Description

Introduction:

As individuals embark on the journey of retirement planning, finding accessible and effective tools becomes crucial. Amidst the overwhelming options for retirement calculators and software, the quest for a straightforward Microsoft Excel® spreadsheet tailored for calculating a simple annuity proved challenging. The absence of a suitable solution prompted the creation of a personalized tool, now available for free download. This article introduces the AceDigi Retirement Calculator, providing insights into its features and functionalities. Additionally, it directs users to other AceDigi retirement calculators, enhancing the overall planning experience.

AceDigi Retirement Calculator Overview:

The AceDigi Retirement Calculator is designed to estimate the future value of retirement savings, taking into account factors such as the starting balance, expected interest rate, and annual investments. Its primary focus is on calculating a simple annuity, incorporating interest earned along with annual payments. Users can compare the total payments made over the years to the interest earned, gaining a clear understanding of the growth of their retirement fund. The tool also allows users to run simulations with random annual interest rates and a variable number of annual payments, providing a dynamic perspective on retirement savings.

Creating a Solution:

The genesis of the AceDigi Retirement Calculator lies in the creator’s frustration while searching for a specific type of retirement planning tool. Unable to find a Microsoft Excel® spreadsheet tailored to calculating a simple annuity, the decision was made to create a personalized solution. This initiative underscores the commitment to addressing the specific needs of individuals seeking a straightforward and accessible retirement planning tool.

Features of AceDigi Retirement Calculator:

