Description

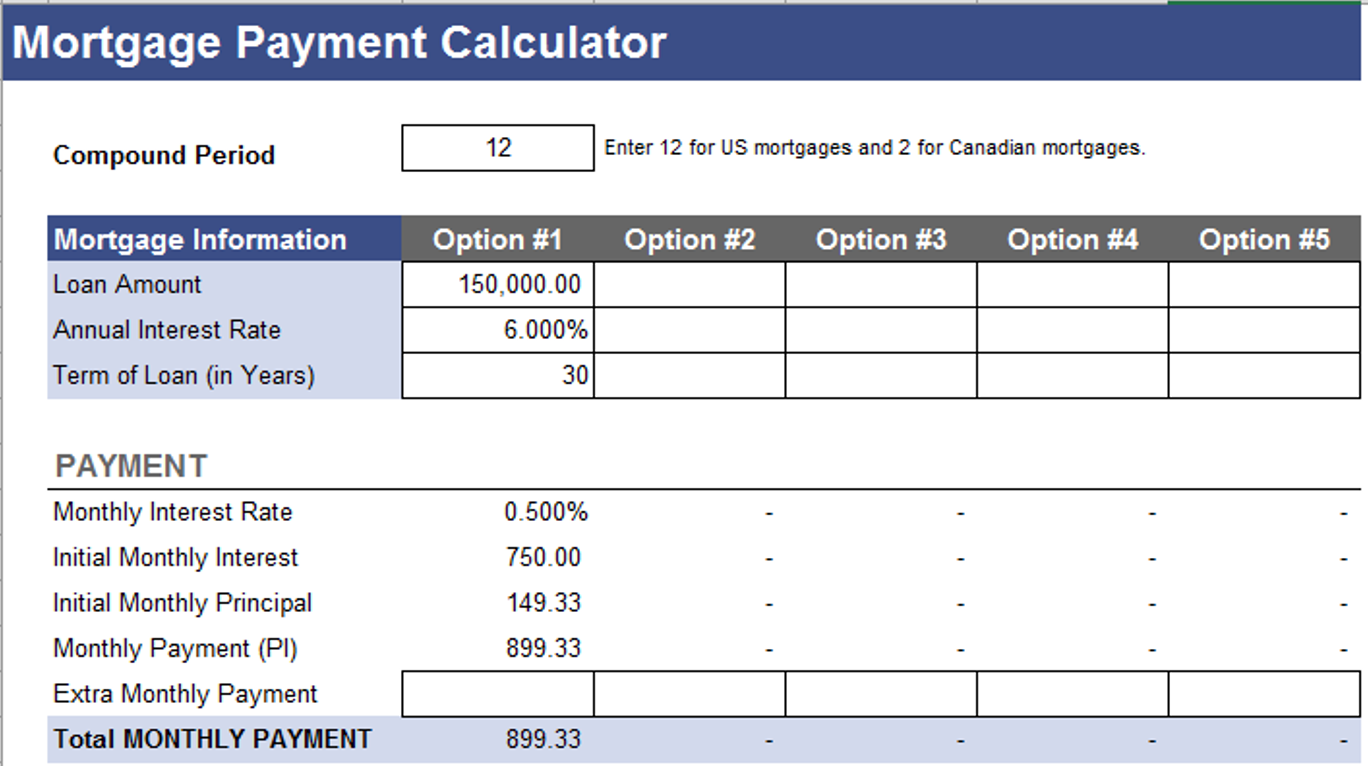

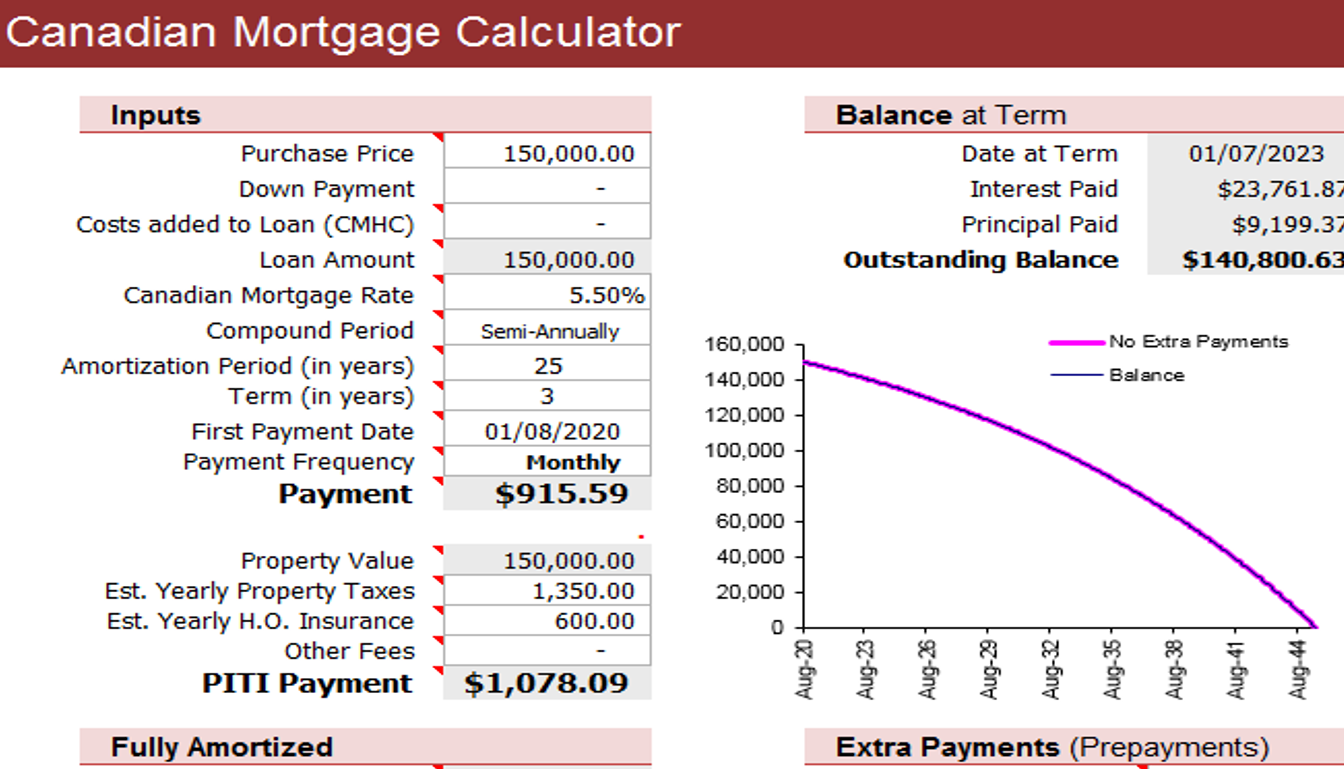

In the realm of homeownership, making informed financial decisions is paramount. The AceDigi Mortgage Payment Calculator emerges as an invaluable tool, offering a simple yet comprehensive solution for individuals navigating the complexities of mortgage planning. Designed to empower users in comparing mortgage options, understanding payment structures, and strategizing for the future, this calculator transcends its simplicity to become an indispensable asset in your homeownership journey.

