Description

Introduction:

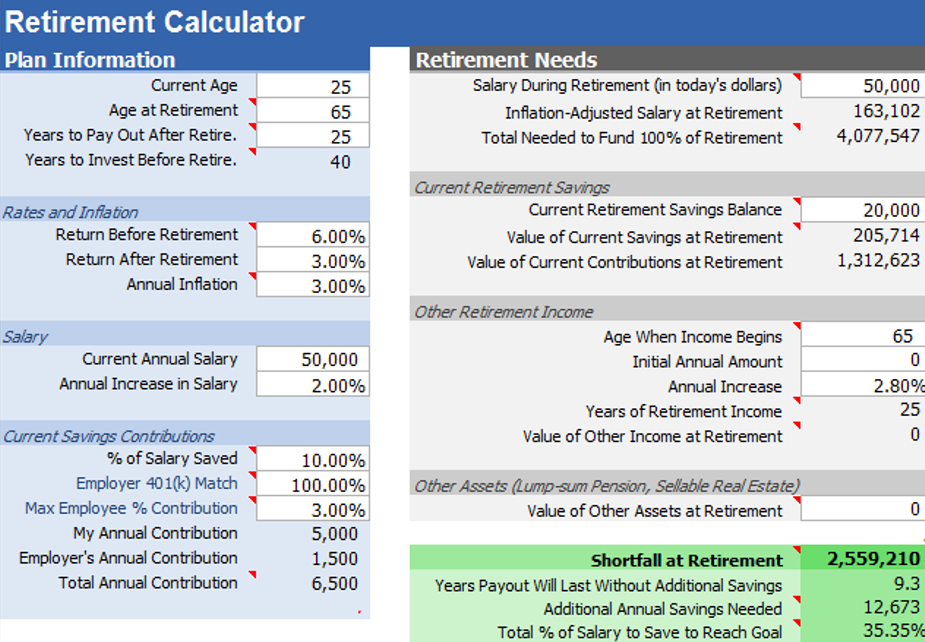

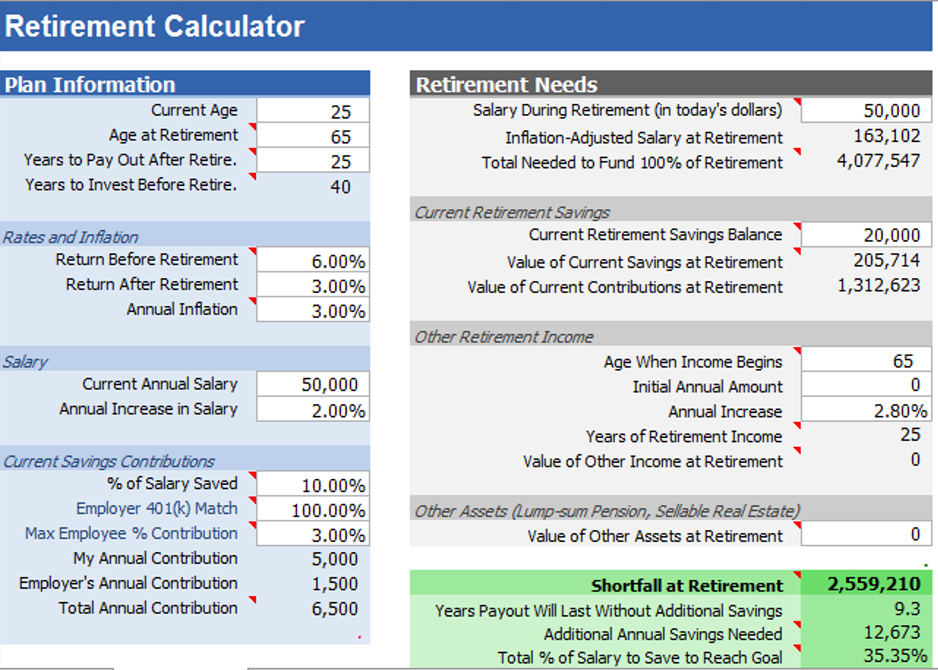

Planning for retirement is a crucial aspect of financial stability, and the AceDigi Retirement Planning Spreadsheet is designed to assist individuals in estimating the savings required to achieve their retirement goals. This tool combines elements of 401(k) savings and retirement withdrawal calculations, offering a quick estimation for users. The spreadsheet, though not a substitute for professional financial planning software, serves as a valuable resource for those seeking a preliminary assessment of their retirement savings needs.