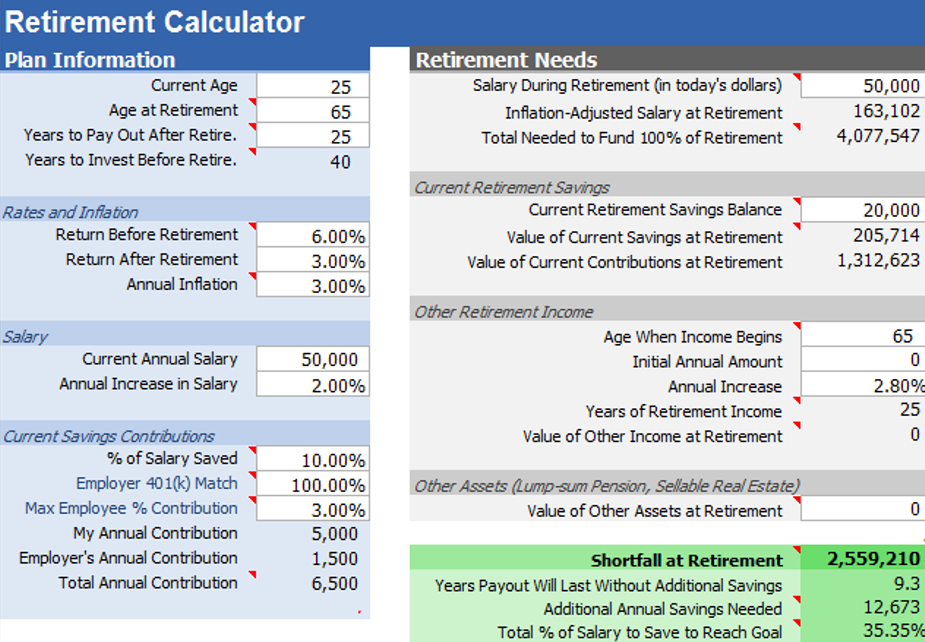

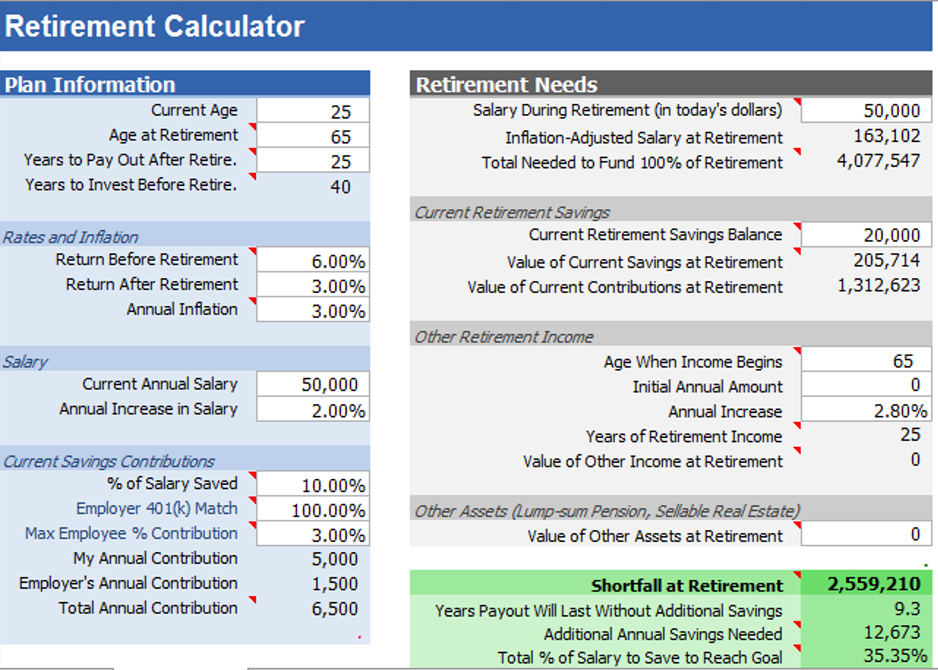

- Estimation of Future Value:*The calculator enables users to project the future value of their retirement savings based on a combination of factors, including the starting balance, expected interest rate, and annual investments.

- Comparison of Total Payments and Interest Earned: A key feature is the ability to compare the total payments made over the years to the interest earned. This comparative analysis provides valuable insights into the financial growth of the retirement fund.

- Simulation Capabilities: Users can run simulations with varying annual interest rates and adjust the number of annual payments. This dynamic feature offers a realistic outlook on potential scenarios, enhancing the tool’s versatility.

AceDigi Retirement Calculator in Action:

To use the AceDigi Retirement Calculator effectively, users input their starting balance, expected interest rate, and annual investments. The tool then generates projections of the future value of their retirement savings, considering the compound effect of interest and annual contributions. The comparison between total payments and interest earned facilitates a comprehensive understanding of the growth trajectory.

More AceDigi Retirement Calculators:

- 401(k) Savings Calculator: Estimate your 401(k) savings after a specified number of years of contributions. This calculator provides insights into the growth of your 401(k) fund over time.

- Retirement Calculator: This tool estimates the total savings accumulated and the expected duration of those savings during retirement. It serves as a comprehensive resource for retirement planning.

- Retirement Expenses Worksheet: Accessible through personal.vanguard.com, this worksheet aids in estimating your retirement budget by considering various expenses, including housing, personal, living, and medical expenses. An essential resource for planning the financial aspects of retirement.

- Retire Early Calculators: Created by John P. Greaney, P.E., these calculators cover safe withdrawal rates and calculate the required funds for early retirement. The Generation-X Retirement Planner offers extensive insights into retirement planning for a specific demographic.

- Simple Savings Calculator: Similar to the 401(k) Calculator and Retirement Planning Spreadsheet, this tool offers flexibility by allowing users to include extra regular or annual deposits. It serves as a versatile option for those seeking customization in their retirement planning.

Conclusion:

The AceDigi suite of retirement planning tools, anchored by the AceDigi Retirement Calculator, empowers individuals with accessible and effective resources for shaping their financial future. From estimating future values to comparing payments and interest earned, these calculators provide a holistic approach to retirement planning. As users navigate the complexities of financial preparation for retirement, the AceDigi suite stands as a reliable companion, offering tailored solutions and dynamic simulations to guide them on their journey towards a secure and well-planned retirement.

Emily Thompson –

These templates have turned mundane tasks into a breeze. The attention to detail is evident, and they’ve made data analysis surprisingly enjoyable. A fantastic find!

5. Omar Hassan –

As someone who isn’t an expert, these templates have been a blessing. Simple to navigate with clear instructions. Now, I can manage my data without any hassle. Great job!

Charlotte Anderson –

As someone who isn’t an expert, these templates have been a blessing. Simple to navigate with clear instructions. Now, I can manage my data without any hassle. Great job!

Sophia Williams –

I’ve tried various templates before, but these stand out. They’re not just functional; they add a touch of elegance to my work. Definitely worth the investment.