Understanding AceDigi Mortgage Payment Calculator: Unveiling the Features

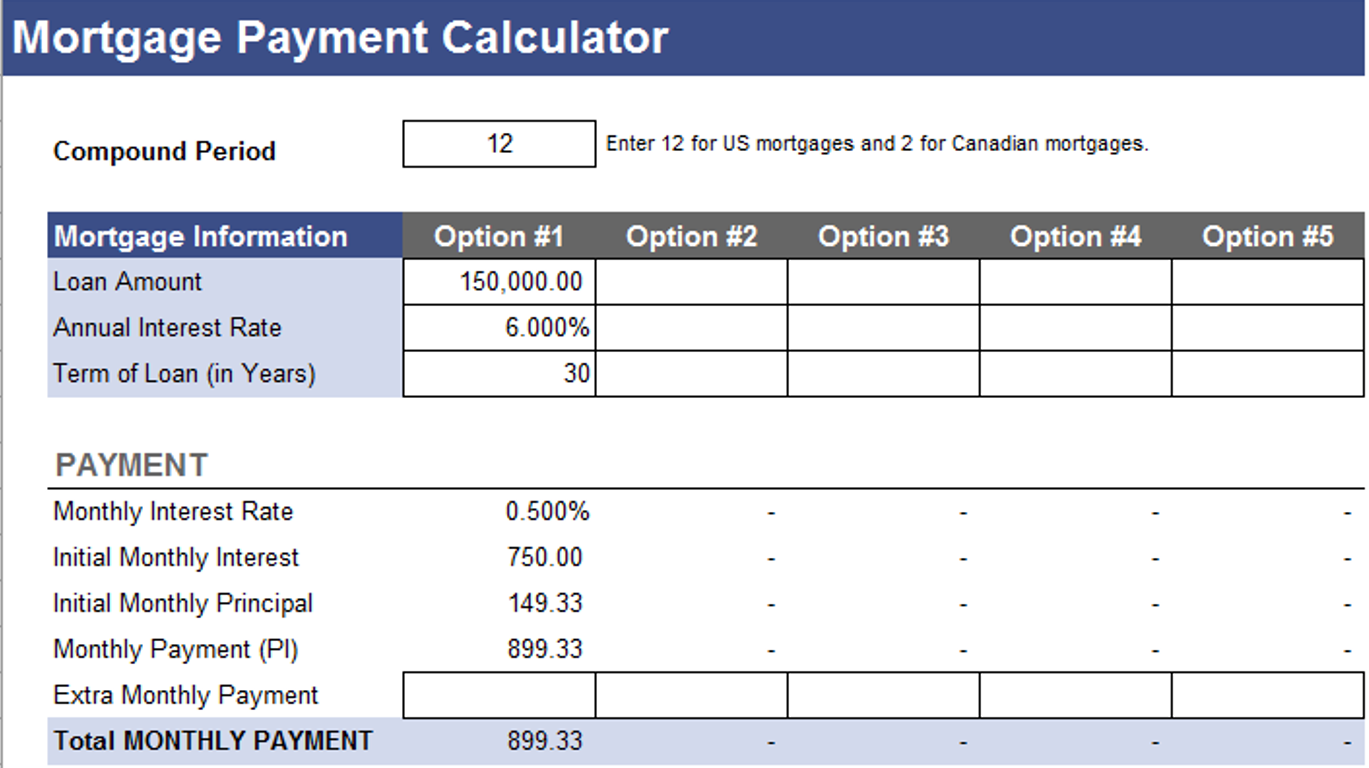

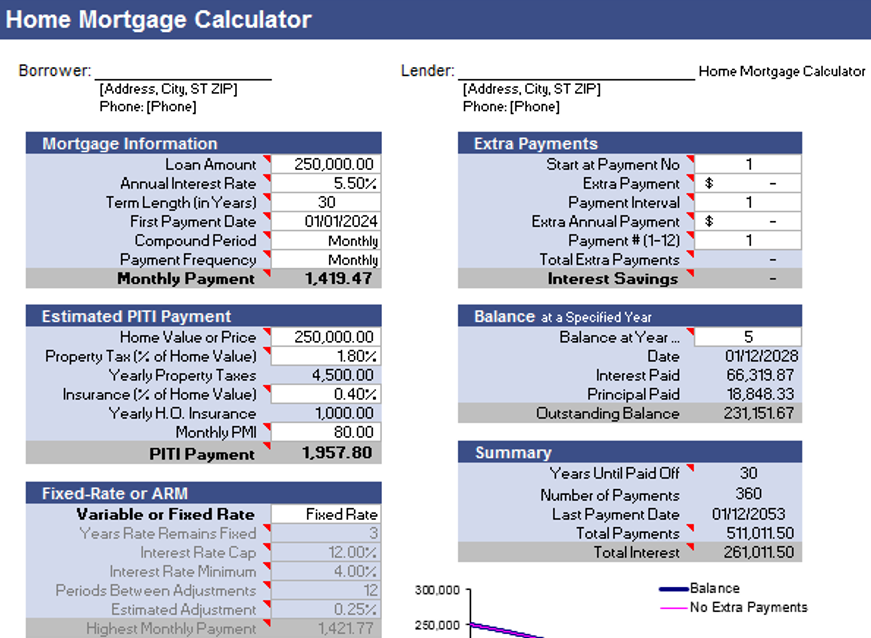

The AceDigi Mortgage Payment Calculator, a user-friendly spreadsheet, stands out as an effective means to compare various mortgages seamlessly. Its primary functions include calculating monthly payments, accommodating extra payments for accelerated debt reduction, and estimating home equity over a specified duration. Let’s delve into the key features that make this calculator a valuable companion in your homeownership endeavors.

Online Mortgage Payment Calculator: Accessibility at Your Fingertips

To enhance accessibility and user convenience, AceDigi introduces an online mortgage payment calculator. This web-based tool allows users to perform quick calculations without the need for software installations. However, for those seeking customization options or a downloadable version, the traditional spreadsheet and Google Sheets versions are readily available.

Exploring the AceDigi Mortgage Payment Calculator: A Detailed Guide

- Comparing Mortgage Payments:

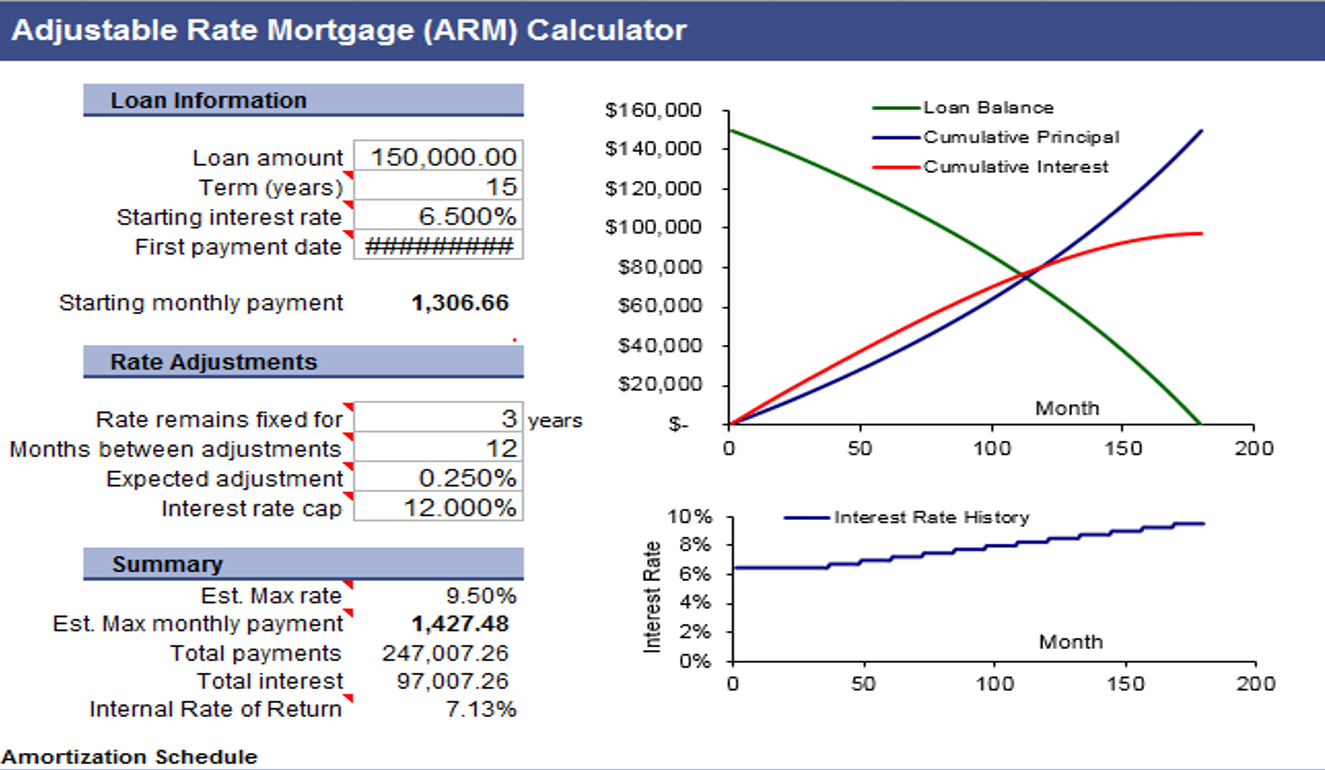

The calculator excels in facilitating side-by-side comparisons of different monthly mortgage payments. By inputting variables such as terms, rates, and loan amounts, users gain insights into their financial commitments. It’s crucial to note that this comparison focuses on the monthly payment itself, excluding additional costs like closing fees, mortgage insurance, or property taxes.

Users can effortlessly expand the calculator’s functionality by inserting more columns, tailoring it to their specific needs. While longer terms may yield lower monthly payments, considering the total interest paid over the loan duration remains essential.

- Paying off Your Mortgage Early:

The calculator provides a unique opportunity to explore the impact of making extra payments on the principal, commonly known as prepayments. This feature empowers users to strategize for early mortgage payoff, ultimately saving on interest payments.

The concept of making extra payments is akin to investing money in an interest-bearing account with a similar interest rate as the mortgage rate, excluding tax considerations. While the potential interest savings are significant, users should weigh the liquidity aspect, as accessing the extra funds may require selling the house or leveraging home equity.

- Estimating Accelerated Biweekly Mortgage Payments:

The calculator introduces an “Accelerated Biweekly Payment” plan for those seeking an early mortgage payoff strategy. In this plan, payments are made every two weeks, totaling 26 payments annually (equivalent to 13 monthly payments). Users can estimate the effect of accelerated biweekly payments by entering the extra monthly payment, simplifying the planning process.

- Calculating Home Equity:

As homeowners plan for the future, estimating home equity becomes a crucial aspect, particularly when considering selling the property. The calculator’s bottom rows facilitate this estimation, emphasizing the importance of owner’s equity. Owner’s equity is calculated as the home value minus the outstanding loan amount, providing a snapshot of the property’s financial standing.