Development History:

Originally created in response to multiple requests for a comprehensive retirement calculator, the AceDigi Retirement Planning Spreadsheet has undergone several updates to enhance its functionality and accuracy. Notable updates include bug fixes, additional features such as limiting Other Retirement Income, formula adjustments for Current Annual Contributions, and improved labels and instructions for better user understanding. These continuous refinements demonstrate the commitment to providing a reliable tool for retirement planning.

Using the AceDigi Retirement Calculator Spreadsheet:

Understanding the AceDigi Retirement Planning Spreadsheet is essential for accurate results. It is crucial to acknowledge that future rates of return, inflation, salary changes, unforeseen disasters, and life events are unpredictable. Users should view the spreadsheet as a mathematical exercise, with the responsibility for selecting inputs and interpreting results resting on their shoulders.

Rates of Return and Inflation:

The spreadsheet allows users to estimate future rates of return and inflation. A unique feature is the ability to enter different rates of return for the accumulation period and the retirement period. This flexibility acknowledges the shift in investment strategy during retirement towards lower risk, lower return investments.

Defining Your Retirement Goal:

- Salary: Enter the desired retirement lifestyle salary in today’s dollars, considering it as a lifestyle benchmark rather than an actual income or withdrawal amount. The calculator adjusts payouts for inflation, and if there’s expected income during retirement, it factors that into the withdrawal calculations.

- Years to Pay Out: Determine the number of years you want your retirement nest egg to last, considering factors like life expectancy, potential support from family, and government assistance.

Current Savings Contributions:

The spreadsheet calculates savings based on a percentage of your salary. As your salary increases, the savings amount also increases. Annual savings contributions are not limited to 401(k) contributions, but if an Employer Match is specified, the spreadsheet assumes contributions to a 401(k) first, with excess savings allocated to other accounts.

Social Security:

The spreadsheet does not include social security calculations. Instead, users can use the Other Retirement Income section to input estimates of other income sources like social security, using resources such as the Social Security Administration’s Retirement Estimator.

Taxes:

While the calculator does not account for taxes, users are reminded of the significant impact taxes can have on savings. Users should assume correct tax-related decisions applicable to their specific situations when using the calculator.

Additional Retirement Calculators:

The AceDigi suite includes other calculators such as the Annuity Calculator, Withdrawal Calculator, and 401(k) Savings Calculator, each serving specific purposes in the retirement planning process.

Conclusion:

The AceDigi Retirement Planning Spreadsheet, despite its simplicity, offers a valuable starting point for individuals seeking a preliminary estimation of their retirement savings requirements. Users should approach it with an understanding of its limitations and actively participate in selecting inputs and interpreting results to make informed financial decisions for a secure retirement.

2. Fatima Khan –

Love the customization options! These templates have allowed me to tailor my work to my specific needs. Well-designed, and the support provided is excellent. A satisfied user!

Liam Walker –

I’ve tried various templates before, but these stand out. They’re not just functional; they add a touch of elegance to my work. Definitely worth the investment.

Emily Thompson –

As someone who isn’t an expert, these templates have been a blessing. Simple to navigate with clear instructions. Now, I can manage my data without any hassle. Great job!

5. Omar Hassan –

Love the customization options! These templates have allowed me to tailor my work to my specific needs. Well-designed, and the support provided is excellent. A satisfied user!