Unlike generic line of credit calculators, the AceDigi Line of Credit Tracker is fine-tuned to offer precision in recording financial transactions and adjusting to changes in interest rates.

Beta Version Alert:

As of now, this spreadsheet is considered a “beta” version, indicating that it is a work in progress and has not undergone extensive usage to guarantee error-free functionality. Users are encouraged to provide feedback and report any issues encountered, contributing to the refinement of this valuable tool.

Note to Lenders:

For lenders intending to use this spreadsheet to manage client accounts, it is imperative to ensure that the calculations and assumptions align with the terms specified in the contract. Lenders bear the responsibility of verifying the accuracy of the tool and must strive to eliminate errors for seamless financial management.

Update 1/24/2023: Enhancements for User Guidance

In the latest update, a Conditional Formatting (CF) rule has been implemented to highlight dates in red, serving as a visual indicator of warnings or errors. This addition aids users in identifying potential issues, such as duplicate dates in consecutive rows. It is recommended to combine multiple payments or draws on the same day into a single row, ensuring clarity and accuracy in tracking.

Estimating an Interest Reserve:

The Line of Credit Tracker offers a structured approach to estimating an interest reserve:

- Input planned or actual disbursements with corresponding dates and draw amounts.

- If the line of credit transitions to a loan at a specific date, record the conversion date when the loan becomes a standard loan.

- The Total Interest Accrued amount provides an estimate of what would be required in an Interest Reserve account.

Managing Interest Rate Changes:

The spreadsheet provides clear guidance on handling interest rate changes. Users are advised to enter the date and a 0 payment whenever the interest rate changes. This ensures that accrued interest is updated, and subsequent calculations consider the new rate, maintaining accuracy in financial tracking.

Assumptions Built into the Spreadsheet:

Several key assumptions are embedded in this spreadsheet to align with common practices in line of credit management. These include:

Interest accrues on a daily basis, with the Days in Year value set at either 365 or 360, depending on the lender’s method of calculating “per diem” interest.

Interest, calculated using the simple interest formula, is not added to the principal balance. The Total Owed comprises the Principal Balance and the Unpaid Interest Balance

Payments are applied as of the end of the previous day, with a sequence prioritizing the Interest Accrued and Interest Balance, followed by the Principal.

The Interest Accrued amount is rounded to the nearest cent for precise calculations.

Interest is charged on a draw on the day it is made, adhering to industry standards.

Principal-Only payments can be simulated by entering a negative draw amount, providing users with flexibility in recording financial transactions.

In conclusion, AceDigi’s Line of Credit Tracker stands as a valuable asset for small business owners and lenders, offering a tailored solution for precise tracking of financial activities associated with lines of credit. As a beta version, user feedback is essential to refine and enhance its capabilities further. Utilize this innovative tool to navigate the complexities of line of credit management with accuracy and confidence.

Liam Walker –

These templates have significantly improved the way I track my projects. User-friendly and visually appealing. Added a professional touch to my presentations. Highly recommend!

Liam Walker –

Love the customization options! These templates have allowed me to tailor my work to my specific needs. Well-designed, and the support provided is excellent. A satisfied user!

Amit Modi –

I stumbled upon these templates and couldn’t be happier. They’re like a secret weapon for productivity. The range is impressive, and the simplicity of use is refreshing

3. Yusuf Ali –

Absolutely loving these templates! They’ve brought a level of organization to my work that I didn’t know I needed. Clean designs and intuitive functionality make them a winner.