Decoding Terminology: A Guide to Key Terms in the Calculator

Understanding the terminologies used in the AceDigi Mortgage Payment Calculator is essential for optimal utilization. Here’s a brief guide:

Compound Period:

Represents the frequency of compounding the annual interest rate. For US mortgages, a monthly compound period (entering 12) is common, while Canadian mortgages often use a semi-annual compound period (entering 2).

Loan Amount:

Signifies the borrowed amount. Users can input the current balance, adjusting the Loan Term to reflect the remaining mortgage years.

Annual Interest Rate:

The quoted interest rate assumed to be fixed annually. Users must consider this rate in conjunction with the compound period.

Term of Loan (in Years):

Reflects the total mortgage duration, typically 15 or 30 years. For accurate input, users can enter the current mortgage balance and specify the remaining years using a formula.

Monthly Interest Rate:

Calculated from the annual interest rate and compound period, providing the monthly interest rate.

Initial Monthly Interest:

Displays the initial monthly interest payment, offering insights into the interest versus principal distribution on the first payment.

Monthly Mortgage Payment (PI):

Represents the total monthly payment, including both principal (P) and interest (I), derived from the borrowed amount, loan term, and interest rate.

Extra Monthly Payment:

Indicates the additional amount users wish to pay toward the principal each month, assuming no penalties for prepayments.

Number of Payments:

Derived from the total loan term but adjusted for potential early payoffs due to extra payments. The NPER formula calculates the required number of payments.

Total Payments:

The aggregate amount paid (principal and interest) over the loan duration.

Total Interest:

Represents the total interest paid over the loan’s life.

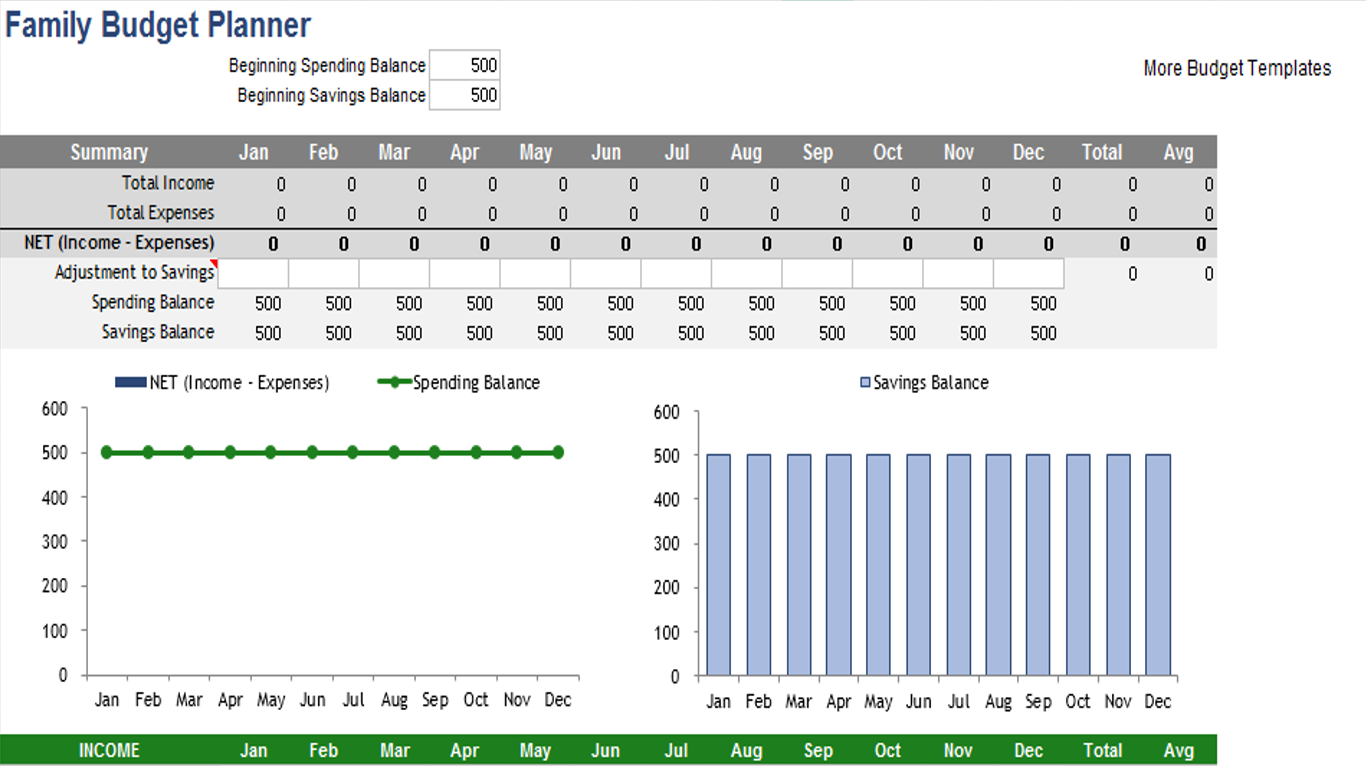

BALANCE at Year N:

Allows users to input a specific year to determine the outstanding mortgage amount and estimated home equity.

Loan Balance Due:

Indicates the remaining principal amount to be paid.

Property Value:

Reflects the market-dependent value of the property, requiring an estimation for calculating owner’s equity.

OWNER’S EQUITY:

Conveys the anticipated home equity after a specified number of years, calculated as the property value minus the outstanding loan amount.

Conclusion: AceDigi Mortgage Payment Calculator – Your Financial Ally

In the complex landscape of homeownership, the AceDigi Mortgage Payment Calculator emerges as a versatile and user-friendly ally. Beyond its simplicity, this calculator empowers users to make informed decisions, strategically plan for mortgage repayment, and estimate home equity over time. The inclusion of online and spreadsheet versions ensures accessibility for users with diverse preferences. As you embark on your homeownership journey, let the AceDigi Mortgage Payment Calculator be your guide, providing clarity, foresight, and financial empowerment. Download the calculator today and take a proactive step towards a secure and well-managed mortgage experience.

Reviews

There are no reviews yet.